Will Dogecoin Reach $1? Tokenomics and Price Analysis

Sep 29, 2025

Dogecoin began as a joke, but today it stands as one of the most recognizable names in the cryptocurrency market. From Elon Musk tweets to explosive rallies, Doge’s price has shown the ability to defy expectations. But the question remains: Will Dogecoin reach $1—and stay there?

In this deep dive, we’ll explore Dogecoin’s origins, tokenomics, demand drivers, and realistic scenarios that could shape its future.

Key Takeaways

- Dogecoin tokenomics ensure constant issuance, with inflation decreasing as supply grows.

- Dogecoin’s price is driven more by speculation, liquidity, and sentiment than utility.

- Hitting $1 is possible, but sustaining it requires Ethereum-scale demand and liquidity.

What Is Dogecoin? — Context and Origins

Dogecoin is a decentralised electronic currency launched by software engineers Billy Markus and Jackson Palmer in December 2013. Unlike Bitcoin or Ethereum, neither of which was conceived with ambitions to revolutionize world finance or run decentralized programs, Dogecoin started out as a parody to mock the speculative frenzy over digital currency at the time. Its take on using the logo and name, based on the popular “Doge” meme, provided it with a silly, carefree persona from its inception.

From Joke to Movement

What began as satire quickly evolved into an active community on the Internet, specifically on Reddit and Twitter (now X). Early adopters began using Dogecoin for micro-tipping, crowdfunding across the Internet, and charity efforts. This community-driven approach to culture became the foundation of Dogecoin: grassroots, tongue-in-cheek, and open to all.

Technical Roots

Dogecoin shares Litecoin’s codebase and utilizes the Scrypt algorithm for work-on-proof mining. In 2014, Dogecoin was merged with Litecoin to allow it to be mined by those who can mine two networks simultaneously.

The merge-mining agreement ensured long-term and sustainable network stability and security and did not compel Dogecoin to mine its hash work power separately.

The Meme Economy and Beyond

The cultural relevance of Dogecoin skyrocketed during the 2021 bull run, when mainstream celebrities such as Elon Musk made it popular through social media networks. Speculative passion propelled DOGE from units of a cent to an all-time high of around $0.73 during May 2021.

Even though it was dismissed by cynics as speculative mania, the episode cemented Dogecoin’s stature as the flagship memecoin—a genre of cryptos less driven by protocol innovation and technological breakthrough and more by community emotion, humor, and cultural velocity.

Fast Fact

In 2014, the Dogecoin community crowdfunded the Jamaican bobsled team’s Winter Olympics trip—proving memes can fuel real-world impact.

How Dogecoin Works — Network and Utility

Dogecoin is more than a meme—a functional blockchain with clear technical specifications, community-supported application, and clearly defined boundaries that characterize its presence in the cryptocurrency space.

To find out whether Dogecoin tokenomics allow it to thrive and address issues like “Will Dogecoin reach $1?,” we need to see exactly how the network works.

Consensus and Security

Dogecoin utilizes a Proof-of-Work system with the Scrypt algorithm, like Litecoin. Since 2014, it has been merged-mined with Litecoin and can therefore secure two chains simultaneously.

This configuration provides Dogecoin with a larger insurance policy against attacks than it would have on its own, but it also places it in a mutual relationship with the long-term health of Litecoin.

This system facilitates the DOGE price action observed during earlier bull runs, when network usage and speculation tended to move in tandem.

Transactions and Network Efficiency

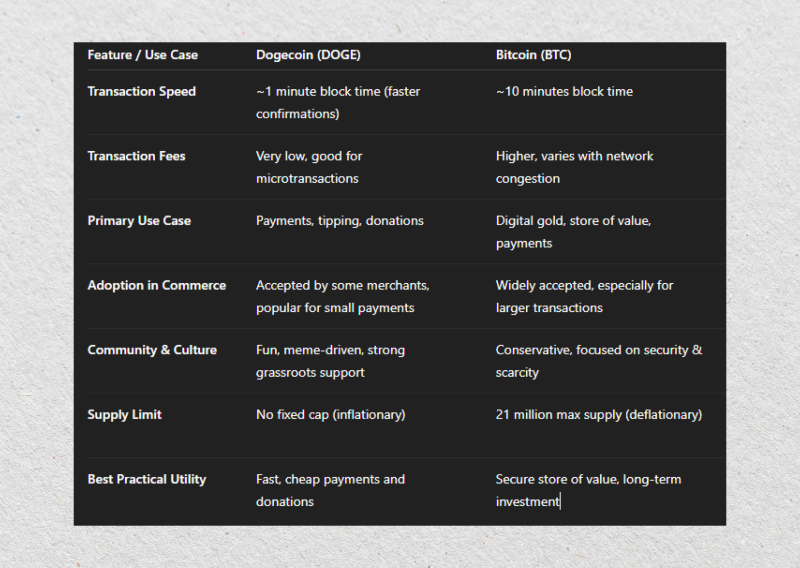

One of Dogecoin’s strongest attributes is its cost-effectiveness and speed, with a block interval of one minute—many times faster than Bitcoin’s ten minutes.

