Why “Skip the Latte” is Poor Financial Advice

Oct 10, 2023

When it comes to personal finance advice, one of the most commonly heard suggestions is to “skip the latte” and save money instead. This concept, popularised by financial author David Bach, is known as “The Latte Factor.”

The basic idea is that small daily expenses like a morning coffee can add up over time, and by eliminating these expenses, you can save a significant amount of funds.

However, this advice has sparked a debate among financial experts, with some arguing that it is flawed and unrealistic. In this article, we will delve into the arguments against the “skip the latte” advice and explore the nuances of personal finance.

Key Takeaways:

- “Skip the latte” may be bad advice for many because it overlooks the importance of making big financial moves.

- One of the most significant financial moves is investing in assets that have the potential for growth, for example, index funds and gold.

- Planning your financial future and creating a sound plan is an important aspect that you should not ignore.

What is The Latte Factor?

David Bach first introduced “The Latte Factor” in his best-selling book, “The Automatic Millionaire.” Simply put, it says that if you stop spending money on unnecessary everyday luxuries, like drinking coffee every morning and buying bottled water, fast food and soft drinks — then you’ll accumulate enough to save up and grow your wealth.

Over time, compound interest would enable you to earn even more if you put your savings to work. No matter how much return you get, or no matter if you choose not to invest at all — according to Bach, what really matters is how much you save rather than the return itself.

“We all throw away too much of our hard-earned money on unnecessary ‘little’ expenditures without realising how much they can add up to,” David Bach explains.

The Flaws of the Latte Factor

While the advice to “skip the latte” may have good intentions, there are some flaws to the idea:

Wealth is Not Finite

One of the key flaws in the “skip the latte” advice is the assumption that wealth is finite and needs to be preserved at the expense of daily enjoyment. This perspective views money as a scarce resource that should be hoarded and saved for the future. Well, this is, of course, true at some point, but it is important to remember the following:

Such a mindset fails to acknowledge the abundance of opportunities available to increase one’s income. In today’s gig economy and with the rise of side hustles and online businesses, there are numerous ways to earn additional money. So, instead of focusing on cutting back on small indulgences, individuals can explore avenues to increase their income and expand their wealth.

Spending Habits and Discipline

The “skip the latte” advice assumes that individuals will simply redirect the latte money saved from not attending a coffee shop towards saving or investing. However, human behaviour is complex, and our brains are wired to prioritise short-term pleasures over long-term goals.

Changing a habit, such as skipping a daily latte, requires discipline and consistency. Unless individuals can commit to making this decision every day for the rest of their working lives, it is unlikely that they will truly put the concept of the Latte Factor into practice. Moreover, even if someone successfully eliminates their daily coffee habit, there is no guarantee that they will save or invest their extra money instead of spending it elsewhere.

The Value of Experiences and Relationships

While the Latte Factor highlights the potential savings from skipping a daily latte, it fails to consider the value of experiences and relationships that can be fostered through such indulgences. Many people enjoy meeting friends or colleagues for a cup of coffee, and these interactions can lead to valuable connections, business opportunities, and personal growth. The financial benefits of socialising and building relationships should not be overlooked.

Additionally, the pleasure derived from small daily indulgences, such as a morning latte, can contribute to overall well-being and happiness. It is essential to strike a balance between saving for the future and enjoying the present.

The Power of Big Financial Moves

One of the biggest reasons why skipping the latte might not be the best financial strategy is the potential impact of making big financial moves. When it comes to building wealth, it’s important to consider actions that have a substantial effect on your financial situation. While saving a few dollars on coffee can add up over time, it pales in comparison to the potential gains from making significant changes, such as increasing your income or investing in assets that appreciate in value.

One such big financial move is switching jobs to obtain a higher salary. Most people are hesitant to pursue new job opportunities, but the reality is that a better job can often result in a pay increase of ten per cent or more. By taking the initiative to explore new opportunities and negotiate a higher salary, you can significantly improve your financial situation.

For example, if you’re currently earning $50,000 per year and manage to secure a job that pays $60,000, that extra $10,000 can make a substantial difference in your overall financial picture.

