Brazil X Ban Lifted After Musk Pays $5 Million

Oct 09, 2024

Elon Musk’s X has always been a place for free speech, where many accounts share and communicate local news and multimedia with little restrictions compared to other social media platforms.

This approach motivated a controversial decision by Brazil’s Supreme Court in August banning X, formerly known as Twitter. However, X is now back in service in the country.

Within 40 days of the Brazil X ban, the social media network complied with the implied court requirements, and the platform is live for around 40 million users. Let’s review this decision, its timing, and what are the anticipated implications.

Brazil Lifts X Ban – What Happened

On 8 October, Justice Alexandre de Moraes, the Brazilian Supreme Federal Court justice, ordered a full return of X in Brazil as the network’s governing body adhered to the court ruling issued in late August.

X’s Global Government Affairs disseminated the information in a post, expressing that “it is proud” to resume service in Brazil. Elon Musk’s owned social network has been actively promoting freedom of speech since the billionaire took over X ownership.

The company agreed to pay a $5.1 million (28 million Reals) fine required by the Brazilian government to resume its service. Other criteria include appointing a legal country representative and banning accounts that spread disinformation.

Why Did Brazil Ban X?

Elon Musk often describes himself as an advocate for freedom of expression, speaking his mind, criticizing openly, and encouraging network users to do the same.

However, this approach did not sit well with the Brazilian government, especially with the approaching mayoral elections on 6 October. In August, Musk criticized the current Brazilian ruling system, including its president, court, and the 2022 presidential elections that led Lula da Silva to the chair.

In fact, Elon Musk was in close relations with the ex-president, Jair Bolsonaro, who helped introduce Starlink to the country and issued a Defense Order of Merit medal to the billionaire businessman.

Brazil’s Supreme Federal Court Justice de Moraes warned X about the spread of misinformation and false allegations against the current government. Musk challenged its Brazilian counterpart, especially after a ban move was discussed.

On 30 August, the X ban in Brazil was announced, stopping the service from millions of users who comprise the 6th largest market for the social media platform.

The Importance of This Decision

Lifting the ban of X in Brazil in less than 40 days from ceasing raises the question about a possible internal propaganda campaign regarding the mayoral elections. However, the Brazilian court stated that the ban had nothing to do with the freedom of expression or speech and was merely a legislative decision to comply with the country’s laws.

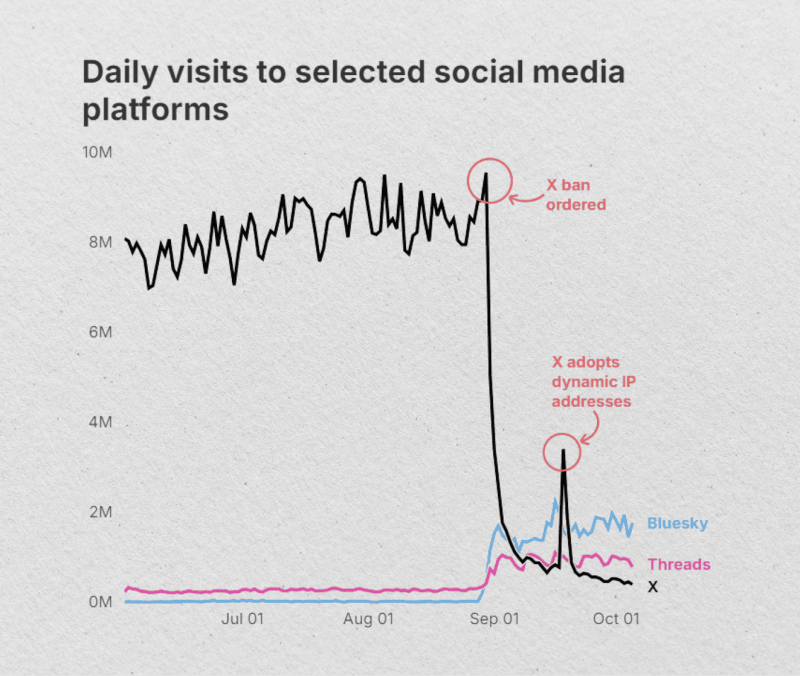

The social platform was massively affected when Brazil banned X, as the daily visits count fell dramatically from over 6 million to less than 1 million. Many of them used VPN to conceal their IP address and access X or switched to other alternatives like Bluesky and Threads.

Conclusion

The Brazil X ban did not last long, and after 39 days of closing the X service, according to the rules of Brazil’s Supreme Court, the ex-Twitter returned to Brazil.

Justice Alexandre de Moraes stated that X paid the specified fines and agreed to comply with local rules by appointing local representatives and restricting accounts from spreading misinformation.