B2CONNECT Update: Smarter Liquidity Routing and Management Combined with Revamped UI

July 30, 2025

B2BROKER announced a new update to its crypto-native liquidity hub, B2CONNECT. This release builds on the recent improvements presented in the last liquidity updates and introduces better tools to manage and compose liquidity for boosted brokerage performance.

The new B2CONNECT update covers key aspects of the solution’s liquidity management practices, including:

- Multi-Provider Liquidity Management.

- Detailed Spread Controls.

- Symbol-Based Invalidation Algorithm.

- Aggregated Trade Execution Reporting.

- Redesigned UI for Automated Swap Charges.

- More Reliable Order Flow for FOK.

- Account-Level Symbol Management.

- A completely revamped Web UI.

Let’s dive deeper into these features and explore how they enhance liquidity management, making it more robust and seamless.

Revamped Web UI Highlighting Modernity

The update introduces a comprehensive redesign of the B2CONNECT Web UI from top to bottom. Modern interfaces with sleek workflows provide a more intuitive and data-rich experience for administrators.

Some of these introductions include:

- New Side Menu: This new toggle puts the most important operational tools closer to users, moving less-used tools away and making the navigation much more seamless.

- Higher Information Density: The new, dense design gives users 20% more data visibility on the screen, which means less scrolling.

- Enhanced Table Controls: New controls for tables supporting sorting, filtering, and customising columns. Action buttons are now always visible, making working with data easier and faster.

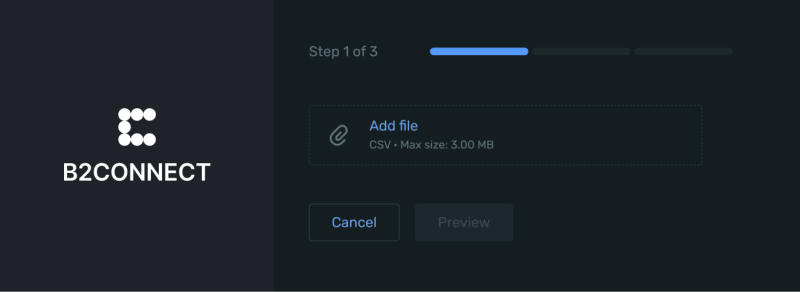

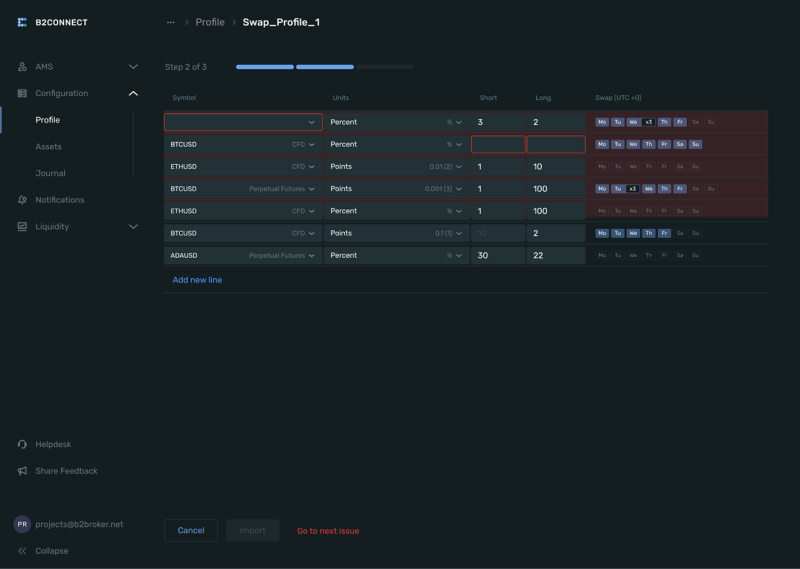

Streamlined Import Wizards Workflows

The old import pop-ups have been completely replaced with a new multi-step wizard that guides the user through file uploads and CSV imports for spreads or swaps.

