What to Choose Instead of MT4 White Label Providers?

14 Jun, 2024

MetaTrader 4 has long been considered the gold standard in the forex industry, providing brokerages with a full-featured trading interface. However, the market for trading systems is not limited to just MT4 and its successor, MT5. With the changing trends and new technologies emerging, more and more white label providers offer brokerage solutions that rival the features of MT4 white label offering.

This article will explore the alternatives to MT4 white label providers, their unique offerings, and why brokerages should consider them in their search for the perfect trading solution.

Key Takeaways:

- Despite the popularity of MT4 and MT5, WL brokers have faced certain challenges due to stricter requirements from MetaQuotes.

- Several alternatives to MT4 white label provider options are available on the market.

- Many technology providers offer comprehensive platforms equipped with the necessary tools, features, and extensive support for the competitive edge of WL brokers.

- The choice of white label providers should be based on individual brokerage needs and client preferences, requiring thorough comparison, evaluation, and testing.

What Is MT4?

MetaTrader 4 was developed by MetaQuotes Inc. and launched in 2005 as an online trading terminal for forex and CFDs. Its custom charting tools, automated trading capabilities, and availability of Expert Advisors (EAs) – programmable trading robots – quickly made it the preferred software in the retail forex trading industry.

In 2010, MetaQuotes Inc. released the successor to MT4: MetaTrader 5. The new version had an upgraded user interface and additional features such as a built-in economic calendar and depth of market functionality.

Today, the two terminals are immensely popular among both brokerages and traders. In fact, according to different sources, MT4 and MT5 remain the most widely used trading platforms globally, with a combined market share of over 70%.

Fast Fact

In June 2021, the number of companies using MetaTrader 5 surpassed those using MetaTrader 4, making it the most popular trading platform currently available.

What Is an MT4 White Label?

A white label solution provider is a company that offers ready-made trading solutions to brokerages. These solutions include trading platforms, back-office systems, and other tools necessary for running a brokerage business.

Essentially, white label providers allow brokerages to launch their own trading platform without needing expensive and time-consuming development from scratch. As a result, brokerages can enter the market quickly, reduce costs, and focus on growing their client base.

Despite MT4’s apparent success and widespread adoption, there have been some challenges recently for WL brokers looking to offer the platform to their clients. MetaQuotes has implemented strict requirements for white label brokers applying for their terminals, making it more difficult for companies to access the MT4 and MT5 platforms.

Is MT4 White Label Solution Available Today?

In the past, obtaining a MetaTrader 4 or 5 White Label was relatively straightforward. Brokers would need to provide basic company registration documents and were then granted access to the platforms. However, as the industry became more saturated with brokers offering MT4, MetaQuotes became more demanding in maintaining a higher standard for their platforms.

The new requirements now include providing a Certificate of Incorporation, Register of Directors and Shareholders, Registered and Physical Address proof, and Corporate Account Verification. These added criteria ensure that only legitimate and well-established companies are granted access to MT4 and MT5 platforms, promoting a more professional and secure trading environment for retail traders.

Apparently, many third-party providers have decided to stop offering MT4 and MT5 white label solutions completely. However, this does not mean brokerages are left without viable options.

Best White Label Providers for Forex Brokers

Here are the top replacements for MT4 white label provider options that brokerage firms should consider:

B2Broker

B2Broker, one of the leading technology and liquidity providers, has fostered recognition across the crypto and forex brokerage industry by offering award-winning software infrastructure, liquidity, crypto payment, white-label solutions, and multi-asset liquidity platforms. As of the time of writing, the company provides two platforms for white-label brokers – the highly popular cTrader terminal and the proprietary B2Trader platform.

White Label cTrader is built with modern functionality and trading mechanisms while featuring a range of tools and features for brokerages to operate their business efficiently, including liquidity aggregation, high-quality price quotes, margin account system management, and reporting tools.

B2Broker’s proprietary crypto spot trading platform, B2Trader, is designed for brokers and institutions that want to enter the crypto market without building their own infrastructure. It has a sleek layout, customizable design options, and mobile app support, making it a competitive alternative to other terminals.

Besides getting the technology itself, the company’s clients also benefit from Tier-1 liquidity aggregation services, B2Core CRM and back-office support, crypto payment processing with B2BinPay, copy trading functionality with B2Copy, licensing support, and more.

X Open Hub

Established by XTB SA, a leading provider of FX and CFD liquidity and technology, X Open Hub has carved a niche in delivering forex white-label solutions for global brokerages. X Open Hub offers white label broker software that’s recognized worldwide as a preferred solution by many budding financial services companies.

