MetaTrader vs cTrader: Which Trading Platform Shall You Choose?

Oct 1, 2025

The trading industry is highly reliant on advanced platforms, whereby brokers are able to offer seamless access to overseas markets. These are not simply intended for ease of order execution and position maintenance but are also intended to offer an improved trading experience based on speed, convenience, and ease of use.

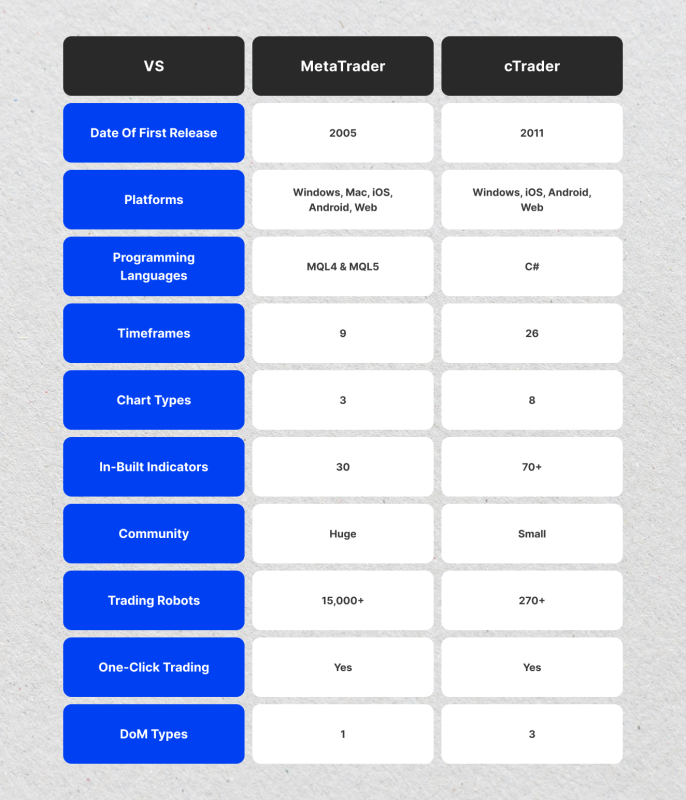

Among the wide array of options, MetaTrader vs cTrader have taken the top spots and are highly valued throughout the industry for their stability, security, and variety. Even as both have the same core purpose, usage, adoption, charting, and trading style, support differs between them.

Selecting between the two ultimately boils down to determining the platform that best supports your brokerage model, targeted clients, and long-term goals.

Key Takeaways

- MetaTrader is historically one of the most popular trading platforms for trading Forex and various and charting and drawing tools.

- cTrader is relatively recent, with an array of interactive features and advanced functionalities that have made it so successful.

- MetaTrader 4 and 5 differ slightly in operational capabilities, market coverage, and trading features.

MetaTrader vs cTrader: Overview

MetaTrader was developed by MetaQuotes and remains the world’s most recognized retail trading platform. MetaTrader 4 was launched in 2004, focusing primarily on Forex and CFD trading. Then, MetaTrader 5 was launched in 2010, expanding coverage to stocks, commodities, and futures.

MetaTrader is quite popular for its simplicity and large library of indicators, scripts, and add-on features. It is also known for offering an Expert Advisor, a custom algorithm that executes trades by monitoring the market and opening/closing positions without human intervention.

cTrader was introduced by Spotware Systems in 2011 and was built to compete with MetaTrader by addressing its limitations. It stands out with advanced charting, 50+ timeframes, interactive drawing tools, and Level 2 pricing.

cTrader is also known for its clean, modern interface, making the user experience much more intuitive and customized. The software also integrates cAlgo for automation and algorithmic trading robots.

