Is Infinite Banking a Scam? Unveiling the Truth Behind the Concept

Oct 17, 2023

In the world of personal finance, there is a concept that has gained attention and sparked controversy: infinite banking. Some claim it to be a revolutionary way to take control of your finances, while others dismiss it as a scam designed to benefit insurance salespeople.

In this guide, we will delve into the depths of infinite banking policy, exploring what it is, how it works, its pros and cons, and why some people believe it’s a scam.

Key Takeaways:

- Infinite banking policy accumulates a cash value over time as the premiums are invested in the insurance company’s investment portfolio.

- The strategy has its own benefits, but it also has issues with high fees, complexity, and more, resulting in it being regarded as a scam by some.

- Infinite banking is not the best policy if you need only the investment component.

What is Infinite Banking?

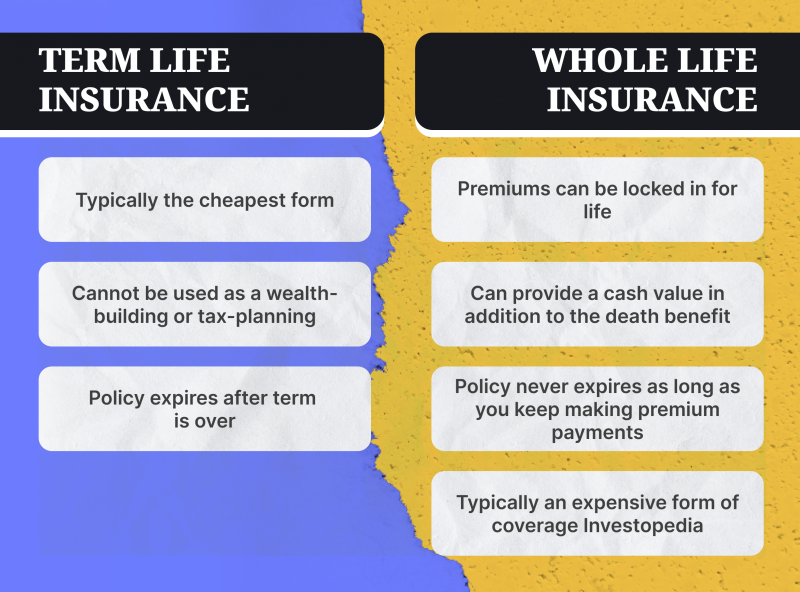

The infinite banking concept revolves around the use of whole life insurance policies as a financial tool. Unlike “term life” insurance, which solely provides a death benefit, “whole life” insurance combines insurance coverage with an investment component. The policyholder pays premiums, which are divided into two parts: the cost of insurance and the cash value.

Fast Fact

The average annual rate of return on whole life insurance cash values ranges from 1% to 3.5%. However, some of these profits will be eroded by inflation.

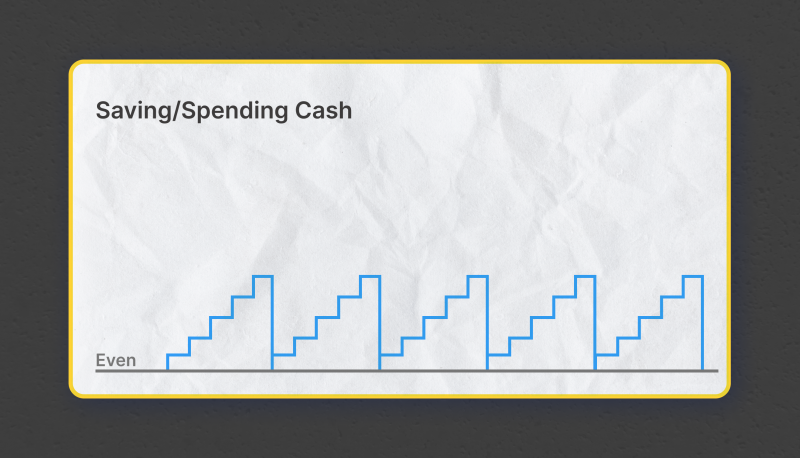

The cash value is the portion of the premium that accumulates over time. It grows at a guaranteed rate, similar to the rates paid in the corporate bond market. The idea behind infinite banking is to use this cash value as a source of financing for various purposes, such as investments or personal expenses, while still earning compound interest on the cash value.

The concept of infinite banking was first proposed and popularised by Nelson Nash, a financial advisor and author of the book “Becoming Your Own Banker”. Nash’s book outlined his vision of how individuals could use whole life insurance policies as a financial tool to become their own “banker” and take control of their finances.