Among the provider’s top offerings is their XOH Trader web platform, which boasts of a modern design, educational materials and broad customisation options. Additionally, the platform provides built-in economics news, heat maps and market sentiment, creating a single hub for all forex trading needs. It also has its mobile version, XOH Mobile, giving brokers and their traders full flexibility in terms of accessibility.

X Open Hub offers extensive institutional liquidity on over 5000 global instruments, including forex, commodities, shares, indices, ETFs and bonds. Furthermore, their WL offerings come with licensing and regulation guidance, back-end support, and a dedicated X Open Hub team for technical support.

Leverate

Leverate is a white label brokerage provider that specialises in the development and management of advanced FinTech platforms for both B2B and B2C markets. Leverate’s digital products are fully automated, focusing on delivering optimal business results. Clients are supported by dedicated account managers and 24/7 customer service, assuring prompt and effective responses.

SIRIX, provider’s award-winning platform, offers a comprehensive trading experience with its one-click execution and advanced chart analysis tools. The WL package includes the SIRIX server, the platform itself, as well as back-end tools such as real-time risk management with LX Risk. Additionally, brokers have access to Sirix Social, enabling them to integrate social trading features into their services.

Beyond the technology, Leverate connects its clients to large trading networks under the LXCapital solution, providing access to a vast pool of top financial institutions. As a result, brokers can offer competitive rates to their end-users on over 2,000 instruments, including Forex pairs, commodities, indices, stocks, futures and cryptocurrencies.

Leverate‘s attention to technology and customer support has earned it a strong reputation in the industry, making its solutions a reliable alternative to MetaTrader white label.

Devexperts

Devexperts is a reputable provider of financial software solutions with a team of more than 800 engineers, serving a vast clientele, including retail and institutional brokerages, investment funds, and insurance companies since 2002. Committed to excellence, they offer custom solutions tailored to individual brokerage needs, ensuring optimal quality and performance in their software products. For new and existing brokerages, Devexperts offers their white label platform DXtrade.

DXtrade comes in three versions – CFD, XT, and Crypto – catering to different asset classes. The CFD version is specifically designed for OTC like crypto CFDs and the forex market, offering highly customisable features, automated trading functionality, and an array of order types.

The provider offers everything a brokerage needs to succeed in the competitive online trading industry, including a dedicated account manager, API support, mobile trading apps, and back-office system. Moreover, DXtrade seamlessly integrates with multiple liquidity providers and comes with additional benefits. Known for its experience and expertise, Devexperts is a top choice for forex brokers looking for an alternative to MT4 whitelabel providers.

Soft-FX

Soft-FX, a fintech development firm, has been providing software and support services to the financial sector and digital asset platforms since 2005. With a team of experts in IT, legal, and financial domains, Soft-FX offers comprehensive support to foster client business growth. Their multi-asset trading platform, TickTrader, offers a cost-effective solution for brokers looking to expand their trading offerings.

TickTrader is a feature-rich platform equipped with advanced risk management and order execution tools. It supports multiple account types and currencies, as well as algo trading and PAMM functionality, making it suitable for global brokerages. Along with its powerful front-end features, TickTrader has an extensive back-office system that provides full control over trading operations.

Beyond their white label platform, Soft-FX offers additional solutions for brokerages such as liquidity aggregation and margin trading software. Furthermore, the company also provides a wide range of APIs for easy integration with external systems and custom development services for bespoke solutions tailored to specific business needs.

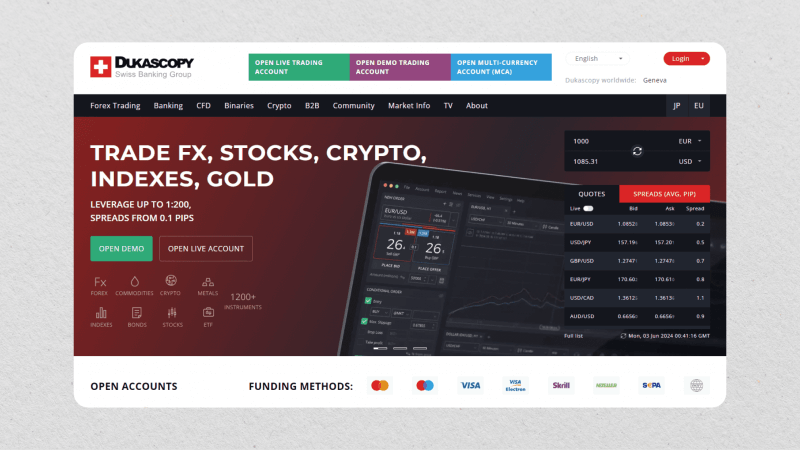

Dukascopy

Dukascopy Bank, an online Swiss banking entity, offers a suite of services spanning mobile and online trading, banking and finance. Its physical presence extends beyond its Geneva headquarters, with offices located in both Riga and Tokyo, manned by a workforce of over 300.

