What Are Index Funds, and How do you invest in them?

Over the years of the development of electronic trading in all its forms, many financial instruments have been invented, each of which has certain investment characteristics, thanks to which it becomes possible to develop an individual trading strategy for the possibility of maximising profits in the trading process.

At the same time, due to its advantages, index funds trading has gained popularity as universal access to a large number of indices containing securities of companies ranked according to a particular feature or criterion.

Key Takeaways:

- Index funds are a ready-made selection (portfolio) of stocks of different companies ranked according to a certain feature or characteristic.

- One of the strongest advantages of index funds is diversification, allowing you to have shares of hundreds of distinct companies in your portfolio.

- One of the most popular index funds is the Vanguard S&P 500 ETF, which replicates the price movement dynamics of the index of the same name of the largest U.S. companies.

What Do Index Funds Stand For, and How Do They Work?

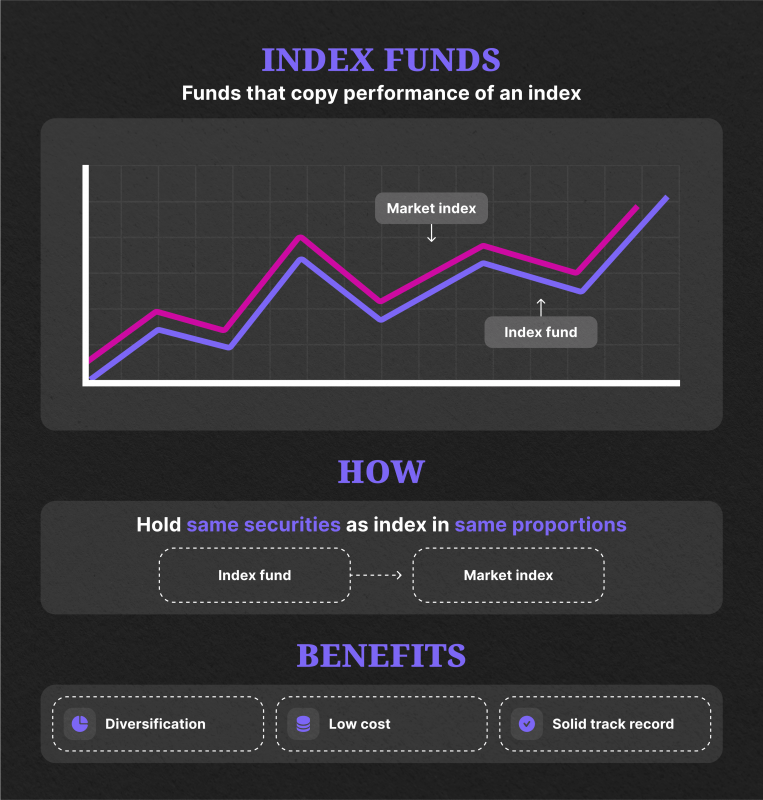

An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds a representative sample of securities in a particular index in order to compare as closely as possible their various economic indicators and characteristics within a particular sample group, including volatility, trading turnover and value dynamics and sector-wide impact.

Index investing refers to a passive investment strategy used to generate returns similar to a specific market index. Investors achieve this goal by replicating specific indices, such as a fixed income or equity index.

Indexation is also among the indices used to measure the performance of economic activity. One way to invest in an index is to buy shares of exchange-traded funds that track an underlying benchmark index.

Stock indexes were initially created to show the state of affairs in a particular area of the economy. For example, the Dow Jones Industrial Average index reflected the state of affairs in the manufacturing industries and included shares of major US industrial companies, while The Dow Jones Transportation Average index included shares of the largest transport companies and showed the state of the transport industry of the United States as a whole.

Fast Fact:

The index fund is very similar to a regular ETF, with the difference being the degree of management, which reduces trading commissions.

