Best DAO Projects in 2025

May 29, 2025

Just a few years ago, DAOs were an experimental concept only crypto insiders talked about. Fast-forward to 2025, and these decentralized communities are shaping the future of finance, governance, digital identity, and even culture.

From billion-dollar treasuries to funding public goods and pioneering new models of online collaboration, DAOs are doing what no boardroom ever could: putting decision-making in the hands of everyday people, powered by code.

In this article, we’ll take you inside the best DAO projects leading this year, explain what makes a DAO “great,” and explore where decentralized governance is headed.

Key Takeaways

- The best DAOs in 2025 thrive because of active, engaged members—not just flashy roadmaps.

- DAOs automate decision-making and money management, reducing bureaucracy and building trust.

- Delegate voting, AI tools, and cross-chain tech make DAOs more scalable and intelligent.

What Is a DAO?

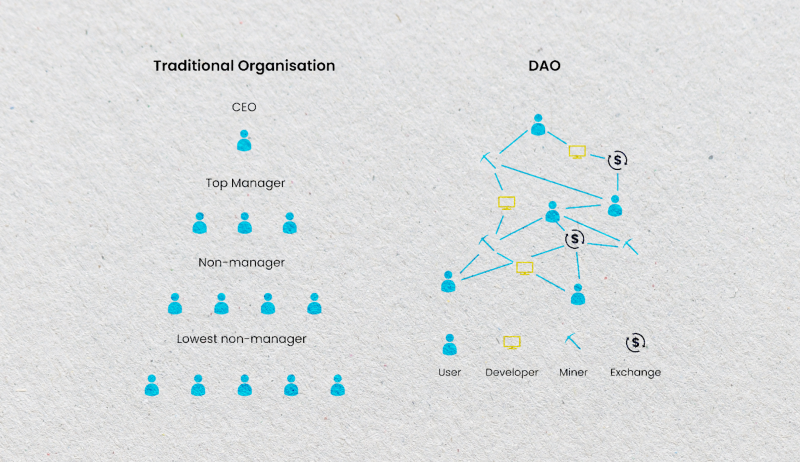

A decentralized autonomous organization (DAO) is a community-led group operating entirely online, built around blockchain technology. Instead of having a CEO or board of directors making the calls, decisions in a DAO are made collectively by its members — usually people who hold the DAO’s governance tokens.

What makes a DAO truly unique is how it runs. Everything—from how money is spent to how rules are enforced—is handled through smart contracts. These are bits of code written on the blockchain that automatically execute when certain conditions are met.

Because of this, DAOs can function independently without needing a manager or centralized control. And since all actions are recorded on the blockchain, everything is fully transparent and permanent, reducing the chances of shady backroom decisions or corruption.

Today, you’ll find DAOs behind many major crypto and Web3 projects—governing DeFi platforms, NFT communities, funding initiatives, or digital art collectives. What’s powerful is that anyone, anywhere in the world, can join these organizations and contribute.

Many participants remain pseudonymous, working across time zones to collaborate, build, vote, and fund projects without ever stepping into a physical office or forming a traditional company.

Imagine a DAO controlling a large treasury for a DeFi protocol to give you an idea of how they work. A community member might suggest using funds to reward liquidity providers or to develop a new feature.

If enough people vote “yes,” the proposal is passed, and the smart contract automatically releases the funds to make it happen. No emails, no approvals from executives, no red tape. Just code and consensus.

Top DAO Projects in 2025

DAOs have come a long way from being niche experiments. By 2025, they’re running billion-dollar ecosystems, funding public goods, governing DeFi protocols, and even influencing how the internet evolves. Today’s best DAO projects have built passionate communities, strong governance models, and real impact beyond hype.

Let’s dive into some of the standout DAOs leading the way in 2025—and what makes them worth watching.

Arbitrum DAO

Arbitrum isn’t just a popular Layer 2 scaling solution—it’s also home to one of the most active DAOs in the Ethereum ecosystem. With the ARB token, users vote on allocating hundreds of millions in treasury funds to incentivize developers, support infrastructure, and grow the ecosystem.

