How to Build a Profitable Forex Brokerage in 2024?

Jan 05, 2024

The Forex market is an incredibly lucrative industry that continues to experience significant growth year after year. In 2023, its total size reached an astounding $2.4 quadrillion, which is approximately 30 times larger than the combined US stock and bonds market. Projections indicate that this figure will continue to grow in 2024 and beyond.

Moreover, about 10 million traders actively participate in this industry, with more new individuals joining in search of fresh opportunities. Thus, it’s no wonder that many entrepreneurs are looking to start their own businesses in this thriving sector.

However, building a profitable Forex brokerage requires careful planning, strategic decision-making, and a solid understanding of the market. In this comprehensive guide, we will walk you through the step-by-step process of creating a successful Forex brokerage in 2024.

Key Takeaways:

- It is important to estimate your initial capital and costs, secure necessary funding, and have a contingency plan in case of unexpected expenses or market downturns.

- Working with a reliable technology provider can streamline the licensing process and ensure compliance with regulatory standards.

- Registering your brokerage in a suitable jurisdiction is crucial, as it affects licensing requirements, reputation, and tax implications.

- Partnering with a reputable liquidity provider ensures competitive offerings for clients.

Prepare a Business Plan

As with any business venture, you need to have a clear plan in place to ensure the success and sustainability of your Forex brokerage company.

Estimate Your Initial Capital and Costs

Having a clear understanding of the initial capital and costs involved is of utmost importance when planning a business. This includes setting up operating funds and trading funds, as well as ongoing expenses such as employee salaries and marketing budgets. You may need to secure the necessary capital for your venture by seeking funding from personal savings, bank loans, or investors.

A minimum of two years’ worth of capital is required to sustain your business. This will give you time to build a strong client base and generate consistent profits. It is also important to have a contingency plan in case of any unexpected expenses or downturns in the financial markets.

Analyse the Market

The market is vast, and catering to every type of successful Forex trader is nearly impossible. Therefore, it’s essential to narrow down your focus and identify the specific group of Forex traders you want to serve.

- Target Market: Research your competitors and identify their strengths and weaknesses. Determine the demographics of your target audience, including their age, gender, income level, and location. This information will help you tailor your services and marketing strategies to meet the needs of your target market.

- Specific Niche: Consider your unique offer or trait: small spreads, service reliability, etc. Alternatively, you could focus on serving a niche market, such as beginner traders or high-net-worth individuals. This will help to differentiate yourself from competitors and attract a loyal customer base.

Register Your Forex Brokerage

Once you have defined your target market, it’s time to register your Forex brokerage. This step involves completing the necessary legal requirements to establish your business as a legitimate entity.

Jurisdiction Selection

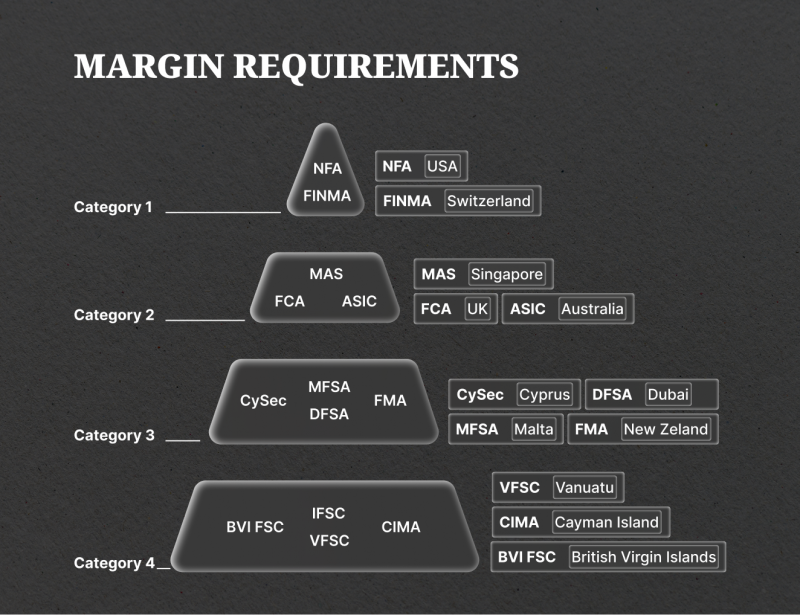

Different countries have varying regulations and licensing requirements for Forex brokers. Consider factors such as the cost of obtaining a licence, the reputation of the regulatory bodies, and the tax implications of operating in a particular jurisdiction.

Offshore jurisdictions are often popular among startup brokers due to their flexible regulations and lower costs. These include:

- The Cayman Islands,

- Cyprus,

- Malta,

- Hong Kong,

- Mauritius,

- Seychelles,

- Vanuatu.

