What is Slippage in Trading? – Definition

Oct 21, 2022

Opening a deal on the financial market is accompanied by some kind of magic, don't you agree? At least, that's what many beginning traders think. Sometimes they "for some reason" start each deal with a small minus (it's a spread), then the position is not always clearly opened at the price they requested. In the first case, the reason is the discrepancy between the Bid and Ask prices, which does not always coincide with the current quote. In the second case, it is about slippage that can reach several points.

In this article, we will cover the topic of what is slippage and the factors affecting it. Additionally, we will examine how slippage impacts the trading process and what measures could be taken to avoid it.

What is Slippage In Trading?

In fact, the example of the spread situation was not given by accident. Like slippage in trading, it is a normal phenomenon, and in standard conditions (not in the period of increased volatility), it does not cause any special worries. However, if the market has too strong dynamics, or an extraordinary situation, which the broker warns about, the spread widens considerably, making short-term trading in such conditions less profitable. The same can happen in the case of slippage. Hence the obvious question is: What is slippage?

Slippage, in simple words, is the difference between the price at which you wanted to start trading and the price at which the trade was actually opened. For market execution, this situation is quite normal because when the trader sends an order to open a position, he will be offered a real counteroffer.

If the asset is liquid, active, and popular, then the slippage will either be absent or minimal. If you have chosen an extremely unpopular and illiquid asset, then you will have to settle for the price that will be offered to you at the opening of trade. It may differ from the quoted price by as much as 5-10 pips. That's why traders try to choose assets with high liquidity in order to avoid such unpleasant phenomena as Forex slippage.

There are several different types of slippage. Let's take a look at each of them in brief:

Positive slippage

Let's say you want to open a trade to buy the EUR/USD currency pair at a price of 1.254. However, no one is selling it at this price right now, and there is only an offer at 1.253. In the case of market execution, the broker will open a position at that price. Since that price is lower than the price you requested, the Buy trade will open on better terms. This is called positive slippage.

Negative slippage

In this case, suppose you are trying to open the same trade to buy the EUR/USD currency pair at 1.254, and the seller in the financial market is ready to offer a counter bid only at 1.255, then the trade will start on less favorable conditions for you —- by 0.001 points. This is called negative slippage in trading.