In 2025, Arbitrum DAO is pioneering multi-layered governance, letting subDAOs handle specific grants or projects. It’s one of the most decentralized and well-funded examples of how a blockchain network can be truly owned by its users.

Uniswap DAO

Uniswap revolutionized token swaps, and its DAO is doing the same for decentralized governance. With the UNI token, users propose everything from fee changes to treasury usage.

What’s special about Uniswap DAO in 2025 is its focus on sustainability: funding user education, research, and even legal advocacy to protect DeFi from overregulation. Its Snapshot votes attract massive participation, proving that token holders do care when the stakes are high.

Aave DAO

Aave DAO is like a decentralized bank run by its community. It manages the Aave lending protocol, which now supports dozens of chains and assets. In 2025, Aave DAO’s Safety Module—a pool of funds set aside to protect users from insolvency—is considered a best-in-class example of community-managed risk.

The DAO oversees protocol upgrades, interest rate models, and expansion plans. Everything, from design to deployment, goes through public proposals and voting.

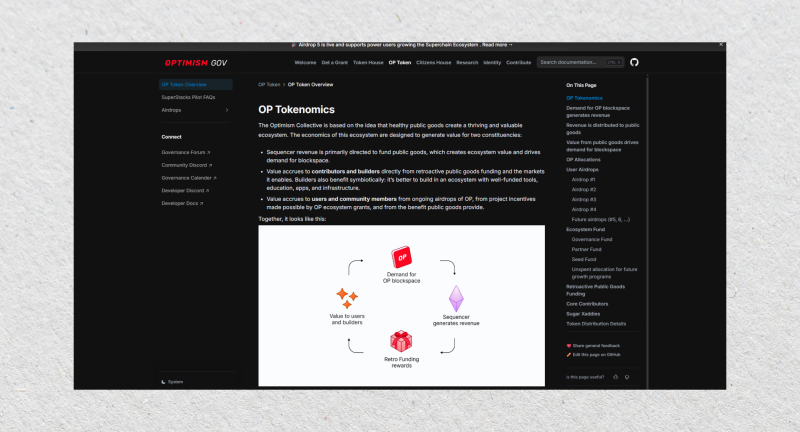

Optimism Collective

The Optimism DAO is doing something boldly: redirecting value back into the public goods that power Ethereum. Through its two-part governance model—the Token House (for token holders) and Citizens’ House (for non-token-based participation)—it funds open-source devs, researchers, and creators.

In 2025, its Retroactive Public Goods Funding (RPGF) round distributed tens of millions to underappreciated builders. This is DAO governance with a conscience.

MakerDAO

If you’ve ever used DAI, the decentralized stablecoin, you’ve touched MakerDAO’s work. But beyond issuing stablecoins, Maker is known for deep governance experimentation.

In 2025, it’s rolling out its “Endgame” plan: a vision for scalable, modular governance through MetaDAOs, autonomous subgroups that manage different parts of the ecosystem. Maker has proven that governance can evolve without breaking its core promises of stability and transparency.

Gitcoin DAO

Gitcoin DAO’s mission is to help fund people building open-source software and digital infrastructure. It runs quadratic funding rounds, where even small donations get amplified based on community interest.

In 2025, Gitcoin DAO will support not just code but also climate initiatives, journalism, and DeSci (decentralized science). It’s proof that DAOs can make the internet a better place, one grant at a time.

