Synthetic Futures: A Trader’s Guide to Replicating Positions with Options

Aug 06, 2025

Regulatory data from sources like ESMA and the U.S. CFTC paints a clear picture: a vast majority of retail traders, often between 70% and 90%, consistently lose money. This high rate is the direct result of using simple but highly leveraged instruments without a disciplined strategy.

Sophisticated traders follow a different approach entirely. They construct their own market exposure with sophisticated strategies that offer more control and flexibility. One of the most effective among these is the creation of synthetic futures.

Key Takeaways

- A synthetic futures contract is a strategy where traders use one call and one put option to copy the performance of a futures contract.

- The main risk comes from the sold option in the structure. A trader can be unexpectedly “assigned” a position in the underlying asset, which instantly changes their portfolio’s risk.

- The strategy is generally used by experienced options traders. Managing the risks of options “Greeks” requires a high level of market knowledge.

What Is a Synthetic Futures Contract?

A synthetic futures contract is not an actual product you can buy or sell on an exchange. It is a trading strategy that uses a combination of other financial instruments—almost always call and put options—to mimic the risk and reward profile of a traditional futures contract.

You cannot find a “synthetic future” on a list of tradable assets. Instead, a trader actively constructs this position in their own account by simultaneously buying and selling specific options. The goal is to create a position whose value changes point-for-point with the underlying asset, just like a normal futures contract.

The Building Blocks: Call and Put Options

The standard construction for a synthetic future with options involves using one call option and one put option. To create the correct payoff structure, both options must have the exact same asset, strike price, and time of expiration.

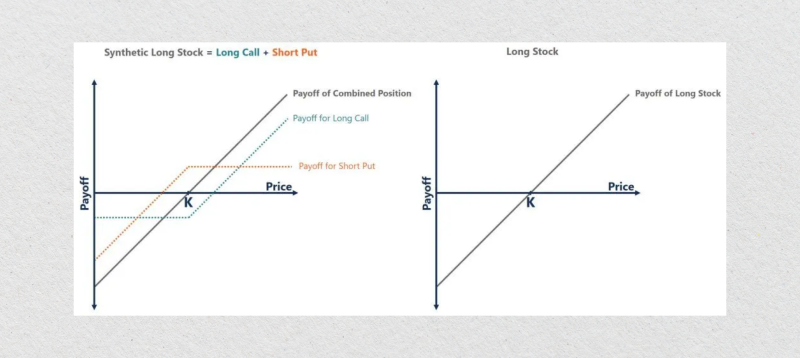

The relationship that makes this work is known as Put-Call Parity. When a trader combines a long call with a short put (or the other way around), the complex, non-linear risks of the options effectively cancel each other out. What remains is a clean, linear exposure to the asset’s price, almost identical to that of a real futures contract.

This ability to construct a futures position gives advanced traders immense flexibility. They are no longer limited by the specific contracts offered by an exchange and can create their own custom synthetic futures trading exposure using the options market.

How to Create a Synthetic Long Futures Contract

To build a position that mimics a long future, a trader needs to execute two orders at the same time. The strategy requires using both a call and a put option. Both options must be for the same underlying asset, share the same strike price (usually at-the-money), and have the same expiration date:

- Buy 1 Call Option

- Sell 1 Put Option

Formula: Long Synthetic Future = Long Call + Short Put

The call option gives the position its unlimited upside potential should the asset’s price rise. At the same time, the put option creates an obligation to buy the asset if the price declines, which generates the downside risk profile.

When combined, the non-linear risk elements of the options cancel each other out, leaving a linear payoff.

The payoff diagram for a long synthetic futures contract shows a simple, straight diagonal line: unlimited profit as the price rises and unlimited loss as it falls, exactly like a real long future.

How to Create a Synthetic Short Futures Contract

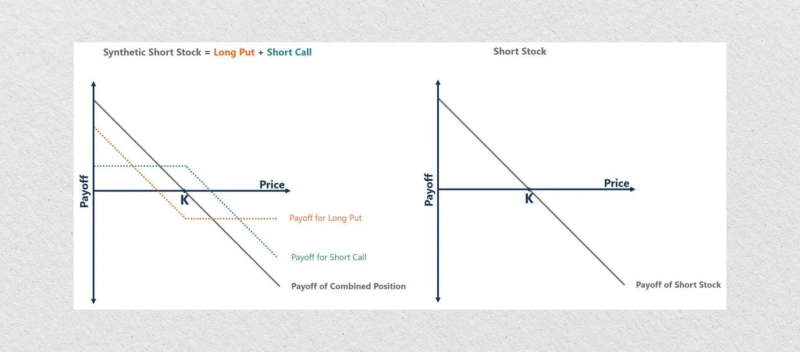

To replicate a short futures position and profit from a falling market, a trader uses the opposite construction. Again, both options must share the same strike price and expiration date:

- Sell 1 Call Option

- Buy 1 Put Option

Formula: Short Synthetic Future = Short Call + Long Put

Here, the long put gives you the right to sell the asset, providing profit potential in a falling market. The short call obligates you to sell if the price rises, creating unlimited upside risk. This structure perfectly mimics the payoff of a short futures contract.

The short synthetic payoff diagram shows the inverse of the long synthetic one.

Advantages of Synthetic Futures Over Futures

Traders build synthetic futures positions to gain specific strategic advantages that you simply can’t get from standard, exchange-traded futures contracts.

- Complete Control Over Strike and Expiration

A trader using standard futures is locked into the exchange’s fixed contract specifications, such as quarterly or monthly expiration cycles. There is no room for customization.

A synthetic futures position built with options, however, offers a trader complete control. They are free to select synthetic futures prices and any expiration date. This allows them to construct a position that is perfectly tailored to a specific market view or time horizon.

