Game of Trades Review – Is This Service Profitable?

Jan 12, 2024

The year 2024 kicks off with a lot of uncertainty. Despite recent strong performance in the market, with the S&P 500 generating an impressive 26% total return in 2023, investors are wary of potential factors that may negatively impact the economy, including debt levels and political shifts in Washington, D.C.

In light of this, many investors are looking for services that can help them make informed decisions and navigate through the ups and downs of the financial landscape. One such service is Game of Trades, a subscription-based platform that provides market analysis and trading signals.

But is it really worth the investment? In this Game of Trades review, we will explore the features, pros, and cons of the platform to see if it’s worth your time and money.

Key Takeaways:

- Game of Trades offers a platform for subscribers to access insights and analysis on various traditional and alternative assets.

- The platform offers comprehensive coverage on various markets, economic indicators, policy decisions, sentiment measures, commodities, fixed income, and digital assets.

- Members also have access to certain features, such as the investor Radar and trading room, which provide a space for knowledge sharing and education.

- Game of Trades also has a YouTube channel with 280k+ subscribers, providing market updates and analysis in an easily understandable format.

What is Game of Trades?

Game of Trades is an independent investment research platform launched in 2019 that provides in-depth financial market analysis and insights. It aims to bridge the gap between institutional investors and individual traders by offering objective recommendations on asset allocation and investment strategies.

The platform covers a wide range of financial instruments, including stocks, cryptocurrencies, bonds, and more. With a combination of technical and fundamental analysis, Game of Trades claims to offer valuable market intelligence for mainly medium-term swing trades and long-term investing.

The platform’s philosophy revolves around democratising institutional-quality research for all investors, regardless of their financial background or experience. Game of Trades strongly believes that top-tier research should not be limited to a select few but rather accessible to all.

Membership Options

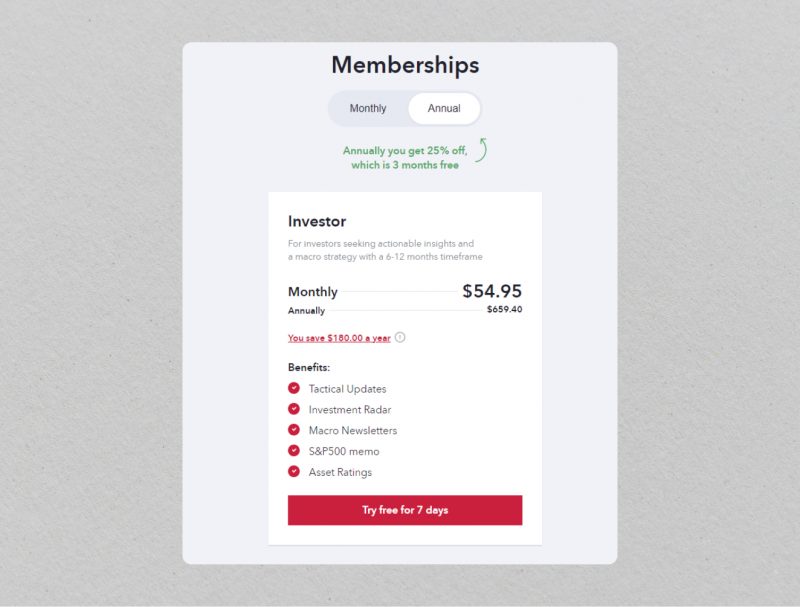

Game of Trades offers two membership options: Monthly and Annual. The monthly subscription costs $69.95 a month, while the annual plan is priced at $54.95 a month ($659.40 a year). When you opt for an annual subscription, you also get three months free (25% off) as compared to the monthly membership. Thus, by choosing the annual plan, members save up to $180.00 a year.

With a subscription to Game of Trades, you gain access to a variety of benefits designed to enhance your investment journey, including tactical updates, Investment Radar, macro newsletters, S&P500 memos, asset ratings and model portfolio. These features are available to both monthly and annual members.

While GOT may have a higher price point compared to some other services, it does offer a 7-day free trial for new subscribers. This allows potential members to test the platform and its features before committing to a subscription.

Features and Offerings of Game of Trades

Game of Trades offers subscribers access to several useful features and capabilities. Let’s review them one by one:

Markets Analysis

The cornerstone of Game of Trades is its comprehensive market analysis. Through different approaches and techniques, the platform gives a holistic view of the current financial landscape. This includes:

- Macroeconomic analysis, where the team identifies prevailing market dynamics through various indicators such as intermarket analysis, business cycles, and valuations,

- Quantitative analysis, which leverages statistical methods to make more informed investment decisions,

- Technical setups, which helps time entries and exits for optimal trading opportunities.

Investment Radar

The platform offers a unique feature called the Investment Radar, which presents a data-driven approach to investing. It combines fundamental, technical, and quantitative analyses to provide subscribers with a comprehensive overview of potential investment opportunities.

The Investment Radar uses a scoring system based on various factors such as valuation, momentum, and sentiment to rank assets and identify those with the highest potential for returns.