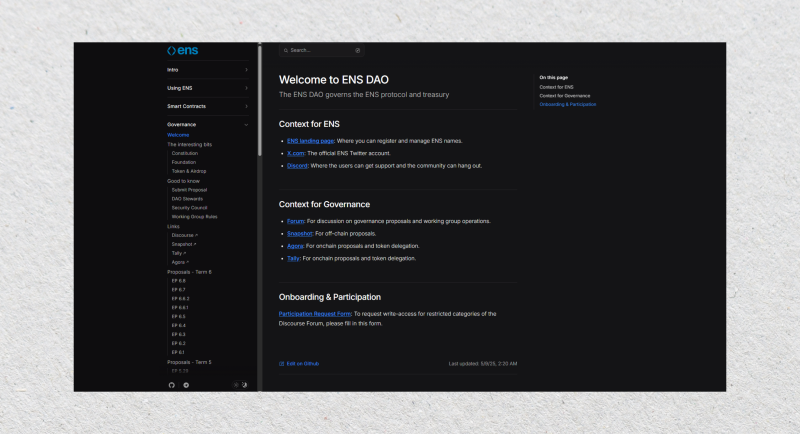

ENS DAO

The Ethereum Name Service (ENS) turns complex wallet addresses into human-readable names like your name.eth. But it’s the DAO behind it that makes the system resilient. ENS DAO manages pricing, feature upgrades, and community funds.

As digital identity becomes more crucial in 2025, ENS DAO is evolving to support cross-chain domains, reputation layers, and integrations with dApps. It’s not flashy, but it’s foundational.

Nouns DAO

Nouns DAO mints and auctions one NFT daily—and uses the proceeds to fund community ideas, from meme campaigns to open-source software. It’s weird, whimsical, and wildly successful.

By 2025, it’s evolved into a cultural DAO powerhouse, funding everything from short films to public installations. It’s a masterclass in how DAOs can blend art, community, and purpose.

PleasrDAO

PleasrDAO is a collective of NFT enthusiasts and culture curators. They’ve bought iconic pieces like Edward Snowden’s NFT and the Wu-Tang Clan’s secret album.

In 2025, PleasrDAO will focus on digital preservation, ensuring key pieces of internet history are archived and accessible. It’s a DAO that treats art with reverence and uses community capital to protect cultural milestones.

MetaCartel DAO

One of the earliest DAOs, MetaCartel, continues to punch above its weight. It funds early-stage dApps, community events, and experimental protocols. Think of it as a Web3 incubator with no suits, no pitch decks—just builders backing builders.

In 2025, MetaCartel branched into education, funding programs that teach smart contract development and community governance. It’s the grassroots spirit of Web3, alive and thriving.

Fast Fact

The total value held in DAO treasuries surpassed $40 billion globally in early 2025, making some DAOs richer than traditional venture firms.

Key Characteristics of a DAO

DAOs may sound complex at first glance, but once you break them down, their core traits are pretty straightforward—and genuinely transformative.

These aren’t just fancy terms; each characteristic is critical to how some of the best DAO projects function and why they’ve become so important in the blockchain world.

Decentralization

At the heart of a DAO is decentralization. No single leader, CEO, or top-down authority is making all the decisions. Instead, power is spread across a wide community of participants.

Everyone with a stake—typically in the form of governance tokens—has a say in how the organization is run. This creates a more democratic structure, where decisions emerge from the community rather than being handed down by a few at the top.

Autonomy Through Code

DAOs are called autonomous for a reason. Much of what they do is handled by smart contracts—self-executing programs that run on a blockchain. Once a smart contract is deployed, it automatically follows its rules, no questions asked.

For example, if a proposal passes with enough votes, the contract might automatically transfer funds or update system settings—no human intervention is required. Automation reduces bureaucracy and builds trust because no one can secretly override the system.

Transparency by Default

Unlike traditional companies, where decisions often happen behind closed doors, everything in a DAO happens in the open. Every proposal, vote, and transaction is recorded on a public blockchain.

Anyone can see who voted for what, how funds were used, and what decisions were made. This level of transparency keeps everyone accountable and prevents shady dealings from slipping through the cracks.

Community Ownership and Governance

In a DAO, the people who use the product or support the mission are often in control. Governance tokens act like voting shares — holding them means shaping the organization’s future.

Want to propose a new feature? Allocate funds to a certain cause? Change a rule in the protocol? All of that can be initiated and voted on by the community. It’s ownership with responsibility, and it aligns everyone’s incentives.

