What Is MT4 White Label Solution? Is It Still Accessible?

Jun 13, 2024

The MetaTrader 4 (MT4) platform has long been a cornerstone for white label brokers in the forex market and CFD trading industry, renowned for its comprehensive features. Developed by MetaQuotes, this trading platform swiftly gained traction among numerous players, solidifying its position as an industry standard. According to Finance Magnates, both MT4 and MT5 held 78.7% market share at the end of 2020.

However, recent developments have reshaped the WL brokerage landscape, prompting a reassessment of the MT4 white label solution and its accessibility.

Key Takeaways

- The recent increase in regulatory scrutiny and changes in compliance requirements have led to stricter accessibility to MT4 for white label brokers.

- Offshore brokers face significant challenges in meeting MetaQuotes’ heightened requirements for MT4 and MT5 platforms.

- The decrease in the availability of the MT4 white label solution has prompted brokers to explore alternative trading platforms and strategies.

What Is MT4?

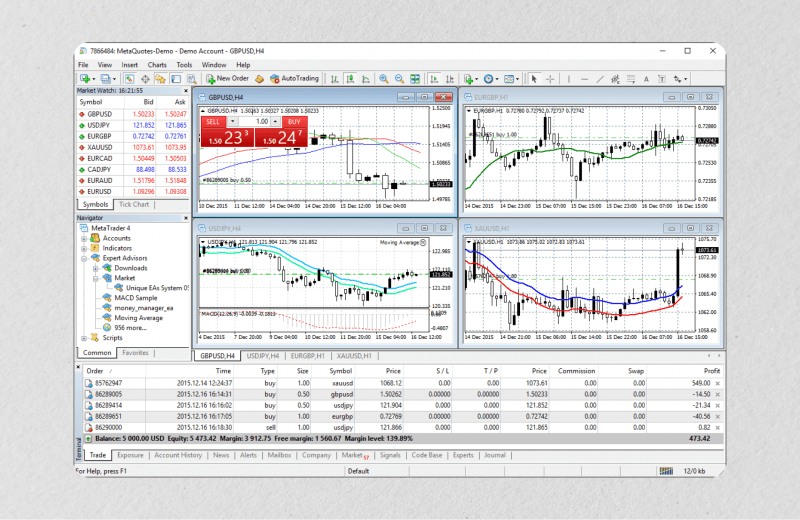

MetaTrader 4 is a powerful platform that offers an extensive range of features and tools to traders. It was created by MetaQuotes in 2005, and quickly gained a massive following due to its advanced charting capabilities. The system accommodates traders of all skill levels, with its ease of use and powerful capabilities.

Among the popular features of MT4 are:

- Algorithmic Trading: MT4 offers an Expert Advisor that can automate strategies to ease the trading process, freeing traders from the hassle of financial markets analysis. This feature is highly sought after by brokers and traders alike. The platform also provides a fully-fledged environment for developing, testing, and optimizing algorithmic trading programs.

- Mobile Trading: To cater to the needs of traders on the go, MT4 offers mobile versions for iOS and Android devices. These apps provide all the functionality of the desktop version, allowing users to access their trading accounts and trade from anywhere in the world.

- Trading Signals and Copy Trading: For those who don’t have the time to trade, MT4 offers the option to copy deals from other traders automatically. The platform also has a vast library of signals and allows for both free and paid subscriptions.

- Analytics: MT4 is equipped with an array of analytical tools, such as charts, indicators, and objects, to help traders make educated predictions and perform risk management. The platform also has a vast library of technical indicators available in its Code Base and Market section.

One of the key factors contributing to MT4’s success was its white label solution. This approach allows small retail brokers to rebrand the platform, customizing its appearance and features to align with their brand identity.

What’s The Difference Between MT4 and MT5?

One of the important distinctions between the two platforms is that programs written for MT4 cannot run on MT5. This lack of backwards compatibility can be a significant drawback for traders who were hoping to switch to MT5. Additionally, the depth of market (DOM) data in MT5 is much more useful and relevant to trading compared to that of MT4.

In terms of functionality, MT5 has several advantages over MT4. It offers a netting system for position accounting, making it easier to keep track of multiple positions on the same asset. The backtesting tool in MT5 has also been improved, allowing for more accurate results and faster testing.

Moreover, MT5 has a wider range of built-in technical indicators compared to MT4. It also includes two additional pending orders, buy stop limit and sell stop limit, providing traders with more flexibility in their trading strategies.

Lastly, MT5 offers several non-standard timeframes, which can be beneficial for traders who prefer to analyze the market using these timeframes. In MT4, additional scripts need to be installed in order to access non-standard timeframes.

