Best Forex CRM Providers in 2024: Find The Right Fit for Your Business

Nov 11, 2024

The Forex landscape has evolved significantly in the 2020s, fuelled by a surge in retail investors seeking accessible ways to enter the FX market. With this growing demand, numerous mid-sized brokerages have emerged, offering affordable commissions and personalized services tailored to retail traders. This trend has opened up substantial opportunities for brokers to cater to a wider audience and tap into the expanding retail Forex market.

However, as competition intensifies, new brokerages face considerable challenges and need the right tools to stand out and succeed. One of the most crucial investments for any broker in today’s market is a robust Forex CRM system, allowing brokers to streamline client interactions, automate workflows, and maintain compliance.

In this article, you will find the answers to the questions about why CRM systems are an integral component of the Forex brokerage business, what functionality they have, and what solutions have gained the greatest popularity in the market today.

Key Takeaways:

- Forex CRM system solutions have become essential tools for brokerages, offering unparalleled support in managing client relationships.

- By centralizing all aspects of client interactions into a single hub, Forex CRMs allow businesses to efficiently oversee, monitor, and track client relationships, fostering stronger connections and smoother operations.

- Forex CRM software excels in reporting and analytics, providing brokers with valuable insights that drive informed decisions and strategic growth.

Why is Forex CRM a Game-Changing Solution for Brokers?

In today’s highly competitive and digitized Forex market, brokers increasingly recognize the vital role of a robust customer relationship management (CRM) system in driving growth, operational efficiency, and client satisfaction.

With the global Forex market valued at over $2.4 quadrillion annually and an estimated 15 million traders actively participating worldwide, brokers face a dynamic and challenging environment where managing client relationships is complex and critical.

The importance of Forex CRMs has been reinforced by recent statistics showing the direct impact of customer experience on broker success. According to a 2024 report by HubSpot, businesses that use a CRM see a 78% sales improvement and marketing alignment.

Given the competitive nature of Forex trading, where clients can easily switch brokers based on their experience and support, these numbers underscore the significance of a well-integrated CRM. Additionally, 91% of businesses with over ten employees now use a CRM, highlighting how integral CRM systems have become across industries and even more so in complex, high-volume sectors like Forex trading.

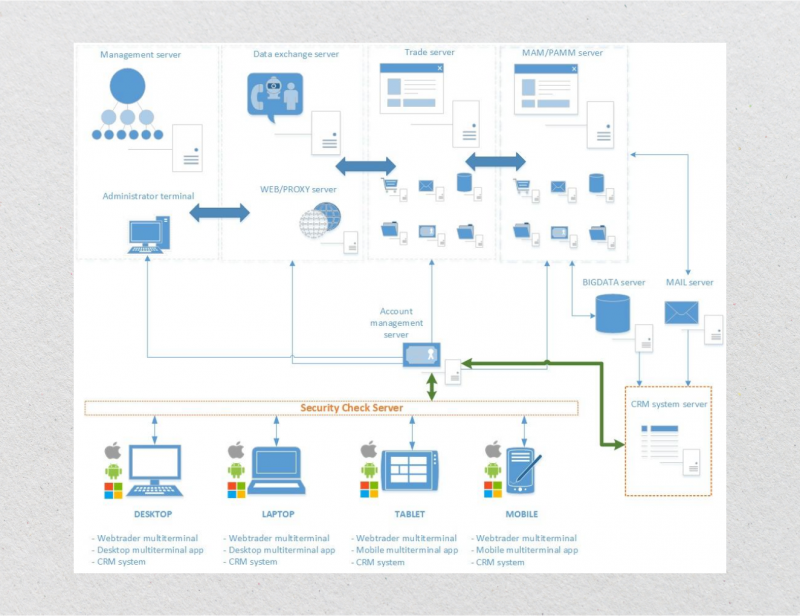

In an industry where data accuracy, timely communication, and compliance are paramount, Forex CRMs address these challenges by consolidating essential functions into one centralized system. Modern Forex CRMs integrate with popular trading platforms like MetaTrader 4 and 5, allowing brokers to manage client accounts, trading activity, and support services in real-time.

