Credit Suisse’s Risk Gauge Hits All-time High

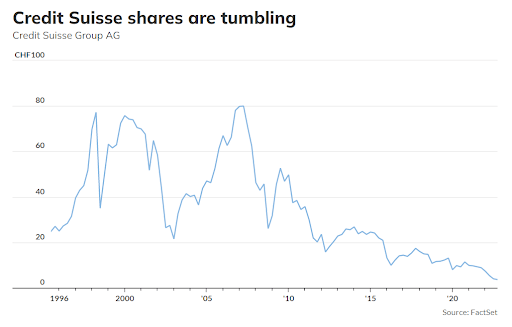

On Monday, the bank indeed opened its doors to the public. However, shares for CS fell 11% at the open, setting a new record low. For the year, the bank's shares have dropped 59%.

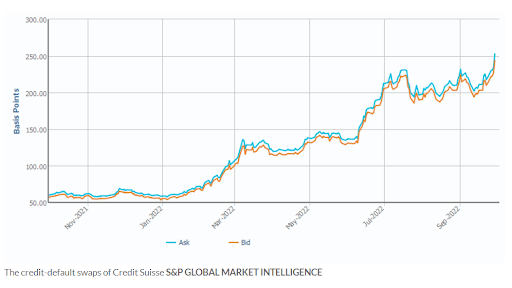

Credit-default swaps are the market that has caught traders' attention. In essence, they are bets on whether the debt issuer will survive. It is not uncommon for companies to have 5-year credit default swaps, but it is extremely high for a major bank, and Credit Suisse hasn't seen one this high since 2009. (UBS had 126 five-year credit-default swaps, Goldman Sachs had 143, and the government of Switzerland had 7, according to IHS Markit.)

The bank has been losing money for three consecutive quarters at a time when Wall Street was posting profits. The Swiss bank was not the only one to lend to Bill Hwang's Archegos Capital Management, but it lost $5.5 billion during the collapse of the family office due to its inability to exit positions as quickly as rivals Goldman Sachs and Morgan Stanley. It was one of the first to deal with financier Lex Greensill's bankrupt Greensill Capital supply chain fund, which Credit Suisse claims would take five years of lawsuits to unravel.

This is only the tip of the iceberg when it comes to the headaches Credit Suisse faces. Against the backdrop of volatility in Swiss real estate fund markets, the bank postponed a planned capital raise for a real estate fund on Monday.

As Credit Suisse prepares to release its quarterly report at the end of October, speculations are swirling about the results of a strategy review. As CS claims, the bank intends to take "steps to reinforce the wealth management franchise, reshape the investment bank into a capital-light, advisory-led banking business, and more focused markets business, assess available options for the securitized products business, including attracting third-party capital, and decrease the group's absolute cost base to below 15.5 billion francs ($15.7 billion) in the mid-term."

On Friday, Ulrich Koerner, the newly appointed CEO of Credit Suisse, sent a memo to the entire bank, saying the bank had an adequate capital portfolio and liquidity position despite its slumping stock price. As The Wall Street Journal reported, a second memo by the CEO mentioned that Credit Suisse had approximately $100 billion in capital reserves, with high-quality liquid assets close to the $238 billion disclosed in June.

Some strategists doubt the bank has enough capital. As an example, experts at RBC Capital Market speculate the bank may need an additional 4 to 6 billion francs to cover whatever restructuring is taking place in addition to buffering against capital headwinds.

A bank in need of capital is not the same as one struggling to survive. According to FactSet, senior dollar-denominated debt maturing in 2025 traded at 94 cents on the dollar.

According to Saba Capital Management's founder Boaz Weinstein, the bankruptcy risks of CS are overstated.

As reported by the Daily Telegraph, the Bank of England is satisfied that no major developments have taken place at the bank, but it works closely with Swiss regulator Finma to keep track of the bank's operations.

When questioned if the situation may damage the markets as a whole and how severe it was, Citi strategists said that they understood the nature of the concern. However, analysts believe the current scenario is totally different from 2007 because the balance sheets have fundamentally changed in terms of capital and liquidity. "We struggle to see something systemic."