CFD Trading Strategies: A Practical Guide to Risk and Execution

July 01, 2025

Most people who attempt CFD trading will lose money. This is a statistical reality published by brokers themselves. The critical question isn’t if most traders fail, but why.

The answer almost always comes down to a failure in one of three areas: the lack of coherent CFD trading strategies, poor risk management, or choosing the wrong broker. We will address all three of these points in this guide.

Key Takeaways:

- Success in CFD trading is built upon a clear and consistently applied strategy.

- Choosing a regulated, fast, and cost-efficient broker is a critical part of a trader’s success, on par with the strategy itself.

- Risk management is fundamental to trading. Lacking disciplined risk controls, even well-conceived trades can produce significant losses.

Understanding Market Conditions for CFD Trading

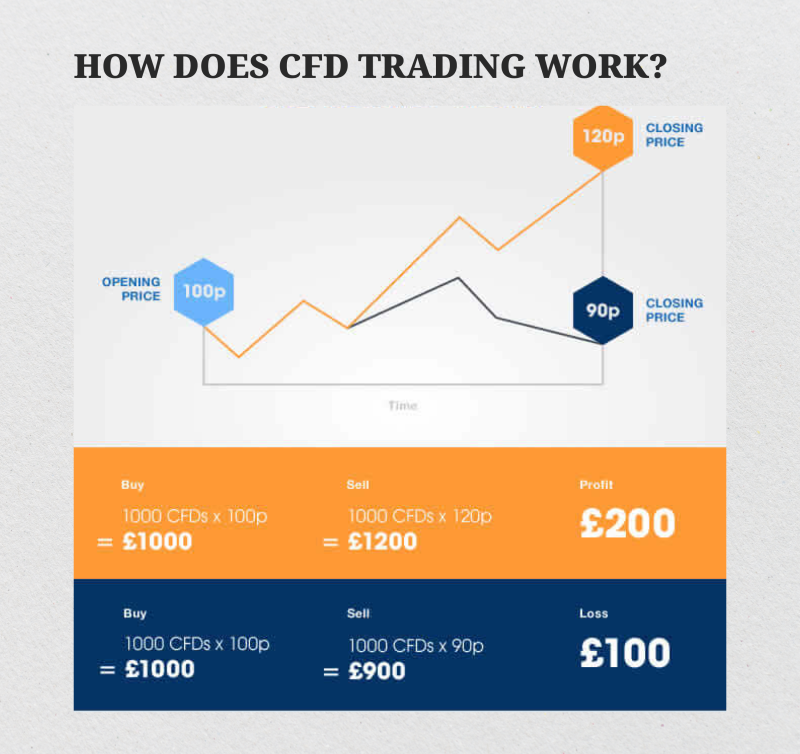

A contract for difference (CFD), put simply, is a financial instrument that allows traders to speculate on movements in asset prices without direct ownership of the asset.

Rather than purchasing shares, gold, or crypto directly, a trader instead contracts with a broker. They agree to exchange the difference in an asset’s price from the opening to the closing of the position. A price shift in your favor results in a profit. A shift against you results in a loss.

CFDs let traders go long (buy) when they anticipate a price increase. They can also go short (sell) on an expected price decline. This two-way approach provides speculative opportunities in both rising and falling markets and is a key part of their appeal.

Leveraging is also a core component. CFDs allow you to control a large position size with a smaller amount of capital. However, leverage increases both potential profit and potential loss, so it requires strict risk discipline.

Essentially, the CFD market is built on the principle of price speculation, not asset ownership. This structure creates a dynamic trading environment, well-suited for short- to medium-term CFD trading strategies.

Fast Fact

DMA stands for Direct Market Access — a type of CFD trading that routes your orders directly to the market, offering more transparency and control.

How to Choose the Right CFD Trading Strategy?

It’s critical to take a moment before entering a trade. Picking the right CFD trading strategy isn’t merely emulating what someone else has done—putting what brought them success into action yourself—it’s about aligning your mindset, your appetite for loss, and your objectives with what is specific to trading with CFDs.

This market is a high-risk, high-reward environment. A large percentage of retail investor accounts lose money here, often from choosing a trading strategy that is inappropriate for them.

Let’s go through the most significant factors before you decide on a particular method for trading CFDs.