This new approach prevents the loss of unsaved settings due to unintentional closing and is designed to handle more complex data, providing clearer feedback and simplifying administrative work.

Multi-Provider Liquidity Orchestration

Professional brokers know that multiple liquidity providers work better than a single LP because any outage from one source can impose significant brokerage operational risks. Therefore, B2CONNECT released a new multi-provider liquidity orchestration engine.

This system integrates and manages multiple liquidity providers simultaneously, with active monitoring across all sources. If one issue is detected, it automatically triggers failover logic to reroute orders to a better provider.

This results in a massively reduced service downtime and a new level of trading reliability. It delivers complete multi-maker and multi-taker compatibility, giving brokers the confidence to remain operational under any market conditions.

Advanced Spread Control Tools

B2CONNECT now offers a revamped Web UI that allows admins to define the maximum limit for spread in any symbol directly.

Brokers can set spread limits for each asset individually or in bulk by uploading a CSV file. The system will automatically keep the spread within the allowable range, eradicating invalid quotes and sharp fluctuations.

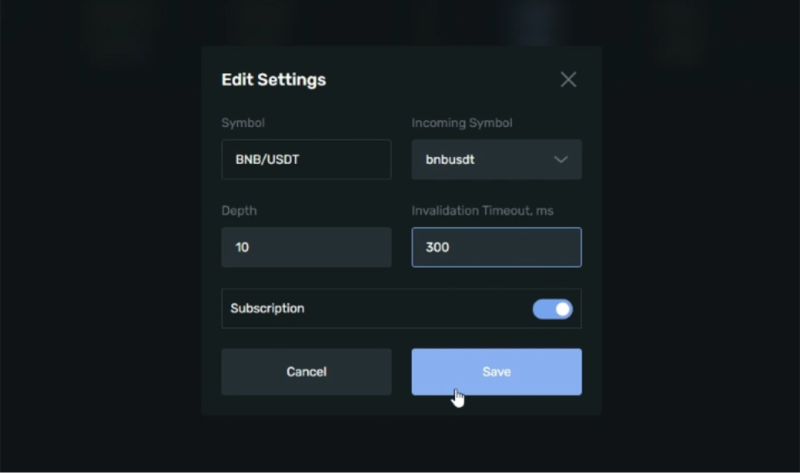

Symbol-Based Invalidation

One of the major challenges for brokers is encountering a stale or “dead” price quote from a liquidity provider, which can potentially result in off-market executions and financial losses.

To proactively combat this, B2CONNECT features an intelligent symbol-based price invalidation system, offering granular control over the integrity of price feeds.

This system works on two levels:

- Admins can set an Invalidation Timeout for each symbol per provider. If a quote isn’t updated within the defined timeframe, it’s automatically discarded.

- The system is also event-driven. If a provider is manually disabled or if it sends an external invalidation signal from its end, the system will react instantly according to the broker’s settings.

Once a quote is invalidated, it is immediately removed from the order book to minimise operational risks, leading to a more accurate and trustworthy price feed for every offered instrument.

Consolidated Trade Execution Reports

Processing high-volume orders across multiple LPs can result in fragmented reports with many partial fills. This creates challenges for certain trading platforms and complicates back-office reconciliation.

To solve this, the B2CONNECT introduces aggregated execution reporting. The system now merges all partial fills from a single order, sending one consolidated report to the taker’s platform.

This approach creates much cleaner reports for traders and significantly simplifies reconciliation for internal teams.