Investing in Assets with Growth Potential

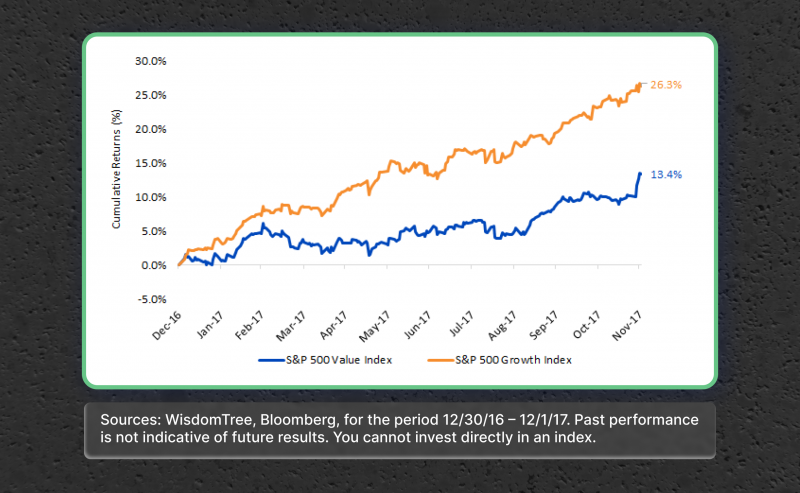

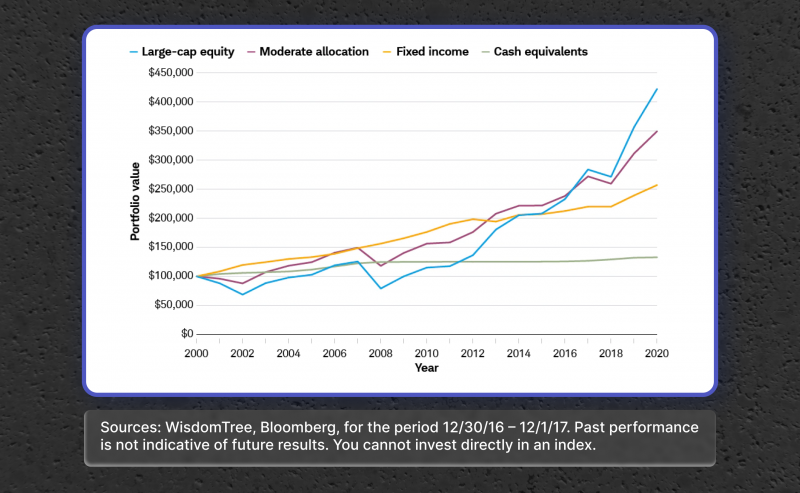

Another significant financial move is investing in assets with growth potential, such as index funds or gold. While skipping the latte might save you a few dollars each day, investing those savings in index funds can generate much larger returns over time.

Index funds are a type of investment that tracks a specific market index, such as the S&P 500. By investing in these funds, you can benefit from the overall growth of the market and potentially earn higher returns compared to traditional savings accounts or low-yield investments.

Fast Fact:

The average stock market return is about 10% per year, though that 10% average rate is reduced by inflation.

Of course, it’s important to strike a balance and not discount the impact of small daily expenses. The key here is to prioritize actions that have a significant effect while still being mindful of the smaller savings that can add up over time.

The Importance of Financial Planning

While the “skip the latte” advice may have its flaws, it does highlight the significance of financial planning and the impact of small daily expenses on long-term savings. Rather than focusing solely on cutting back on indulgences, individuals should adopt a holistic approach to financial management. This includes setting clear financial goals, creating a budget, and prioritising expenses based on personal values and priorities.

Strategies for Effective Saving

When it comes to saving and investing, there are various strategies that individuals can employ to make the most of their financial resources. Here are some approaches to consider:

Automate Savings

One effective way to ensure consistent savings is to automate the process. By setting up automatic transfers from your paycheck to a savings account, you can prioritise saving without needing to actively think about it. This removes the temptation to spend money and makes saving a regular and effortless habit.