This has become particularly important as trading volumes have surged with the rise of retail trading and digital platforms, with data from the Bank for International Settlements showing that daily Forex trading volumes exceeded $7.5 trillion in 2022. For brokers, this volume demands precision in client management, rapid response times, and tailored support — capabilities that a Forex CRM enhances through automation and centralized data management.

Fast Fact:

Unlike a classic CRM system, an FX CRM offers a vast array of specialized tools designed to enhance interaction with the Forex market.

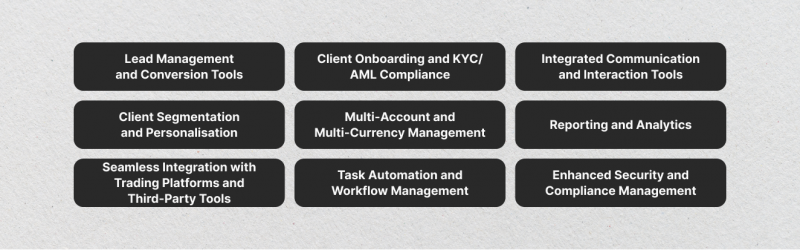

Key Features to Look for in a Forex CRM

When selecting a Forex CRM, it’s crucial to understand the features that make it a valuable tool for managing client relationships, streamlining operations, and complying with regulatory requirements. Here’s a look at the key features that can significantly enhance a Forex CRM’s effectiveness:

Lead Management and Conversion Tools

A Forex CRM should offer robust lead management tools essential for capturing, organizing, and nurturing leads throughout the sales process. Look for features like automated lead capture, lead scoring, and prioritization to help brokers identify high-potential prospects. Additionally, automated follow-up workflows, such as email or SMS sequences, keep leads engaged and increase conversion rates by ensuring timely, personalized contact.

Client Onboarding and KYC/AML Compliance

Simplifying client onboarding is a must in the Forex industry, where regulatory requirements are stringent. A good Forex CRM should automate know-your-customer (KYC) and anti-money laundering (AML) processes, ensuring compliance without slowing down onboarding. Automated identity verification, document collection, and secure data management allow brokers to meet compliance standards seamlessly while delivering a smooth client onboarding experience.

Integrated Communication and Interaction Tools

Forex brokers must maintain continuous communication with clients, often across multiple channels. A high-quality Forex CRM integrates various communication methods — like email, SMS, and VoIP — into one platform, allowing brokers to keep all client interactions centralized and accessible.

Automated notifications and alerts ensure clients stay informed about critical updates, such as market changes or margin calls. At the same time, live chat and chatbot integrations provide real-time support that enhances the client experience.

Client Segmentation and Personalisation

Advanced client segmentation allows brokers to categorize clients based on factors like trading behavior, volume, experience level, and geographical location. This enables brokers to tailor services and marketing efforts to specific client groups, creating a more personalized experience. By tracking client behavior, the CRM can suggest targeted content or product offerings, helping brokers provide relevant, timely engagement that fosters loyalty.

Multi-Account and Multi-Currency Management

Many Forex clients manage multiple trading accounts and trade in different currencies. A CRM that offers multi-account management lets brokers view and handle various accounts under a single client profile, simplifying account oversight and switching. Multi-currency support is also vital for international clients, enabling smooth transactions and accurate reporting regardless of currency.

Reporting and Analytics

Insightful analytics are critical to any effective Forex CRM, offering brokers real-time data on client activity, trading volume, and other critical metrics. Customizable reports and dashboards accurately view client performance and profitability, helping brokers make informed, data-driven decisions. With client profitability analysis, brokers can identify high-value clients and assess the most effective services, enabling strategic resource allocation.

Seamless Integration with Trading Platforms and Third-Party Tools

Integrating CRM with popular trading platforms (like MetaTrader 4 and 5) and third-party tools is essential for a cohesive brokerage system. These integrations allow synchronized data flow between the CRM and trading platforms, payment gateways, and marketing tools, ensuring brokers can manage all operations from a unified interface. This enhances data accuracy, reduces manual data entry, and improves the client experience.

