Best Platforms to Trade Perpetual Futures in 2025

July 18, 2025

Perpetual futures are becoming increasingly popular. Convenience and availability of financial products are on the minds of traders, with spiking volumes of trades and interest in general being registered by the search engines.

In essence, they’re just like traditional futures contracts but never expire. This factor makes them very attractive because they enable the users to purchase/sell instruments with no consideration of liquidation time or even asset ownership.

Let us now delve more deeply into how to trade perpetual futures and how to find the best perpetual futures sites in 2025.

Key Takeaways

- Perpetual futures are futures contracts that do not expire.

- Perpetuals are increasingly popular due to their flexibility, accessibility, and ability to trade on both sides of the market.

- The funding rate mechanism assists price fixation in perpetual contracts to ensure real-time valuation.

- B2TRADER has recently added perpetual futures to accommodate the rising demands and market trends.

Perpetual Futures: Overview, How They Work

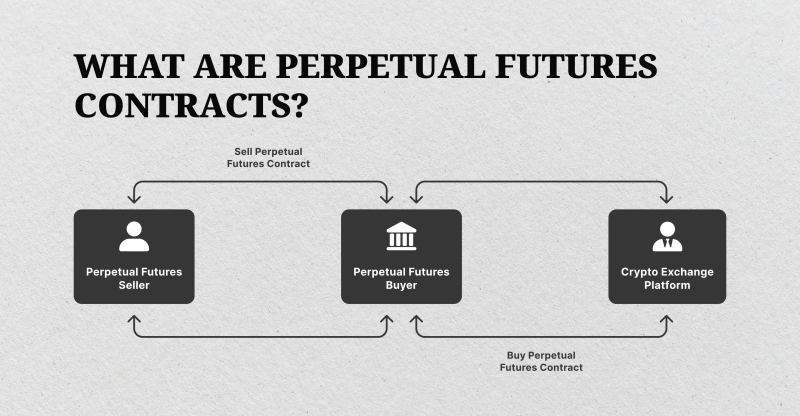

A perpetual future is a financial instrument that allows traders to speculate on an asset’s price without owning it. Unlike traditional futures contracts, perpetuals have no expiration dates, allowing positions to be held theoretically forever.

These contracts reflect the underlying asset’s spot price value through the funding rate mechanism, by which the derivative contract price is kept near the value of the real market.

The perpetual futures offer leverage and agility, thus the interest from retail and institutional traders. Traders either go long or short on an asset, i.e., profit during bearish and/or bullish trends.

Perpetuals are in abundance in cryptocurrencies such as Bitcoin, Ethereum, or other high-earning altcoins. Crypto perpetual futures have high-profit opportunities, mainly in highly volatile market conditions.

Leverage is one of the characteristic features of these derivatives markets, in which bigger position sizes can be traded against a relatively moderate margin. This makes the potential gains bigger but increases the risk. The trader, therefore, must manage leveraged trades more carefully to avoid margin calls and liquidations.

Reliable perpetual futures trading platforms must be able to provide real-time quotes, advanced risk management tools, and access to deep marketplace liquidity.

Funding Rates

Funding rates are frequent payments between long and short-position holders of the same contract, which maintains the perpetual price alignment with the spot market.

- When the funding rate is positive, long traders pay short holders.

- When the funding rate is negative, short traders pay long holders.

Funding rates are calculated based on the difference between the perpetual contract’s price and the actual spot value, combined with interest rates. They are typically charged every 8 hours, while some platforms have different intervals, extending up to one or many days.

Rising Popularity and Trends

Perpetual futures in 2025 continue to remain extremely popular, most especially in cryptocurrency markets, due to the confluence of market volatility, agility, and high liquidity. Institutional adoption becomes bigger by the day, and increasingly, more exchange platforms incorporate these instruments in the services offered by them, e.g., B2TRADER.

Retail investors are also increasingly drawn to perpetuals due to their simplicity and widespread adoption, shifting from being exclusive to a few trading desks to more online perpetual futures trading platforms.

Additionally, the novelty of AI trading bots and automated risk management tools has made participation easier for beginners.

