Is Bitcoin Loophole a Scam? What Do Reviews Say?

Dec 18, 2024

The surging popularity and prices of cryptocurrencies have led many service providers to offer trading and brokerage opportunities, exploiting the massive demand for crypto trading.

However, the accessibility of cryptocurrencies led to a rise in unreliable platforms, luring users with different tactics and sugar-coating their services with flashy words and promises.

Bitcoin Loophole has made the news in recent years due to its bold claim of using algorithmic bot trading to find Bitcoin trading opportunities and generate massive profits. Many trusted these offerings and learned that “All that glitters is not gold.” Let’s review Bitcoin Loophole, its claims and approach, and what makes it a highly doubtful trading platform.

Key Takeaway

- Bitcoin Loophole is a scam crypto platform that claims to use AI and algorithmic trading to achieve guaranteed returns.

- The platform lacks regulatory guidance, exposing users’ funds to extreme risks.

- Many users reported bitcoinloophole.com for its unreliable services and inability to realize their claimed gains.

What is Bitcoin Loophole?

Bitcoin Loophole is a trading platform that claims to use automated trading software to execute orders quickly and accurately. It allows users to invest in multiple virtual currencies, such as Bitcoin, Ethereum, Bitcoin Cash, and other crypto market assets.

However, the claims of quick profits in a short time and a no-fee system make these services “too good to be true.”

The platform capitalizes on mainstream crypto trading, where almost every trader has shown interest in cryptocurrencies and digital assets. It profits from the massive volatility and price activity.

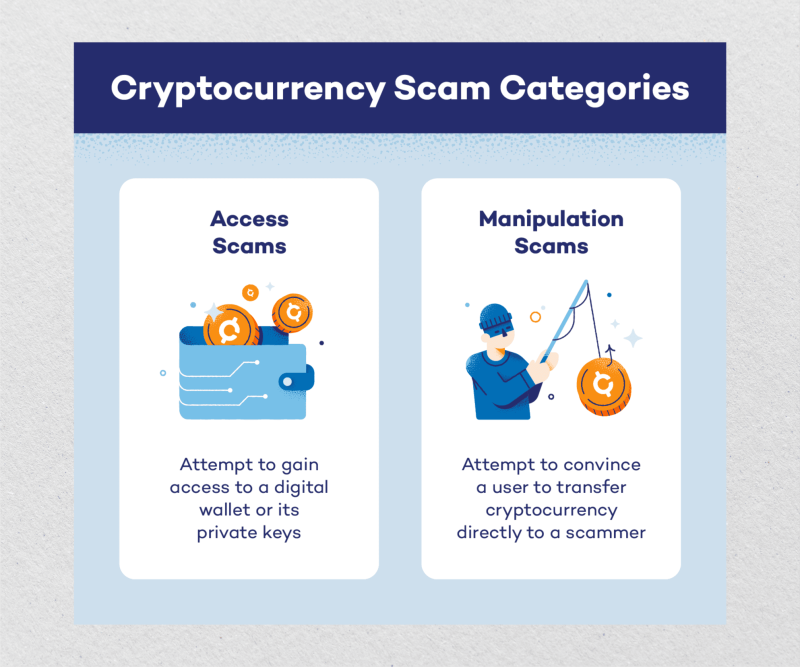

However, due to recent scam programs and hacks, users are becoming more aware of these malicious tactics. They are doing due diligence and researching the provider’s legitimacy to avoid becoming victims.

Is Bitcoin Loophole Safe?

No. The platform overpromises and under-delivers, with several stories of investors depositing considerable amounts and receiving nothing in return.

Many Bitcoin Loophole reviews state that they were asked to add more funds to support their margin accounts or to participate in recovery programs after losing their initial investment.

How Does Bitcoin Loophole Work?

Due to the volatile nature of the cryptocurrency market, where most assets and coins fluctuate unexpectedly and rapidly, manual order placement and maintenance are becoming increasingly challenging.

Therefore, trading bots and algorithmic software have become popular. These systems can track market movements, find trading opportunities based on user parameters, and place orders quickly. Traders can configure this technology to optimize their trades and manage their risks.

However, this system approach is personalized, while Bitcoin Loophole tries to generalize this concept and claims that every user will be able to generate thousands of dollars without intervention by a human broker.

Bitcoin Loophole Review: Is it a Scam?

While the platform claims to make crypto trading scalable and profitable, users say otherwise. Many users outlined their experience regarding user interaction, the registration process, regulatory background, and trading activities.