Task Automation and Workflow Management

Automating routine tasks — like follow-up emails, client reminders, and reporting — frees up brokers to focus on high-priority activities. A Forex CRM with customizable workflows and task notifications helps brokers ensure critical actions aren’t missed, increasing operational efficiency. Automated workflows also standardize processes across teams, improving consistency and reducing errors.

Enhanced Security and Compliance Management

Forex CRMs must prioritize data security, especially in today’s regulated environment. Protect client information by looking for features like data encryption, secure document storage, and audit trails. The CRM should also have built-in compliance tools for regulatory standards, such as GDPR or CCPA, safeguarding brokers from regulatory risks and ensuring client data privacy.

Forex CRM Solution Providers — What Is The Best Option In 2024?

Selecting the right CRM software is of the utmost significance for Forex brokers, aiming to enhance client relationships, streamline operations, and ensure regulatory compliance. Below is an overview ofthe best Forex CRM providers in 2024, highlighting their key features and benefits.

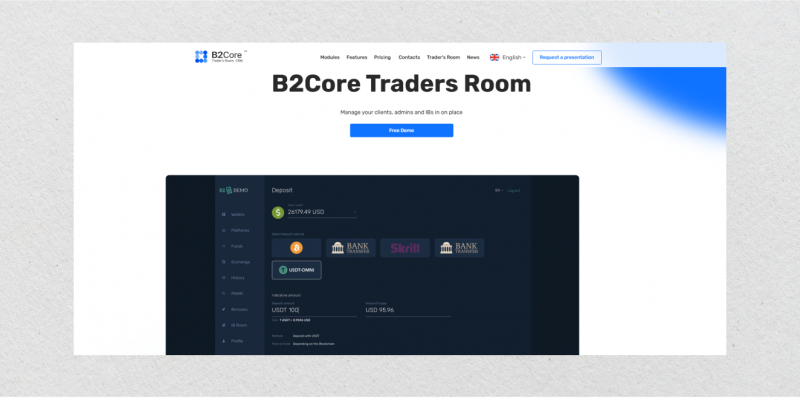

B2CORE

B2CORE is a next-generation CRM designed by B2BROKER company for Forex and cryptocurrency brokerages, offering an all-in-one solution for managing client interactions and trading processes. Its integration of trader’s room, back-office software, CRM functionalities, and IB partnership programs make it a versatile choice for brokers in diversified markets.

Key features include an advanced trading interface that can be customized to enhance the client experience. B2CORE also includes secure tools for money storage and multi-currency conversion, making it ideal for handling traditional and digital assets.

The user interface is adaptive, adjusting to various devices to improve client accessibility. With real-time analytics on trading performance and robust security protocols, including two-factor authentication, B2CORE offers a multifaceted solution that suits brokers looking to expand into multiple financial markets.

FX Back Office

FX Back Office provides a fully-featured CRM and back-office software solution specifically designed to meet the needs of Forex brokers. Known for its modular approach, the platform allows brokers to tailor their CRM setup according to specific operational needs, making it highly adaptable and scalable.

The platform’s key features include centralized client management, consolidating all relevant client information, such as contact details and trading history, in one accessible location. Additionally, FX Back Office offers robust risk assessment tools, which are crucial for maintaining compliance and minimizing operational risks. Its compliance and reporting modules support KYC and AML requirements, streamlining regulatory processes through automated workflows and customizable reports.

Leverate

Leverate offers a wide-ranging suite of brokerage solutions featuring a CRM system that enhances client management and operational efficiency for Forex brokers. The CRM includes a lead management system for capturing and nurturing leads through automated workflows and marketing tools for targeted campaigns to boost client acquisition and loyalty.

It also provides compliance tools like automated KYC and AML checks to ensure regulatory adherence. Leverate is compatible with various trading platforms and back-office systems, facilitating seamless integration and improved operations.

Kenmore Design

Kenmore Design offers a customizable Forex CRM tailored for brokers, emphasizing flexibility and scalability. This system enhances client interactions and allows personalized services, making it a good choice for brokers looking for growth.