Confirmations are fast, and fees are very low. These are attributes that are suited to using Dogecoin to make small payments and as tips, particularly when sending DOGE to USD and when one wants a cheaper alternative to Ethereum-based payments.

In some ways, Dogecoin’s design is aligned with its initial concept of a “fun” and user-friendly payment coin. Still, it limits its scope by being less programmable than programmable blockchains.

Utility in Practice

The utility of Dogecoin today relies upon payments, tips, and merchant acceptances. Some stores and payment services accept Dogecoin, and there are wrapped versions on Ethereum and Binance Smart Chain to allow for DeFi usage.

However, Dogecoin is nonetheless a Layer-1 only currency with neither smart contracts nor advanced applications. This, however, has not stopped it from being a cultural sensation; instead, it means that DOGE price analysis must factor in speculation and community sentiment, which are often more potent motivators than utility alone.

For newcomers who ask, “How much is 1 Dogecoin worth?” the answer changes daily. Yet, oftentimes, its price is correlated less to real-world usage and more to its popularity cycle and trends on exchanges.

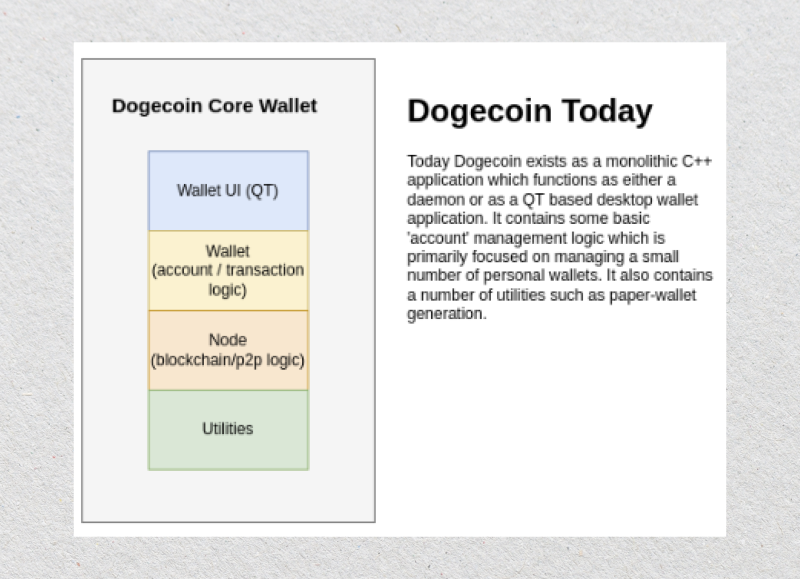

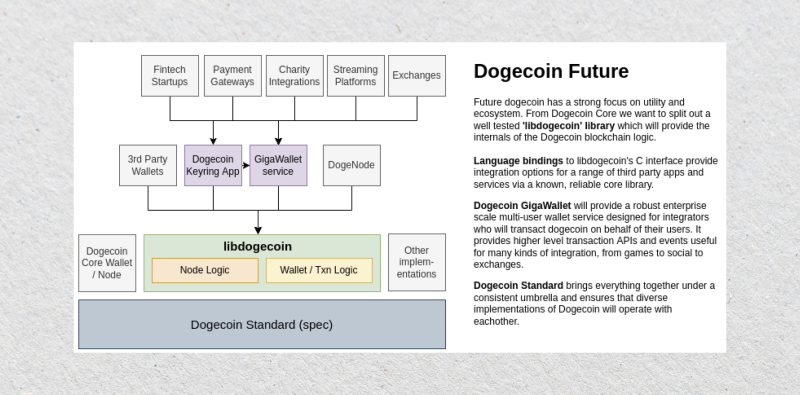

Development and Maintenance

Unlike Ethereum or Solana, there is no large foundation actively working to develop new functionality at all times in Dogecoin. There has only ever been sporadic development, which has mainly consisted of keeping the Dogecoin Core node updated, implementing security patches, and adjusting fees.

This less-frequent strategy has advantages and disadvantages: it provides stability, yet it stifles innovation. This is key for investors when producing a DOGE price prediction, as future performance is less dependent on successive technological advances and more based on external catalysts.

Tokenomics in Detail

The tokenomics of Dogecoin are volatility and predictability: constant issuance, diminishing inflation, high ownership concentration, and incentives to miners based on its linkage to Litecoin. These fundamentals are why Dogecoin’s price is prone to sharp cycles, and why spikes based on sentiment rule supreme over steady appreciation.

For those comparing Dogecoin to an equity investment with performance comparable to a stock advisor or expecting trashing outperformance from its marketplace, it’s important to remember Dogecoin is fundamentally a meme coin.