Major Types of Index Funds

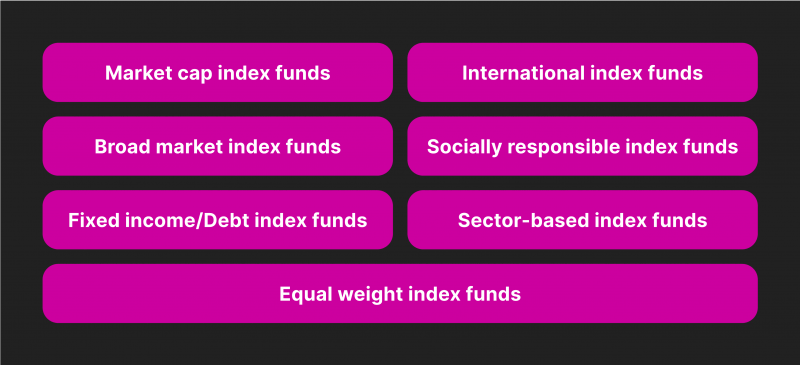

Today, the group of index funds has a large number of types and sizes they take. Each separately taken from the types of funds has certain criteria for selection of those or other companies that form it. Let’s consider the main types of index funds:

Market Cap Index Funds

Index funds that track market capitalisation ranges are a popular investment option. Market capitalisation is determined by the total value of a company’s outstanding shares, and index funds allocate their investments based on these values.

Large-cap funds, like those that mirror the S&P 500, typically invest in companies with market caps exceeding $10 billion. On the other hand, small-cap funds target companies with market caps below $2 billion.

International Index Funds

International index mutual funds are investment vehicles that strive to mirror the returns of sector-specific indices such as banking, technology, infrastructure, and more. These equity funds are designed to expose investors to international markets and allow them to participate in the performance of specific sectors across different countries. By investing in these funds, individuals can access a diversified portfolio of international stocks that closely track the movements of their respective sector indices.

Broad Market Index Funds

Broad market index funds aim to capture a significant portion of an investable market, which can consist of stocks, bonds, or other investable assets.

While some index funds focus on tracking a specific segment of the stock market, like large-cap or small-cap stocks, total stock market index funds encompass companies from both these areas. Opting for broad-market index funds can be advantageous while seeking cost-effective exposure to an entire asset class or a particular country or region.

Socially Responsible Index Funds

Socially responsible index funds offer investors the chance to diversify their portfolio by investing in a range of companies that prioritise equal employment opportunities, environmental responsibility, occupational health and safety, and the production of goods that enhance the quality of life.

It is important to note that the unit value of this option may experience significant fluctuations due to its investments in both domestic and international stock markets.

Fixed Income/Debt Index Funds

A debt index fund is a type of mutual fund that focuses on investing in fixed-income instruments, including corporate and government bonds, corporate debt securities, and money market instruments. The primary objective of these funds is to provide capital appreciation to investors.

Like how stock funds track popular stock market indices, debt index funds track bond indices, which allows them to have lower expense ratios than actively managed funds. Bonds can be a valuable component of an investment portfolio, particularly during retirement, as they offer stability and income generation.

Sector-Based Index Funds

Sector-based index funds are designed to concentrate on specific sectors of the economy, such as technology, healthcare, or financials, offering investors focused exposure to particular industries. These funds have the advantage of providing targeted exposure to specific sectors and can be utilised for tactical asset allocation.

Nevertheless, it is essential to note that they come with a higher concentration risk than broad-market index funds, and there is a possibility of underperforming the broader market under certain conditions.

Equal Weight Index Funds

An equal-weight index fund is an exchange-traded fund that implements an investment strategy where each component of the underlying index or portfolio is assigned an equal allocation weight.

In contrast to traditional market-cap-weighted index funds, which assign higher weights to larger companies and lower weights to smaller ones, equal-weight index funds offer equal exposure to all constituents.

By providing equal exposure, these index funds enable investors to capture the growth potential of smaller companies that may be overlooked in market-cap-weighted strategies.

As a result, they are commonly utilised by investors who prioritise diversification and have confidence in the ability of smaller companies to outperform or match the performance of larger ones, particularly over the long term.

What Kinds of Costs Do Index Funds Have?