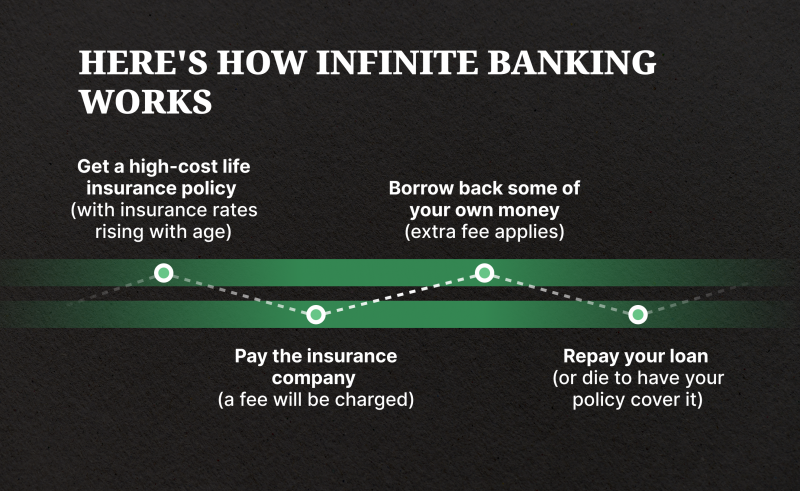

How Does Infinite Banking Work?

To understand how infinite banking works, let’s take a closer look at the process. It starts with purchasing a whole life insurance policy from an insurance company. The policyholder pays regular premiums, which are invested by the insurance company. Over time, the cash value of the policy grows, and the policyholder can access this cash value through policy loans.

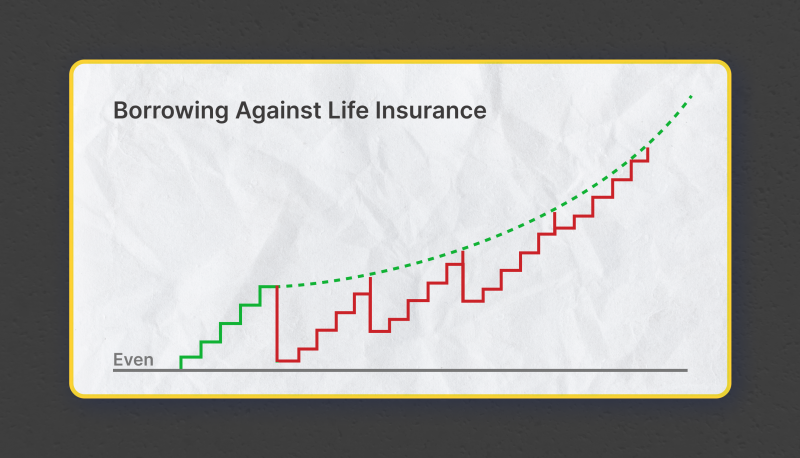

Life insurance loans work differently from traditional bank loans. The policyholder borrows against the cash value of the policy, and the insurance company charges interest on the loan. The interest rate is typically lower than what a bank would charge. The policyholder can use the loaned funds for various purposes, such as investing in real estate or starting a business. As the policyholder repays the loan, the cash value of the policy continues to grow, allowing for future borrowing opportunities.

Imagine an individual who purchases a $1,000,000 whole life insurance policy and pays annual premiums of $15,000. After five years, the policy’s cash value may reach approximately $150,000. At this point, the policyholder can take out a loan against the full cash value and use the $150,000 to invest in a cash-flowing asset, such as real estate.

While the cash is utilised for other investments, the policy’s cash value continues to grow, unaffected by the loan. However, it is crucial to note that the policyholder must not only pay the mortgage on the investment property but also the interest on the policy loan. The interest payments are made to the insurance agent, not to oneself, although the policyholder may receive dividends as a mutual insurance company’s shareholder.

The Pros of Infinite Banking

Infinite banking has its proponents who highlight several advantages of this financial strategy:

Guaranteed Growth

Unlike other investment vehicles that are subject to market fluctuations, the cash value of a whole life insurance policy grows at a guaranteed rate. This stability can be appealing to those who prefer a conservative approach to their investments.

Access to Liquidity

Infinite banking provides policyholders with a source of liquidity through policy loans. This means that even if you have borrowed against the cash value of your policy, the cash value continues to grow, offering flexibility and access to funds when needed.

Asset Protection

In some jurisdictions, whole life insurance policies offer protection against creditors. This means that the cash value within the policy may be shielded from potential legal claims or bankruptcy proceedings, providing an additional layer of security.

Death Benefit Utility

Unlike term life insurance, whole life insurance policies cover an individual’s entire life and provide a death benefit to the policyholder’s beneficiaries in the event of the policyholder’s death. This death benefit is usually a lump-sum payment that is equal to the face value amount of the policy. The death benefit can be used to cover funeral costs, outstanding debts, and other expenses that the family may incur. In addition, the death benefit can be invested to provide long-term financial security for the policyholder’s family.