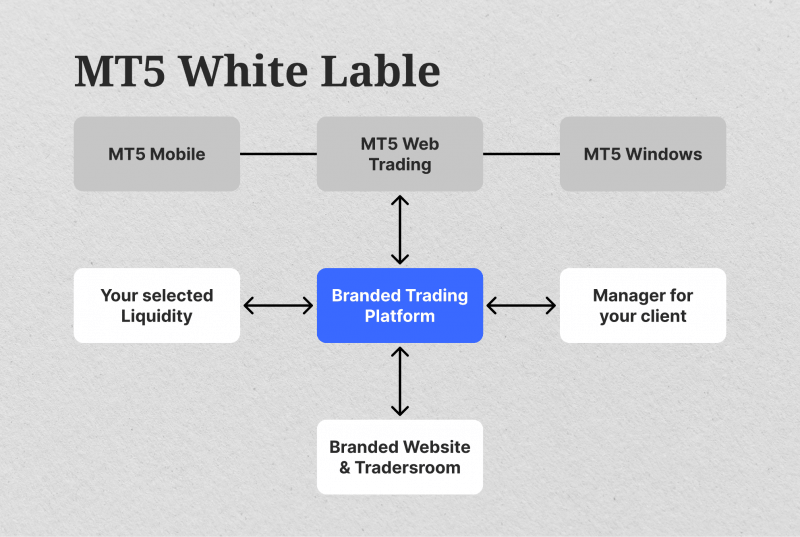

The White Label Solution: Empowering Brokers

The MT4 white label solution provided a cost-effective and efficient way for brokers to establish their presence in the online trading business. Instead of investing substantial resources into developing a proprietary trading platform, brokers could leverage MetaQuotes’ ready-made platform while maintaining their unique brand identity.

This solution offered several key advantages:

- A Quick Entry: By adopting the MT4 white label solution, brokers could swiftly launch their trading services without the time-consuming process of setting up their own platform.

- Cost Benefits: Developing an in-house trading platform can be a capital-intensive endeavor. The MT4 and MT5 white label eliminated the need for extensive software development, reducing overhead costs and allowing brokers to allocate resources more strategically.

- Customization: While the core functionality remained consistent, brokers could tailor the platform’s appearance, branding elements, and specific features to align with their unique value proposition.

- Seamless Integration: The white label arrangement facilitated seamless integration with various liquidity provider firms, ensuring brokers could offer competitive spreads and execution speeds to their clients.

The Changing Regulatory Landscape

As the online trading industry evolved, regulatory bodies worldwide became increasingly vigilant, aiming to protect investors and maintain market integrity. This heightened scrutiny led to a tightening of compliance requirements, particularly concerning client onboarding, anti-money laundering (AML) measures, and the prevention of fraudulent activities.

The Crackdown on Unregulated Brokers

MT4 white label provider MetaQuotes has taken a strong stance against unregulated brokers, particularly those catering to clients in the United States. The company has implemented stricter requirements for brokers seeking to use MT4 and MetaTrader 5 white label, with a focus on ensuring compliance with regulatory standards.

This move has been driven by the need to maintain the reputation of their products and address concerns raised by regulatory bodies regarding unregulated brokers’ practices. As a result, MetaQuotes has made it more challenging for white label brokers to access their platforms, as these entities are not directly regulated.

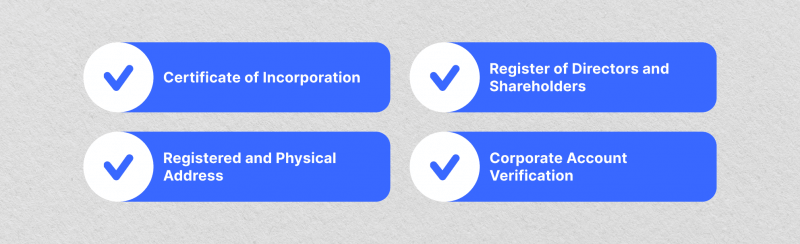

MetaQuotes’ Updated WL Requirements

MetaQuotes has updated its requirements for white label brokers, adding new criteria that must be met to gain access to MT4 and MT5 platforms. These requirements include:

Certificate of Incorporation

Before becoming a forex broker, a company must register as a legal entity in any chosen jurisdiction. The registered activities should also be related to online currency trading, financial services, investment services, trading of financial instruments, and other relevant activities.

Additionally, if the chosen jurisdiction requires a license for the registered activities, the broker must obtain this prior to providing trading services.

Register of Directors and Shareholders

After registering as a legal entity, brokers must provide recent and certified copies of documents such as a Director’s passport. In some cases, a selfie of the Director with their passport may also be required. During the verification process, brokerage firms may also need to provide a video recording of themselves holding their ID or passport.

Registered and Physical Address

A registered address will be provided in the standard set of registration documents, but brokers must also provide proof of a physical address through certified utility bills. If the company has been registered for more than six months, a certificate of good standing or incumbency must also be provided.

Furthermore, the domain name used by the broker should be registered under the company’s full name, and proof of ownership may be required during the verification process.