To determine whether the Bitcoin Loophole is a scam, let’s take a look at the typical services that you should expect from a brokerage platform.

Fast Fact

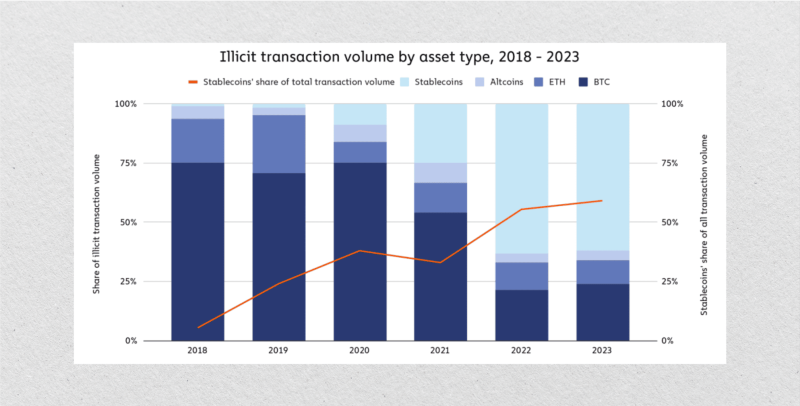

In 2023, The FBI reported almost $4 billion in lost funds in crypto investment scams, a 53% increase compared to the previous year.

Regulatory Control

Trading Forex and crypto is governed by three different categories of authorities and license issuers. Top-tier regulators include FCA, SEC, and ASIC. Mid-tier like CySEC, FSC Mauritius, and DFSA, and low-tier like VFSC, IFSC Belize, and Labuan FSA.

However, the Bitcoin Loophole website is not regulated by financial agencies or jurisdictional frameworks, making its users highly susceptible to fraud and illegitimate business activities.

Therefore, signing up and depositing funds with this platform is highly risky because there are no legally binding agreements to deter the operator in case of violation. Moreover, financial regulators provide investors insurance in case of platform insolvency, which Bitcoin Loophole lacks.

Services & Promises

Popular crypto exchanges promise transparent trading processes, quick execution engines, and multiple risk management and automation tools, which help customers make informed decisions.

However, Bitcoin Loophole’s promises are over the top, such as 77% returns in seven days and $13,000 in 24 hours, which is too good to be true.

Financial asset classes, especially cryptocurrencies, are highly dynamic and unpredictable. Prices move based on demand, supply, speculations, economic pressures, political factors, and many other drivers.

Therefore, predicting these factors and generating guaranteed profits is impossible even with the most advanced algo-trading technology.

Capital Safety and Investing Model

Exchange platforms offer spot or derivatives markets to allow users to buy and store actual cryptocurrencies or trade Bitcoin CFDs without holding a coin.

The Bitcoin Loophole offers only CFD trading without allowing users to connect wallets and store their holdings safely away from the internet. This exposes users’ trading accounts to manipulation and loss because the operator can easily access them.

Website Interface

The platform utilizes a very simplistic website interface that is deemed unprofessional and confusing. This default build and functionality resemble those of already exposed crypto scam operators.

The website lacks crucial information that investors require, such as available markets, assets, execution models, account details, and regulatory information, which raises its scam alert.

Brokerage Fees

Typical brokerage platforms charge multiple fee systems to compensate for their operations and activities. However, the Bitcoin Loophole app states that registration, depositing and withdrawing, and brokerage services are totally free, which raises concerns.

How Bitcoin Loophole Lures Traders?

The platform uses several tactics combined with too-optimistic promises to attract customers, mostly playing on the emotional factor.

Advanced algorithms: Effortless income generation sounds like a great deal, and it is a trending technique on multiple platforms. However, using artificial intelligence does not come with guaranteed returns.

Emotional-free trading: Making fact-based decisions is generally a good approach to investing. However, the platform uses this trick without demo trading or actually educating users on becoming skilled investors.

Flexible investments: CFDs are more convenient than physical asset ownership and storage. However, it allows operators to manipulate traders’ accounts without delivering tangible value.

High success rate: Bitcoin Loophole states that its system achieved an 85% success rate, which cannot be verified and replicated to other users since financial markets are unique and traders have distinct goals.

Conclusion

Bitcoin Loophole is a crypto trading platform that uses AI technology to claim legitimacy. It has been under the radar for many years, and many describe it as a scam due to its lack of regulations, opaque trading services, and unregulated trading activity.

Registering with this operator can expose your invested capital to significant risks, especially since no legal frameworks or authorities can recover your lost money. Therefore, we recommend that you begin trading away from this platform.