The Cons of Infinite Banking

While there are potential benefits to infinite banking, it’s essential to consider the drawbacks as well:

High Costs

One of the primary criticisms of infinite banking is the high costs associated with whole-life insurance policies. The premiums for these policies are generally much higher than those for term life insurance. Additionally, the fees and commissions can eat into the cash value, reducing the overall returns.

Limited Investment Options

When using infinite banking, the policyholder’s investment options are limited to the funds available within the policy. While this can provide stability, it may also restrict the potential for higher returns that could be achieved through other investment vehicles.

Opportunity Cost

By allocating a significant portion of your income towards a whole life insurance policy, you may miss out on other investment opportunities. It’s crucial to consider the opportunity cost of tying up your funds in a policy that may not provide the same level of returns as alternative investments.

Complexity

Infinite banking can be a complex financial strategy that requires careful planning and understanding of the policy terms. It may not be suitable for individuals who prefer a more straightforward approach to managing their finances.

The Debate: Is Infinite Banking a Scam?

The question of whether infinite banking is a scam has been a topic of much debate. Some argue that it is a legitimate strategy that can provide financial benefits, while others claim it’s a scam designed to benefit insurance salespeople.

Let’s look at the reasons why infinite banking may be a scam.

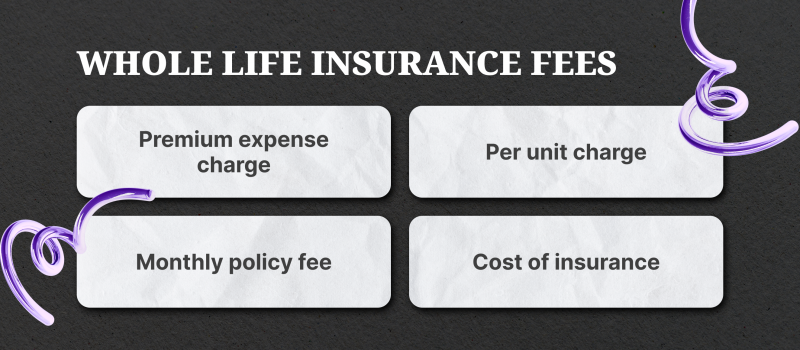

One of the key drawbacks of infinite banking is the presence of a range of fees that can significantly eat into the overall returns. These fees can include premium expense charges, monthly policy fees, per-unit charges, and the cost of insurance itself.

When you add up all these fees, the amount of money in your cash value is substantially less than what you initially put in. This means that even if you can borrow against the cash value, you are essentially burning money on fees just to access your own funds.

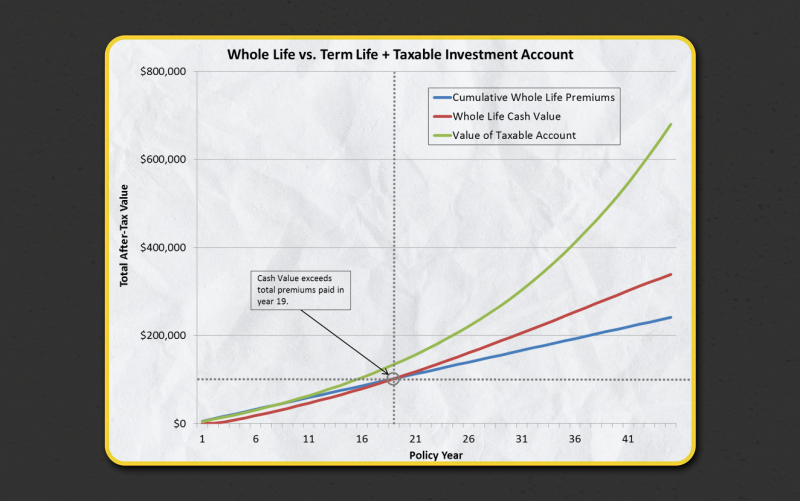

Basically, your cash value has been wiped out by fees, so borrowing money against what you have left is way worse than simply investing this money in the traditional way.

Let’s look at a real-life example. Consider the case where you purchased one such policy and conducted a detailed analysis of its performance. Then, after 15 years into the policy, you would have discovered that your policy would have been worth $42,000. However, if you had simply saved and invested that money instead, you could have had more than $200,000. In other words, you would have been $160,000 ahead without the burden of excessive fees.

Understanding the Fees and Charges of Whole Life Insurance

To fully evaluate the viability of infinite banking, it’s essential to understand the fees and charges associated with whole life insurance policies. These fees can vary depending on the insurance company and the specific policy.