Global, Open Participation

DAOs are borderless by design. Anyone with an internet connection can participate, regardless of location, background, or credentials. Most members don’t use real names—they might be known only by their crypto wallet address or a nickname.

This openness means DAOs attract contributors worldwide: developers, designers, marketers, strategists—people who believe in the mission and want to help shape it.

Treasury Control

Many DAOs manage substantial treasuries—sometimes holding millions or even billions in crypto assets. What’s unique is that a central party doesn’t control these funds. Instead, treasury spending is dictated by community consensus.

Every proposal to use funds must pass a vote. This makes DAOs feel more like community-run venture funds or co-ops, where resources are pooled and decisions are made collectively.

Criteria for Selecting the Best DAO Projects

With so many DAOs popping up across the crypto ecosystem, it can be hard to tell which ones are genuinely impactful and which are just riding the hype. Not all DAOs are created equal—and frankly, some don’t do much beyond putting up a governance token and calling it a day.

So, how do you separate the truly valuable DAOs from the ones that fizzle out? Here are the key things to consider when identifying the best DAO projects for 2025.

Active, Engaged Community

A great DAO isn’t just about the code—it’s about the people. The most effective and best DAO projects have active communities that genuinely participate in decision-making. This means more than just showing up to vote.

Look for forums full of thoughtful discussion, regular community calls, and open debates. If people care enough to show up, ask questions, and propose changes, that’s a good sign the DAO has real energy behind it.

Transparent and Accountable Governance

If you can’t easily determine how a DAO works or where its money goes, that’s a red flag. The best DAO projects are transparent by default. You should be able to track past proposals, see how people voted, and follow how funds are being used.

Clear documentation, public voting records, and active communication channels show that a DAO is serious about accountability.

Well-Managed Treasury

Let’s be honest—the best DAO projects are managing serious money. Some treasuries are worth millions, even billions. So it matters how that money is handled. Top DAOs have a structured approach to treasury management, with budgets, audits, and safeguards in place. Even better?

DAOs that allocate funds strategically—supporting long-term growth, rewarding contributors, and funding real innovation, not just throwing cash at buzzwords.

Real-world or Ecosystem Impact

At the end of the day, a DAO should do something that matters. Whether it’s funding public goods (like Gitcoin), scaling blockchain infrastructure (like Arbitrum), or managing a critical protocol (like Aave), the DAO should make a measurable contribution to the ecosystem or broader society.

The best DAO projects leave a footprint—they ship features, build communities, or drive meaningful conversations forward.

Participation Rates and Proposal Quality

It’s not just about having the option to vote—it’s about whether people use that voice. High participation rates in governance votes show that a DAO’s members are engaged and invested.

Quality matters, too: well-researched, clearly written proposals signal maturity and focus. Conversely, low engagement or a flood of poorly thought-out proposals can mean the DAO struggles to stay relevant.

Longevity and Consistency

The crypto space moves fast, but great DAOs show staying power. If a DAO has been around for a few years, weathered market ups and downs, and is still building—that’s a huge plus.

Longevity means the community believes in the mission, and the structure is resilient enough to adapt. Consistent governance activity, long-term planning, and evolving roadmaps are all signs of a healthy DAO.

Innovative Governance Design

Some of the best DAO projects are pushing the boundaries of what online governance can look like. From delegate-based voting to citizenship models to modular MetaDAOs, innovation in governance shows that a DAO is thinking long-term.

The best DAO tokens are experimenting with what they do and how they do it, and often share their tools and frameworks with the broader Web3 space.

Future of DAO Governance

As DAOs mature and the crypto space becomes more sophisticated, governance is no longer just a novelty—it’s evolving into a serious, scalable, and sometimes surprisingly elegant system for collective decision-making.

In 2025, the future of DAO governance will be shaped by better voting models, smarter tools, cross-chain capabilities, and a growing level of institutional interest.

Here’s a closer look at where things are headed.

