End of An Era — What’s Next After the MetaTrader 5 White Label?

June 6, 2024

The MT5 WL has been a crucial instrument for brokerage houses in the burgeoning financial trading sector. Offering a plethora of features, this platform can be customized to meet the specific objectives of brokerage firms and traders involved in FX and CFD trading.

With continuous technological progress and the changing landscape of market requirements, the industry is increasingly inclined to look beyond MT5 and seek out alternative platforms and solutions that can better address the evolving needs of financial intermediaries and traders. This shift signifies a readiness to embrace innovation and adapt to the dynamic nature of the financial trading field.

This article will explain MT4/5 WL systems and how they affect the trading field. You will also gain knowledge about the distinctive features and competitive differentiators they offer, as well as what alternatives exist today.

Key Takeaways:

- MT4/5 WL platforms are the most popular choice of trading ecosystem among FX brokers and various trading exchanges.

- MT4 and 5 WL Platforms offer a wide range of functionalities, among which the most sought-after are copy- and algo-trading.

- One of the most commonly used WL platforms as an alternative to MT4/5 is cTrader.

What is MetaTrader 4/5 WL?

MT4 and MT5 are highly acclaimed and widely used trading apps created by Meta Quotes Software. These systems have established themselves as the benchmark for online trading in a variety of capital markets, reckoning FX, +, and futures.

Traders and brokers around the world rely on the superior features, simple and intuitive user-interface, and powerful analytical tools offered by MT4 White Label and MT5 to execute trades and analyse market trends effectively.

These versatile platforms comprise a fully integrated set of functions geared to the prerequisites of both retail traders and professional investors. The robust visual representation tools, coupled with a diverse selection of technical metrics and drawing options, allow traders to run detailed market research and make deliberate trading decisions.

Due to the ideal combination of powerful trading tools, ease of use, and versatility, these solutions have gained popularity among ordinary traders and professional investors, allowing the company to support their continual growth and constantly bring new aspects and improvements to the functionality of the platforms.

This allowed the company to expand its business and cooperate with various solution providers and services in the FX space and other markets such as crypto, CF, and capital markets.

Fast Fact:

As of today, MetaQuotes no longer offers MT4 or MT5 options to work within the WL model.

What is the Impact of MT4/5 White Label Offerings on the Trading Industry?

In the process of its systematic development, the FX niche has experienced significant changes in the emergence of new solutions and concepts aimed at expanding the potential of trading systems to give users new advantages in terms of speed of work with financial markets, stability, and ease of use of the trading terminal interface.

It also involved using the ability to use a product according to the “all-inclusive” model, a solution that would give investors full access to trading digital assets based on an ecosystem that includes individual services. The applications and the operation of each of these affect the performance of the overall trading system and allow you to increase the efficiency of the trading algorithms used.

With the arrival of White Label systems on the trading market, it has become possible not only to develop a product that combines a set of different integrations that provide full-fledged trading in general but also to offer this product to other companies wishing to enter the market, be it Forex, stocks or crypto.

This, in turn, provoked severe changes in the trading sphere, increasing not only the popularity of such a business model but also the demand for ready-made solutions due to their availability, multifunctionality, and high possibilities of remodeling of internal infrastructure elements and visual elements of the interface.

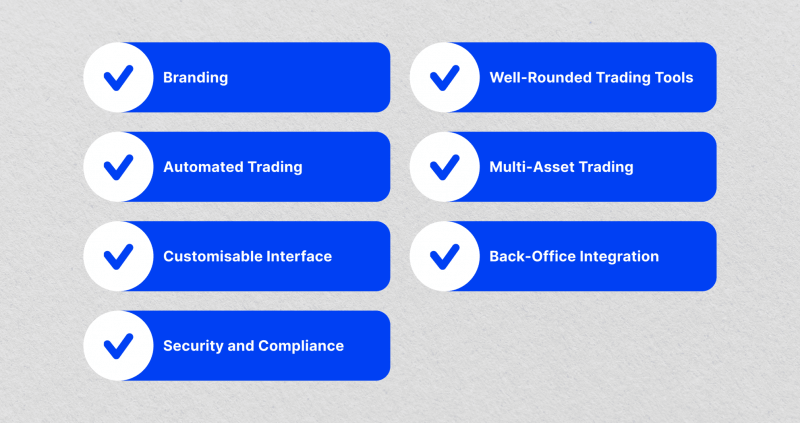

Core Features of MetaTrader 4/5 White Label

Throughout its existence, Metatrader WL applications have undergone many stages of advancement and changes that have become the foundation for realizing modern concepts and ideas to improve the user experience of interacting with the product. In this way, the following key features have enabled the platforms to achieve high levels of efficiency, performance, and security:

Branding

Through the MT4 white label setup, brokerage houses have the option to customize the trading structure to align with their branding vision. The modification involves integrating logos, color schemes, and brand-specific features to ensure a distinct and personalized trading journey for their clientele.

