How Renewable Energy Stocks Can Supercharge Your Portfolio

Feb 18, 2025

In 2024, the European Union reached a major milestone: nearly half (47%) of its electricity came from renewable sources, officially surpassing fossil fuels.

Renewable energy isn’t just good for the planet; it’s also creating big investment opportunities. Governments are pushing for greener policies, technology is making renewables cheaper and more efficient, and investors are paying attention.

In this article, we’ll dive into the top renewable energy stocks, the benefits of investing, and the challenges to watch out for.

Key Takeaways

- Renewable energy is growing rapidly, with government policies, technological advancements, and increasing demand driving its expansion.

- Top renewable energy companies, like NextEra Energy and First Solar, are leading the transition toward cleaner energy solutions.

- Market volatility, policy changes, and competition with fossil fuels pose risks, but strategic investments can mitigate these challenges.

Why Invest in Renewable Energy?

Renewable energy is rapidly transforming the global energy landscape, offering cleaner and more sustainable alternatives to traditional fossil fuels.

In recent years, the adoption of renewable energy sources like solar, wind, and hydropower has grown significantly. As of 2022, approximately 28% of the world’s electricity was generated from renewable sources, up from 19% in 1990.

In 2023, the world added a record 473 gigawatts (GW) of renewable energy capacity, marking a 13.9% increase from the previous year. Notably, 86% of all new power capacity additions in 2023 were from renewable sources, with significant contributions from solar and wind power.

Government Initiatives and Policies

Governments play a big role in accelerating the adoption of renewable energy. Many have introduced green policies and subsidies and set ambitious carbon neutrality goals.

For instance, the European Union’s Green Deal aims to make Europe the first climate-neutral continent by 2050, focusing on reducing net greenhouse gas emissions by at least 55% by 2030.

Similarly, countries are implementing subsidies and tax incentives to encourage the adoption of green technologies. These measures aim to reduce greenhouse gas emissions and stimulate economic growth by creating jobs in the renewable energy sector.

Fast Fact

The UN’s global roadmap calls for a 100% increase in modern renewable capacity and the creation of 30 million jobs in renewable energy by 2025.

Technological Advancements Making Renewables Competitive

Technological innovations have significantly reduced the costs of renewable energy, making it more competitive with traditional fossil fuels. Advances in solar panel efficiency, wind turbine design, and energy storage solutions have improved performance and lowered prices.

For example, the development of perovskite solar cells and offshore wind energy projects are paving the way for more efficient energy production.

Impact on Stock Market Trends

The surge in renewable energy adoption has also influenced stock markets. Companies specializing in renewable technologies have grown substantially, attracting investors eager to support sustainable initiatives. Investing in renewable energy stocks is becoming increasingly popular as the world shifts towards cleaner energy sources.

Renewable energy investments benefit the environment and present lucrative opportunities for investors. Many renewable energy stocks are poised for significant growth in the coming years.

Best Renewable Energy Stocks to Consider

Investing in renewable energy stocks is an excellent way to support sustainable initiatives while potentially benefiting from the sector’s growth. Let’s explore some leading companies in this field.

NextEra Energy (NEE): A Leader in Renewable Energy

NextEra Energy is recognized as one of the largest global producers of wind and solar energy. The company operates through its subsidiary, NextEra Energy Resources, which focuses on renewable power generation.

Despite a recent decline in fourth-quarter profits due to higher costs in its renewables segment, NextEra remains committed to expanding its clean energy portfolio. The company has reaffirmed its 2025 profit forecast, indicating confidence in its long-term growth strategy.

Interestingly, between 2026 and 2029, NextEra Energy plans to add nearly 5.4 gigawatts (GW) of new solar facilities and about 3.4 GW of new battery storage.