Your Trading Style

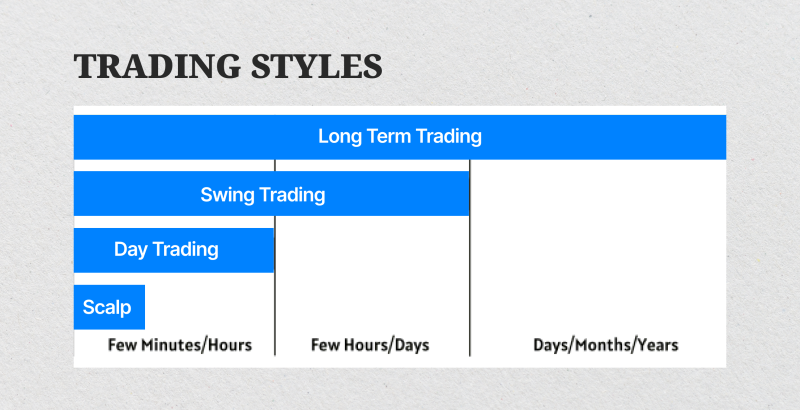

A key initial question is how you prefer to interact with the market. People who are comfortable with quick decisions and who dedicate significant time to monitoring screens often lean towards scalping or day trading.

However, if your lifestyle doesn’t support that level of intensity, different strategies can offer more flexibility. Swing trading or position trading, for example, involve trades that last for days, weeks, or even months, and can be less stressful.

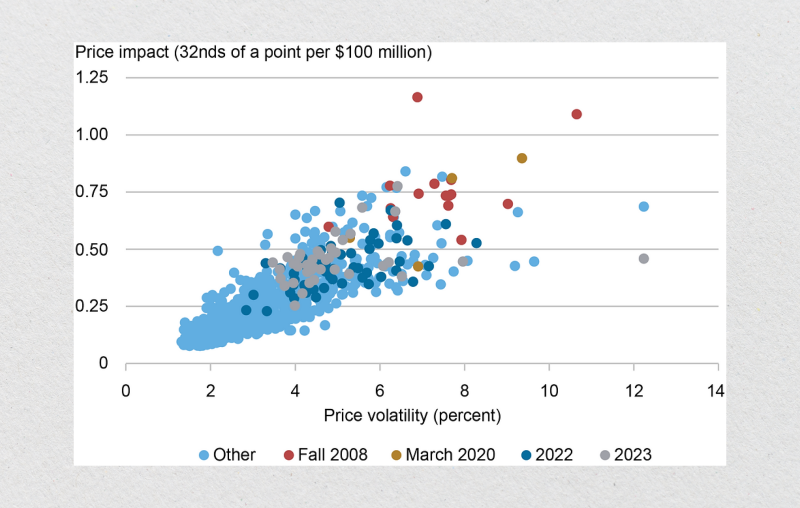

Volatility and Liquidity

Every underlying asset behaves differently. Crypto CFDs and oil might see wild swings in a single day, while Forex pairs like EUR/USD move more steadily. That is the nature of volatility. It can be either a significant advantage or a major risk, based on your trading approach.

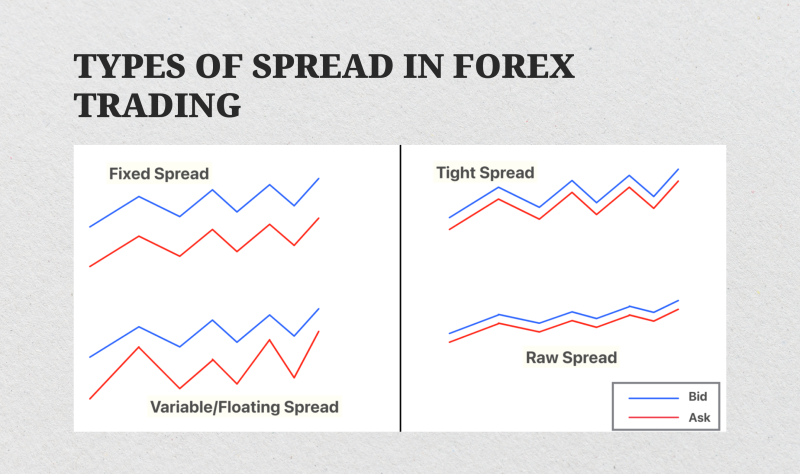

Liquidity is equally critical. This factor determines your ability to open or close a CFD position near the quoted market price. Illiquid assets, by contrast, tend to have wider bid-ask spreads. Such spreads can erode potential profits or complicate exiting a position in a fast-moving market.