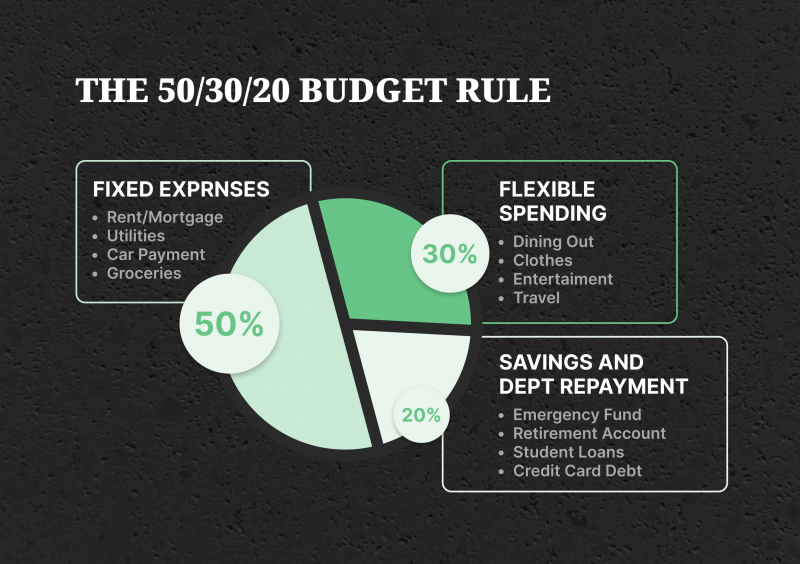

In many cases, splitting up monthly income according to the 50/30/20 rule is a great idea. The 50/30/20 rule suggests that you should allocate 50% of your monthly income for essentials, 30% for wants and 20% for savings (student loan debt, health insurance, emergency fund, and so on).

Prioritise High-Interest Debt

Before focusing on saving and investing, it is crucial to address any high-interest debt. Paying off credit card company debt or high-interest loans should take precedence, as the interest charges can quickly eat into your savings. Once you have eliminated or reduced these debts, you can redirect the funds towards saving and investing.

Diversify Investments

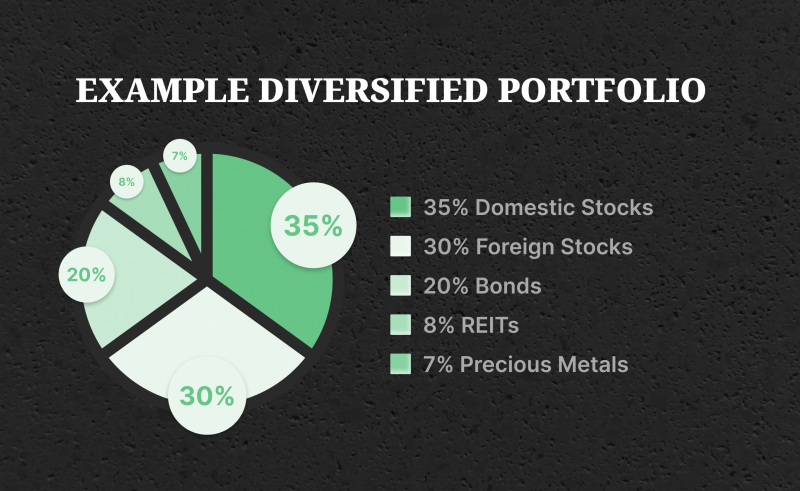

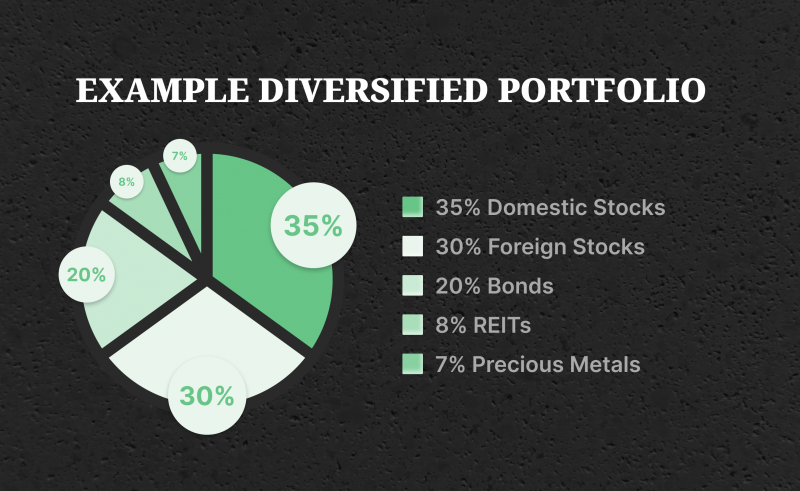

When it comes to investing, diversification is key. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and maximise potential returns. Consider working with financial advisors to develop an investment strategy that aligns with your goals and risk tolerance.