- Premium expense charge: This is a percentage of the premium amount that is deducted as a fee.

- Monthly policy fee: Some policies have a flat monthly fee that is charged in addition to the premiums.

- Per unit charge: This fee is based on the death benefit amount and can vary depending on the policy.

- Cost of insurance: This is the cost of the required life insurance coverage associated with the policy.

When calculating the potential returns of an infinite banking strategy, it’s crucial to factor in these fees and charges to determine the true value of the cash value growth.

The Reality of the Infinite Banking Concept

If you have come across the concept of infinite banking, it is highly likely that it was introduced to you by an insurance salesperson. These individuals often intend to sell the idea and downplay fee implications.

To avoid making mistakes and losing money, it is advisable to keep your financial strategy simple. If you require life insurance, opt for term insurance, which provides coverage for a specific period at a lower cost. By doing so, you can allocate the saved premiums towards investments that offer higher returns and greater flexibility.

Fast Fact

A healthy 30-year-old would pay $26 per month for a 20-year term life policy with a $500,000 payout, while a whole life policy with the same payout would cost the person $451 per month.

Alternatives to Infinite Banking

Infinite banking is not the only financial strategy available. There are alternative approaches that may better suit your financial goals and preferences. Here are a few alternatives to consider:

- Traditional banking: Making a bank account and utilising traditional banking products and services can provide access to liquidity without the complexities associated with whole life insurance policies.

- Investment accounts: Investing in low-cost index funds or other investment vehicles can offer higher potential returns compared to the guaranteed growth of a whole life insurance policy.

- Retirement accounts: Contributing to retirement accounts such as IRAs or 401(k)s can provide tax advantages and long-term growth opportunities.

It’s important to explore different options and consult with a financial advisor to determine which strategy aligns best with your financial goals and risk tolerance.

How to Evaluate Infinite Banking for Yourself

Now that you have a comprehensive understanding of infinite banking, it’s time to evaluate whether it’s the right strategy for you. Here are some steps to consider:

- Educate yourself: Continue your research and gain a deeper understanding of the intricacies of infinite banking.

- Assess your financial goals: Determine your short-term and long-term financial objectives and whether infinite banking aligns with them.

- Consider your risk tolerance: Evaluate your comfort level with risk and whether the conservative nature of infinite banking suits your preferences.

- Consult with a financial advisor: Seek the guidance of a qualified financial advisor who can provide personalised advice based on your unique circumstances.

- Compare alternatives: Compare the potential benefits and drawbacks of infinite banking with alternative strategies to make an informed decision.

Conclusion

Infinite banking is a complex financial strategy that combines whole life insurance policies with a source of financing through policy loans. While it offers potential benefits such as guaranteed growth and access to liquidity, it’s important to consider the high costs, limited investment options, and opportunity costs associated with this strategy.

The debate surrounding infinite banking as a scam highlights the need for careful evaluation and understanding of the fees and charges. One thing is certain: the infinite banking concept does not promise quick riches. It typically requires large capital investments, and it takes ten years or longer for the cash value component to grow and be collateralised.

Remember, personal finance is a journey, and it’s essential to continually educate yourself and adapt your strategies to align with your evolving financial goals and circumstances.

FAQs

Which is better for insurance purposes only: term life or whole life?

Term life insurance offers more flexible coverage at a more affordable cost than whole life insurance. Term life insurance policies provide coverage for a specified period of time, such as 10, 20, or 30 years. This means that you can tailor your policy to meet your specific needs. Additionally, the premiums for term life insurance are generally lower than those for whole life insurance, allowing you to save money in the long run. Furthermore, term life insurance does not come with the additional fees and charges associated with whole life insurance, making it a more cost-effective option.

At the same time, term life insurance does not provide any cash value, meaning that you will not receive anything if you outlive the policy. Additionally, term life insurance is not permanent, meaning that it will expire after a certain period of time.

Can infinite banking insurance be considered a good idea?

Infinite banking can be a good idea for individuals who are looking for a long-term investment strategy and who are willing to make substantial capital investments. Also, an infinite banking life insurance must provide the right types of riders and be funded appropriately, as this is often overlooked in the process.

It is important to keep in mind, however, that infinite banking does not promise quick riches and that it typically takes ten years or longer for the cash value component to grow and be collateralised.

How do you buy an infinite banking insurance policy?

To buy an infinite banking insurance policy, you need to do research and compare different policies from different insurance companies. Make sure to understand the terms and conditions of each policy and to ask any questions you may have. It’s also important to understand the fees and charges associated with each policy and to read the reviews from other customers to make sure you are getting the best deal. Once you have made your decision, you can purchase the policy and begin making regular premium payments.