For those exploring how to trade CFDs daily, starting with highly liquid assets that have consistent volume is a prudent approach. Good examples include major indices, top Forex pairs, or large-cap stocks.

Capital and Risk Tolerance

CFDs are leveraged instruments. This means you can open large positions with relatively small deposits. While this feature boosts potential profits, it also introduces a high risk of substantial losses. In fact, it’s common to see disclaimers like “X% of retail investor accounts lose money when trading CFDs,”—and there’s a reason for that.

If your capital is limited, focus on smaller trades with conservative risk management. Those with more experience and financial cushioning might explore higher-risk approaches, such as news trading or specific breakout strategies. In any case, a solid risk management plan is non-negotiable.

Broker Conditions

Even the most brilliant CFD trading strategy can fail if your broker is dragging you down. Spreads, commissions, and execution speed are critical factors when executing your CFD strategy. They can determine the outcome of a trade, especially for short-term setups.

For day traders or scalpers, even a minor latency on a trading platform or a broad spread between sell prices can destroy profits. You should also check the tax implications for capital gains in your jurisdiction, as this will impact net profitability.

You should open a CFD trading account only after a full assessment of the broker’s offerings and market reputation. If you don’t want to be a losing trader, choosing a broker is as important as deciding on your strategy.

Top CFD Trading Strategies: What Actually Works in the Real World?

While CFD trading can bring rewards, true success is more than just spotting a chart pattern. Consistent trading results come from a clear strategy—one that you understand, trust, and can apply with discipline.

Let’s look at some of the most respected, time-tested strategies that many active traders employ.

Trend Following Strategy

At its fundamental basis, trend following assumes there is a tendency for markets to travel in consistent directions over a significant length of time. Traders employing this strategy never attempt to call market tops or bottoms.

They would rather enter in line with the momentum only after verifying the trend’s direction, whether it is an uptrend or a downtrend. Trend-followers would normally employ indicators like moving averages (50-day, 200-day, etc.) for entry points.

They would exit on trend reversal signals, for example, price crossing under a moving average or RSI divergence. The strategy’s appeal rests on its simplicity: “Buy high, sell higher” or “Sell low, buy lower”—something that is counterintuitive to the conventional approach of buying into a dip but performs extremely well in strong directional markets.

Range Trading Strategy

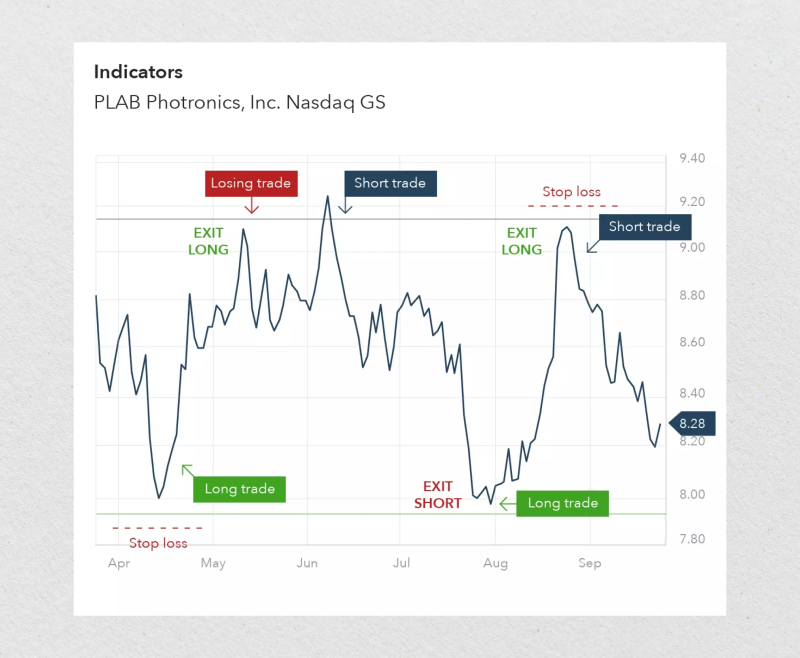

CFD markets often move sideways more than they trend. This is the environment where range trading becomes effective. Traders in this strategy focus on identifying key support and resistance zones. The price often bounces repeatedly between these two levels, which creates the appearance of a price “box.”