Take Advantage of Retirement Accounts

Contributing to retirement accounts, such as a 401 (k) or an Individual Retirement Account (IRA), is a smart long-term savings strategy. These accounts offer tax advantages and can help you build a nest egg for your retirement. If your employer offers a matching contribution, be sure to contribute enough to take full advantage of this benefit.

Fast Fact:

Fidelity suggests that by age 50, you should have saved around six times your salary for retirement.

Track Expenses and Identify Opportunities for Savings

Monitoring your expenses and identifying areas where you can cut back can help you find additional funds to save and invest. Consider using budgeting apps or spreadsheets to track your spending and identify patterns or areas of overspending. By making small adjustments to your lifestyle and spending habits, you can free up more money for saving and investing.

Taking Advantage of Investment Opportunities

At the core of investment operations is the goal of maximising returns while managing risks. This requires a deep understanding of financial markets investment vehicles and the ability to make informed decisions based on thorough analysis and research.

Let’s look at some of the strategies for making the most of investment opportunities:

1. Setting Investment Goals

Before embarking on any investment journey, it’s essential to establish clear and realistic goals. These goals act as a roadmap, guiding your investment decisions and helping you stay focused on your long-term objectives.

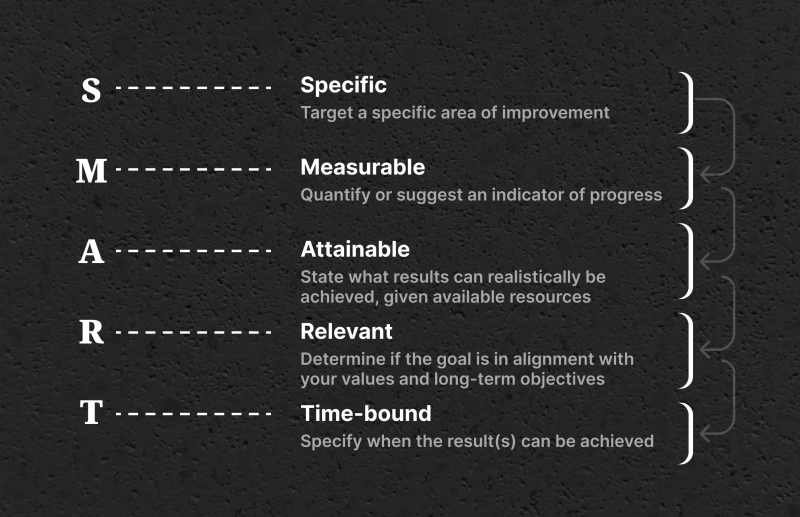

Your investment goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider factors such as your financial situation, risk tolerance, time horizon, and future aspirations when defining your investment goals.

2. Asset Allocation Strategies

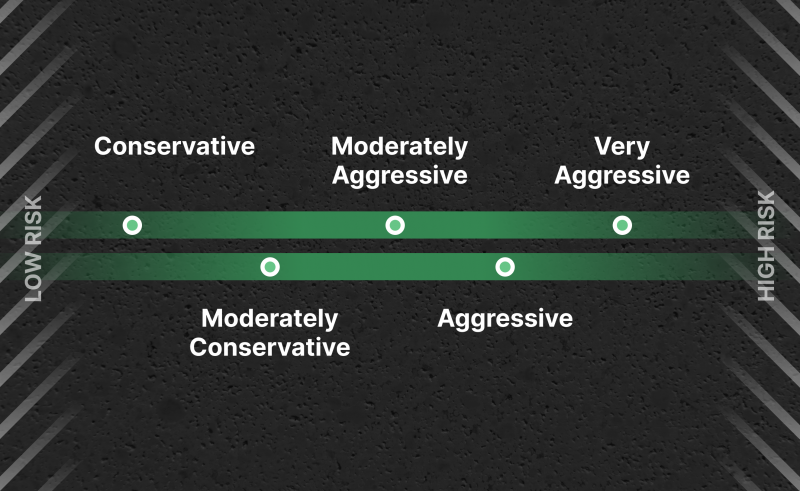

Asset allocation is the process of distributing your investment portfolio across different asset classes, such as stocks, bonds, real estate, and commodities. It is a key strategy to manage risk and optimise returns. The right asset allocation strategy depends on your investment goals and risk appetite. Common strategies include the conservative approach, balanced approach, and aggressive approach.