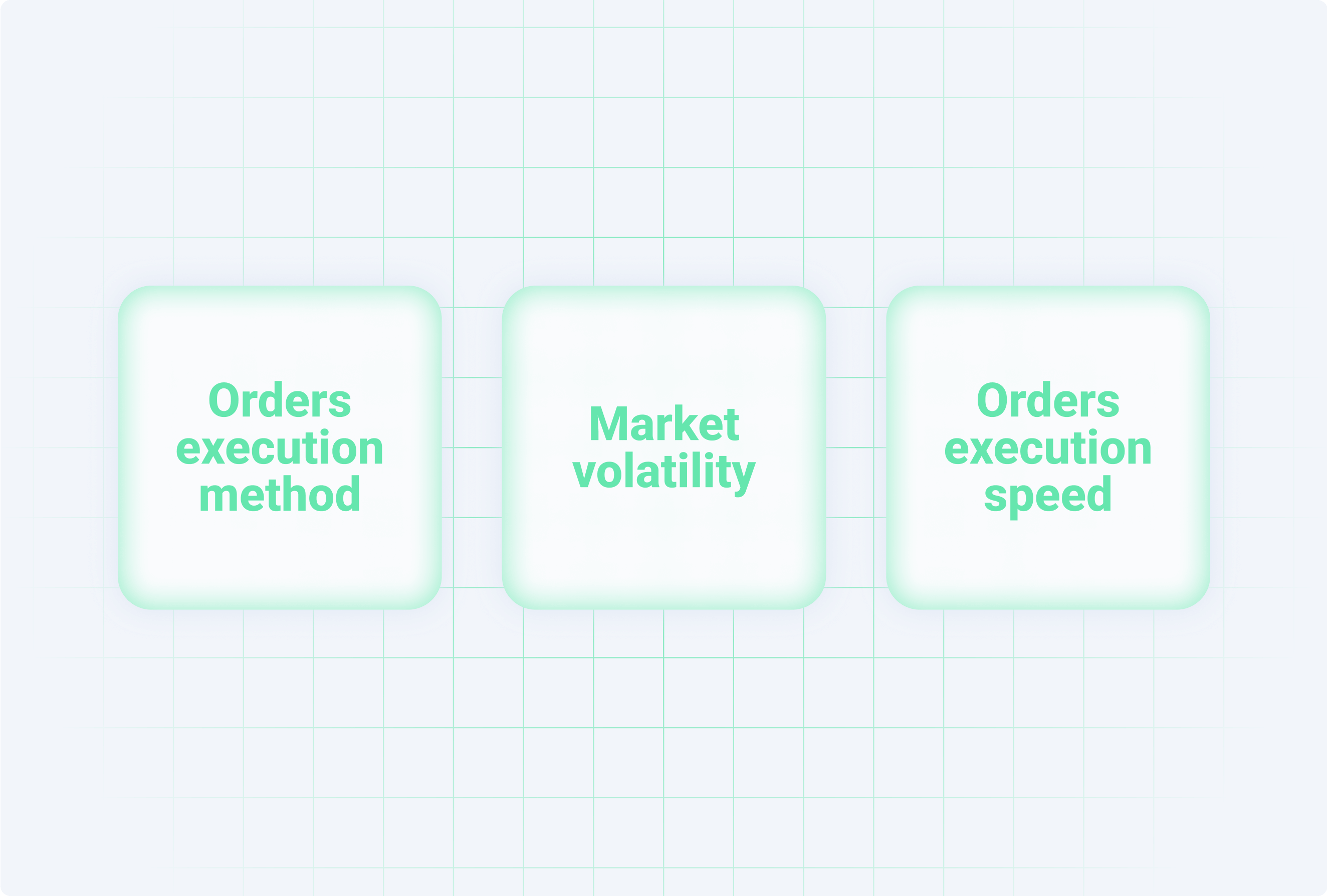

Factors Affecting Slippage

There are several common causes contributing to slippage in trading:

1) Market volatility

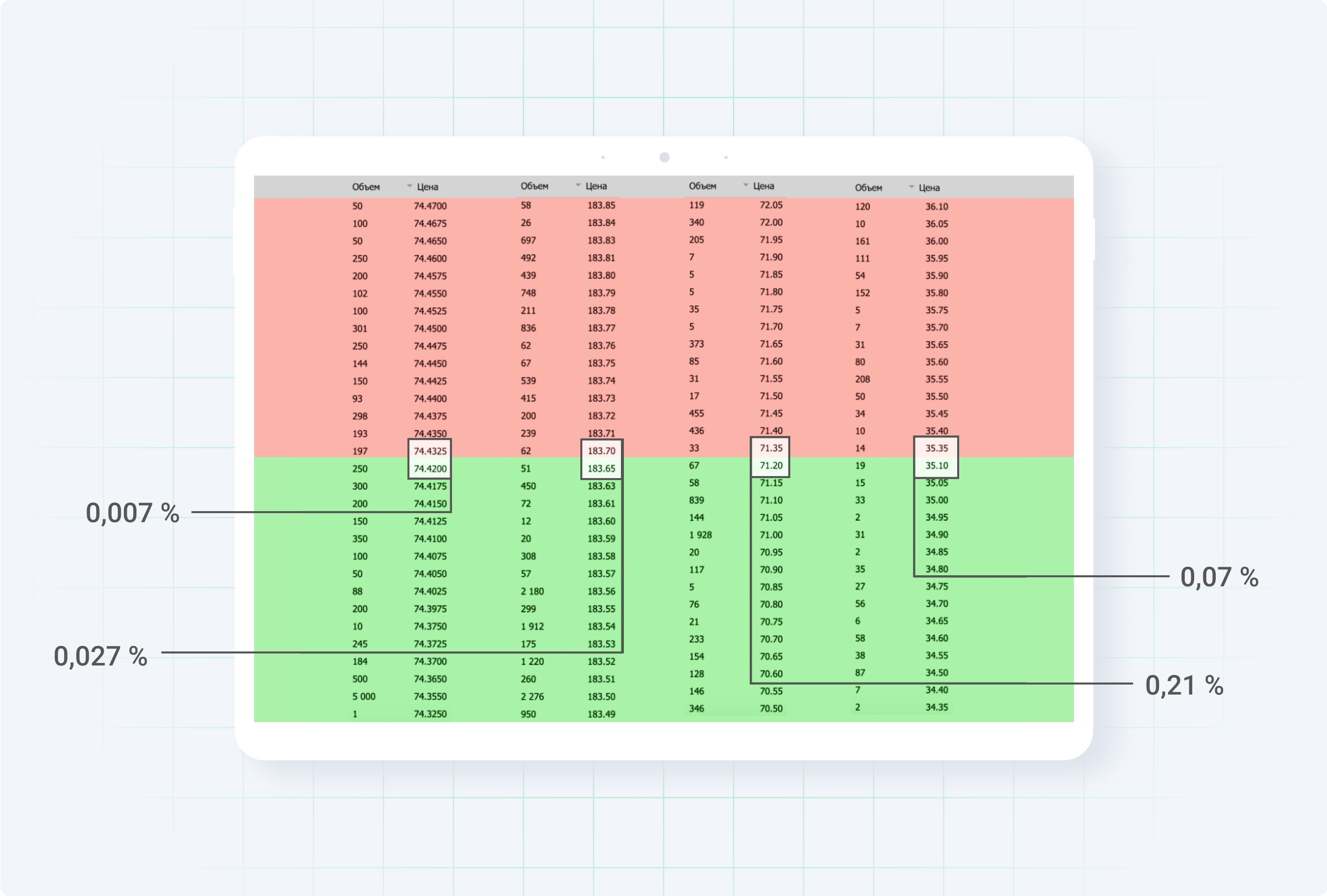

Volatility is the range between a quote's minimum and maximum values for a currency or stock asset. The greater this value, the more active the currency pair moves. And this, in turn, entails an increased probability of slippage.

