Moonpay Review — Is It Legit?

Oct 8, 2024

Today, the trading platform market is dotted with an incredible variety of options, each offering unique features and opportunities to unlock trading potential in the capital markets.

At the same time, the wide range of in-depth customization and modernization of such platforms make them an indispensable tool for interaction with exchanges, digital wallets, and other integration solutions, without which full-fledged trading is impossible. One such platform is Moonpay.

This article is a brief guide to what the Moonpay platform is and how it works. It also tells you its advantages and disadvantages and whether it is legal.

Key Takeaways:

- Moonpay simplifies crypto purchases with an easy-to-use interface and strong security measures, including KYC and AML compliance.

- This platform available in over 160 countries, Moonpay supports multiple payment methods and offers a diverse range of cryptocurrencies.

- While Moonpay is legitimate and reliable, it has higher fees compared to some competitors and lacks advanced trading options for experienced users.

What is Moonpay?

Moonpay is a financial technology company that provides a fast and simple way for users to buy and sell cryptocurrencies. The platform acts as a payment gateway, allowing individuals to purchase cryptocurrencies like Bitcoin, Ethereum, and other digital assets using traditional payment methods such as credit or debit cards, bank transfers, and Apple Pay.

Moonpay’s service is embedded in various crypto wallets, exchanges, and websites, making it accessible to users directly through those platforms. It’s designed to simplify the process for both beginners and seasoned crypto traders by offering a straightforward and user-friendly experience. The platform also emphasizes security, complying with regulatory standards, and ensuring safe transactions through encryption and fraud prevention measures.

Fast Fact:

MoonPay complies with the General Data Protection Regulation (GDPR), ensuring that customers’ and employees’ personal information is managed with the highest standards of security and legality.

How Does Moonpay Work?

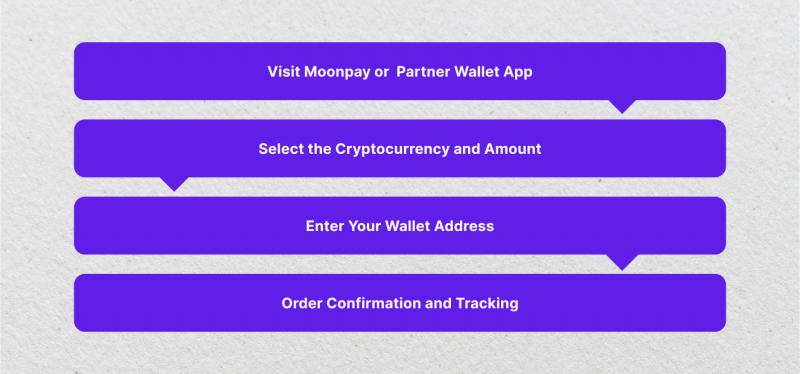

Moonpay acts as a bridge between traditional payment systems and cryptocurrency networks, making it easier for users to buy and sell digital assets. Here’s a step-by-step breakdown of how Moonpay operates:

1. Choosing Cryptocurrency

Users can select which cryptocurrency to purchase, such as Bitcoin, Ethereum, or other digital assets, through Moonpay’s interface or within a partnered platform like a crypto wallet or exchange.

2. Entering Payment Details

Moonpay allows users to pay using traditional methods like credit or debit cards, bank transfers, Apple Pay, and other payment systems. Users enter their payment information securely on the platform.

3. Identity Verification

For first-time users, Moonpay may require identity verification to comply with KYC regulations. This typically involves submitting identification documents and proof of address.

4. Transaction Processing

Once the payment details and verification are complete, Moonpay processes the transaction. It connects to the traditional banking system to withdraw funds and then convert them into the selected cryptocurrency.

5. Receiving Cryptocurrency

After the transaction is approved, the purchased cryptocurrency is transferred directly to the user’s wallet address. The crypto is delivered within a few minutes, depending on the network speed.

6. Selling Cryptocurrency

Moonpay also supports selling crypto for fiat currencies. Users select the crypto they want to sell and provide their payout method. Moonpay facilitates the exchange by depositing the fiat currency into their bank account.

Virtues and Shortcomings of the Moonpay Trading Platform

Moonpay offers access to a multi-functional trading platform for traders and investors of all levels of specialization.

At the same time, this platform has a certain set of advantages and disadvantages that determine market participants’ degree of interest in it.

Advantages of Moonpay

Some of the advantages of this platform include the following:

User-Friendly Interface

Moonpay provides a user-friendly platform that is specifically designed to simplify the process of buying and selling cryptocurrencies. It is tailored to cater to beginners, allowing them to engage in crypto transactions without navigating through complicated exchanges.

Wide Range of Cryptocurrencies

Moonpay offers support for a wide range of popular cryptocurrencies, such as Bitcoin, Ethereum, and others, providing users with diverse options for their cryptocurrency transactions.