The MetaTrader vs cTrade tradeoff often comes down to accessibility versus features. MT provides broader brokerage coverage and community resources, while cTrader offers greater transparency and superior charting that resonates with advanced trading strategies.

cTrader vs MetaTrader Comparison: Charts, Interfaces, and Technical Indicators

This cTrader vs MetaTrader breakdown focuses on the differences in usability, charting, and technical tools. The interface’s first impression and market depth directly impact the evaluation process. Here’s how they compare.

User Interface and Onboarding

MetaTrader provides a simple, straightforward design that is quick to learn but somehow feels outdated compared to modern UI standards. Beginners find onboarding relatively easy, as most brokers offer extensive tutorials and one-click setup for MT4 and MT5 platforms.

cTrader offers a more polished and modern interface, featuring customizable layouts, detachable panels, and a dark mode toggle. It delivers a smoother user experience, with easy access to charts, order types, and account data. However, onboarding for a new trading account may take slightly longer due to the broader toolsets and settings, which require users some time to adjust.

Timeframes, Charting and Technical Analysis

MetaTrader offers nine timeframes on MT4 and 21 on MT5, with charting tools that cover basic needs, including multiple chart types and various drawing tools. This layout is sufficient for more retail Forex strategies, while advanced traders may find this restrictive.

On the other hand, cTrader offers 26 timeframes, accurate by-the-tick charts, and detachable charting windows, ideal for multi-market tracking. The charting interface in cTrader is more fluid, with smooth zooming and scrolling, making technical analysis more seamless and efficient.

In short, traders who rely on chart precision find cTrader’s package significantly richer than MetaTrader, especially when applied to complex trading strategies and coupled with advanced technical indicators.

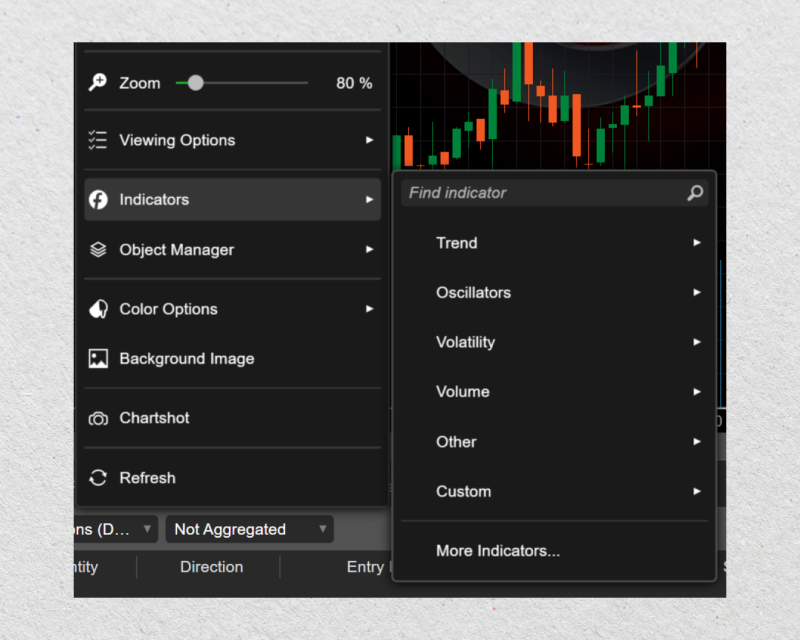

Built-in and Custom Indicators

MetaTrader provides 30 built-in indicators in MT4 and 38 in MT5. However, it extends them with a massive community library of thousands of free and paid add-ons. Traders can also use custom scripts and Expert Advisors for technical analysis and automated trading systems.

cTrader, on the other hand, has more than 70 built-in technical indicators and integrates seamlessly with custom cAlgo indicators. Its native technical suite is more comprehensive than MetaTrader, reducing reliance on third-party tools and extensions.

In conclusion, MetaTrader excels in community support and extensive plugin availability, while cTrader delivers stronger built-in technical resources for charting and analysis, offering better depth and flexibility.