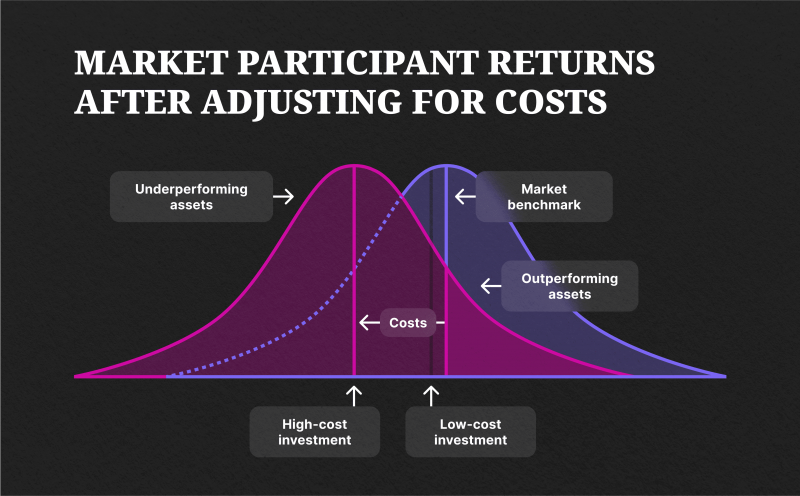

Index funds offer investors a distinct advantage over actively managed funds by minimising fees that can affect their returns. This is primarily because index funds require less effort and resources than managed accounts. Consequently, investors are not burdened with the expense of hiring professionals to analyse financial statements and make investment decisions.

While index funds are generally more cost-effective than other types, it is essential to acknowledge that they may still entail certain expenses. Let’s explore these essential costs further.

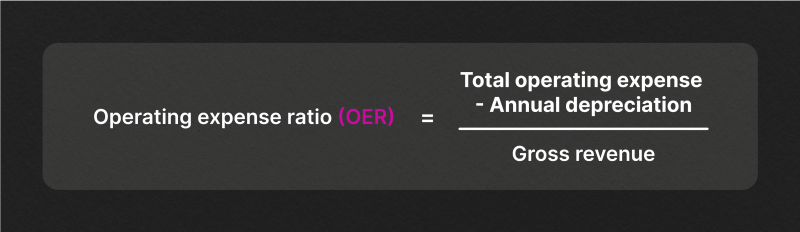

Expense Ratio

One of the main costs associated with an index fund is the expense ratio, which is the fees deducted from each shareholder’s returns based on their total investment. To find the expense ratio for a mutual fund, you are required to consult the fund’s prospectus or look for it when getting a quote from a financial website.

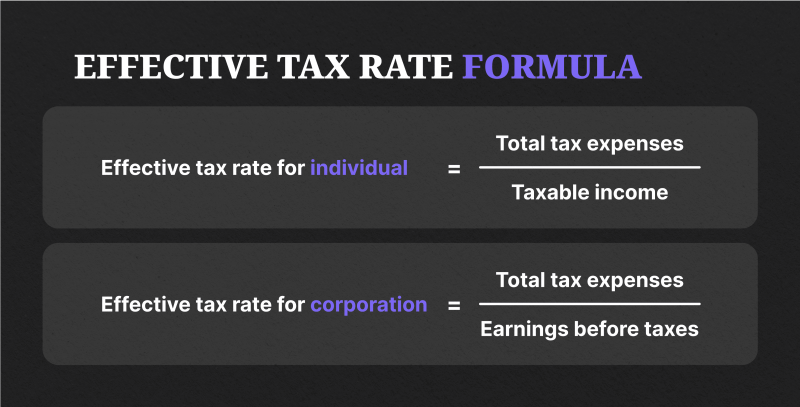

Tax-Cost Ratio

Apart from the fees that need to be paid, owning the fund outside of tax-advantaged accounts like a 401(k) or an IRA may also result in capital gains taxes. Similar to the expense ratio, these taxes can significantly impact the overall investment returns by reducing them.

Investment Minimum

Index funds offer a flexible investment option with varying minimum prerequisites. While some funds may allow investors to start with no initial investment, others may require a few thousand dollars. Once the minimum threshold is met, adding funds in smaller increments is possible, allowing investors to build their investment portfolios gradually.

Account Minimum

The investment minimum is distinct from the brokerage’s account minimum. While it is possible for customers to open a traditional or Roth IRA with a brokerage account minimum of $0, this does not eliminate the prerequisite of an investment minimum for a specific index fund.

