B2BROKER Introduces cTrader White Label Prop Trading Solution

Jan 10, 2024

Interest in proprietary trading has surged, while traditional online trading is declining. In response, last year, B2BROKER launched B2PROP, a platform based on trading challenges that has rapidly become a preferred option on the market. Following this triumph, B2BROKER is now unveiling its cTrader White Label prop trading solution—a full-service brokerage infrastructure for institutional and retail brokers.

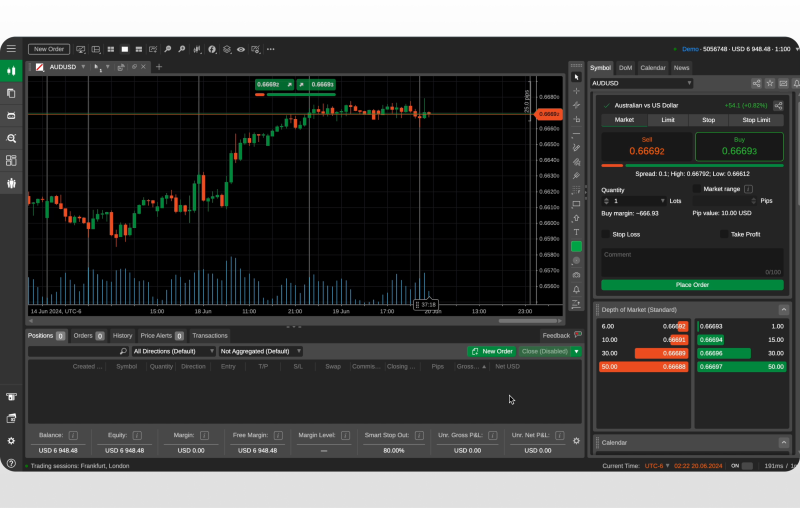

Since 2022, the B2BROKER team has offered Forex and CFD brokers the cTrader White Label platform. The cTrader Prop Trading WL is a specialized solution explicitly created for proprietary trading companies.

This latest addition provides an efficient, streamlined setup for a personalized, brand-specific prop trading experience.

The platform challenges traders to engage with virtual funds in trading contests, where winners receive real funded accounts. This setup is designed to maximize profitability for both traders and firms, featuring explicit profit goals and set risk parameters. Let’s review the unique features of B2BROKER’s cTrader WL prop trading solution.

General Overview

B2BROKER’s cTrader WL prop trading solution offers a robust structure for proprietary trading firms, cryptocurrency and Forex brokers, and multi-asset brokerage houses to establish custom trading challenges. These challenges are crafted to test and refine traders’ abilities using defined measures such as profit goals, risk boundaries, and performance standards.

The cTrader White Label Prop is a turnkey solution by B2BROKER that incorporates the cTrader platform and a client cabinet derived from B2PROP. It includes liquidity or data feeds, cryptocurrency processing, and integration with payment systems. This solution represents an optimal choice for starting a proprietary trading enterprise.

“cTrader Prop Trading WL provides a complete brokerage infrastructure for institutional and retail brokers. Our solution enables brokerages to quickly offer a branded, customizable experience for our clients.”

Ivan Navodnyy, Chief Product Officer at B2BROKER

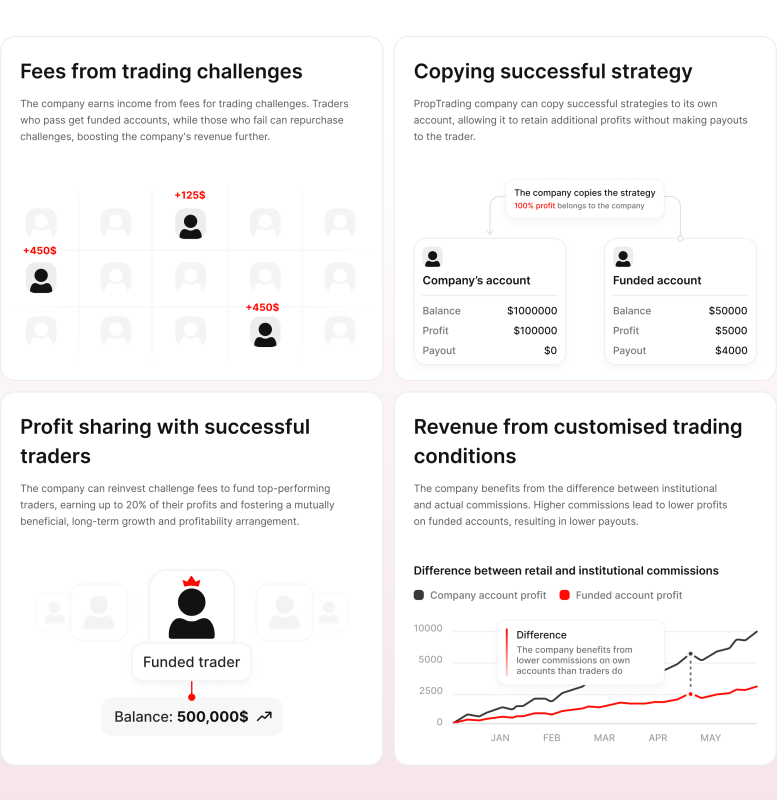

Income Opportunities for Brokers

B2BROKER’s offerings present multiple revenue opportunities for proprietary trading firms. A primary source of income is the fees charged for participating in trading challenges. Additionally, firms benefit from adopting successful trading strategies devised by their traders, securing profits without additional disbursements.