The trader does not chase breakouts. Instead, they wait for the price to approach one of these boundaries. They look for buy signals near a support level, and prepare to sell or short near a resistance level.

This method requires both patience and precision. Indicators like Bollinger Bands or RSI can help refine entry points. The core principle, however, is to anticipate repetitive price action. The behavior is analogous to a ball bouncing between two walls before it finally breaks through one side.

Breakout Strategy

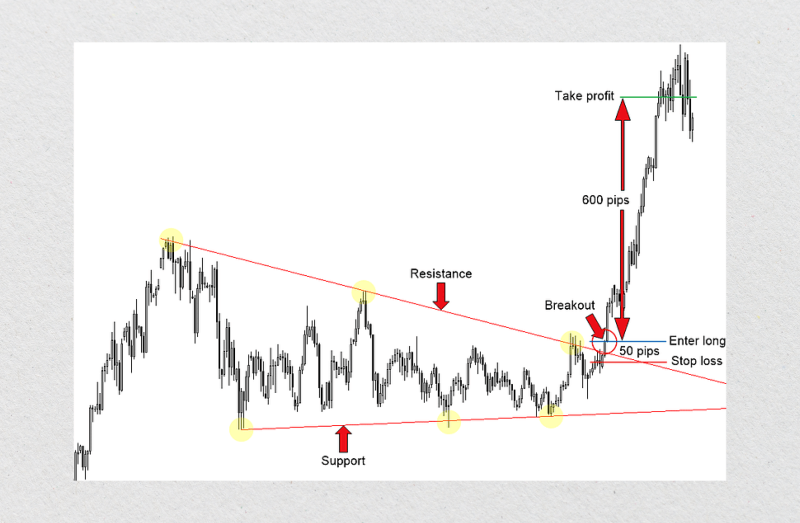

Breakout trading is a strategy of anticipation. It involves traders waiting for the price to move decisively outside of a well-defined range or chart pattern (like a triangle or flag). The goal is then to trade in the direction of the resulting surge in volatility.

The premise is straightforward: when price builds pressure within a range, the eventual breakout can be both rapid and forceful. Successful breakout traders use volume confirmation to validate moves—high volume adds credibility that the breakout isn’t a fake.

Stop-loss placement is critical here. Traders typically place their stop-loss just outside the opposite boundary of the breakout zone. This method of tight risk management is crucial because false breakouts (or “fakeouts”) are a common and costly issue.

News-Based Trading Strategy

Markets react strongly to major macroeconomic news. This includes events like interest rate changes, GDP reports, inflation data, and central bank announcements. Traders who thrive on news-driven volatility prepare meticulously for these events.

Instead of predicting the exact direction, many position themselves with pending orders before major announcements. Another approach is to wait for the initial volatility spike to fade, then enter the post-news trend.

This strategy demands a quick mind, fast execution, and tight risk controls. However, when executed correctly, a single news event can generate gains equivalent to several days of trading in quieter markets.

Scalping Strategy

Scalping is the art of precision. With this approach, traders make numerous trades, sometimes dozens or hundreds, in a single day. Their goal is to build up small profits from each separate trade.

Timeframes for this strategy are extremely short, frequently ranging from 1 to 5 minutes. To be successful with scalping, three market conditions are generally required: high liquidity, consistent volatility, and very tight spreads. This approach favors liquid CFD instruments, such as Forex majors or major stock indices, where price changes occur frequently.

While the profit per trade is small, the compounding effect across many trades can be significant. However, the method is mentally demanding. It requires low-latency execution and a disciplined exit plan for every trade.