- Potential for Higher Capital Efficiency

Depending on the brokerage’s margin model, constructing a synthetic position can sometimes require less initial capital than an outright futures contract. The premium a trader collects from selling one option helps to directly offset the cost of buying the other option.

This structure can offer a more capital-efficient method for gaining leveraged exposure. It is particularly relevant for retail traders who may not have access to the complex portfolio margining systems that large institutions use.

- Eliminating the Cost and Complexity of Rollover

A traditional futures position held long-term must be “rolled over.” This involves closing the expiring contract and opening a new one in a further-out month, a process that incurs transaction costs and potential slippage every time.

A synthetic position does not need rollover. A trader simply chooses their desired expiration date from the outset. The position can then be closed manually before expiration or be left to expire automatically.

- Granular and Precise Position Sizing

Standard futures contracts come in large, fixed sizes. An E-mini S&P 500 futures contract, for example, controls a notional value equal to 50 times the index price. For smaller accounts, achieving precise position sizing with such large units can be difficult.

Options, however, provide much more granular control. Using options, a trader can build a synthetic futures trading position with a much smaller notional value. This allows for highly precise risk management that can be aligned perfectly with their account size.

Core Synthetic Futures Trading Strategies

The flexibility of synthetic futures opens up a range of trading techniques, from simple to complex ones. Advanced market participants employ basic strategies for precise hedging, capital-efficient speculation, and even trading changes in market conditions.

Directional Speculation

The most common use for a synthetic futures contract is straightforward directional speculation. A trader with a bullish market view can construct a long synthetic position to gain leveraged exposure to rising prices, mirroring the payoff of a standard long future.

A trader with a bearish outlook would construct a short synthetic future. This creates a position that profits from a falling market, but with the added control of choosing a custom strike price and expiration date not available on traditional exchanges.

Portfolio Hedging

An investor with a large spot portfolio, for instance, might use a synthetic short position as a flexible hedging tool. They can construct a short synthetic future using options, which lets them protect their portfolio from a potential short-term market decline without selling their core holdings.

This is a common risk management method. It is used by both institutional funds and sophisticated individual traders. The goal is to insulate long-term holdings from the impact of temporary market volatility.

Trading Implied Volatility

Because these positions are constructed from options, they have a direct exposure to changes in implied volatility. An advanced trader can adjust the structure of a synthetic future. They can create a position that is delta-neutral (unaffected by price direction) but still has either a positive or negative vega.

A positive vega position gains value if implied volatility increases. A negative vega position profits if volatility falls. This strategy isolates volatility as the main driver of the position’s profit or loss and is a sophisticated technique used by options specialists.

Fast Fact

Vega is an option’s direct exposure to changes in implied volatility. It measures exactly how much an option’s price will change for every 1% increase or decrease in the underlying asset’s volatility. A position with positive vega profits when volatility expands.

A Realistic Look at the Risks of Synthetics

The flexibility of synthetic futures comes with a significant trade-off: a more complex risk profile than that of a standard futures contract. These are not risks to be taken lightly.

- Assignment Risk on the Short Option Leg

The single greatest risk is assignment. When you sell an option to create a synthetic position, you take on an obligation. The buyer of that option can exercise it against you at any time (for American-style options), forcing you into a long or short position in the underlying asset when you may not want it.

This can happen unexpectedly, creating a sudden need for more margin and forcing you to manage a position you did not plan to hold.

- The Complexity of Options “Greeks”

A synthetic future is made of options, and it inherits all their complexities. To manage such a position well, a trader needs to understand beyond just price direction (Delta). They must also grasp how its value is affected by time decay (Theta), shifts in volatility (Vega), and the rate of price change (Gamma).

Failing to understand and manage these other variables can cause unexpected losses. This can happen even if the trader’s core directional bet on the market was correct.

- Liquidity and Transaction Costs

For many assets, the primary futures market is far more liquid than the individual options markets. Building a synthetic position in illiquid options can result in wide bid-ask spreads, making it difficult to get a good entry price and even harder to exit without significant slippage.

Furthermore, creating a synthetic position requires executing two separate transactions—one call and one put. This means a trader will almost always pay more in commissions to open and close a synthetic position compared to trading a single, standard futures contract.

Conclusion

A synthetic future is ultimately a strategy of replication. It gives a sophisticated trader the tools to construct a position with a linear, futures-like payoff, but with complete control over the strike price and expiration date by using the options market.

However, this flexibility comes with a more complex risk profile. The synthetic position takes on all the characteristics of the options used to create it. This includes direct exposure to time decay, changes in implied volatility, and the operational risk of an early assignment.

This is why synthetic futures trading is generally considered the domain of advanced traders. While a powerful instrument, it requires a deep understanding of options theory. It also demands an active management style to handle its complex, multi-faceted risks.

Disclaimer: The content in this article is for informational purposes only and does not constitute financial or investment advice. All trading strategies, including those that use options and synthetic futures, involve a significant risk of loss and are not suitable for every investor.

FAQ

What is a synthetic future?

The synthetic futures strategy combines a call option and a put option to create a position that behaves exactly like a real futures contract.

What is an example of a short synthetic future?

To create a short synthetic future on a stock trading at $100, a trader would sell a $100 call option and simultaneously buy a $100 put option, both with the same expiration date.

What are the advantages of synthetic futures over futures?

The main advantage is flexibility. Unlike standard futures with fixed terms, a trader can create a synthetic position with any strike price and expiration date available in the options market to match their strategy.

What is the biggest risk of trading synthetic futures?

The biggest risk is assignment on the option a trader sold. This happens when a trader is unexpectedly forced by the exchange to buy or sell the underlying asset, which can disrupt their strategy and margin calculations.