Best Copy Trading Software in 2025

June 19, 2025

Suppose you get to trade like a pro without the need to spend years studying charts, concern about the market news the next day, or obsess over every decision. It’s no longer a fantasy but the reality in 2025 provided by copy-trading technology.

All exchanges are not created equal. Some are flashy and social, while others are geeky and Institutional-friendly. With the advent of AI-based recommendations, social leaderboards, and even DeFi integration, the landscape is evolving at a breakneck speed. How do you sort the ones worthy of your trust—and your hard-earned capital?

This article will detail the fundamentals of copy trading programs, how they function, and their types.

Key Takeaways:

- Copy trading in 2025 integrates automation, the social factor, and advanced analytics to appeal to both sporadic investors and institutions.

- These best sites emphasize openness, user-friendliness, and AI-matching to match users with the best methods.

- Rising developments on gamification, the integration of DeFi, and fractional trading are increasingly decentralizing and crowdsourcing the space.

What Does Copy Trading Software Stand For?

The software for copy trading is the equivalent of having an expert trader secretly working on your behalf. It provides ordinary investors the ability to copy the moves of experienced traders automatically—no charts, no guesswork, no worry.

Once you choose a trader to copy, the software syncs your account with theirs. When they open a trade, your trading account does the same. If they exit a position, so do you. It’s trading Forex on autopilot, but with the freedom to choose who’s in the pilot’s seat.

What makes copy trading so appealing is its simplicity. Financial markets can feel intimidating, especially for beginners. Not everyone has the time or expertise to study patterns, track the news, and make fast decisions. Copy trading software closes that gap. It offers a way for new traders to tap into expert-level strategies—without having to become experts themselves.

It’s also worth clarifying that copy trading isn’t the same as social or mirror trading. While those models have their own perks, they work differently. Social trading strategies are more about sharing ideas within a community, and mirror trading typically involves automated algorithms-powered strategies. On the other hand, a copy trading software focuses on real human traders and the real-time replication of their decisions.

Fast Fact:

Copy trading increased by more than 200% throughout the period from 2020 to 2024, with younger investors below 35 spearheading the trend in the crypto and forex markets.

Best Copy Trading Platforms of 2025 — Top Tools for Every Trader Profile

With the growth of passive investing, the need for automated trading, intelligent trade copier technologies, and effortless access to diversified trading strategies has brought about a new generation of copy trading software.

Regardless of whether you are a Forex trader, financial market investor, or brokerage looking to implement copy trading tools, the platforms represent strong ecosystems aligned with your objectives.

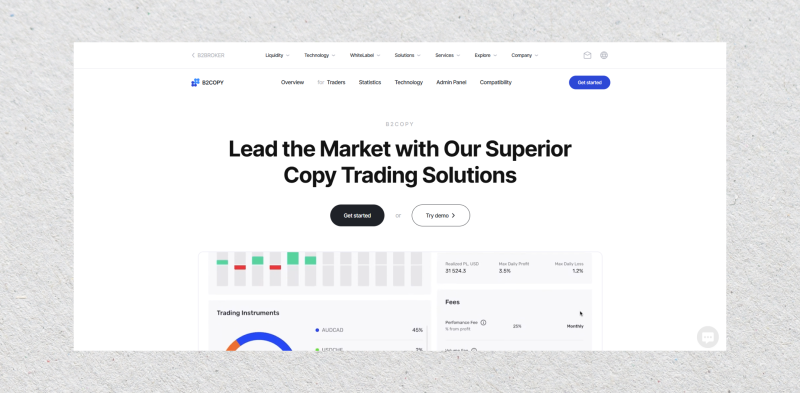

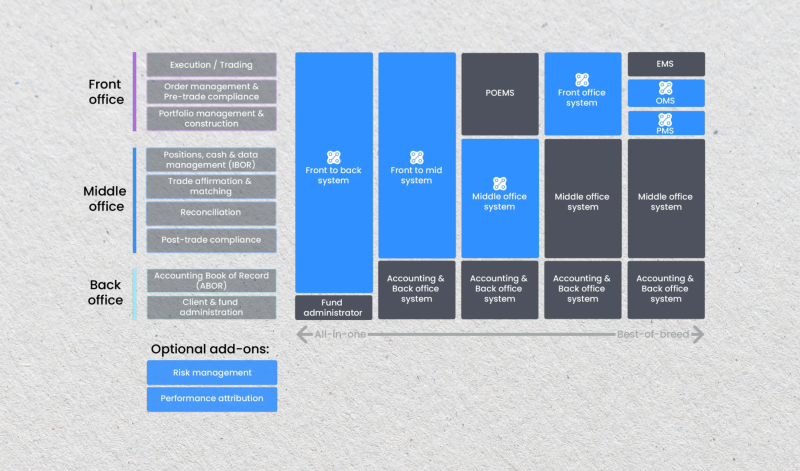

B2COPY by B2BROKER

B2COPY is a money management platform built by B2BROKER, designed specifically for the requirements of the business entities serving the financial industry. It differs from most pre-packaged solutions in that it has been engineered to integrate extensively with MetaTrader 4, MetaTrader 5, and cTrader, providing a modular framework designed to conform to the specific needs of the brokerages and Forex trading firms.