The CRM features a centralized client management module, robust affiliate tracking tools for managing programs, and customizable reporting for performance tracking and compliance. Kenmore provides a versatile platform with strong affiliate management capabilities and extensive customization options.

CloudForex CRM

CloudForex CRM is a cloud-based system that delivers essential client management and operational tools to Forex brokers, offering flexibility and scalability. This platform is particularly suitable for brokers who want to manage operations in a cloud environment, providing seamless access to data and workflows from any location.

Key features include centralized client profiles with detailed activity logs, making it easy for brokers to manage client data. CloudForex CRM also provides lead-tracking tools that enable brokers to capture, segment, and follow up with leads in a structured way. Automated workflows simplify onboarding, KYC compliance, and follow-ups, helping brokers maintain high operational efficiency.

UpTrader

UpTrader provides a fully integrated CRM system with back-office and trading software, creating a unified ecosystem ideal for Forex brokers. It includes a sales funnel that tracks clients from lead generation to conversion, offering valuable insights into client acquisition stages.

The platform’s multi-level partnership program supports complex affiliate structures, allowing brokers to expand their reach effectively. With integrated marketing tools for email campaigns, notifications, and client segmentation, UpTrader ensures consistent client engagement. Compatible with MT4, MT5, and cTrader, UpTrader is an excellent option for brokers aiming for efficient scaling.

HubSpot CRM is a versatile, user-friendly platform known for its robust automation features, though not specifically designed for Forex. It includes robust contact management and sales pipeline tracking, adaptable for brokers who customize a general CRM.

With powerful marketing automation, brokers can run targeted campaigns and gain insights into sales and client engagement. HubSpot’s customizable workflows and intuitive interface make it an appealing choice for brokers looking for a flexible CRM with strong marketing capabilities.

Zoho CRM

Zoho CRM offers advanced automation and AI-powered insights, making it highly adaptable to Forex brokers with diverse needs. Its AI assistant, Zia, provides predictive analytics and suggestions, enhancing data-driven decision-making.

Zoho supports omnichannel engagement through email, social media, phone, and live chat, making it easy for brokers to interact on clients’ preferred channels. Extensive customization options make Zoho a good fit for brokers seeking a tailored, scalable CRM solution.

Freshsales CRM

Freshsales by Freshworks is an intuitive, sales-focused CRM ideal for small to medium-sized brokerages. Combining automation and AI tools enables efficient client management on a budget.

Features include a built-in phone system and sales sequences for automated follow-ups, with AI-driven lead scoring to help brokers prioritize. Freshsales is practical for brokers needing essential sales tools, reliable automation, and streamlined client interaction.

Pipedrive CRM

Pipedrive is a visual CRM with an intuitive sales pipeline, perfect for brokers wanting a straightforward system for client interactions and sales management.

It includes visual pipeline management, a drag-and-drop interface, and chatbot integration for easy lead capture and qualification. With lead scoring and numerous integration options, Pipedrive is a solid choice for brokers focused on simple, effective sales and lead management.

Conclusion

Selecting the right Forex CRM is vital for brokers to streamline client management, enhance efficiency, and ensure compliance. With trading volumes over $7.5 trillion daily, brokers need a CRM that centralizes data, automates workflows, and supports regulatory needs.

The most effective CRM depends on a brokerage’s goals and strategy, whether for affiliate management, platform integration, or analytics. A robust Forex CRM goes beyond daily tasks — it’s a strategic investment in client loyalty, profitability, and competitive edge in the digital Forex landscape.

FAQs:

How do I choose the right Forex CRM for my brokerage?

Consider factors such as integration capabilities with trading platforms, customization options, scalability, security features, and the specific needs of your brokerage.

How do CRMs protect client data?

Leading Forex CRM providers implement robust security protocols, including data encryption, two-factor authentication, and compliance with international data protection regulations.

Do CRMs offer support for multi-currency and multi-account management?

Yes, solutions like B2CORE and FYNXT provide multi-currency support and allow for efficient management of multiple trading accounts under a single client profile.

Are there trial versions available to test CRM systems?

Many CRM providers offer demos or trial periods, allowing brokerages to evaluate the system’s features and suitability before committing.