During periods of important financial news, this is most evident. In times like this, the market reacts instantly. There are so many deals that quotations are literally jumping. When the trader decided to open, the prices were at one level, and when the broker was able to execute the trade, they were at another. This is the difference that will be expressed as slippage.

2) Orders execution speed

The speed at which your orders are executed reflects the interval from when the broker sends an order to buy/sell the asset until the actual buying/selling. The shorter the interval, the better because the value can change in the intervening time, and the order will close at a different price than the one you specified.

The speed of the transaction will depend not only on the quality of the connection but also on how quickly the broker realizes the transaction. This, in turn, depends on the technical capabilities of the broker and, of course, on his decency.

3) Orders execution method

There are only two types of order execution:

Instant Execution — this type of processing eliminates the possibility of slippage, and the position can be opened only at a price specified by the trader. If the current price changes by the execution time, the transaction will not be executed, and there will be a so-called requote.

Market Execution — this process involves opening a position at any price. By sending an order to open a position, the trader agrees that the deal will be done at any current price. The plus of this type is a 100% entry into the market without requote. The minus is the slippage.

Slippage Impact on Trading Process

If a trader opens a Forex deal for several days, weeks, or months, he expects to join a significant price movement. Therefore, a difference of a few pips when opening trade will pass virtually unnoticed to him and will not affect the result of the trade. However, if you trade intraday and get a negative slippage of some points on Forex that does not cancel the spread, a positive transaction result will have to wait longer.

How else can slippage affect trading? The problem of "wandering" quotes can be encountered when executing Stop Loss and Take Profit orders: in fact, they are not the closure of the transaction, but, in the case of a buy position, the sale at a declared market price. In the case of a sell position, your limit levels are a buy order. That's why they may be triggered in precisely the same way, not at the exactly stated price, but at what is currently being offered on the market. As you may have guessed, it can be better than the asking price or worse. For example, your Stop Loss can work 10 pips further than you planned in a sharp drop or rise.

How to Avoid Slippage

Any trader should consider "slippage" in building and testing trading strategies. Otherwise, the developed strategy on the real market can give unpleasant surprises and be unprofitable, even though it could show excellent results in history.

Given the factors described above, there are some simple ways to reduce the impact of slippage in trading:

1) Set in the trading terminal the maximum allowed deviation from the requested price (in points).

If the price deviation (in the moment) will be more than this parameter (critical slippage), then such a trade simply will not be executed. In this case, you will not get profit, but transactions with a high probability of loss will not open.

2) Avoid trading during periods of liquidity problems.

This is meant for non-standard situations that pose some danger: news, scheduled and force majeure events, opening/closing of trading sessions, and low-volatility markets on holidays. Those who catch active/weak volatility or try to trade exotic assets should be prepared for increased slippage and probability of requotes by several times.

3) Trade using pending orders: Buy Stop/Sell Stop and Buy Limit/Sell Limit.

Limit orders are great because they can only be executed at a price that is at least as good as the requested price. This completely eliminates negative slippage. Trading this way is not easy but quite profitable if your strategy supports pending orders.

4) Use a reliable broker.

Choosing the right provider and setting the minimum deviation level is crucial. Unscrupulous brokers often create "fake" requotes, which is an artificial delay in order execution, allowing critical slippage even with high liquidity, practice cancellation of trade results, and other problems. Such a broker "holds back" just the most profitable deals because the trader's loss is his profit. Therefore, when starting trading activities, it is necessary to choose a reliable and trustworthy broker with a great experience on the market with full responsibility.

Conclusion

Based on the above, it can be concluded that the broker cannot guarantee your orders' execution without slippage. Otherwise, that is, in case of execution of all your orders at your prices, the broker will have to take the loss equal to the difference between the price at which he will execute your order and the real price, which will be on the market at the moment of execution of this order. And that, as you have already guessed, is not at all logical from a commercial point of view. Slippage was, is, and will be normal for trading at the exchange. However, although technically, there are no tools that can completely eliminate slippage in trading, it is essential to remember that there are methods that help to avoid it and make your trading experience as good as possible.