Story of Big Tech Giant Apple Will Not Be About Growth This Time. However, Bulls Believe in The Opposite.

Aug 03, 2023

Apple’s June quarter earnings report isn’t likely to be a growth story, and with the stock already up 50% year to date, there isn’t much room for mistakes.

However, the business’s legion of bullish analysts expect stronger growth ahead and forecast more increases for what is now the world’s most valuable corporation, with a market worth of $3.1 trillion.

- Its Performance:

Thursday’s market closure will follow a report from the big tech Apple . Analysts anticipate it will report third fiscal quarter revenues of $81.9 billion, down around 1% from the second quarter, and a profit of $1.19 per share, down a penny from the same period last year.

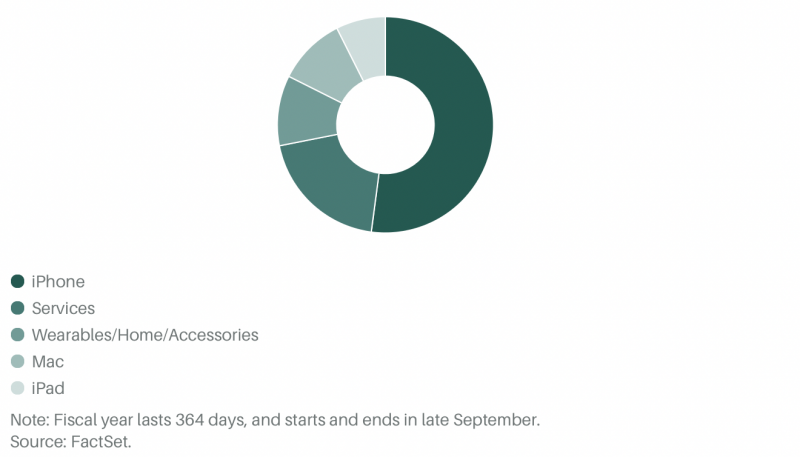

FactSet estimates that the Street anticipates iPhone sales of $40.3 billion, down 1%, and Mac and iPad sales of $6.6 billion and $6.5 billion, respectively, down 10%. The sales sector is forecast to earn $8.3 billion in sales, up almost 4%, and $20.8 billion in services revenue, up 6%, which will offset these declines.

The performance of big tech giant Apple (AAPL) in its Asian landscape, which covers the mainland, Hong Kong, Taiwan, and Macau, will be a major indicator for the quarter. Revenue is expected to be $13.7 billion, a 7% decrease from last year. Revenue from the Americas is expected to be $38 billion, up 1.5% over the previous year.

Apple CFO Luca Maestri predicted that June sales would equal the March quarter, which saw a 2.5% year-over-year decline in revenue. Maestri anticipated that the exchange rate would have a four percentage point effect on revenues and that the services segment would continue to face macroeconomic challenges in digital advertising and gaming.

- Major Profits:

The iPhone accounted for $205.5 billion of Apple’s $394.3 billion in total revenue forfiscal 2022.

Analyst Harsh Kumar of Piper Sandler said in a research report published before the quarter that China handset concerns for Apple are a bit overblown. He is certain that the company’s earnings call will be well welcomed because of the resilience of the Chinese and iPhone divisions. On Monday, Kumar reaffirmed his Overweight rating and increased his target price from $180 to $220.

Due to “a clear uptick in demand around the key China region this quarter” for iPhones, Wedbush analyst Dan Ives predicts that big tech company Apple will post an equal-to-or-stronger quarter for iPhone revenue.