How to Buy SafeMoon and How Legit is it?

Aug 15, 2024

SafeMoon, the much-hyped decentralized finance (DeFi) protocol and a meme coin, has garnered both praise and criticism since its launch in 2021. While some tout its unique tokenomics, others have raised red flags about its legitimacy. Through the years, SafeMoon has faced accusations of being a scam, with multiple lawsuits looming over the company.

This begs the question: How to buy SafeMoon in 2024? Is it truly safe to invest in this token? Before making any investment decisions, let’s take a closer look at the project and its controversies.

Key Takeaways

- SafeMoon aimed to discourage short-term trading and incentivize long-term holding through its unique tokenomics model.

- It has faced significant controversies and allegations of being a scam, leading to its price dropping dramatically.

- Legal troubles have resulted in SafeMoon filing for Chapter 7 bankruptcy and ceasing operations.

- It’s still possible to buy SafeMoon using a wallet that supports the BSC network, such as Trust Wallet or MetaMask.

What Is SafeMoon?

SafeMoon (SFM) is a meme token launched in March 2021 amid a bull market and operating on the BNB Smart Chain (BSC). Positioning itself as a “community-driven” DeFi protocol, SafeMoon garnered significant attention and a devoted following, particularly among those seeking the next big thing in the crypto space.

One of the defining features of SafeMoon was its unique tokenomics model, which aimed to discourage short-term trading and incentivize long-term holding, achieved through a 10% transaction fee, where 5% is distributed to existing holders as a “reflection” and the remaining 5% is used to bolster the project’s liquidity pools and burn a portion of the token supply.

Safemoon’s main goal was to solve the “liquidity problem” often associated with new cryptocurrencies by incentivizing users to hold their tokens rather than engage in frequent trading.

The SafeMoon team had ambitious plans for the project, including developing a cryptocurrency wallet, an NFT marketplace, and even a hardware SafeMoon wallet. Additionally, they aimed to integrate the token with various games, educational apps, and charitable initiatives.

How Does SafeMoon Work?

The core mechanics of SafeMoon revolve around its three-step process for each transaction: Reflection, Liquidity Pool Acquisition, and Burn.

- Reflection: This aspect of the tokenomics model rewards holders by distributing 5% of each transaction fee to all existing SafeMoon holders based on their proportional token holdings. The idea is to incentivize long-term holding and discourage frequent trading or “day trading” of the asset.

- Liquidity Pool Acquisition: The remaining 5% of the transaction fee is used to automatically add liquidity to the SafeMoon-BNB trading pair on decentralized exchanges. This process aims to create a price floor and stabilize the token’s value, limiting significant price fluctuations.

- Burn: The final 5% of the transaction fee is converted into Binance Coin (BNB) and permanently removed from the circulating supply of SafeMoon. This “burning” mechanism is intended to increase the token’s scarcity and rarity over time, potentially driving up its price.

History has demonstrated that, despite their excitement and promise, many advancements in cryptocurrency are often accompanied by controversies and setbacks.

Celebrity Endorsements and Hype

Shortly after its launch, the SafeMoon token experienced an unprecedented surge in value by 23,000% in one month after launch, largely attributed to celebrity endorsements from musicians Lil’ Yachty and Nick Carter, YouTuber Logan Paul, and social media hype. The token became the most searched coin on CoinMarketCap at that time, surpassing even big meme coins like Shiba Inu.

Safemoon’s rise to fame has been fueled by its strong community and widespread promotion on platforms like TikTok, Reddit, and Twitter. However, some have questioned the credibility of these endorsements, prompting investigations into potential paid promotions or “pump and dump” schemes.

Controversies Surrounding SafeMoon

Since its launch, the project has faced numerous allegations of being a scam, with multiple class-action lawsuits filed against the team behind it.

Coffeezilla’s Accusations

One of the most notable accusations against SafeMoon came from YouTuber and influencer Stephen “Coffeezilla” Findeisen, who accused the project’s CEO, John Karony, of misappropriating millions of dollars from the liquidity pool. Coffeezilla presented evidence of transactions showing the movement of funds from Safemoon’s liquidity wallet to a separate company run by Karony.

Former SafeMoon CTO Thomas Smith was the only member of the team to respond to these allegations, stating that the funds were removed before Karony’s appointment. He provided evidence in the form of blockchain transactions showing an outflow from liquidity pools dated March 5, 2021. However, this did little to quell suspicions and sparked further investigations into SafeMoon’s operations.

Coffeezilla later made more reports on SafeMoon, including allegations of a pump-and-dump scheme involving various influencers.

The allegations made by Coffeezilla had a significant impact on SafeMoon’s reputation and price. The news of potential fraudulent activity within the project caused a sharp decline in the token’s value. The price of SafeMoon dropped over 45% in just a week after the video was published.

Lawsuits Against SafeMoon

One of the most significant legal battles faced by SafeMoon is a class-action lawsuit filed in February 2022, alleging that the project was a pump-and-dump scheme. The defendants included Logan Paul himself as well as other prominent figures who promoted the token on their social media accounts with misleading information.