Besides copy trading, it accommodates advanced functionality such as multi-account arrangements (PAMM and MAM), real-time replication of trades, and adaptable commission schemes, all in an end-to-end brandable platform.

This solution targets brokers, fintech startups, and prop trading firms who would prefer to add a copy trading software to their platform rather than developing it from the ground up. It’s a business-to-business platform, not a do-it-yourself retail Forex trading platform.

The strength of B2COPY lies in its high degree of customization and institutional-grade tools. It offers precise trade syncing with ultra-low latency and allows businesses to fully control branding, permissions, and analytics. However, since it’s an enterprise-level solution, it requires some technical setup and existing trading infrastructure to be implemented properly.

ZuluTrade

ZuluTrade has long been one of the go-to names in copy trading; in 2025, it’s still going strong. It brings together a massive community of professional traders and experienced investors in a platform that supports manual and algorithmic strategies.

The platform integrates with regulated brokers, giving users access to forex, cryptocurrencies, stocks, and indices. You can connect your brokerage trading account or open one directly through ZuluTrade’s services.

What stands out about ZuluTrade is its lively trading community, integrated risk management tools, and versatile copying methods—including automated bots. It’s perfect for those who crave choice and clarity.

However, the platform’s interface is overwhelming at first, and the performance of the trader can range drastically from excellent to terrible, so due diligence is a prerequisite.

eToro CopyTrader

The eToros CopyTrader is one of the easiest platforms available to date. Its simple layout and communal approach are why the platform has captured the hearts of both new and intermediate trading users.

Users can browse top investors with just a few clicks, review their stats—including risk scores and historical returns—and begin copying them instantly.

It works simply by allocating a portion of your funds to a trader, and the platform mirrors their portfolio in real time. If they buy, you buy. If they sell, you sell. You maintain full control and can pause or stop copying at any moment.

The beauty of eToro lies in its accessibility. There are no additional fees for copy trading, and the built-in metrics make it easy to track performance. However, users are confined to the assets offered by eToro itself, and since it’s a closed ecosystem, there’s no option to use your own broker.

DupliTrade

DupliTrade is a platform that takes a more professional approach. It’s built to work directly with MetaTrader 4 and 5, especially appealing to investors who want to replicate strategies from vetted, high-performance traders.

Each of the signal providers on DupliTrade has gone through a screening process, and their trade histories are presented with thorough metrics. All this makes it simpler for users to make a decision based on facts, rather than relying on hype.

DupliTrade is ideal for veteran investors or brokerages who wish to provide solid and selective copy trading. It may not have the flashy community features of something like eToro, but it gets the performance tracking and pro-grade replication right where it matters.

CopyMe

CopyMe is a relatively new player in the space but is fast gaining traction across the crypto space. It provides a social-first model that allows users to follow crypto traders according to certain strategies, token interests, or NFT portfolios.

What’s unique about CopyMe is its interactive layer. You can communicate with other users, comment on trades, join interest-based groups, and access live-streamed trading sessions. It’s actually a lot more of a social application than a trading terminal, but this appeals to a younger generation of tech-savvy people.

A mobile-first system, CopyMe provides real-time feeds, push alerts, and an easy-to-use dashboard where you can follow copied portfolios from anywhere.

Although its crypto focus is a significant bonus for crypto enthusiasts, at the moment, it does not provide much access to the traditional financial markets as it is still building its trader pool.