Well-Rounded Trading Tools

Both MT4 and MT5 white label products provide users with a complete broad spectrum of trading characteristics. These tools include various chart types, such as line charts, bar charts, and candlestick charts, along with an array of market-related graphic tools, like metrics and drawing tools. Additionally, both platforms allow users to seamlessly execute trades directly from the charts, enhancing the efficiency of their trading activities.

Automated Trading

Many trading platforms provide support for automated trading through the use of expert advisors. They enable traders to implement automated trading strategies based on predefined rules and criteria. By utilizing EAs, traders can automate their trading activities, including generating buy and sell signals, managing trades, and implementing risk management strategies without manual intervention.

Multi-Asset Trading

MT5 is a versatile platform that caters to various asset classes such as Forex, stocks, futures, and options. Conversely, MT4 is primarily designed for Forex trading and may not offer the same breadth of asset classes as MT5.

Customizable Interface

Brokerage firms can customize the user interface to align with their clients’ bespoke demands. This can improve the user experience, leading to higher client satisfaction.

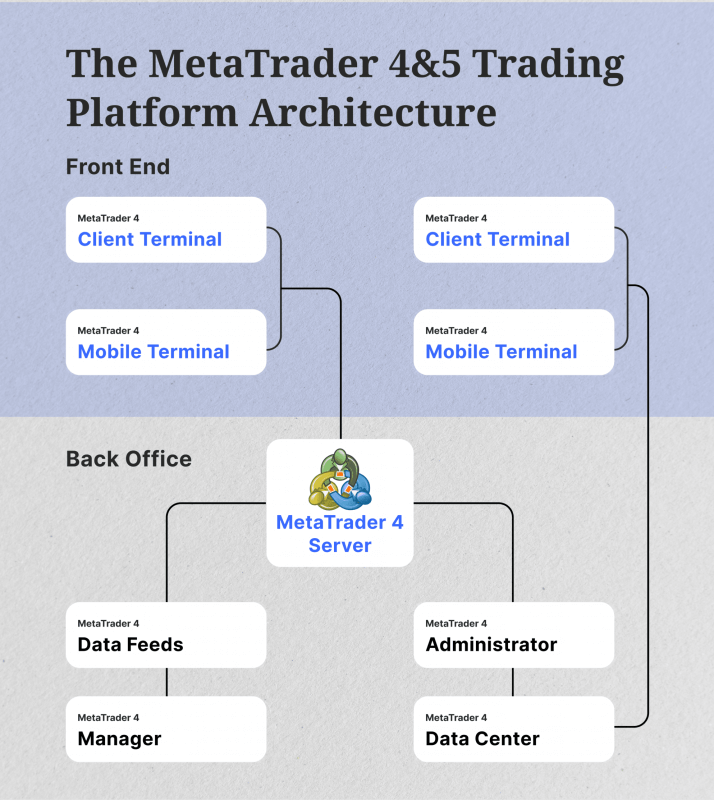

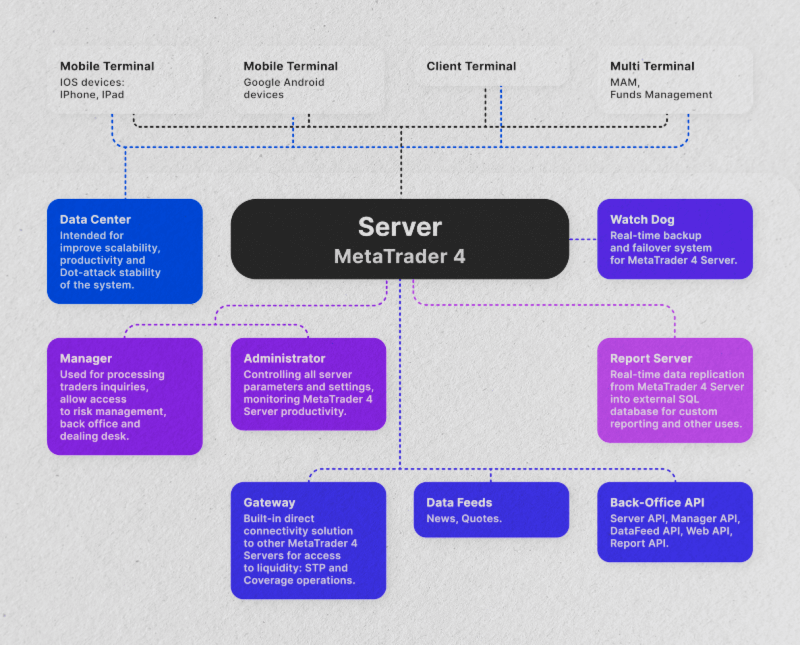

Back-Office Integration

WL packages encompass fully integrated back-office integrations for client management, reporting, and analytics. These solutions empower brokers to oversee and streamline their operational processes effectively.