Selling Points of Index Funds

Index funds, like any other type of fund, have gained popularity among inverters due to their features that have helped multiply capital. At the same time, they offer several advantages that set them apart from other types of funds. Here are the main ones:

Affordability

An index fund differs from other actively managed investment funds as it takes a more passive approach, avoiding frequent buying and selling of financial instruments. Instead, the fund focuses on rebalancing its portfolio to match the index’s composition. This strategy not only helps maintain the fund’s alignment with the index but also positively impacts the overall cost of investment.

Lower Fund Management Cost

Actively managed funds come with various expenses, including employing a team of analysts to assist in the analysis and selection of stocks and brokerage charges incurred when buying or selling stocks in the portfolio.

These costs ultimately result in higher fund management charges. Conversely, index funds experience a significant reduction in these costs as stock selection is based on the index’s composition, allowing for a more minor fund management team.

Diversification

Many well-known index funds are built on diversified indices, providing investors with exposure to various sectors of the economy. This means that even if an investor chooses an index fund based on a large-cap, mid-cap, or small-cap index, their investments will still be spread across multiple sectors.

By diversifying their investments, investors can reduce the overall risk to their principal amount. Additionally, investing in broad-based indices allows investors to benefit from the growth potential of different economic sectors.

Long-Term Performance

Index funds have a reputation for offering consistent and predictable returns over the long run, although it’s important to note that performance can never be guaranteed.

Financial experts have consistently advocated for the advantages of holding index funds, particularly for the average investor looking for long-term benefits. As a result, index funds are widely regarded as a solid foundation for retirement accounts, such as IRAs and 401(k) accounts.

The Most Popular Index Funds to Invest In

Today, the market of index funds offers a wide variety of investment options, allowing you to track the dynamics of changes in the total value of companies within a particular sector or industry. The best index funds that have become benchmarks of economic evaluation of the state of the economy of different companies are the following:

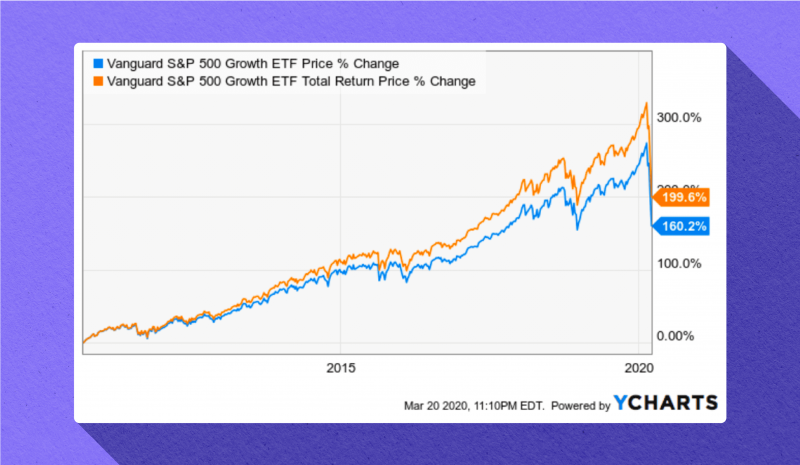

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF is a popular investment option that tracks the performance of the S&P 500 index. This exchange-traded fund (ETF) allows investors to gain exposure to a diversified portfolio of large-cap U.S. stocks.

By investing in this ETF, individuals can benefit from the potential growth and returns of the S&P 500 index, which is widely regarded as a benchmark for the overall performance of the U.S. stock market.

The Vanguard S&P 500 ETF provides a convenient and cost-effective way for investors to participate in the stock market and potentially achieve long-term investment goals.