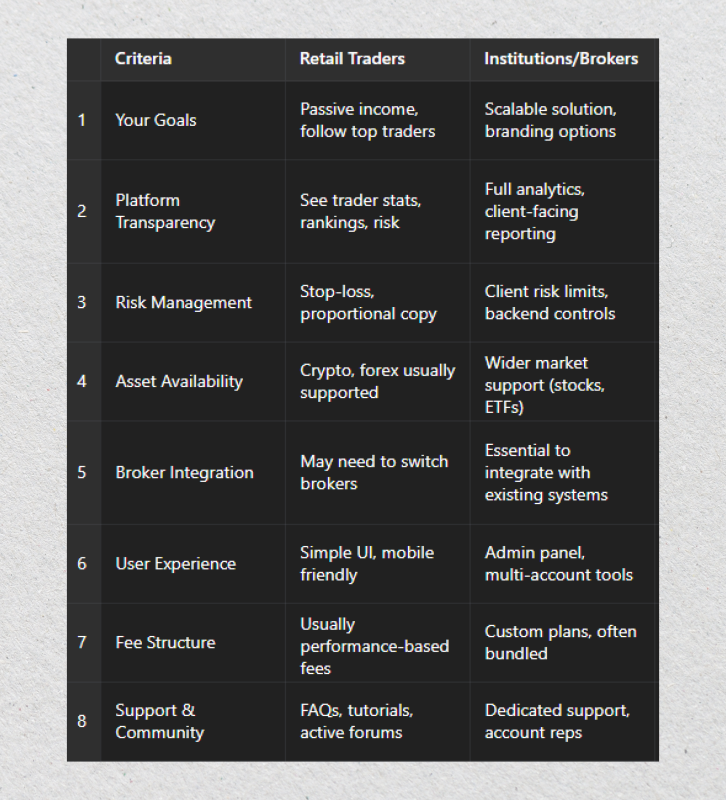

How to Choose the Right Copy Trading Software?

Selecting the best copy trading platform isn’t about choosing the name everyone mentions first or the platform with the coolest layout—it’s about identifying a platform compatible with your objectives, level of experience, and risk tolerance.

Regardless of whether you’re an experienced investor or a fintech company constructing your own offering, the optimal software should be an extension of your strategy, rather than a constraint.

Understand Your Goals

Before comparing, get clear on what you want from the copy trading software. Are you a retail trader looking to follow a few top performers and earn passively? Or are you a broker wanting to integrate a scalable solution into your client ecosystem?

Your goals will shape everything—from the level of control you need to the features that matter most. A casual investor might prioritize simplicity and mobile access, while a business will need deep backend customization and regulatory alignment.

Evaluate Platform Transparency

Not all copy trading services are equally transparent. A good platform will offer complete visibility into the traders you’re copying—performance history, risk scores, win/loss ratios, and even trading styles.

If you trust someone else’s decisions with your money, you should know how they’ve performed over time and what risks they typically take.

Avoid platforms that feel like a black box. If you can’t easily see how traders are ranked or what data is used to assess them, that’s a red flag.

Look for Built-In Risk Management

Risk is always part of the game, even with the best traders at your fingertips. That’s why strong risk management tools are a must. Look for features like stop-loss settings, allocation limits, and risk-adjusted performance metrics. The ability to copy trades proportionally rather than blindly can help you maintain control over your exposure.

Check Asset Availability and Broker Integration

Different platforms support different asset classes. Some focus solely on forex and crypto, while others include stocks, ETFs, commodities, or indices. Ensure the software you’re considering aligns with the markets you’re interested in.

Also, check whether the platform works with your preferred broker—or if it forces you to use their proprietary service. If you already have a brokerage account you trust, choosing software that allows seamless integration is ideal.

Prioritise User Experience

Copy advanced trading tools should simplify your life—not complicate it. A clean interface, responsive mobile app, and intuitive settings can make all the difference. If it takes 20 minutes just to find a trader’s history or adjust your portfolio settings, it’s probably not the right fit.

For institutions and brokers, the user experience matters too—but from a different angle. Back-office tools, admin controls, and multi-account management features become more important at scale.

Compare Fees and Commission Structures

Fees can eat into profits faster than most people realize. Some platforms charge a fixed subscription, others take a percentage of your copied profits, and some may bundle everything into the broker’s spreads.

Be sure to understand the fee model upfront. More importantly, compare it to the quality of service and returns you’re likely to receive.

Don’t Ignore Support and Community

Lastly, look at the platform’s support ecosystem. Is there helpful customer service when you need it? Are there educational resources, FAQs, or forums where you can ask questions and share experiences?

A vibrant, engaged community of traders and followers can be a big bonus. It adds an extra layer of insight and helps build trust in your strategies.

Future Trends in Copy Trading

With the advancing financial technology, copy trading is about to undergo significant change. It was first conceived as an uncomplicated process of duplicating trades but now is becoming an intelligent, multi-faceted experience––influenced by artificial intelligence, decentralization, and the end-user’s need for more intelligent automation.

Here are the upcoming trends redefining the future of copy trading software in 2025 and later.