Security and Compliance

The MT4/5 WL platforms have been meticulously crafted with a thorough suite of security specifications and compliance tools. These are implemented to guarantee a secure and well-regulated trading environment for all users.

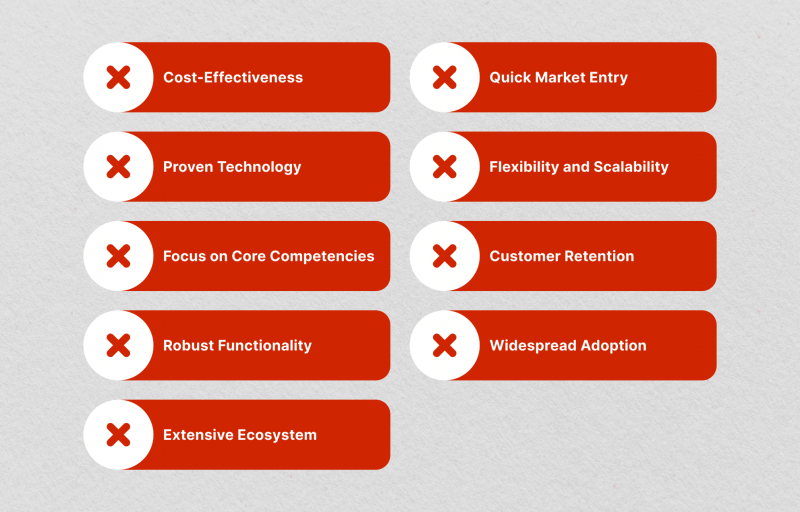

Competitive Differentiators of MetaTrader 4/5 WL Setup

Due to the popularisation of MT platforms, as well as their systematic improvement and modernization, the interest of many brokerage companies and various exchange platforms in creating their own brokerage venture has generated a sharp surge in demand for WL products developed on their basis, including due to the following competitive advantages they provide. Among them, we can emphasize the following:

Cost-Effectiveness

When considering establishing an MT5 WL system, it’s paramount to note that this alternative is more affordably priced compared to creating a custom trading system from the ground up. By opting for an MT5 WL system, brokers can take advantage of MetaTrader’s well-established technology without having to bear substantial development costs. This can be a prudent strategic move for brokers who want to enter the market or expand their offerings while managing costs effectively.

Quick Market Entry

MT White label products allow brokers to rapidly introduce their trading services without having to invest time in the lengthy process of developing and testing a trading program from scratch.

Proven Technology

MT platforms have gained widespread recognition and trust within the trading community due to their ability to provide a dependable and resilient trading venue for clients. These systems are known for their reliability and robustness, making them a popular choice among traders.

Flexibility and Scalability

The modular design of MT4 and MT5 allows WL providers to easily customize and scale the systems to meet their clients’ particular objectives.

This flexibility enables them to offer tailored solutions that cater to the unique needs of different market segments, from small-scale brokerages to large-scale financial entities.

Focus on Core Competencies

By leveraging a white label application, brokers can direct their attention towards essential business functions such as acquiring and servicing customers, instead of dedicating resources to the development and upkeep of technology. This empowers brokers to streamline their operations and enhance their focus on providing high-quality services to their clients.

Customer Retention

Utilizing a well-established and trustworthy trading framework such as MT can significantly improve customer satisfaction and loyalty. This is because numerous traders favour the reliability and familiarity entailed with widely trusted trading networks.

Robust Functionality

MT4 and MT5 are well-established and feature-rich trading applications, offering a fully fledged suite of proprietary charting systems, technical trends, automated trading functionality, and more.

This depth of functionality allows white label companies to offer a robust and highly capable trading space to their clients, catering to the diverse needs of both individual traders and corporate investors.

Widespread Adoption

MT4 and MT5 have become the global standard for online trading, with millions of active users worldwide.

WL providers gain tremendous financial benefits due to the ubiquitous adoption and brand recognition they enjoy. This is because traders are already well-acquainted with the platforms and their functionalities, making it easier for them to embrace and utilize these services.