Why Trade Perpetual Futures Contracts

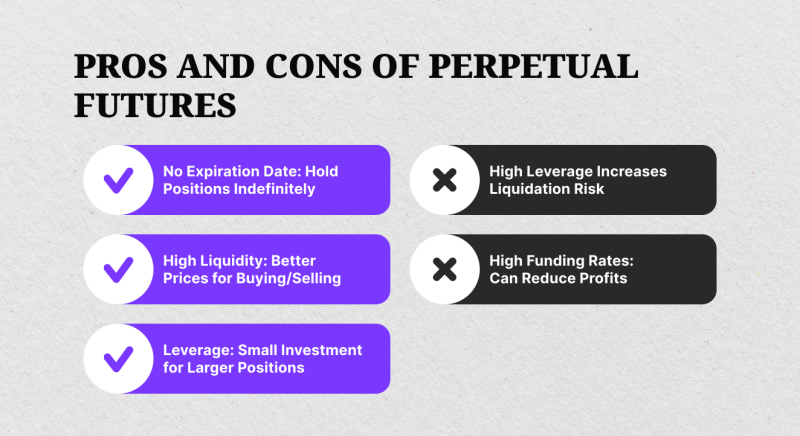

Traders choose perpetual futures for the possibility of leveraged profits and continuous trading opportunities without time constraints. These contracts offer strategic advantages over traditional futures, especially in portfolio diversification strategies. Let’s explore the top benefits of trading perpetual futures in 2025.

No Expiration Dates, Unlike Traditional Futures

The key benefit of perpetual futures is the lack of expiry dates. Traditional derivatives, including futures, forwards, and options, carry predetermined maturing dates, and the respective parties have to close the position or roll over the position before expiry.

But the perpetuals eliminate the inconvenience of this by leaving the position vacant effectively indefinitely.

This ongoing functionality for trades permits smoother long-term strategies, avoids slippage during high-traffic time liquidation, and avoids contract rollover losses.

For active traders, this means ongoing access to live market dynamics, allowing planning for strategies, hedging, and arbitrage in shorter- and longer-term trades.

Margin Trading to Achieve Higher Potential Profits

Perpetual futures contracts involve margin trading, in turn allowing users to open bigger positions for smaller amounts of capital. By using the leverage of their orders, the traders multiply both gains and risks simultaneously.

Therefore, risk management instruments, such as stop-loss orders and optimized margins, as well as other suitable instruments for high-risk, high-return trades, must be in place.

Funding Rates for Sustainable Pricing

The funding rate mechanism works to maintain price parity between the spot market and the perpetual contracts. The principle protects the traders against erroneous market conditions in the case of prices greatly diverging from the proper values.

For example, if the futures price is higher than the spot price, capital will flow to the takers of the short position from the takers of the long position, encouraging more shorts to be executed.

These frequent deliveries ensure perpetual futures price convergence and prevent contract values from deviating significantly from the spot price of the underlying security.

High Accessibility, High Liquidity

Perpetual futures continue to be traded on online platforms to enable traders to execute orders and exploit price discrepancies across multiple markets and assets.

This growing supply adds more liquidity, namely for mainstream cryptocurrency contracts, including those for Bitcoin and Ethereum. Traders receive tight spreads and favorable exchange rates, boosting the number of transactions at online brokerage platforms.

Best Platforms to Trade Perpetual Futures in 2025

Choosing the right platform is essential for a successful perpetuals trading session. Some of the best providers offer robust security, broad liquidity, and competitive fees. Here are the top five perpetual futures trading platforms that you can find in 2025.

B2TRADER

B2TRADER, operated by B2BROKER, is making waves in 2025 as a white-label platform for institutional and retail clients. It has added perpetual futures to its multi-asset offerings, in addition to Forex, metals, cryptocurrencies, indices, energy, commodities, NDFs, equities, and ETFs across both CFD and Spot markets.

Contact the B2BROKER Team and Explore B2TRADER

Its superior trading engine supports ultra-low latency, fast processing, tight spreads, and competitive trading fees. One of its strongest features is dynamic leverage, which allows users to choose their leverage multiplier to suit their trading techniques and risk strategies.

B2TRADER also integrates B2BROKER’s liquidity ecosystem, connecting the platform to Tier-1 liquidity providers, financial institutions, and multi-asset liquidity pools. It also collects and distributes quotes and assets through industry-leading liquidity bridges, such as PrimeXM, oneZero, and B2CONNECT.

What sets B2TRADER apart is its infrastructure. It includes integrated charting tools, real-time risk management, and built-in order routing for optimal execution. With advanced APIs and FIX protocol support, it appeals to algorithmic traders and liquidity providers alike.

Security is also a strong point for B2TRADER, incorporating anti-DDoS protection, two-factor authentication, and real-time fraud monitoring to safeguard user funds and maintain platform integrity.

Its user interface is intuitive and customizable, catering to both novice and professional traders, as well as offering a fluid mobile application with an end-to-end journey from user registration to trading.

Offer B2TRADER to Your Clients

OKX

OKX remains a good choice for perpetual futures trading in 2025. Renowned for its powerful trading engine and comprehensive asset coverage, OKX enables traders to swap perpetual futures at 125x leverage. The platform is marked for its high-speed executions, high-grade security, and professional-level trading features.

