B2Broker Unveils B2Core v2.1 with Savings Functionality, New Trading Platform, Fresh PSPs, and UI Enhancements

Apr 15, 2024

B2Broker, the acclaimed provider of technology and liquidity solutions, has declared the launch of the most recent release of its cutting-edge CRM and back-office solution, B2Core.

This extensive update brings a highly anticipated savings capability, integration of the advanced day trading platform TradeLocker, the addition of payment systems, and various enhancements to the platform’s user interface and functionality.

Let’s delve into each of these enhancements and discuss their implications for B2Core clients.

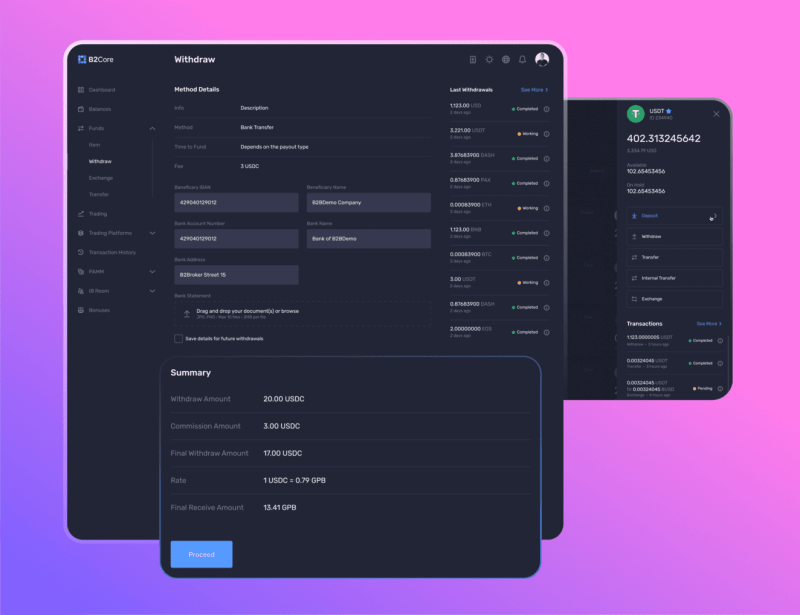

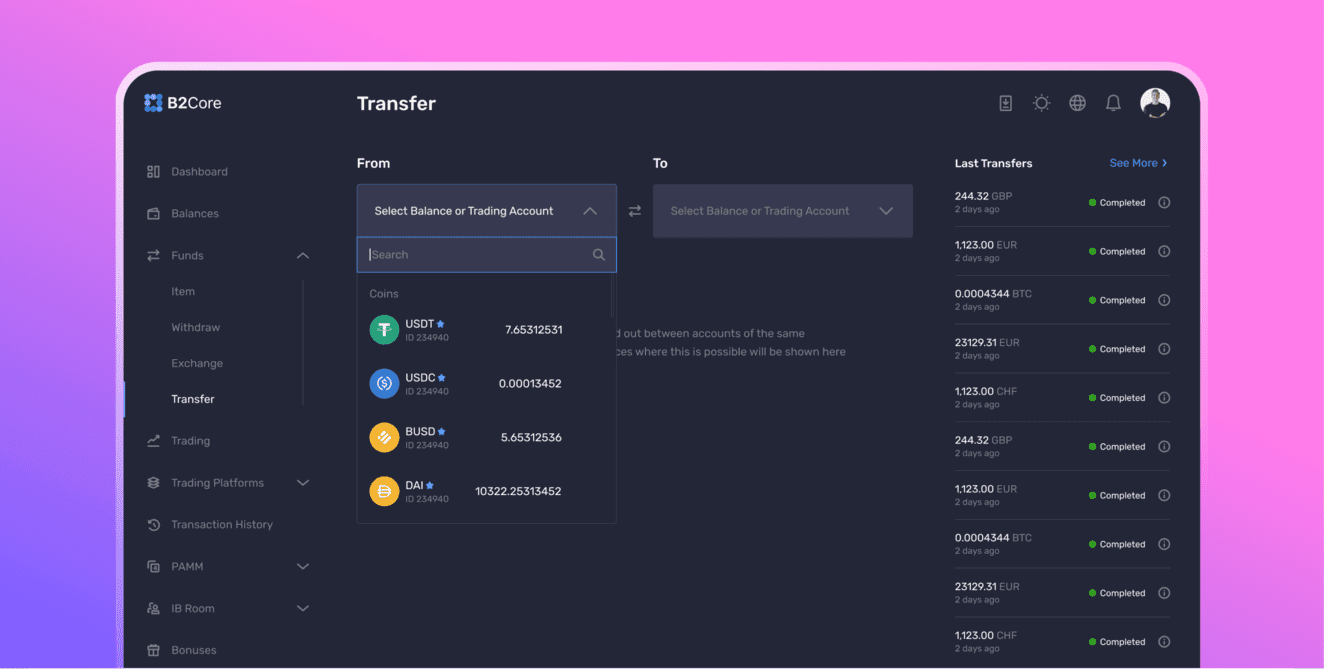

Improved UI & Enhanced Performance

Alongside the introduction of new features, B2Core v2.1 boasts a completely revamped UI, significant functional updates, and bug fixes.

- A section for withdrawals now provides comprehensive transaction details, encompassing commissions, exchange rates, and the net withdrawal amount.

- Minimum deposit settings are now enforced during account creation, ensuring alignment with back-office configurations.

- Account selectors are now categorised by type (e.g., Fiat, Coins, MT4, MT5) for streamlined navigation on the Deposit, Withdraw, and Transfer pages.