Extensive Ecosystem

The MT4 and MT5 configurations have a thriving ecosystem of third-party developers, including independent programmers, software companies, and solution providers.

WL providers can leverage this ecosystem to offer their end-users a wide range of additional tools, indices, and integrations, further enhancing the value and versatility of their trading products.

What’s Next After the MT5 White Label?

In the ever-evolving trading segment, brokerage houses and financial software service developers are looking for up-to-date solutions and techniques that can surpass the capabilities of MT5 WL. These potential alternatives offer a variety of key attributes that aim to serve traders with deeper functionalities and a more tailored trading experience. By exploring these alternatives, they can stay ahead of the curve and meet the growing demands of their clients.

Among those alternatives, some options can be a good fit instead of MT4/5 WL systems:

1. cTrader White Label

Developed by Spotware Systems, cTrader is a multi-asset trading system that adds extra functions and configurable controls to traders. It boasts a smooth interface, powerful charting software, automated trading operations, and a vibrant ecosystem of third-party add-ons. Additionally, cTrader’s white-label solutions enable brokerage houses to configure a custom-built trading space customized to their particular needs.

2. TradeSmarter White Label

The Tradesmarter WL platform is a comprehensive and innovative solution designed to help brokerage ventures and financial agencies offer a top-notch trading ecosystem under their own brand. This platform stands out for its intuitive UI, advanced trading functions, and extensive customization patterns, making it a versatile selection for brokers aiming to deliver a premium trading space to their end-users.

3. Match-Trader White Label

The Match-Trader platform is an emerging and innovative trading infrastructure developed to meet the needs of modern brokers and traders. As a white-label solution, it offers extensive customization features, countenancing brokers to brand and tailor the platform to their individual criteria.

Match-Trader simplifies online trading with its extensive range of features and services. In addition to 24/7 server maintenance and technical assistance, you will also benefit from having your own account managers who can guide you in becoming familiar with the brokerage world. Moreover, the white-label packages provide training sessions to ensure your team is well-versed in the technology.

4. Etnasoft White Label

Etnasoft is renowned as a leading technology developer specializing in delivering all-encompassing white-label solutions tailored to brokers and financial companies. Their cutting-edge platform is meticulously crafted to meet the demands of contemporary trading landscapes, offering an array of advanced functionalities, customizable options, and unwavering security measures.

5. X Open Hub White Label

X Open Hub is a world-renowned financial software innovator that offers a WL solution based on its proprietary trading ecosystem. The X Open Hub white-label solution aims to serve financial firms with a customizable operating system, liquidity source, and a range of back-office support services. This solution is designed to cater to retail and corporate traders’ needs, focusing on security, compliance, and operational efficiency.

Conclusion

While MT5 WL systems have been a dominant force in the market, offering robust functionality, widespread adoption, and scalability, the industry is witnessing the rise of progressive technology systems and white-label companies challenging the status quo.

As the industry matures, brokers and financial service providers must carefully evaluate the various WL options available, considering factors such as functionality, scalability, integration capabilities, regulatory compliance, and the overall alignment with their company’s strategy and target client base.

The key to success in this changing landscape will be the ability of WL providers to continuously innovate, adapt to market trends, and offer tailored solutions that provide a truly differentiated and profitable trading journey for their end-users.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

Is the MT5 white-label era coming to an end?

The MT5 white-label ecosystem is not necessarily ending, but the trading products landscape is diversifying with the emergence of several compelling alternatives. Brokers and financial service providers now have more options when selecting a white-label solution.

What are the key features of the potential variants to the MT5 WL?

Alternative WL programs, such as cTrader, TradingView, FinanceFeeds, Tradier Brokerage, and FXOpen, offer a broad set of attributes, reckoning enhanced customization settings, improved integration and interoperability, advanced automation and algorithmic trading options, and a stronger focus on mobile and cloud-based technologies.

How should brokers and financial service providers evaluate the different white-label options?

When evaluating WL products, brokers and financial service providers should consider factors such as functionality, scalability, integration capabilities, regulatory compliance, and the overall alignment with their corporate strategy and target client base.

Will the MT5 WL continue to have a significant footprint in the market?

While the MT5 white-label may maintain a significant presence, the emergence of complementary solutions demonstrates that the trading software landscape is transforming. Brokerage businesses and traders can access various options to meet their evolving needs.

How can brokerage agencies and financial service providers ensure they make the right choice when selecting a WL model?

Brokers and financial service providers should conduct thorough research, evaluate the specifics and capabilities of the forthcoming WL options, and assess how well they align with their business objectives and client needs.