Delegate-Based Voting Is Becoming the Norm

Let’s be honest: most people don’t have the time (or desire) to read every proposal, join community calls, and vote on every issue. That’s where delegate-based voting comes in—and in 2025, it’s catching on quickly.

Instead of voting on everything themselves, some of the best DAO projects can delegate their voting power to trusted representatives—like electing a mini “congress” of experts who vote on their behalf.

These delegates are usually highly active community members, developers, researchers, or power users who commit to being involved and transparent.

Platforms like Tally and Agora are making delegation seamless, and many DAOs are even offering incentives and performance metrics to keep delegates accountable.

AI Is Entering the DAO Toolbox

Artificial intelligence isn’t replacing DAO members—but it’s becoming a helpful assistant. In 2025, we’re seeing AI-powered tools that help the best DAO projects summarize proposals, analyze voting trends, detect Sybil attacks, and even simulate the potential outcomes of proposals before they’re passed.

Think of it like having a smart co-pilot that reduces information overload. Some DAOs are also exploring AI agents that can manage routine tasks autonomously, like distributing grants or moderating community forums.

Cross-Chain Governance Is Taking Off

The crypto ecosystem is no longer just about Ethereum. Many DAOs today operate across multiple blockchains—Ethereum, Layer 2s like Arbitrum and Optimism, or alternative chains like Solana, Avalanche, and Cosmos. That means governance can’t stay siloed.

In 2025, cross-chain governance tools are finally catching up. Projects like Zodiac, Wormhole, and LayerZero enable DAOs to coordinate decisions and execute proposals across different networks without breaking security or user experience. This is crucial for DAOs managing multi-chain protocols or treasuries.

Institutional Adoption Is Getting Real

A few years ago, the idea of a DAO getting backing from a bank or a large enterprise seemed far-fetched. But in 2025, that’s starting to change. Institutional players are no longer sitting on the sidelines—they’re getting involved in governance, partnering with the best DAO projects, or launching their own community.

Some join as passive token holders or treasury managers, while others contribute tools, compliance frameworks, or legal wrappers to make DAO participation less risky.

The line between “decentralized” and “professional” is becoming blurred. While this raises concerns about centralization, it also gives DAOs more legitimacy and access to real-world assets and networks.

DAO Tooling Is Growing Up

Remember when running a DAO meant hacking together Google Docs, Discord chats, and janky voting UIs? That era is fading fast. Today, there’s a wave of purpose-built DAO tooling — think platforms like CharmVerse, Coordinape, Gnosis Safe, Hats Protocol, and more.

These tools make managing memberships, coordinating contributors, tracking performance, automating payments, and creating custom governance flows without writing a single line of code easier. DAOs are now operating with the operational sophistication that rivals startups or nonprofits — and it’s only improving.

Conclusion

DAOs are no longer just a crypto experiment — they’re becoming the new digital institutions of the internet age. Whether it’s funding the next big DeFi protocol, preserving digital art, or rethinking how we govern online communities, DAOs are showing us what’s possible when code and community come together.

2025 isn’t just the year of better blockchains—it’s the year governance grows. If you’re considering joining one of the best DAO projects, contributing to one, or even launching your own, now’s the time. The future of decentralized collaboration is here — and it’s not waiting for permission.

FAQ

What is a DAO in simple terms?

A DAO is a group of people working together online under shared rules written into blockchain-based code—no bosses, just community.

How do I join a DAO?

Most DAOs are open to anyone. You just need to hold their governance token or participate in community platforms like Discord or Snapshot.

Are DAOs legal organizations?

It depends on the jurisdiction. Some register as LLCs, others remain purely on-chain, but legal clarity is slowly improving in 2025.

Can I earn money in a DAO?

Yes! Many of the best DAO projects pay contributors for tasks, ideas, dev work, and governance, just like a job, but decentralized.

What are governance tokens used for?

They’re like voting shares. You use them to propose, vote on, or influence decisions within the DAO.