Conservative approaches typically allocate less to equities and more to bonds and other fixed-income assets. Balanced approaches allocate an equal portion of funds to equities and bonds, while aggressive approaches allocate more to high-risk assets, like stocks, crypto, and more.

3. Researching Investment Opportunities

Thorough research is crucial when identifying investment opportunities. It involves analysing financial statements, evaluating market trends, understanding industry dynamics, and assessing the performance of individual companies or assets. Research tools and resources such as financial news outlets, company reports, and investment research platforms can provide valuable insights to inform your investment decisions.

4. Risk Management Techniques

Risk management is an integral part of investment operations. It involves identifying, assessing, and mitigating risks associated with investments. Diversification, hedging, and setting stop-loss orders are some common risk management techniques. Investing portfolios should be aligned with your risk tolerance and investment goals, ensuring that risk and reward are balanced.

5. Portfolio Construction and Diversification

An effectively constructed investment portfolio is essential for achieving long-term success. Portfolio construction involves selecting a mix of assets that align with your investment objective and level of risk tolerance. Diversification is a key strategy to reduce risk by spreading investments across different asset classes, industries, and regions. It helps to minimise the impact of any single investment’s performance on your overall portfolio.

6. Monitoring and Evaluating Investments

Continuous monitoring and evaluation of your investments are crucial to ensure they remain aligned with your investment goals and market conditions. Regularly review your portfolio’s performance, assess the progress towards your goals, and make adjustments as necessary. Keep track of industry and market trends, as well as any changes in the economic landscape that may impact your investments.

7. Tax Considerations in Investment Operations

Tax considerations play a significant role in investment operations. Understanding the tax implications of your investments can help you optimise your after-tax returns. Different investment vehicles, such as IRAs or tax-efficient funds, offer tax advantages. Consult with a tax professional to ensure you are aware of and utilising all available tax-saving strategies.

8. Investment Psychology and Emotion Management

Investment decisions can be influenced by emotions such as fear, greed, and overconfidence. Managing emotions and adopting a disciplined approach are crucial for successful investment operations. Avoid making impulsive decisions based on short-term market fluctuations. Develop a long-term investment mindset and stick to your investment plan, even during periods of market volatility.

9. Investment Operations in Different Financial Markets

Investment operations can take place in various financial markets, such as stock market, bonds, real estate, and commodities. Each market has its own characteristics, risks, and opportunities. Understanding the dynamics of different markets and asset classes is essential for diversifying your investments and maximising potential returns. Consider factors such as liquidity, volatility, and regulatory environment when venturing into different markets.

Last Words

While the “skip the latte” advice may have gained popularity, it is important to evaluate its merits critically. Personal finance is a complex and individualised journey, and there is no one-size-fits-all approach. Instead of fixating on eliminating small indulgences, individuals should focus on comprehensive financial planning, setting clear goals, and making informed decisions.

However, it’s also important not to discount the cumulative effect of small savings. Finding a balance between focusing on big financial moves and being mindful of everyday expenses is key to achieving long-term financial success.

Remember, financial well-being is about more than just skipping a latte – it’s about making intentional choices that align with your values and long-term goals.

FAQs

What is the best way to get started investing?

Start with a financial plan. Figure out how much you can invest each month and how much capital you need to reach your goals. Then, research different investment options and pick the ones that best fit your needs. Monitor your investments and adjust your strategy as needed. Stay informed about current events and economic trends that could affect your investments.

Which types of investments are there?

Common types of investments include stocks, bonds, mutual funds, and ETFs. Other options include real estate, venture capital, and cryptocurrency. There are also commodities like gold, metals, agricultural products, and other types of investment options.

What is the best time to invest?

The best time to invest is when you are financially ready and have a clear understanding of your goals. Your investment plan should be tailored to your specific needs and should be reviewed regularly. In general, the earlier you start investing, the better off you will be.

How risky is investing?

All investments carry some degree of risk. Generally, the higher the potential return, the higher the risk. It is important to assess your own risk tolerance and level of knowledge before investing. Many experts recommend investing through mutual funds or ETFs, which are less risky than investing in individual stocks, for example. Do not forget about risk management strategies, like diversification and rebalancing.