- A unified date format has been instituted to ensure consistency across the platform.

- URL navigation differences between the old and new UI have been resolved for seamless transitions.

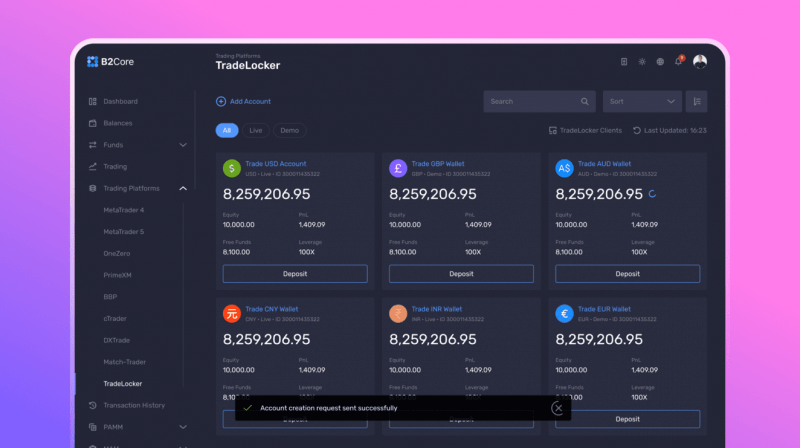

B2Core Integrates with TradeLocker Trading Platform

B2Core v2.1 introduces TradeLocker, an innovative trading platform seamlessly integrated into the trader’s room. This addition enhances the company’s existing suite of integrated platforms, including MetaTrader 4, MetaTrader 5, cTrader and B2Trader, offering brokerages a complex set of trading solutions.

TradeLocker presents a comprehensive suite of powerful trading tools and instruments aiming to cater to a wide spectrum of clients, from novices to seasoned traders. The platform is equipped with versatile features designed to support a variety of trading strategies and preferences, facilitating a seamless and efficient trading experience for brokerage clients.

TradeLocker integrates with TradingView to offer a sophisticated charting capability, granting users access to an extensive array of customisable charts and indicators. The platform provides traders with modern tools to manage risks effectively.