Multiple Payment Options

Our platform offers a variety of convenient payment options to accommodate our users. These options include debit/credit cards, bank transfers, Apple Pay, Google Pay, and other widely used payment methods. This diverse selection increases accessibility and ensures that users can choose the best method that suits their needs and preferences.

Quick Transactions

Moonpay is known for its efficient transaction processing, enabling most purchases to deliver cryptocurrency to the user’s wallet within a few minutes. This rapid processing ensures that users can access their cryptocurrency swiftly after purchasing.

Global Availability

Moonpay offers its services in more than 160 countries, allowing users from all around the globe to access its platform and services.

Security

The platform emphasizes security by implementing strong encryption measures and adhering to international KYC and AML regulations to ensure the safety and integrity of all transactions and user information.

Easy Integration

Moonpay integrates with various third-party platforms, including wallets, cryptocurrency exchanges, and websites. This allows for enhanced usability and convenience, making it easier for users to access and utilize Moonpay’s services across different platforms.

Disadvantages of Moonpay

Here are some of the disadvantages of the Moonpay platform:

High Fees

Moonpay is known for charging higher fees than many other cryptocurrency exchanges, especially regarding credit and debit card purchases.

Strict Verification Process

The KYC process is an essential step in financial services that verifies the identity of clients and assesses potential risks of illegal intentions for the business relationship. This process can often be time-consuming and may require significant documentation, such as government-issued identification, proof of address, and other forms of identification.

Limited Support for Selling Crypto

Moonpay offers a wide range of options for purchasing cryptocurrencies, but its selling feature is currently available only in specific countries and for certain types of cryptocurrencies.

Not Available Everywhere

Moonpay, despite being available globally, is subject to restrictions in certain regions due to regulatory issues. These restrictions limit access to the platform for users located in specific areas.

Customer Support Concerns

Some customers have shared that they experienced delays and unresponsiveness when seeking assistance from customer support to resolve their issues or disputes.

No Advanced Trading Features

Moonpay is primarily designed for quick and simple cryptocurrency purchases. However, it does not offer advanced trading features, which may not meet the needs of experienced traders who require more sophisticated tools and capabilities for their trading activities.

Moonpay — Is It Legit?

Moonpay, founded in 2019, has established itself as a legitimate and widely trusted platform for purchasing cryptocurrencies. The platform operates in over 160 countries and partners with some of the biggest names in the crypto industry, including Binance, Trust Wallet, and Ledger.

Moonpay’s credibility is built on its adherence to strict regulatory standards such as KYC and AML protocols, ensuring the platform complies with international regulations to prevent fraud and illicit activities.

Security is also a significant factor in Moonpay’s legitimacy. The platform implements advanced encryption protocols to protect users’ financial data and personal information and uses fraud detection mechanisms to safeguard transactions. Furthermore, the transparency in their fee structure — although sometimes considered high — adds to the platform’s trustworthiness.

Moonpay generally has positive reviews across various platforms, with many users praising its user-friendly interface, making it easy for beginners and experienced crypto enthusiasts to buy digital assets quickly. The platform’s integration with well-known crypto exchanges and wallets further enhances its trustworthiness.

Additionally, Moonpay provides straightforward pricing and displays transaction fees upfront, reducing the likelihood of users encountering hidden costs.

However, user feedback is mixed, with some negative reviews pointing out occasional delays in the KYC process and customer service issues. Some users report long waiting times for verification, which can hinder the speed of transactions.

Despite these challenges, most users do not report concerns related to scams or fraudulent behavior, and overall sentiment remains optimistic regarding the platform’s reliability.

Conclusion

Moonpay’s reputation as a legitimate platform remains solid. Its firm regulatory footing, industry partnerships, and widespread user base attest to its credibility.

While there are some areas for improvement — such as reducing fees or speeding up customer support response times — the platform remains a reliable and secure option for purchasing cryptocurrency consistently, delivering a safe and user-friendly experience. This helps it maintain its position as a trusted name in the growing field of cryptocurrency payment solutions.

FAQs:

1. What is Moonpay?

Moonpay is a financial technology platform that allows users to purchase cryptocurrencies using traditional payment methods, such as credit cards, bank transfers, or Apple Pay. Founded in 2019, it has become one of the most popular gateways for buying digital assets.

2. Is Moonpay a legitimate platform?

Yes, Moonpay is a legitimate and trusted platform. To ensure safe and secure transactions, it complies with international financial regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

3. How does Moonpay work?

Moonpay allows users to purchase cryptocurrencies easily through its platform. Users enter their payment information, verify their identity, and complete the transaction. The purchased crypto is then transferred to their designated wallet.

4. What cryptocurrencies can you buy on Moonpay?

Moonpay supports a wide range of cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and many more. The exact offerings may vary depending on the region.