Regulatory bodies in these states offer faster and easier licensing processes compared to major financial centres.

On the other hand, operating in a well-respected jurisdiction can instil trust and credibility in your brand. These include:

- UK (regulated by the FCA),

- Australia (overseen by ASIC),

- Japan (regulated by FSA),

- USA (regulated by NFA).

However, these countries also have much stricter regulations and higher licensing fees, which may be a barrier to entry for smaller startups.

Licensing Process

Research the licensing requirements of your chosen jurisdiction and ensure that you meet all the necessary criteria. The licensing process may involve submitting various documents, such as proof of identity, proof of address, and professional reference letters. Working with a reliable technology provider can streamline the licensing process and ensure compliance with regulatory standards.

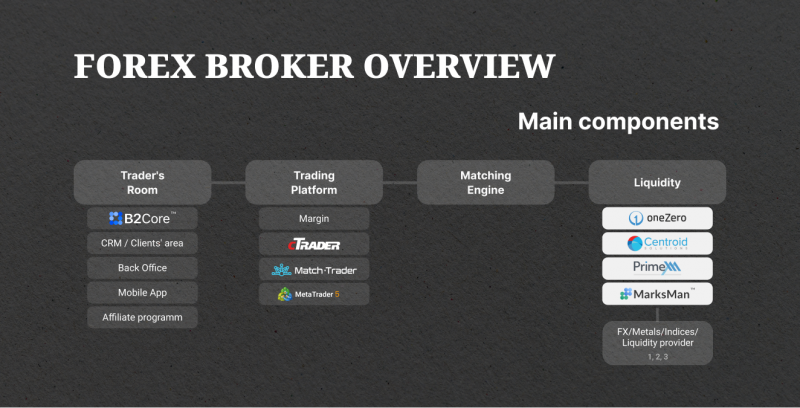

Choose the Right Technology Provider

When building an operating and trading infrastructure for your brokerage, you have two options:

- develop your own technology

- partner with a reputable technology provider

Developing your own may seem like a better solution in some cases, but it requires significant time and resources, and there is no guarantee that the end product will meet quality standards if you have no experience and necessary knowledge. Thus, it may be better to partner with technology providers specialising in creating certain solutions for trading businesses.

Considerations for Choosing a Technology Provider

When choosing a technology provider, there are several key factors to consider. Look for a provider with a proven track record and positive client reviews. Consider their experience in the industry and the range of solutions they offer. Ensure that the provider can meet your specific needs, such as connectivity to liquidity providers, a user-friendly trading interface, and robust back-office support.

All-in-One Solutions

Opting for an all-in-one, Forex white label solution from a technology provider can simplify the setup process of your Forex brokerage. This type of solution includes a platform that works with every trading strategy, liquidity connectivity, and back-office tools.

Choose a Trading Platform Trusted by Traders

A user-friendly and reliable trading software will enhance the trading experience for your clients and contribute to the overall success of your Forex brokerage.

Several trading platforms are trusted and widely used by traders in the Forex market. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular choices due to their extensive features, user-friendly interfaces, and compatibility with various devices. Other platforms, such as cTrader and Utip, also offer advanced trading features and customisable options.

Fast Fact

According to recent data, MT4 is the most popular trading platform, with 85% of traders using it. MT5, used by only 6% of traders, is the second most popular platform.

Look at the platform’s features, customisation options, and compatibility with different devices. Research options that offer advanced charting tools, real-time market data, and a variety of order types. Additionally, ensure that the platform is compatible with mobile devices to cater to the growing number of traders who prefer to trade on the go.

Implement a Client Office with Forex CRM

A client office with a Forex customer relationship management (CRM) system is essential for managing client accounts, providing support, and generating leads for your Forex brokerage.

A robust CRM system is essential for building and maintaining strong relationships with your clients. It allows you to track client interactions, personalise communication, and provide timely support. By leveraging CRM data, you can analyse client behaviour, identify trends, and tailor your marketing strategies to maximise client acquisition and retention.

Such a system should include features such as account management, deposit and withdrawal options, reporting and trading tools, and customer support functionalities. Additionally, it should integrate seamlessly with your chosen trading platform and back-office systems. Look for CRM solutions that offer lead management capabilities, allowing you to track and nurture leads to convert them into loyal clients.

Usually, Forex CRM solutions are a part of the all-in-one packages offered by technology providers. However, you can also choose to purchase a standalone CRM system and integrate it with your other systems.