Markets: Supported Assets and Advanced Features

When evaluating cTrader vs MetaTrader, supported markets and advanced capabilities are critical. MT4, MT5, and cTrader vary in coverage of asset classes, hedging features, and trade automation. Here’s how they compare in terms of asset availability and trading tools.

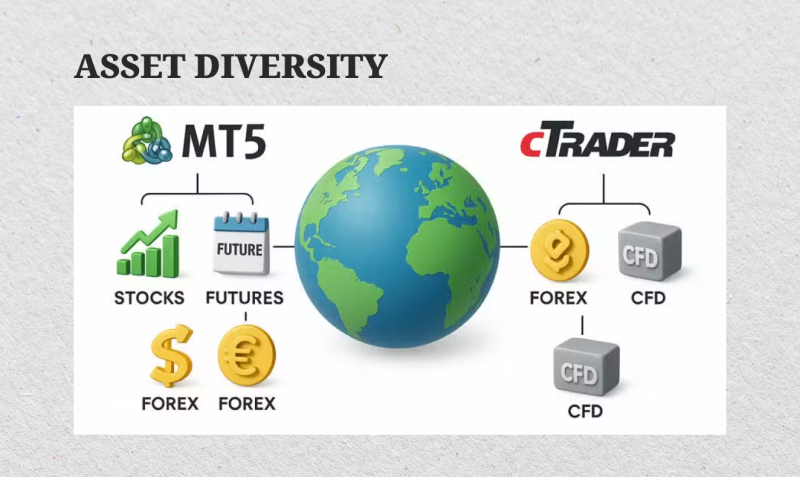

Available Markets, Asset Classes, and CFDs

MetaTrader 4 provides strong Forex and CFD coverage, with MT5 expanding into future, commodity, and stock trading, making it more versatile for traders interested in asset diversification. This coverage makes MetaTrader widely supported by most brokers and trading platforms.

cTrader offers equally robust CFD and Forex trading support, with some brokers extending access to equities and cryptocurrencies. Moreover, it is particularly valued for Electronic Communication Network (ECN) execution and Level 2 pricing, giving traders and institutional investors deeper insight into liquidity.

Hedging and Advanced Trading Features

MetaTrader provides hedging strategies in MT4 with full support for hedging and netting in MT5. Clients are also offered various order types, including live, limit, stop, and trailing stop orders, and advanced ones, including one-click trading and Expert Advisors, one step ahead in the trading experience.

cTrader, on the other hand, supports complete hedging and sophisticated order types, including market depth analysis, stop-limit, and take-profit. Serious traders are drawn to the platform because it supports transparent execution models with a focus on speed and accuracy.

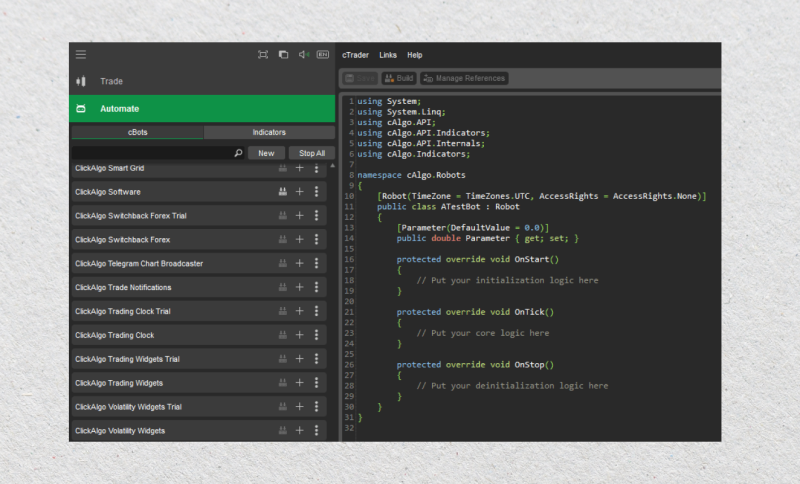

Algorithmic Trading and Automation Features

MetaTrader provides powerful algorithmic trading through Expert Advisors (EAs). Its MQL4 and MQL5 coding languages allow traders to build, backtest, and implement bespoke strategies. The MQL community offers thousands of ready-made scripts, making automation highly accessible to traders on all levels.

