How to Create a Website for a Liquidity Provider: Guide 2026

Nov 11, 2025

Launching a liquidity provider (LP) business requires more than deep pools, smart routing, and competitive spreads. Your website is often the first point of contact for brokers, hedge funds, proprietary trading firms, and institutional clients evaluating your offering.

A liquidity provider’s website must communicate trust, infrastructure strength, execution quality, and regulatory transparency — all within seconds. This guide explains how to build a professional website for a liquidity provider, covering structure, compliance, technology, and conversion strategy.

Key Takeaways

- A liquidity provider website must emphasize credibility, execution quality, and infrastructure reliability.

- Clear segmentation for brokers, exchanges, and institutional clients improves conversions.

- Regulatory transparency and risk disclosures are critical to building trust.

- Technical documentation and FIX/API integration details are expected by professional clients.

- Performance metrics, execution data, and reporting tools should be clearly presented.

- The website should logically guide visitors toward onboarding or integration discussions.

Why a Liquidity Provider Website Matters

Liquidity is invisible — it operates behind the scenes. Your website is the only visible layer clients can assess before initiating due diligence.

Institutional clients evaluate LPs based on:

- Depth of liquidity

- Execution speed

- Pricing competitiveness

- Market coverage

- Technology stack

- Risk management framework

According to research by the Bank for International Settlements (BIS), liquidity conditions significantly impact market stability and trading costs (BIS report). This makes transparency and credibility essential in any LP’s digital presence.

Core Website Structure for a Liquidity Provider

Below is the recommended structure for a professional liquidity provider website.

1. Homepage: Trust & Positioning

The homepage must clearly state:

- What markets you provide liquidity for (FX, crypto, CFDs, equities, commodities)

- Who your target clients are (retail brokers, institutional brokers, exchanges, hedge funds)

- Key differentiators (multi-asset liquidity, aggregation model, prime-of-prime access)

Include:

- Execution statistics

- Uptime guarantees

- Institutional-grade infrastructure claims (if verifiable)

- Regulatory disclosures

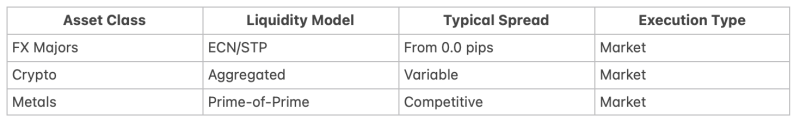

2. Liquidity & Asset Coverage Page

This section should detail:

- Asset classes (FX, Crypto, Indices, Metals, Commodities, Equities)

- Market depth information

- Spread ranges

- Margin requirements

- Trading sessions

Professional clients expect clarity. Avoid vague claims like “best liquidity.”

For further understanding of liquidity aggregation models, see this overview of Electronic Communication Networks (ECN) by Investopedia:

3. Technology & Infrastructure Page

Institutional clients care deeply about technology.

Your website should outline:

- Matching engine setup

- Liquidity aggregation model

- FIX API availability

- Bridge compatibility (MT4, MT5, cTrader)

- Data centers and hosting (e.g., LD4, NY4, TY3)

- Latency metrics

Explain FIX connectivity clearly. The FIX Trading Community provides background on the FIX protocol here:

4. Execution & Risk Management Transparency

Professional counterparties will assess:

- Slippage statistics

- Fill ratios

- Order rejection rates

- Execution policy

- Market vs. limit order handling

Publishing execution reports (monthly or quarterly) builds credibility. The European Securities and Markets Authority (ESMA) requires certain transparency standards under MiFID II (ESMA overview).

Even if not regulated in the EU, aligning with recognized transparency standards enhances trust.

5. Compliance & Legal Information

Liquidity providers must clearly disclose:

- Legal entity name

- Registration number

- Regulatory status

- Risk disclosures

- AML/KYC commitments

- Privacy policy

If operating under specific jurisdictions, link to official regulator databases (e.g., FCA register: https://register.fca.org.uk/).

Transparency reduces friction during onboarding.

6. Onboarding & Integration Section

Your website should explain:

- Client eligibility requirements

- Minimum deposit or collateral

- Margin requirements

- Onboarding timeline

- API documentation access

Provide downloadable documentation (PDF format):

- FIX API specifications

- Symbol lists

- Margin schedules

This shortens the due diligence cycle.

UX Design Principles for Liquidity Providers

Prioritize Clarity Over Marketing

Institutional clients prefer:

- Data-driven content

- Technical documentation

- Transparent metrics

- Direct communication channels

Avoid:

- Overuse of slogans

- Vague superlatives

- Retail-focused language

Use Conversion Logic Appropriate for B2B

Instead of “Open Account Now,” use:

- Request Liquidity Access

- Schedule Technical Call

- Download API Documentation

Security & Infrastructure Requirements

A liquidity provider website must implement:

- HTTPS with SSL encryption

- DDoS protection

- Secure client portal

- Access-controlled documentation

- Server redundancy

Cloud providers like AWS and Google Cloud explain institutional-grade infrastructure practices:

Content Strategy for Liquidity Providers

Beyond static pages, consider:

- Market structure education articles

- Liquidity analytics reports

- Whitepapers on execution quality

- Integration guides

Educational content positions your LP as a thought leader rather than just another liquidity source.

For example, this B2BROKER video explains liquidity aggregation and its role in brokerage infrastructure:

Embedding relevant educational videos enhances engagement and improves SEO performance.

Common Mistakes to Avoid

- No regulatory disclosure

- No technical documentation

- Overly generic marketing language

- No clear target audience segmentation

- No visible execution statistics

- Broken onboarding process

Institutional clients perform deep due diligence — your website should make their process easier, not harder.

How Website Structure Connects to Liquidity Infrastructure

A strong liquidity provider website should reflect operational strength:

- Aggregation technology

- Multi-asset coverage

- Risk management controls

- Integration flexibility

For firms offering liquidity services, connecting website messaging with infrastructure capabilities (aggregation engines, matching engines, bridges, APIs) creates alignment between marketing and technical operations.

Final Thoughts

Creating a website for a liquidity provider is not a design exercise — it is a trust-building mechanism. Professional clients evaluate risk, execution, infrastructure, and compliance before committing capital.

A well-structured LP website should:

- Clearly present asset coverage

- Provide transparent execution metrics

- Explain integration and connectivity

- Demonstrate regulatory and legal clarity

- Guide institutional visitors toward onboarding

In highly competitive liquidity markets, clarity and credibility often differentiate successful providers from the rest.