Trading Watchlist

The watchlist presents a collection of swing trade ideas that the platform’s analysts believe offer a favourable risk-to-reward ratio. While the ideas for potential trades do not provide specific entry prices or profit targets, they offer actionable insights into short and medium-term catalysts affecting the markets.

Each trade idea is presented as an in-depth analysis article, examining the market conditions and providing technical analysis to support their views. It’s important to note that the trade ideas on Game of Trades are not always actionable, but they do come with buy/sell/hold recommendations in some cases.

Articles and News

In addition to the trading watchlist, GOT offers investing insights that provide a longer-term view of the markets through a series of articles and publications. They provide an overview of macroeconomic conditions and analyse trends in the current markets.

These materials often rely on historical patterns to project the future trajectory of asset prices over the next two to five years. However, as with any investment thesis, it’s essential to exercise caution and critically evaluate the data and arguments presented.

Ratings

The ratings dashboard provides an at-a-glance overview of the platform’s bullish or bearish sentiment for specific asset classes over different time frames (medium-term (6-12 months) and long-term (1-5 years)). It covers a wide range of asset classes, including major market indexes, bonds, commodities, and digital currencies.

Accompanying each rating is a bulleted summary that explains the rationale behind it, directly sourced from the trading watchlist and investment/trading strategy articles. This allows subscribers to easily understand the factors driving the ratings and make informed decisions based on them.

Trading Room

Members of Game of Trades have access to the trading room, which is a chat platform for subscribers to interact with each other and the team. In this space, members can share their trade ideas and setups on stocks or ETFs.

If you want to know more about a specific stock or asset, you can request a chart analysis in the trading room. The team responds with a detailed technical and fundamental analysis within 24-48 hours during market hours.

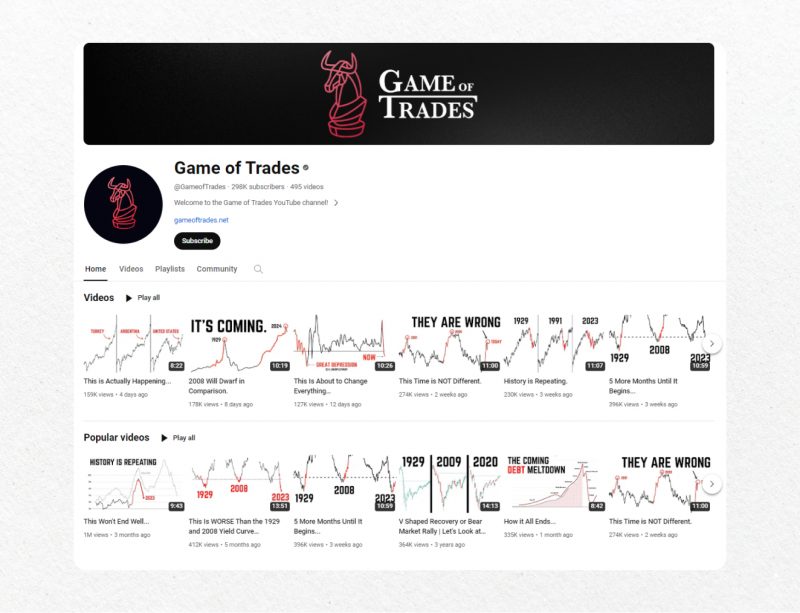

GOT’s YouTube Channel

Game of Trades also has a YouTube channel where the team regularly shares market updates, trade ideas, and technical analysis on different events. The channel has 289k subscribers and over 31 million views to date, making it a popular source of financial information, education and trading knowledge.

All the videos are presented in an easy-to-understand format, making it accessible to traders of all levels. The channel covers a wide range of markets and different assets, including SP500, precious metals, commodities, and cryptocurrencies.

Market Coverage

One of the standout features of Game of Trades is its comprehensive coverage. The platform offers in-depth look into:

- US Indices: S&P 500, Dow Jones, and Nasdaq;

- Global Markets: Emerging Markets, DAX 40, and FTSE 100;

- Economic Indicators: GDP, inflation, unemployment, and trade balance;

- Monetary Policy: Interest rates, quantitative easing, and central bank policies;

- Fiscal Policy: Government spending, taxation, and budget deficits;

- Market Sentiment: Consumer confidence and investor sentiment;

- Commodities: Crude oil, natural gas, and precious metals;

- Fixed Income: Interest rates, bonds, and credit spreads;

- Digital Assets: Bitcoin and Ethereum.

This wide range of markets allows Game of Trades members to gain a comprehensive view of the financial landscape, enabling them to make well-informed investment decisions. Also, the platform’s ability to offer analysis on both traditional and alternative assets makes it stand out among its competitors.

Suitable for Whom?

Game of Trades caters to both active and passive investors, but it is better suited for those with a medium-term trading horizon. This includes traders who hold positions for several weeks or months and long-term investors who aim to build a diversified portfolio over time.

The platform’s insights and analysis are particularly helpful for swing traders looking to capitalise on short-to-medium-term price movements. For those interested in long-term investments, GOT offers fundamental analysis and macroeconomic outlooks to help identify undervalued assets and potential market trends.