In May of the same year, multiple SafeMoon investors filed one more class-action lawsuit against the project for securities fraud. However, this case was voluntarily terminated without prejudice in November 2022.

Fraud Charges and Arrests

In November 2023, SafeMoon faced even more significant challenges when a Federal indictment was unsealed against its founders. The charges included securities fraud, wire fraud, and money laundering through the project. The defendants were accused of deceiving token holders about their access to “locked” liquidity, personal holdings, and trading activity with SafeMoon tokens.

Two of the accused, Braden John Karony and Thomas “Papa” Smith were arrested while third co-founder Kyle Nagy remained at large. The charges were brought by both the SEC and the Department of Justice with assistance from the FBI.

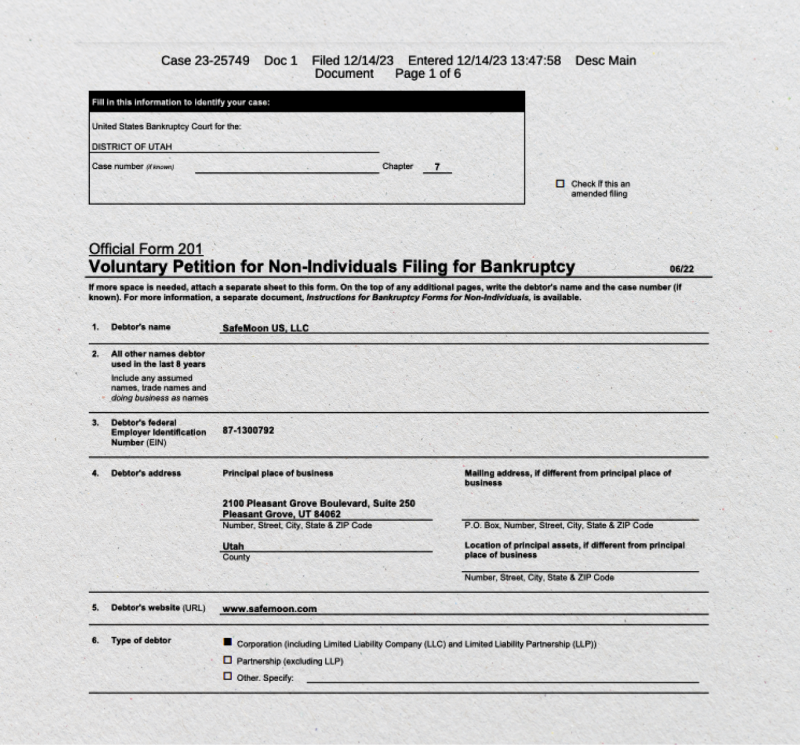

SafeMoon LLC Files for Bankruptcy

The final blow to SafeMoon occurred in December 2023 when the project filed for Chapter 7 bankruptcy. This type of bankruptcy involves the liquidation of assets, making it evident that SafeMoon had no choice but to cease operations due to escalating legal troubles.

Former employees also shared their experiences, revealing they went unpaid for months before being abruptly terminated. Many investors who had faith in the project and its mission to revolutionize DeFi felt betrayed and defrauded, losing substantial funds on devalued SafeMoon crypto assets.

How to Buy SafeMoon?

If you’re still interested in purchasing SafeMoon and willing to take on the risks associated with it, here’s how you can buy it:

Step 1: Set Up a Compatible Wallet

To purchase SafeMoon, you’ll need a cryptocurrency wallet that supports the BSC network. Popular options include a non-custodial Trust Wallet, which allows you to maintain control over your private keys and assets.

Step 2: Acquire Binance Coin (BNB)

Since SafeMoon is primarily traded against BNB on decentralized exchanges, you’ll need to purchase some Binance Coin to use as the base currency for your SafeMoon transaction. You can acquire BNB directly through a centralized exchange like Binance or a decentralized exchange (DEX) like PancakeSwap.

Step 3: Swap SFM with BNB

Once you have BNB in your wallet, you can connect it to a decentralized exchange like PancakeSwap or the project’s native exchange, SafeMoon Swap, which will allow you to swap your BNB for SFM tokens.

On the DEX, navigate to the SafeMoon trading pair and input the amount of BNB you wish to exchange for SafeMoon. Remember the 10% transaction fee, which will be deducted from your purchase.

Step 4: Store Your SafeMoon Securely

After completing the transaction, your SafeMoon tokens will be added to your non-custodial wallet. To protect your assets, keep your recovery phrase, private keys, and other sensitive information in a secure location.

Conclusion

SafeMoon’s promises and unique features have attracted a loyal community. However, the project’s reputation has been significantly tarnished by controversies and legal issues, including allegations of scamming and fraudulent activities, as well as the arrests of SafeMoon developers.

Given SafeMoon’s troubled history, users are advised to proceed with caution and conduct thorough due diligence when investing in any crypto project. The rapidly evolving cryptocurrency landscape requires vigilance and a comprehensive understanding of the ventures that investors choose to support.

Perform extensive research and always remember the fundamental investment principle: never invest more than you can afford to lose.