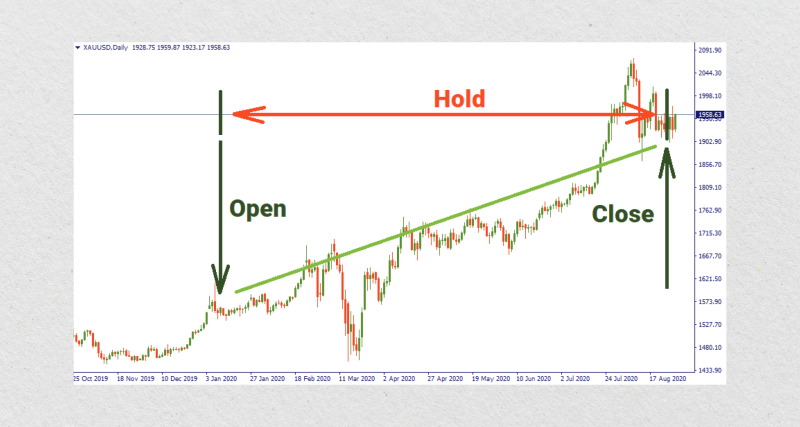

Position Trading

Although CFDs are often associated with short-term speculation, they can also be effective for position trading. The strategy uses the instrument to capitalize on long-term trends, with trades potentially held for weeks or months.

Position traders primarily focus on fundamental analysis instead of short-term charts. Their decisions are often based on factors like economic cycles, corporate earnings, and geopolitical trends. They use CFDs for leverage and shorting opportunities while avoiding the noise of intraday price action.

A position trader’s approach is like that of a marathon runner in a market full of sprinters. They place fewer trades, but each one targets a larger, more sustained market move.

Swing Trading

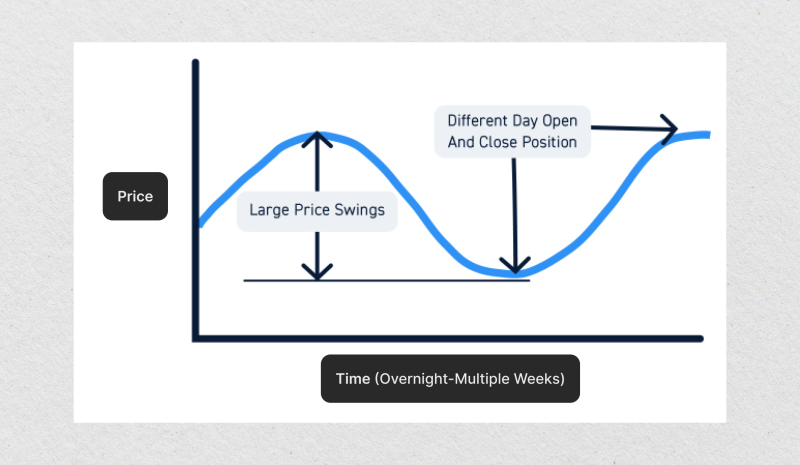

Swing trading is a strategy that fits between the timeframes of day trading and position trading. It is designed to capture price “swings”—these are periods of short-term momentum that happen within a larger, overall trend.

It uses technical analysis—patterns on a chart, moving averages, MACD, or RSI—to time entry and exit. Swing trading operates on longer timeframes than scalping. This provides more opportunity for analysis and trade confirmation. It suits traders who are not always monitoring markets all day but wish to take advantage of daily market fluctuations.

Risk Management in CFD Trading: The Real Deal Behind Smart Survival

Every CFD trader learns—sooner or later—that risk management isn’t just helpful, it’s essential. Without it, even the best strategy can fail. Think of it as your built-in defence system—keeping you afloat when markets get wild and unpredictable.

Here are the most common things to consider as risk management tactics while CFD trading:

Knowledge

A core principle in trading is managing the amount of risk taken on any single position. Most experienced traders follow the 1–2% rule. This means risking only a small, predefined fraction of their total account balance on each trade. This guideline is not arbitrary; its purpose is to ensure a series of losses does not severely deplete a trader’s capital.

On a $10,000 account, for example, a 1% risk per trade means a maximum potential loss of $100. Such a disciplined approach helps ensure that a trader’s capital remains mostly intact after several losing trades. For long-term survival in trading, capital preservation is fundamental.

Stop-Losses

A stop-loss is more than just a technical feature—it’s your safety net. It represents a preset price level. At this price, you accept that the trade’s initial premise was incorrect and exit the position to prevent further losses.