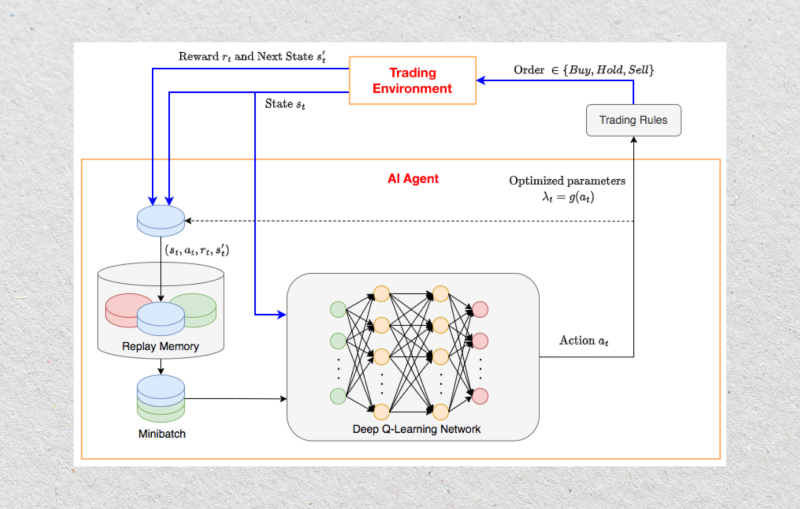

AI-Powered Strategy Matching

One of the most thrilling developments is the increasing deployment of artificial intelligence to customize the copy trading experience. Rather than having to scroll after scroll through trader profiles, customers now witness platforms employ AI algorithms to recommend traders whose goals, risk level, and market orientation suit their requirements best.

Think of it like a Netflix-style recommendation engine—but for your portfolio. These systems learn from your past behavior, analyze your financial profile, and even adapt suggestions as market conditions change. It’s a smarter, more intuitive way to connect followers with the right strategies.

Gamification and Social Engagement

Copy trading is not just about profits—it’s becoming interactive and fun. Platforms are introducing features like trader leaderboards, achievement badges, and community voting systems to engage users more deeply.

Gamification adds a competitive, social element to trading, where traders are motivated not just by returns but by their rankings and reputation. For followers, this means more transparency and community validation when choosing who to copy.

Rise of Decentralized Copy Trading

The DeFi world is slowly merging with copy trading software. There are new emerging exchanges that operate purely on blockchain technology, where one can copy trades from smart contracts instead of middleman brokers.

This model provides higher transparency, reduced costs, and custody management because assets stay in the user’s crypto wallet. Though still in its nascent stage, decentralized copy trading has the ability to transform the way trust and custody are managed in financial replication.

Micro-Copying and Fractional Trading

Another trend gaining traction is the ability to “micro-copy” trades using fractional amounts. Instead of needing large capital to follow top traders, users can now allocate just a few dollars and mirror complex strategies across Forex, crypto, or stocks. This trend appeals to younger or budget-conscious investors who want to diversify without overcommitting funds.

Cross-Platform and Multi-Asset Integration

With diversified investments across asset classes and brokers, the need for cross-platform copy trading software is increasing. The users do not wish to be confined to a single trading ecosystem.

The future is in platforms providing seamless compatibility with several brokers, assets, and exchanges—so individuals can copy Forex trades on one copy trading account while duplicating crypto or commodities on another. Integrated dashboards and cloud infrastructure are enabling this reality.

Improved Transparency and On-Chain Credibility

With the increase of misinformation and fake outcomes, trust is currency. That is why modern copy trading software focus on highly verifiable histories of previous performance.

From blockchain auditing to API-based trade verification, the aim is simple: eliminate manipulation and showcase real, provable trading history.

Some systems even assign “on-chain reputation scores” to traders—so followers can verify past results with total confidence.

Conclusion

Copy trading has come a long way from its humble beginnings. It’s no longer just a shortcut for beginners — it’s a sophisticated ecosystem where technology meets talent, and your financial journey can align with those already mastering the markets.

As we’ve seen, the best platforms in 2025 do more than mirror trades — they build communities, foster transparency, and hand you the tools to grow smarter, not just faster.

But here’s the twist: the most powerful strategy isn’t just in who you copy — it’s in how you choose. Do your research, stay curious, and let your trading tools reflect your values, not just your goals.

FAQ:

What is the main benefit of copy trading software?

It allows users to automatically replicate the trades of professional investors in real time, saving time and reducing the need for advanced knowledge.

Can I copy multiple traders at once?

Yes, most platforms support multi-trader copying, allowing you to diversify your portfolio and manage risk across different strategies.

Is copy trading safe for beginners?

While no investment is risk-free, many platforms offer risk scores, filters, and built-in protection tools to help beginners make informed decisions.

Do I need a large capital to start?

Not at all—many platforms now support fractional copy trading, meaning you can start with as little as $10 or $50, depending on the provider.

What’s the difference between copy trading and social trading?

The copy trading software focuses on replicating trades automatically, while social trading is more about sharing ideas, discussions, and manual decision-making.