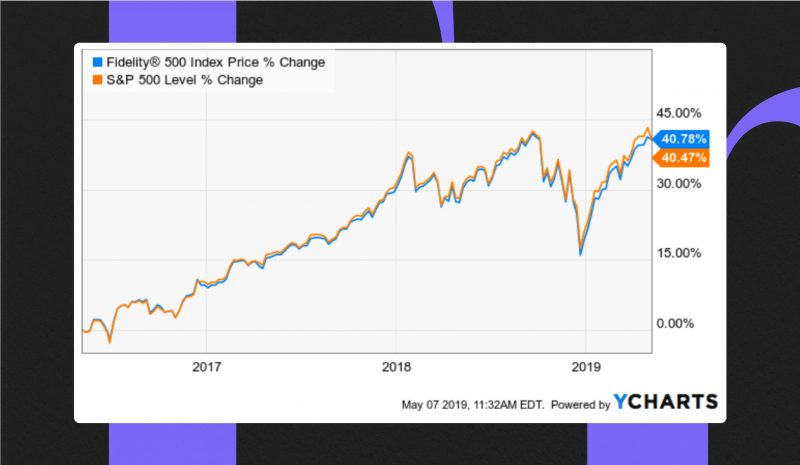

Fidelity 500 Index (FXAIX)

The primary objective of this index fund is to achieve investment outcomes that mirror the overall performance of publicly traded common stocks in the United States.

To accomplish this, the fund typically allocates a minimum of 80% of its assets to common stocks listed in the S&P 500 Index, which serves as a comprehensive representation of the performance of publicly traded common stocks in the United States. Additionally, the fund engages in securities lending activities to generate additional income.

DFA US Large Company (DFUSX)

The DFA U.S. Large Company fund provides investors with a diversified and market-cap-weighted portfolio consisting of the 500 most extensive U.S. stocks. This fund effectively captures the essence of the large-cap segment, offering comprehensive exposure to the performance of prominent companies in the United States.

Investing in Index Funds: A Brief Guide for Novices

If you’re looking for the answer to the question “How to buy index funds?” and begin your investment journey or are already an experienced investor, index funds offer a simple and efficient investment variant to work with. Here is a quick guide to help you kickstart your investment journey in the world of index funds.

Investment Platform Selection

Begin by selecting an online brokerage or investment platform to embark on your investment journey. Nowadays, numerous online platforms provide the convenience of commission-free trading in index funds and ETFs, offering a wide range of options to choose from.

Account Opening

Once you have made your platform selection, the next step is to open an account. This process usually entails providing some personal information, establishing login credentials, and completing a questionnaire that delves into your investment objectives and tolerance for risk.

Account Funding

After successfully setting up your account, the subsequent task is to fund it. This can typically be accomplished through a bank transfer. The amount you decide to start with will depend on your individual financial circumstances and investment goals.

Index Funds Selection

With your account funded, it’s time to carefully select the index funds that align with the investment strategy. Conduct thorough research on different funds, considering factors such as their performance history, management fees, and the specific index they track. Diversifying your portfolio by investing in multiple index funds can be a prudent approach.

Index Funds Purchasing

Once you have identified your preferred index funds or ETFs, you can proceed to purchase shares. Most platforms offer a user-friendly interface that allows you to buy shares directly through their website or app with just a few clicks.

Monitoring and Adjustments

It is crucial to monitor your investments and make adjustments as necessary regularly. While index funds are generally considered long-term investments, it is wise to periodically review your portfolio to ensure it remains aligned with your financial goals. You can make informed decisions and optimise your investment strategy by staying vigilant.

The Bottom Line

Index funds are an excellent investment tool for novice and professional investors due to their advantages over other alternatives. The time-tested trading of index funds means simultaneous analysis of the economy of several different companies and stable income from the growth of companies with high market capitalisation in different sectors.

FAQs:

What is an index fund?

Index funds are a unique financial instrument that consolidates funds from multiple investors and allocates them into various securities, including stocks and bonds. The primary objective of an index fund is to mirror the performance of a specific stock market index. A market index is a theoretical collection of securities representing a particular market segment.

Are index funds good for beginners?

When considering long-term investments, fluctuations in the market become less significant. If you have concerns about purchasing an index fund at a peak, remember that for several years, that peak will appear much smaller. Take advantage of our investment calculator to analyse the potential growth of an investment in an index fund or any other security over time.

How to start investing in an index fund

ETFs and mutual funds are two common forms of index funds that offer investors the opportunity to diversify their profiles. These funds can be easily accessed through a brokerage account, allowing individuals to invest directly in them.

Nonetheless, if you prefer a more automated approach to index fund investing, consider opening an account with a robo-advisor, which can streamline your investment process.