Spot Ethereum ETF Approved – How Will The ETH Price Change Now?

July 23, 2024

Crypto ETFs have been in the spotlight this year, with news triggering massive market outbreaks and driving investors’ decisions. These products are believed to restore faith in cryptocurrencies after years of being abandoned by traditional traders and financial institutions.

After the recent spot BTC ETF approval, which drove Bitcoin to a new record, will the ETH ETF spot trading have the same effects? Or will the post-ETH futures ETF underwhelming scenario prevail again?

Let’s track the possible market outcomes after getting the spot Ethereum ETFs approved.

Ethereum ETF Approved by The SEC

After several speculations and preliminary steps taken by the US Securities and Exchange Commission and Chicago Board Options Exchange to discuss the mechanics of listing Ethereum spot ETFs, the green light was finally granted to some investment firms to start trading.

In May 2024, the SEC individually discussed the mechanics of trading spot Ethereum ETFs with applicants, which many investors described as a “welcome surprise”.

The CBOE confirmed at least five Ethereum ETFs approved products will start trading on July 23rd: the Fidelity Ethereum Fund, the Franklin Ethereum ETF, the Invesco Galaxy Ethereum ETF, the VanEck Ethereum ETF, and the 21Shares Core Ethereum ETF.

The ETH ETF approval by SEC came much faster than the Bitcoin ETF case, which took nine months to go through. However, traders are uncertain about the price outcomes of this decision.

ETH Price Performance

Crypto traders still remember the underwhelming effect of Ethereum’s future ETF contracts, which did not perform as anticipated at the end of 2023. With that in mind, the ETH price is expected to be very sensitive after the ETH trading date is set to July 23rd.

Investors expect Ethereum selling pressures will split the market apart as futures contract holders will most likely liquidate their underperforming positions, which can inflate the coin’s price.

However, natural market dynamics suggest that when the Ethereum ETF is approved, more institutional investors will invest in these crypto products, raising the market value and hoping for a new price record.

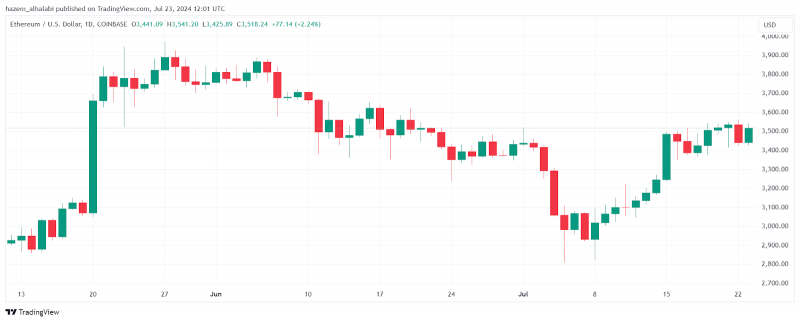

By looking at the price chart, we see that an upward trend in ETH prices started in the second week of July, more significantly from the third week. More importantly, when the decision was made on Friday, July 19th, the coin’s price achieved a 2.34% daily growth.

How to Trade Ethereum ETFs?

As we enter the ETH trading date, investors are racing to purchase these crypto ETFs, fueling a bull market and capitalizing on high price expectations. Here’s how you invest in ETH spot ETFs.

- Find a reliable broker that lists at least one of the five investment firms confirmed for trading ETFs for Ethereum spot contracts.

- Evaluate the ETF trading performance of each investment firm.

- Determine the position size that you can afford and check out if leverage or fractional shares are allowed.

- Watch out for future ETF trends in Ethereum that can affect your spot positions.

Conclusion

The crypto market is getting even more volatile after getting the Ethereum ETFs approved by US legislators. Many believe this move will trigger a new Ethereum price rally, hopefully sending the coin’s price to new records.However, others argue that Bitcoin captured the crypto hype, and ETH ETFs are less likely to experience a similar activity. Traders carefully watch the near-expiry futures contracts on July 26th, anticipating more noticeable price action later than sooner.