Set Up Payment Solutions

Offering a variety of payment solutions is always a good idea, which will attract more clients to your broker business. Ensure that your brokerage house supports popular payment methods and provides secure and efficient payment processing.

Payment Gateway Integration

Integrating a payment gateway allows you to accept various payment methods, including credit cards, bank transfers, and e-wallets. Choose a payment gateway provider that offers secure and reliable payment processing, fraud prevention measures, and seamless integration with your trading platform and CRM system.

Compliance and Security

Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is crucial for the security and integrity of any entity that works with clients’ finances. Implement robust security measures to protect client funds and personal information. Work with payment solution providers that prioritise compliance and offer comprehensive fraud prevention tools.

Find Reliable Liquidity Source

Access to liquidity is essential for the smooth operation of your Forex brokerage. Partnering with a reputable liquidity provider will ensure that you can offer competitive spreads, fast execution, and deep liquidity to your clients.

Some technology providers offer comprehensive solutions that include liquidity connectivity. These solutions allow you to access liquidity from multiple providers through a single integration. Working with a technology provider that offers both trading technology and liquidity connectivity greatly simplifies the setup process and ensures seamless operations for your Forex brokerage.

If you are considering a liquidity provider to choose from, you can refer to our list of the best liquidity providers out there.

Build Your Brand and Generate Leads

Marketing your business is as essential as providing quality services for client acquisition and retention. Having a strong brand presence and effective marketing strategies can help differentiate your Forex brokerage from competitors and attract a loyal trader base.

Thus, you will need a sound marketing plan.

- Branding Development: Develop a unique brand identity that represents your brokerage’s values, mission, and services. This includes designing a logo, choosing brand colours and creating marketing materials.

- Online Presence: Establish an online presence through a professional website, social media profiles, and email marketing campaigns. Utilise search engine optimisation (SEO) techniques to increase your visibility and attract organic traffic to your website.

- Lead Generation: Invest in lead generation strategies such as webinars, educational resources, and affiliate programs to attract potential clients. Offer educational resources, such as trading tutorials, webinars, and market analysis, to empower your clients and help them improve their trading skills. Utilise your CRM system to track and nurture leads and convert them into loyal, active traders.

You can check other marketing strategies in this article.

Build a Loyal Client Base

Building a loyal client base is crucial for the long-term success of your Forex brokerage. Focus on providing excellent customer service, personalised support, and continuous education to retain and engage your clients.

Implement retention strategies to foster loyalty and encourage repeat business. Offer loyalty programs, referral bonuses, and tailored incentives to reward and retain your clients. Continuously communicate with your clients through newsletters, email campaigns, and social media to keep them engaged and informed about market trends and opportunities.

Closing Thoughts

Starting a profitable Forex brokerage requires careful planning, strategic decision-making, and a commitment to providing excellent services to your clients. By following the step-by-step process outlined in this guide, you can build a successful Forex brokerage in 2024. Remember to define your target market, register your brokerage, choose the right technology provider, and implement robust systems for different trading strategies, sufficient liquidity, and client management.

Remember that building a successful Forex brokerage takes time and effort, but with the right strategies and resources, you can achieve your goals and establish a thriving business in the competitive world of trading Forex.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

How much money do I need to start a Forex business?

The exact cost of starting a Forex brokerage will vary depending on various factors, such as the chosen trading platform, business structure, and location. However, as a general estimate, you can expect to spend between $ 7,000 and $20,000.

Can I run a Forex brokerage from home?

Yes, it is possible to run a Forex brokerage from home as long as you have the necessary technology and infrastructure in place. However, keep in mind that running a Forex brokerage requires constant monitoring of market conditions and client activities, so it may not be suitable for those who are unable to dedicate enough time and attention. Additionally, certain regulations may require a physical office space for the operation of a Forex brokerage.

What is the role of a liquidity provider in a Forex brokerage?

A liquidity provider is a financial institution or individual that offers quotes and prices for assets on the market. In the context of Forex trading, a liquidity provider supplies currency pairs at various bid and ask prices to brokers. This allows brokers to offer competitive spreads and execute trades for their clients.

What is a white label Forex broker?

A white label Forex brokerage refers to a business model where an existing broker uses the technological infrastructure of another company and rebrands it as their own. This allows new or smaller brokers to enter the market without having to develop their own trading platform or technology. White label solutions can also include other services, such as compliance and proper risk management.

What are the risks of running a brokerage?

Running a brokerage comes with several risks, including financial, regulatory, and operational risks. Financial risks involve potential losses from market volatility and client positions. Regulatory risks involve complying with laws and regulations set by governing bodies. Operational risks can include technology failures, human errors, and cyber security threats. To mitigate these risks, brokers need to implement certain risk management strategies.