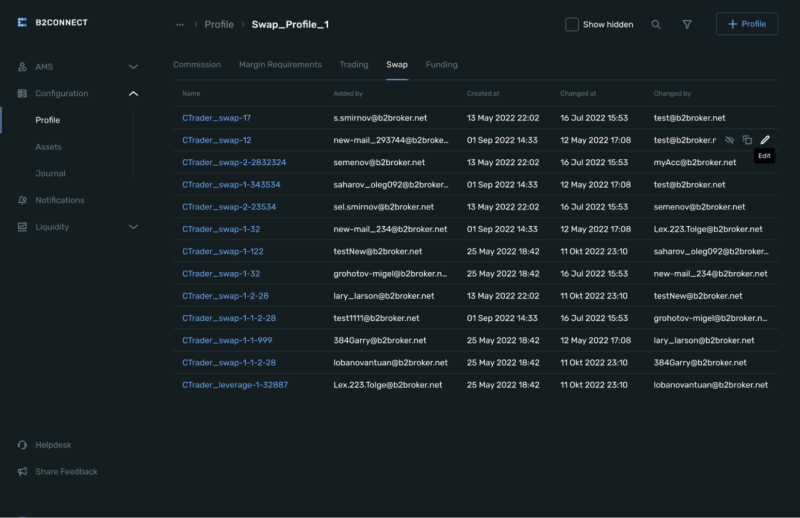

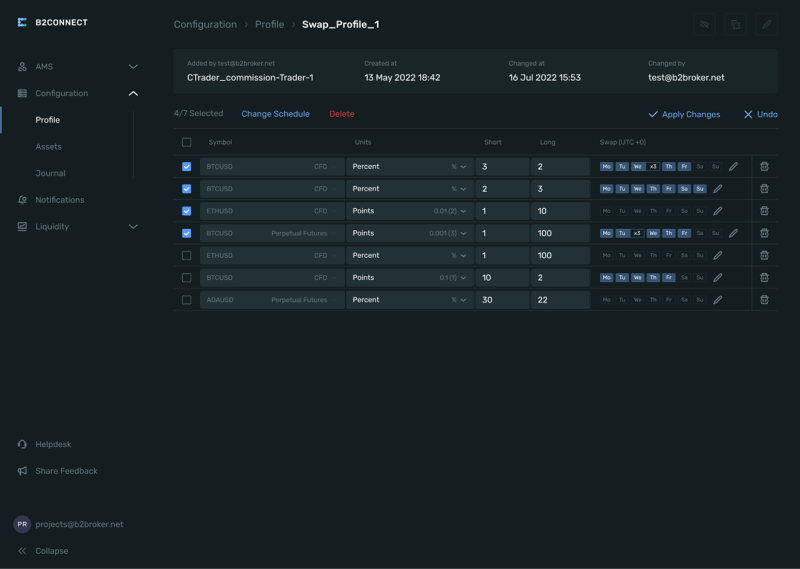

New UI for Automated Swap Charges

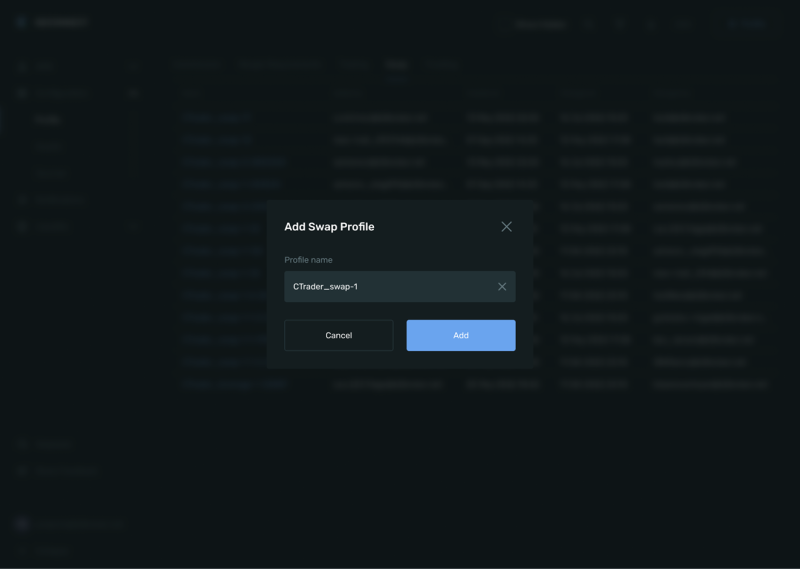

The new B2CONNECT update simplifies the challenging process of swaps with a new Swap Profile Planner and Editor. This enables admins to manage swap charges more efficiently right from the Web UI.