Corporate Account Verification

Brokers must provide a certified reference letter or statement from their bank, confirming the existence of an active account and including the company’s registration number and registered address. This requirement can be challenging for offshore brokers, as it may be difficult to open a corporate account in certain jurisdictions.

Challenges for Offshore Brokers

The tightening of MetaQuotes’ white label policy is particularly problematic for offshore brokers, many of whom had established their businesses in jurisdictions like Seychelles, Vanuatu, and St. Vincent and the Grenadines. These locations offered a more lenient regulatory environment, allowing brokers to operate with fewer restrictions and lower operational costs.

However, the new requirements for obtaining or renewing MT4 white label licenses proved to be a hurdle for these offshore brokers. Providing comprehensive documentation and adhering to stringent KYC procedures often conflicted with the very nature of their offshore operations, which prioritized privacy and minimal oversight.

Consequently, many offshore brokers found themselves grappling with the decision to either adapt to MetaQuotes’ stricter policies or explore alternative trading solutions to maintain their trading offerings.

MetaQuotes Removes MetaTrader Licences of Unregulated Brokers

One such casualty of MetaQuotes’ tightening policies was True Forex Funds (TFF), a prop firm operating in the offshore jurisdiction of St. Vincent and the Grenadines. In February 2024, TFF’s trading license was terminated by MetaQuotes, leading to a global shutdown of their services. This decision was met with strong opposition from TFF’s CEO, Richard Nagy, who labeled it “incomprehensible and irrational.”

MetaQuotes explained that the license termination was due to TFF’s third-party broker failing to adhere to necessary practices for connecting to MetaTrader’s client terminal.

Other offshore brokers, such as Hugo’s Way, Hano Trade, and Kot4x, have faced similar difficulties due to their lack of regulation. It is important to remember that trading on platforms operated by unregulated brokers is risky, as these entities may engage in questionable business practices.

Exploring Alternative Trading Platforms

As the availability of the MT4 white label solution diminished, brokers sought alternative forex trading platforms to sustain their operations. Many explored third-party solutions, such as cTrader, ProTrader, and TradeLocker.

These alternative platforms offered varying degrees of customization, asset coverage, and compatibility with liquidity providers. However, the transition process often requires significant investment in terms of infrastructure, personnel training, and client education.

Best Forex WL Providers on the Market

With the recent developments in the forex world, choosing a reliable white label provider has become even more crucial. A reputable and regulated solution can ensure that brokers comply with regulatory standards and provide clients with a safe trading environment.

To help brokers make an informed decision, we have compiled a list of the top white label providers currently on the market. These providers have been thoroughly reviewed and ranked based on factors such as regulatory compliance, platform features, customer support, and MT4 white label cost.

The Future of Forex Trading

It is evident that the online trading industry is undergoing a transformative period. There has been a shift to alternative platforms, regulated brokers, and an emphasis on investor protection and compliance

However, this evolution also presents opportunities for innovation and adaptation. New trading platforms may emerge, offering advanced trading tools and features, as well as seamless integration with emerging technologies, such as blockchain and artificial intelligence.

Regulatory bodies may continue to refine their frameworks, striking a balance between investor protection and fostering a competitive market environment. Brokers, in turn, may explore novel business models and strategic partnerships to differentiate themselves and cater to diverse client needs.

Conclusion

The evolution of the MT4 whitelabel stands as a testament to the dynamic nature of the online trading industry. Its role in democratizing access to trading platforms is undeniable. However, MetaQuotes’ stricter policies and the subsequent shift towards alternative solutions have highlighted challenges faced by offshore brokers and raised important questions about regulation, compliance, and the future of online prop trading, especially in the US.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

Why was the MT4 app removed?

In 2022, the MT4 and MT5 apps were unexpectedly removed from Apple’s App Store. While the exact reasons behind this decision were not specifically disclosed, there have been theories that this could be due to the rise of fraudulent activities. Specifically, there were rumors that scam trading apps were imitating popular trading platforms that appeared in the iOS app store. However, this speculation was never confirmed by Apple or the developers of MT4 and MT5.

Nevertheless, after being removed for several months, both MT4 and MT5 have been reinstated in the App Store and can now be downloaded again by iOS users.

Do people still use MT4?

Yes, MetaTrader 4 is still widely used by traders all around the world. It is considered as the most popular third-party platform for trading forex. Despite the existence of other alternatives, MT4 has established itself as a reliable and efficient platform for traders of all levels.

Is MetaTrader safe?

MetaTrader 4 and 5 are considered among the safest platforms used by forex traders. This is due to their use of data encryption and authentication processes to protect customers from potential harm. However, it’s important to note that no platform can guarantee complete safety, as there is always a chance of unexpected incidents occurring. It’s always recommended for users to take necessary precautions and stay vigilant while using any trading platform or broker.