If you are a day trader or scalper, Game of Trades may not be the best fit for you. However, you can still benefit from long-term investment insights to properly plan your strategies in advance.

Pros and Cons of Game of Trades

The platform’s main strength lies in its comprehensive and deep analysis and market coverage that includes both traditional and alternative assets. Email alerts make it easy for users to stay up-to-date with market movements and news.

Additionally, the Ratings dashboard provides buy/sell/hold recommendations for various sectors, making it easier for traders to make informed decisions.

Moreover, Game of Trades offers a 7-day free trial for users to try out the platform before committing to a subscription. In this way, potential members can evaluate the features of the platform and determine if it aligns with their investment needs.

On the downside, the trade ideas presented by Game of Trades do not include entry prices and profit targets, which can be a challenge for traders looking for specific guidelines. Additionally, some may find the analysis to be one-sided at times.

Another concern is the lack of historical performance data for the platform’s recommendations. This makes it difficult to evaluate the effectiveness of their strategies and recommendations over time.

Lastly, while the platform is user-friendly overall, the layout can be confusing at times, especially for new users. This may require some time and effort to navigate through all the different features and sections.

Conclusion

Game of Trades is a comprehensive investment research platform that provides in-depth analysis of various financial markets. With a focus on swing trading and long-term investment strategies, the platform offers valuable insights and recommendations for investors and traders. While there are some limitations, such as the lack of specific trade entry prices and profit targets, GOT can serve as a valuable resource in shaping investment strategies and identifying opportunities.

Consider taking advantage of the free trial to determine if Game of Trades aligns with your investment goals and trading style.

Disclaimer: The information provided in this review is for educational purposes only and should not be considered financial advice. Always conduct your own research and consult a professional advisor before making investment and trading decisions. Make sure you implement proper risk management strategies.

FAQs

What types of financial instruments does Game of Trades cover?

Game of Trades covers a wide range of instruments, including stock indices such as the S&P 500, Dow Jones, and Nasdaq. It also covers global markets such as Emerging Markets, DAX 40, and FTSE 100. In addition, Game of Trades offers analysis on commodities, fixed-income instruments like bonds and credit spreads, and digital assets like Bitcoin and Ethereum.

How do you buy a subscription for the GOT service?

To purchase a subscription, simply go to the Game of Trades website and select one of the available subscription options. You will then be prompted to enter your payment information and complete the purchase. Once the purchase is complete, you will have full access to the subscription content.

Is there a refund policy for purchases made on Game of Trades?

According to the GOT’s refund policy, all payments made on the Game of Trades website are non-refundable, including purchases of individual products and subscription or membership fees. In special circumstances, refunds may be considered on a case-by-case basis.

However, Game of Trades offers a 7-day free trial for users to try out the platform before committing to a subscription. This allows potential members to assess the platform’s features and determine if it aligns with their investment needs.

How are subscription fees billed and charged?

Subscription fees are billed and charged automatically using the credit card information provided at the time of purchase. The first payment will be charged immediately upon signing up for a subscription, and subsequent payments will be automatically renewed based on the selected billing period (monthly, quarterly, annual). The subscriber is responsible for ensuring that valid credit card information is on file for automatic renewals.

What are the best investment options for today?

When it comes to long-term investments, a variety of options can provide a good return on your money. Here are some of the best investments to consider in 2024:

High-yield savings accounts:

High-yield savings accounts are a great option for those who want to earn interest on their cash balance while keeping their funds easily accessible. Online banks usually offer these accounts with higher interest rates than traditional savings accounts. They are also FDIC-insured, providing a level of security for your deposits.

Corporate bond funds:

Corporate bond funds are a type of mutual fund that invests in company-issued bonds. These funds provide diversification by investing in bonds from different corporations, reducing the risk associated with investing in a single bond. They also offer higher returns compared to savings accounts and CDs.

Dividend stock funds:

Dividend stock funds are an excellent option for those seeking regular investment income. These funds invest in stocks that pay dividends to shareholders, providing a steady cash payout. Investing in a dividend stock fund can also provide diversification as the fund holds stocks from various companies.

Value stock funds:

Value stock funds are ideal for those looking for bargain-priced stocks with growth potential. These funds invest in undervalued stocks, which have the potential to increase in value over time. Investing in a value stock fund offers diversification by investing in multiple stocks from various companies.

Small-cap stock funds:

Small-cap stock funds invest in the stocks of relatively small companies, which can offer significant growth potential. These companies may become large-cap companies, leading to potential gains for investors.

REIT index funds:

Real estate investment trusts, or REITs, are a popular way to invest in real estate without the hassle of managing properties. REIT index funds offer diversification by investing in multiple publicly traded REITs that specialise in various sub-sectors of the real estate market.

S&P 500 index funds:

Investing in an S&P 500 index fund allows individuals to own a small portion of the top 500 companies in the US, including some of the most successful and recognisable brands.

Rental housing:

Investing in rental properties can be a lucrative long-term investment if managed properly. This option requires selecting the right property, financing or buying it outright, maintaining it and dealing with tenants. With mortgage rates and housing prices becoming more favourable in recent years, it may be a good time to consider investing in rental properties for long-term financial growth.