The user interface is appropriate for both beginners and experienced traders, with advanced charting functions, risk management systems, and support for multiple order types. OKX has an efficient infrastructure for the development and management of trading bots or APIs.

Another one of the advantages of the OKX is its liquidity features. This creates negligible slippage even during adverse price movements, making it a good alternative for high-frequency traders. The exchange also offers competitive fees and innovative rewards for active traders.

It also provides additional focus on security, including cold wallet storage, multi-signature schemes, and a user insurance fund. Staking and other DeFi services are also available on OKX, enabling traders to diversify their methods within a single system.

Coinbase

Coinbase expanded its services to cater to perpetual futures traders by introducing the Coinbase Advanced platform. The platform comes with regulatory compliance and high brand trust attached, and it offers Bitcoin perpetual futures and for other cryptocurrencies. They provide moderate leverage options, appealing to both conservative and risk-taking traders.

It is both interactive and easy to use for beginners, yet offers enough features to appeal to sophisticated traders. Coinbase’s perpetual futures also offer high liquidity, tight spreads, and seamless connectivity with its spot trading and wallet services.

Coinbase also offers educational resources for perpetual futures, including tutorials and careful risk management guidelines. By focusing on education, the company allows newbie traders to approach leveraged products with greater confidence.

The site uses industry best practices, including insurance coverage, end-to-end encryption, and two-factor authentication. With its fully regulated status in the US, the site is the preferred choice for traders who prioritize compliance and transparency.

Binance

Binance is a powerhouse in the perpetual futures market, offering a wide selection of tradable contracts. It lets users trade perpetual futures with leverage up to 125x on hundreds of crypto assets. Its Futures interface is highly customizable and supports features like cross and isolated margins, multiple order types, and integrated risk controls.

One of Binance’s strongest advantages is liquidity. With millions of active users worldwide, the exchange provides deep order books, ensuring fast execution with minimal slippage. This makes it an excellent platform for day traders and high-volume institutional investors.

Binance also invests heavily in technology, offering advanced trading tools, real-time charts, analytics, and mobile access. The Binance Futures Testnet allows users to practice strategies without risking real funds.

The platform uses cold wallet storage, advanced account protection features, and a native emergency fund, SAFU (Secure Asset Fund for Users). The platform is also rolling out more regional compliance measures, making it a viable option in multiple jurisdictions.

Bybit

Bybit is a powerful perpetual trading platform for both retail and institutional clients in 2025. The platform offers a streamlined experience of leverage trading of 125x for major crypto assets, including BTC, ETH, and XRP. The service is renowned for its customer-oriented architecture, along with a stable matching engine.

Furthermore, Bybit features an interactive UI/UX interface, offering user-friendly functionalities such as TradingView-powered charts, advanced order mechanisms, and real-time profit and loss (P&L) monitoring.

It also features copy trading, allowing newcomers to replicate the actions of leading-performing traders. Bybit publicly displays funding rates and transaction fees to stress transparency and gains. Traders can also participate in recurring transaction tournaments, which offer rewards and incentives.

The security is first-rate, featuring multi-signature cold storage wallets, frequent audits, and anti-phishing technology. Bybit even has an insurance fund to absorb losses from liquidations, providing leverage traders with some sense of security.

Conclusion

Perpetual futures have become the basis of modern-day approaches to trading because of the convenience, leverage, and 24/7 access they carry, attracting retail and institutional investors.

In 2025, B2TRADER, Coinbase, OKX, Bybit, and Binance offer strong platforms for beginner and advanced traders to take advantage of open-end futures contracts.

However, the appropriate software for trading is dependent on available trading tools, regulatory climate, access to liquidity, and risk management tools.

FAQ

Are perpetual futures better than spot markets?

Perpetuals offer leverage, short-selling, and no expiration, while spot markets involve asset ownership and long-term position holdings. However, the leverage associated with perpetual comes with certain risks.

How to trade perpetual futures?

To speculate on perpetual futures, choose a reliable platform, deposit into your account, and select your contract. Decide whether to go long or short based on the market analysis, define leverage and stop-loss points, and monitor funding rates.

What is the best futures trading platform?

It is all about your needs. B2TRADER and Binance offer high liquidity and technology-focused interfaces, while Coinbase is best suited for users who prioritize compliance. Bybit and OKX cater to both professionals and newcomers with advanced features and secure infrastructure.

What is the best perpetual futures trading strategy?

The best methods include trend following, scalping, arbitrage, and hedging. Most traders utilize leverage to amplify potential gains while incurring higher risk alongside technical indicators such as the RSI or MACD.