The company’s trading services cover a broad spectrum of assets: foreign exchange, CFDs for stocks, metals, commodities, indices, cryptocurrencies, and binary options. All its operations are overseen by the Swiss Financial Market Supervisory Authority (FINMA), which regulates Dukascopy Bank as both a banking and securities dealer.

Dukascopy Bank offers its own JForex terminal as a white label platform, providing partners with an integrated and comprehensive trading solution. The bank’s white label service is perfect for brokers and regulated financial institutions looking to offer electronic trading services to clients. It provides companies easy access to high-margin business, with spot margin trading available for G10 currency pairs and spot gold. All executions take place in the SWFX – Swiss Forex Marketplace, one of the largest liquidity aggregators globally.

In addition to competitive revenue-sharing models and no market risk, Dukascopy Bank’s white label offering also offers low latency execution, single data feed for clients, no direct implementation costs, and customizable back-office options, making it a trustworthy partner in the world of forex services.

UpTrader

UpTrader, a forex white label provider with ten years of experience, offers comprehensive brokerage solutions for financial service brokers and startups. Their services range from CRM software, a Forex white label system, to liquidity management and branded trading software.

Besides being a MetaTrader 5 white label provider, UpTrader also offers cTrader as a second trading platform. cTrader is an award-winning, feature-rich platform suitable for both novice and experienced traders. It is considered a highly sophisticated platform with features such as advanced charting tools, level II pricing, and one-click trading.

The provider offers assistance in obtaining regulatory licenses and setting up the whole infrastructure for white label brokers. The company offers a full suite of solutions, including CRM and back-office software, affiliate program capabilities, liquidity connections, copy trading features and more.

Tradesmarter

With over a decade of experience in the trading arena, Tradesmarter is well-versed in delivering innovative fintech solutions for the trading industry. Their proprietary platform is a comprehensive solution, incorporating both a client’s cabinet and back-office software, designed to cater to the diverse needs of the trading market. Specifically for forex brokers, Tradesmarter offers the WOW Trader solution.

WOW Trader is a uniquely crafted white label solution for FX and CFD margin trading, while its counterpart, WOW Invest, caters to non-margin real accounts and proprietary trading for stocks, ETFs, and futures. WOW Trader features a user-friendly yet advanced interface, accommodating both beginners and seasoned traders.

Tradesmarter‘s platform offers customizable themes, risk settings, and integrates with over 300 payment gateways. Additionally, the WL solution boasts an impressive integration with more than 180 liquidity providers, granting traders access to a wide range of CFD asset classes.

Conclusion

MetaTrader 4 and 5 hold a grand legacy in the forex trading world. However, their white label solutions are not the only options brokerages should consider. The market is evolving, and so are the offerings from white label providers. This article listed several formidable alternatives that provide comprehensive, versatile, and sophisticated forex trading platforms that can certainly hold their own against the MetaTrader 5 white label.

Brokerages must note, though, that the optimal solution depends on their individual needs, visions, and clients’ preferences. Hence, a thorough comparison, evaluation, and testing are imperative to make the final decision.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

What is a white label forex broker?

A white label forex broker uses the resources of a white-label provider to offer trading services under their own brand name. The provider oversees licences, technology, and infrastructure, while the broker focuses on serving its clients. So, a white label forex broker is essentially a ‘ready-made’ brokerage solution for entrepreneurs or businesses.

How much does a white label broker cost?

Building a white label brokerage firm usually costs thousands or even tens of thousands of dollars, depending on the level of customization and specific features required. Prices are determined based on individual needs, desired functionality, and different providers’ pricing strategies. Research and compare multiple providers before making a decision.

Is white label forex trading profitable?

White label forex trading can be profitable, as it allows brokers to focus on serving clients rather than handling the technical aspects of running a brokerage. However, like any business, success depends on factors such as marketing efforts, customer satisfaction, and market conditions.