Custom Profiles

Brokers can create detailed Swap Profiles assigned to individual client accounts. Within each profile, admins can define precise rules for every trading instrument, offering greater control and flexibility to perform the following tasks:

- Setting unique swap rates for both long and short positions.

- Defining swap charges in either Points or as a Percentage.

- Applying negative rates to debit swaps from an account, as well as positive rates to credit them.

Flexible Scheduling

The built-in planner goes above and beyond simple rollover charges. It is a powerful tool that gives admins full control over scheduling swap charges.

Brokers can set multiple charge times on any day of the week, while supporting the “triple swap” logic for weekends, applied automatically on a chosen day.

Brokerages can now create a fully automated and sophisticated swap strategy that aligns perfectly with their business model.

Efficient Management

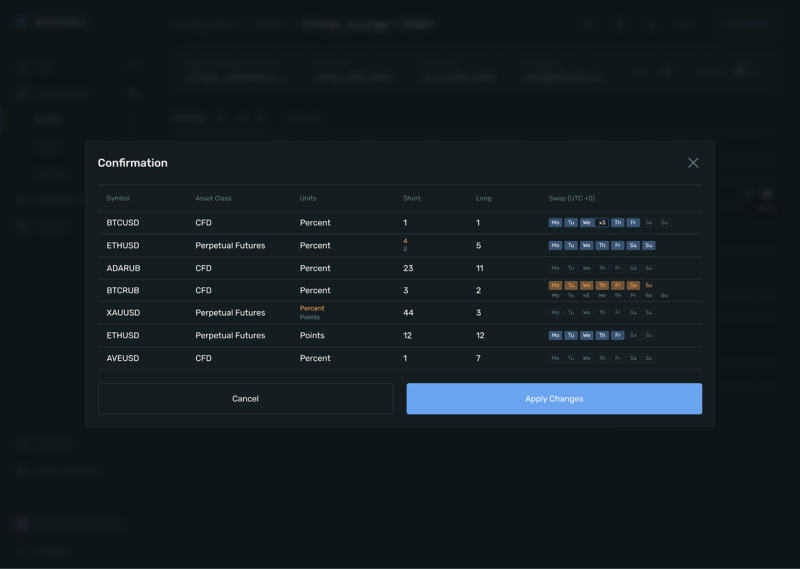

For brokerages offering numerous instruments and managing countless profiles, B2CONNECT offers a powerful CSV workflow for swaps. The system now supports exporting any profile, making bulk changes in a spreadsheet, and importing it back to update or clone settings instantly.

The new smart import wizard checks and validates files for errors before applying changes, ensuring data integrity and accuracy.

This entire workflow is designed to replace manual swap calculations, providing brokers with a well-planned system for managing a key part of every brokerage’s revenue.

Improved Order Flow Management

The update also includes several operational improvements, ensuring that order handling is more robust and reliable. This targets two critical areas:

- Better Fill-or-Kill (FOK) Execution: Improved system capabilities for handling tiny differences in decimal precision between takers and makers. The result is a much higher success rate for requested FOK orders and fewer rejections.

- More Effective Cancel Requests: The order cancellations logic has been refined. This change enhances the success rate of cancellation requests, providing traders with more responsive control in fast-moving markets.

Streamlined Account-Level Symbol Configuration

Managing available symbols for clients has become more seamless. Admins can now enable or disable any trading symbol directly within an account’s settings, rather than managing these permissions in a separate section.

This change makes a big difference for the administrative team, saving time, reducing clicks, and preventing the configuration conflicts that can arise when settings are managed in multiple places.

Improve Liquidity Management to Boost Your Brokerage

These liquidity bridge updates for B2CONNECT are designed to make brokerage management more seamless and flexible, giving more control tools for admins and end-users.