But setting a stop isn’t about placing it at random. It needs to align with your strategy. It could be just below a key support level or beyond a recent swing high or low—whatever fits your logic. The point is to set it and respect it.

Leverage

CFDs are attractive partly because of leverage, which lets you control a large position with a small deposit. And while leverage can amplify gains, it equally magnifies losses. Succumbing to the temptation to increase it, especially after a winning streak, is a common pitfall for many traders.

Prudent traders typically use leverage conservatively. Their focus is on potential downside (loss) rather than only on potential upside (profit). For them, leverage is a tool for capital efficiency, not a mechanism for pursuing outsized gains.

Emotional Control

Risk management involves more than just numbers; it also involves managing yourself. Even with a solid plan, a trader’s greatest threat is often emotional decision-making. Common pitfalls include revenge trading after a loss, overconfidence from a winning streak, or placing trades out of impatience or a fear of missing out (FOMO).

Managing risk effectively involves having the emotional discipline to adhere to your plan. That might mean walking away after hitting your daily loss limit or not forcing trades in choppy conditions. It’s about knowing when not to trade as much as it’s about knowing when to pull the trigger.

Position Sizing and Diversification

Position sizing is another crucial component. Instead of committing all available capital to one trade, disciplined traders may scale into positions or diversify across different instruments. This distributes their risk. It is the practical application of not concentrating all risk in one asset.

Managing the capital committed to each position helps maintain flexibility. It also protects your account from a single large loss. Even within CFDs, diversification can help balance your portfolio’s exposure. This could mean pairing riskier trades with more stable ones where appropriate.

Choosing the Right CFD Broker — What to Think About?

In CFD trading, your broker is a bridge between your strategy and the market. Even with a robust strategy and good execution skills, a poor choice of broker can negatively impact results.

Execution Speed

Rapid and reliable trade execution is essential. Any latency, slippage, or delay in order processing can cause trades to be filled at suboptimal prices. This is particularly damaging during news events or when using scalping strategies. A trader requires a broker that provides immediate execution at the prevailing market price.

If you notice frequent slippage or delays, even in demo mode, that’s a warning sign.

Costs

Fees matter. High spreads or hidden commissions can erode profits before your trade even moves. Some brokers offer “commission-free” trading but widen spreads or charge inactivity, swap, or withdrawal fees.

Focus on the real cost over time—not just the advertised rates. Your strategy deserves a broker with transparent, fair pricing.

Regulation

Always choose a regulated broker. Entities under the oversight of the FCA, ASIC, or CySEC must protect client funds, ensure fair execution, and comply with financial conduct rules. Unregulated offshore brokers may offer tempting leverage, but they often lack accountability—and that’s a risk no serious trader should take.

Platform Quality

You’ll rely on your trading platform every day. It must be fast, stable, and fully equipped—with indicators, alerts, one-click trading, and backtesting tools. A clunky interface or limited functionality can sabotage your decision-making.

If you’re refining CFD trading strategies, a powerful platform is non-negotiable.

Asset Range

Many new traders limit themselves by choosing brokers that offer only a limited range of instruments. But your growth depends on flexibility. The right broker offers access to a wide range of underlying assets—Forex, indices, cryptocurrencies, commodities, and more—so your strategy can evolve without requiring a switch to a new platform.

Conclusion

Success in CFD trading doesn’t come from luck—it’s built on structure, discipline, and smart decisions. Whether you’re trend-hopping, scalping the news, or holding positions for weeks, your strategy must align with your trading style, capital, and mental game.

Nevertheless, even the best tactics fail if your broker lags behind or your risk plan is flawed. So before you enter your next CFD position, ask yourself: Do I have a strategy or just a hunch? Because in this market, you trade your edge—or you trade your account away.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.

FAQ:

What’s the best CFD strategy for beginners?

Trend-following is often ideal for beginners due to its simplicity and clarity in direction.

How do I know if a broker is trustworthy?

Make sure they’re regulated (FCA, ASIC, CySEC), transparent about fees, and offer fast execution.

Are CFDs only for short-term trading?

No—CFDs can be used for both short-term trades and long-term positions, depending on your strategy.

Do I pay tax on CFD profits?

It depends on your country. Some may be subject to capital gains tax—always check local regulations.