The model also includes profit-sharing with top traders and leveraging customized trading conditions that advantage the firms. This varied revenue framework ensures a steady income flow and benefits traders and the firms involved.

A cTrader prop trading server is available for companies that utilize their own solutions or those from third-party providers. This server employs a pricing model based on per-account charges rather than trading volumes, providing a competitive structure that enhances business margin capabilities.

Principal Advantages for Businesses

Traditionally, setting up a trading infrastructure requires a significant resource investment, including a large team for maintenance, hosting, and continuous multilingual support. This can be costly and time-consuming.

B2BROKER’s cTrader White Label solution simplifies and economizes this process. It minimizes the resources required and enables firms to tailor the trading platform to align with their branding and objectives. The introduction of algorithmic bot trading and a dedicated marketplace for traders further enhances the appeal of the solution in the market.

With comprehensive technical support and extensive customization options, firms can preserve their distinct identity while leveraging state-of-the-art trading tools.

Additionally, B2BROKER provides round-the-clock, multilingual support, educational resources, and an extensive knowledge base, equipping firms with all the essentials for successful operation.

“We are thrilled for cTrader to partner with B2BROKER to deliver a tailored white-label solution for prop trading firms. This collaboration highlights the versatility and robustness of the cTrader platform, enabling firms to offer innovative and fully customizable trading experiences. By combining B2BROKER’s extensive industry expertise with cTrader’s advanced infrastructure, we’re empowering prop firms and traders alike to excel in the rapidly evolving prop trading landscape.”

Ilia Iarovitcyn, CEO of Spotware & Developer of cTrader

Key advantages of the cTrader WL prop trading solution include:

Liquidity Aggregation

Firms can take advantage of B2BROKER’s liquidity clusters that consolidate pricing from various sources, offering the tightest spreads available in the market.

Global Access Server Network

Equinix data centers offer connectivity, providing access to a worldwide network and the most prominent financial ecosystems.

100% Tested Features

All features within the White Label product environment undergo rigorous testing to ensure they are ready for immediate use.

Transparent Pricing

The pricing is sourced directly from liquidity aggregators without the involvement of Market Makers, promoting a transparent and equitable trading environment.

Market Sentiment Insights

Gain insights through aggregated data from multiple cTrader servers, revealing the percentage of client accounts that predict price movements.

Full Environment Integration

The solution integrates seamlessly with other essential components such as Liquidity, Trading Platform, Trader’s Room, Payment Systems, and Copy and IB Program solutions, facilitating a comprehensive trading operation.

Advanced Technical Components

To support firms and their traders, the cTrader WL prop trading solution is equipped with sophisticated technical features, such as quotes control, account statements, a reliable backup system, branded WL cTrader, C #-based algo trading, API integration, support for hedging and netting, account management tools and advanced risk control.

Launch Your Proprietary Trading Firm with B2BROKER

Over 300 brokers currently prefer the cTrader platform, and this number is on the rise, especially after the market-leading MetaTrader ceased its white-label offerings. Given current market dynamics, 80% of the market is expected to adopt the cTrader solution soon. Therefore, in this competitive landscape, the right solution is to offer clients multiple trading platforms right from the start.

B2BROKER’s cTrader WL prop trading solution combines advanced technology with exceptional flexibility, enabling businesses to leverage emerging market trends effectively.

Based on the robust cTrader platform, this solution allows firms to initiate customized trading challenges, attract skilled traders, and secure a substantial market share.

For more details about cTrader White Label Prop Trading Solution, click here.

Overview of cTrader

cTrader is a multi-asset FX/CFD trading platform developed by Spotware, guided by the Traders First™ principle. This principle is dedicated to prioritizing the long-term interests of traders, brokers, and proprietary trading firms by offering solutions that address genuine market needs. cTrader is equipped with high-performance features that include ultra-fast order execution, advanced charting capabilities, built-in social trading, and free cloud execution.

This enables users to operate cBots from any device, such as cTrader Mobile. It allows for uninterrupted 24/7 algorithmic trading without requiring local computing resources—all at no additional cost.

For more details about cTrader, visit www.spotware.com