Among its standout features are SL & TP Calculator, On-Chart Trading, One-click Trading, Trailing Stop Loss, and Social Mode, enabling traders to efficiently manage their trades engaging with the market. Users can easily develop or customise bots, signals, indicators, and strategies using the TradeLocker AI at TradeLocker Studio.

Latest Payment System Integrations and Enhancements

The latest B2Core update expands its financial ecosystem with enhanced payment integrations, providing users with broader transaction capabilities.

Sqala has been introduced to facilitate deposits and withdrawals in Brazilian reals (BRL), which are distinguished for their simplicity, exceptional exchange rates, and comprehensive dashboards that keep users informed about their transactions.

Significant enhancements have been made to streamline and secure transactions across various existing payment providers:

- BridgerPay now offers an improved deposit process within the B2Core UI, featuring an automated data fill-in function that simplifies transactions using client-related information.

- Praxis configuration has been enhanced to ensure secure transaction processing. Additionally, to comply with diverse regulatory standards, clients from different countries can now submit different sets of required documents for making deposits through Praxis in the B2Core UI.

- Constructor payment method adjustments now enable clients to attach essential documents for deposits and withdrawals, ensuring higher compliance and record accuracy.

Furthermore, with the update, access to WireCustom and 1-2-Pay for deposits and withdrawals has been corrected, broadening the range of transaction options for users.

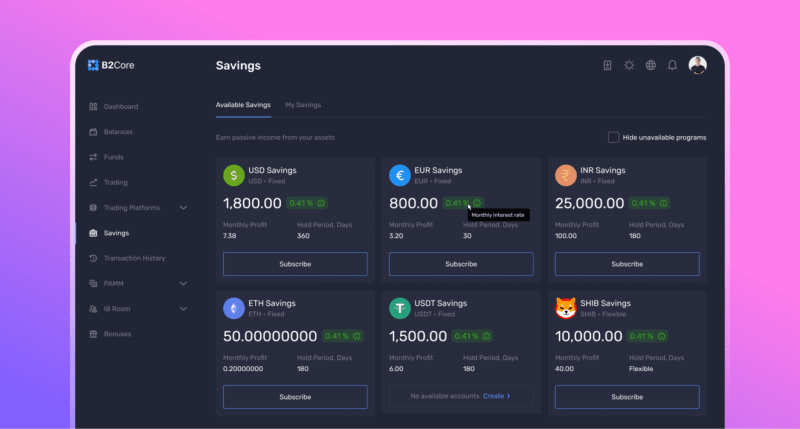

Engage Customers with Savings Feature

The latest update introduces a savings feature to facilitate the creation of savings programs, allowing users to invest idle funds to earn interest over a specified period.

This feature currently supports a fixed savings strategy, enabling the use of fixed interest rates within these programs. Administrators can access, modify, and initiate new savings programs via the presets page, tailoring these programs to meet business-specific requirements and client preferences effectively.

The savings feature offers flexibility in several aspects, including the ability to set the customised annual interest rate on savings, as well as adjust the investment duration in 30-day intervals, such as 30, 60, or 90 days. Furthermore, brokers can enforce a penalty for early withdrawal.

Distinguished by its significant configurability and customisation, this feature encourages clients to retain their funds within the broker’s ecosystem while providing brokers with a strategic tool to boost fund retention and liquidity within B2Core, creating a mutually beneficial scenario.

Bottom Line

Over the years, B2Broker has consistently enhanced the quality of its products and services to ensure the best possible experience for its clients. B2Core v2.1 underscores this commitment, presenting brokers with advanced technological features and enhanced integrations within an intuitive platform.

Looking ahead, the team is already working on the full migration of B2Core to the new interface. Additionally, the company plans to introduce flexible interest rates for the savings feature to enhance its adaptability. The B2Core team also focuses on further integrations and expansions, all aimed at providing clients with more diverse and convenient solutions.

Start exploring these new features today and uncover the benefits for your business.