The cTrader trading platform integrates cAlgo, a C#-based programming language environment for developing automated strategies. It offers powerful backtesting, optimization, and API access. This personalization makes the platform highly favorable for tech-savvy traders and brokerages.

In a nutshell, cTrader’s coding environment is more robust and flexible, while MetaTrader’s larger community and plugin library make automation more accessible to users.

Integration and Customization Options

MetaTrader is highly compatible with third-party software tools, trading signals, and sophisticated brokerage firm additions. Both MT4 and MT5 are able to share thousands of plugins, indicators, and Expert Advisors that enable Forex brokers to tailor trading configurations.

This adaptability enables MetaTrader as the go-to option for broker adoption, with brokers being able to customize offerings based on customer requirements while keeping infrastructure expenditure minimal.

cTrader, however, is based on a newer integration methodology with an API-oriented focus. Increased transparency enables brokers to integrate the platform with risk management tools, liquidity providers, and CRM programs. The platform also supports advanced white-label solutions, so brokers are able to deliver a rich-feature and branded offering with ease.

While MetaTrader achieves leadership through scale, the cTrader platform earns loyalty through innovation and high-quality execution. Platforms will, in the long run, even out such imbalances while determining which platform to provide.

MetaTrader is still the preferred choice from the broker’s point of view, as the majority of traders and institutional clients are familiar with the interface and operations. cTrader is a fresher and clearer infrastructure preferred by sophisticated traders.

Which Trading Platform is Better?

MetaTrader 4 is fast, lightweight, and widely supported among brokers. It is most suited to Forex traders who are after an Expert Advisor-rich system with a large selection of community-developed tools. MT4 is lacking in advanced charting and a less diversified asset list relative to newer platforms.

As a result, cTrader offers an enhanced interface and greater charting flexibility with multiple order type support, depth-of-market pricing, and superior analysis tools. While cTrader is not yet on par with MT4 in terms of broker availability, it offers a richer trading experience.

cTrader vs MetaTrader 4

MetaTrader 4 provides simplicity, speed, and widespread broker support. It is ideal for Forex traders who want a lightweight platform with access to countless Expert Advisors and community-built tools. However, MT4 lacks advanced charting capabilities and a diverse range of trading instruments that modern platforms provide.

As such, cTrader offers a more sophisticated interface and greater charting flexibility that supports various order types, depth-of-market pricing, and stronger technical analysis tools. While cTrader may not match MT4’s broker availability, it delivers a stable trading performance.

cTrader vs Metatrader 5

MetaTrader 5 goes one step beyond Forex, with support for stocks, commodities, and futures. It includes extra timeframes and integrated indicators compared with MT4, as well as hedging and netting modes better suited for experienced traders. MT5 is a better fit for traders who need multi-asset coverage on one platform.

cTrader, however, still bests MT5 in charting capacity, interface, and automated functions based on cAlgo. It still offers execution transparency and Level 2 data as distinguishing features. cTrader is thus ideal for clients seeking technical depth and execution perfection.

Conclusion

MetaTrader and cTrader are two of the most recognized trading platforms, each excelling in different areas. MetaTrader, with its vast broker support, extensive community, and rich ecosystem of indicators and Expert Advisors, remains the go-to choice for accessibility and reliability. cTrader, meanwhile, attracts traders who value modern design, advanced execution transparency, and flexible timeframe options.

Ultimately, the decision comes down to priorities: if you seek familiarity and widespread integration, MetaTrader is ideal, while cTrader offers a forward-looking alternative for those wanting cutting-edge tools and precision.