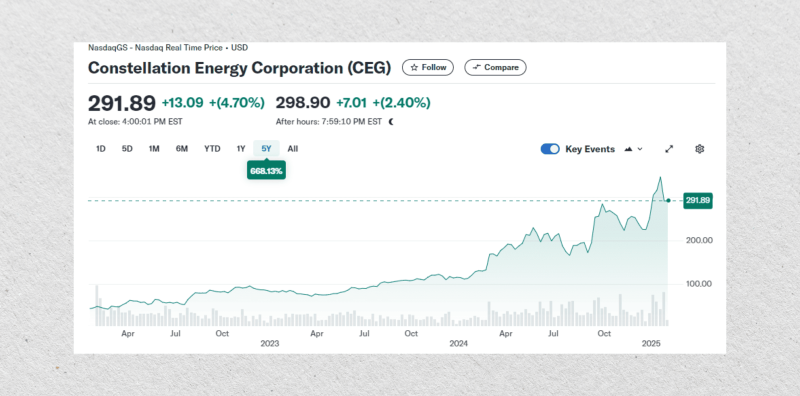

Constellation Energy (CEG): A Leading Carbon-Free Energy Producer

Constellation Energy is a prominent producer of carbon-free energy in the United States, operating a diverse fleet that includes nuclear, solar, wind, and hydroelectric power plants. The company is committed to providing sustainable energy solutions and has been involved in significant industry developments.

In January 2025, Constellation Energy announced plans to acquire Calpine, a natural gas and geothermal power provider, for $26.6 billion. This acquisition is expected to enhance Constellation’s capacity to meet rising energy demands and strengthen its position in the U.S. power market.

Brookfield Renewable Partners (BEP): A Global Renewable Powerhouse

Brookfield Renewable Partners boasts a strong global presence with a diversified portfolio of renewable energy assets, including hydroelectric, wind, and solar facilities.

The company has been actively expanding its footprint through strategic acquisitions and partnerships. For instance, in April 2021, Brookfield entered into a definitive agreement with NextEra Energy Partners to sell a 391-megawatt (MW) portfolio of operating wind assets, showcasing its dynamic approach to capital recycling and investment in higher-return opportunities.

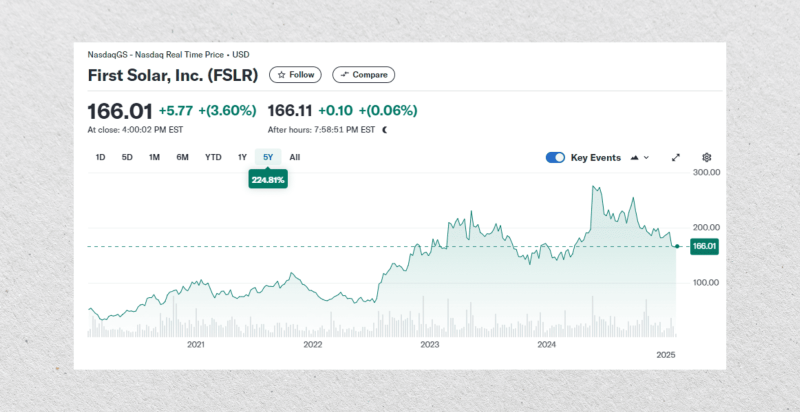

First Solar (FSLR): Leading the Solar Energy Market

First Solar specializes in manufacturing solar panels and developing utility-scale photovoltaic power plants. The company has developed, financed, engineered, and constructed many of the world’s largest grid-connected PV power plants.

In May 2023, First Solar acquired Evolar AB, a Swedish company specializing in perovskite technology, for $38 million. In September 2023, the company broke ground on a new $1.1 billion manufacturing facility in Iberia Parish, Louisiana.

Clearway Energy (CWEN): A Major U.S. Renewable Energy Owner

Clearway Energy is one of the largest owners of renewable energy-generating facilities in the United States. It boasts a diversified portfolio that includes wind, solar, and natural gas-fired power generation facilities. The company focuses on long-term contracts, providing stable cash flows and making it an attractive option for investors seeking exposure to the renewable energy sector.

The company has a growth-oriented strategy, aiming to expand its renewable energy portfolio through acquisitions and development projects.

Benefits of Investing in Renewable Energy

Investing in renewable energy offers numerous advantages, especially for those new to the investment world. Let’s explore these benefits in a friendly and accessible way.

1. Sustainability & Ethical Investing: The ESG Trend

If you want your money to make a positive impact, renewable energy aligns perfectly with Environmental, Social, and Governance (ESG) investing. ESG investing focuses on companies that are responsible, sustainable, and well-governed.

Many investors are now prioritizing companies that reduce carbon footprints, promote clean energy, and operate ethically. Companies with strong ESG ratings often perform better in the long run as they manage risks more effectively.

Fast Fact

Global ESG assets can hit $40 trillion by 2030, according to Bloomberg analysts.

2. Long-Term Growth Potential

The energy demand is constantly increasing, and the world is transitioning toward cleaner sources. Governments, businesses, and consumers are all looking for ways to cut emissions and move toward renewable energy. That shift creates a huge opportunity for investors.

Why renewables are growing:

- Fossil fuels are becoming more expensive and less viable in the long term.

- Many utility companies are replacing coal and gas with wind and solar power.

3. Government Policies & Incentives

Governments worldwide are pushing for clean energy and offering incentives to make it more attractive. That’s great news for investors, as these policies can boost the value of renewable energy companies.

Common incentives include:

- Tax credits for businesses and homeowners that adopt solar and wind power.

- Subsidies to make renewable energy more competitive.

- Green energy mandates that require utilities to generate a certain percentage of power from renewables.

Fast Fact

Over 70 countries have set net-zero carbon emission targets, meaning more investment in renewables.

4. Diversification Benefits for Your Portfolio

Investing in renewable energy can help balance your portfolio. Renewable stocks don’t always move in the same direction as traditional markets, which means they can provide stability during economic downturns.

Here’s how renewables fit into a smart investment strategy:

- Less reliance on oil and gas stocks – If fossil fuel prices drop, renewables can still perform well.

- Growth potential – The sector is still expanding, offering opportunities for high returns.

- Passive income opportunities – Some renewable energy companies offer dividends.

Risks & Challenges of Investing in Renewable Energy Stocks

Investing in renewable energy stocks offers promising opportunities, but it’s essential to be aware of the associated risks and challenges.

Market Volatility and Changing Government Policies

The stock market can fluctuate, and renewable energy companies are no exception. Government policies play a big role in this sector. If a country supports green energy, companies can grow quickly. But if policies change—like cutting subsidies or delaying wind and solar projects—stock prices can drop.

For example, in January 2025, President Donald Trump declared a “national energy emergency” and withdrew the U.S. from the Paris climate agreement. He also lifted bans on offshore drilling and froze new permits for liquefied natural gas terminals. These actions favor fossil fuels and can create uncertainty for renewable energy investments.

Competition with Traditional Energy Sources

Despite the growth of renewables, traditional energy sources like oil and gas remain significant competitors. Fluctuations in fossil fuel prices can influence the competitiveness of renewable energy. For example, lower oil prices might reduce the immediate economic appeal of investing in renewable technologies.

Impact of Interest Rates on Capital-Intensive Renewable Projects

Renewable energy projects often require substantial upfront investments. Rising interest rates can increase borrowing costs, making it more expensive to finance these projects. This scenario can affect the financial viability of new developments and potentially slow down the renewable sector’s growth.

Technological and Operational Risks

Investing in renewable energy also involves technological risks. Technological advancements can render existing solutions obsolete, and operational challenges, such as lower-than-expected energy output or maintenance issues, can affect returns.

Conclusion: Is It the Right Time to Invest?

Renewable energy stocks have great potential, but they also present challenges. The world is moving toward cleaner energy, and governments are pushing for greener policies. This means the industry is likely to continue growing in the long run.

If you’re considering investing, you should have a solid strategy. One way to reduce risk is to diversify your investments—to put money in different renewable energy companies rather than just one. This can help balance risks and rewards.

Disclaimer: This article is for informational purposes only and not financial advice. Investing involves risks; past performance doesn’t guarantee future results. Consult a financial advisor before making investment decisions.