Supply Model and Constant Issuance

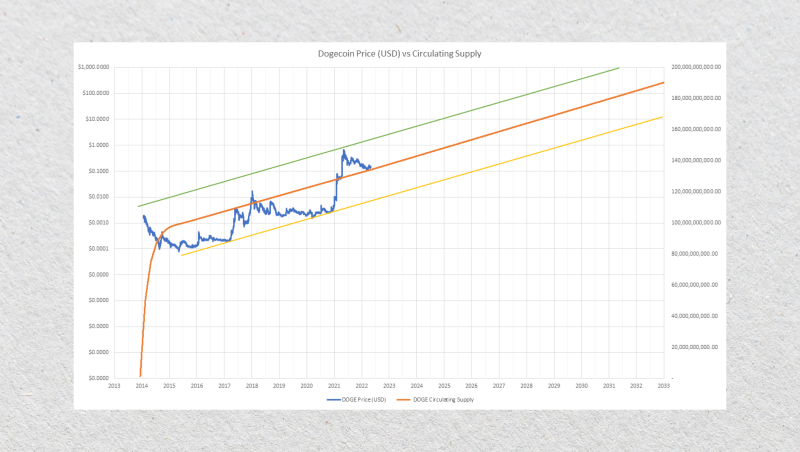

Dogecoin stands out among many other cryptos as it has no hard cap whatsoever. Instead, its network creates a 5 billion predictable new DOGE per year, a trait that has defined Dogecoin’s price action ever since its release. For newcomers to the space, Dogecoin stands out as being unlike Bitcoin’s limited supply protocol.

It positions Dogecoin more similarly to meme coins, whose prices are frequently based on community enthusiasm and sentiment towards the crypto market, rather than on inherent scarcity.

This paradigm places any questions, such as whether DOGE can sustain a bullish approach or struggle during bearish ones, to always be answered with supply growth in consideration.

Inflation Dynamics and Long-Term Effects

Even though new coins are continuously being produced per year, the percentage rate of inflation reduces over time. In the early years, annual inflation was extremely high; yet, as the base supply grows, that same issue becomes a declining percentage of the entire total.

With 2025 at 3.4% and 2030 at an estimated 2.9%, the rate is expected to fall to around 2.3% by 2040. The constant decline is vital while performing technical indicators-based analysis or any reliable forecasting of Dogecoin’s price, as it tells us how dilution pressures say goodbye to in the long term.

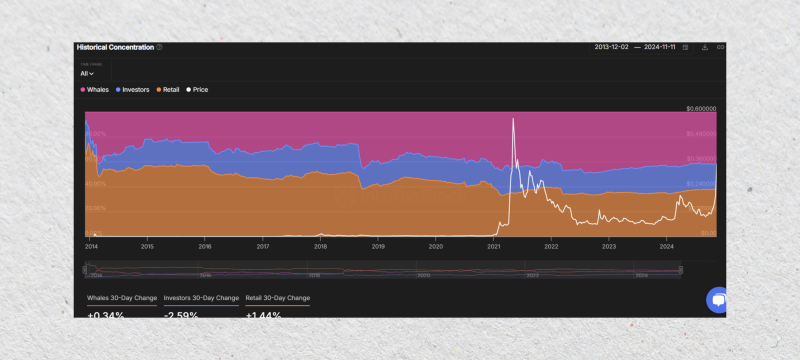

Distribution and Ownership Concentration

Supply allocation to holders is another critical element of Dogecoin tokenomics. Very few wallets control so much of the circulating DOGE to create volatility risks when said whales decide to sell. Yet this concentration sometimes reduces adequate circulating supply enough to boost rallies when new retail demand is added to the system.

To traders comparing DOGE against other meme coins, or indeed stocks with pulverizing outperformance against peers, this uneven allocation is an essential factor to any price study for DOGE.

Miner Economics and Networking Incentives.

The network security is derived from merge mining with Litecoin to ensure stability, but at the same time ties its health with Litecoin’s mining network. Miners are primarily compensated by a fixed subsidy and, to a lesser extent, by transaction fees, as the fees for transmitting DOGE are minimal.

As Dogecoin increases in value, incentives to mine increase with it, and the hashrate and security are accordingly enhanced. During bear markets or declines, this inverse reaction is reduced and can minimize miner activity. Long-term holders who believe in a bullish outlook are compelled to factor this miner dynamic when speculating on any future DOGE price direction.

Demand Drivers and Narrative Engines of Dogecoin

The volatilities of Doge’s price have always been driven by narratives and not puritanical fundamentals. Just like mainstream investors consider profits and accounting disclosures before investing in shares, Dogecoin is driven by culture, liquidity, and sentiment.

This makes it different from equities with steady cash flows, although at some points, experts compare the volatility of Dogecoin with market-obliterating outperformance versus indices during certain periods.

Meme Power and Virality Social

Dogecoin is the meme coin’s flagship still, with each rally proving its ability to bring attention with it. Social network platforms like Twitter/X, celebrity tweets, and yes, pop-culture icons—most famously Elon Musk’s 2021 outing to Saturday Night Live—have gotten humongous moves out of Doge’s price.

The hype cycle is reflexive: attention creates demand, demand increases price, and price creates yet further attention. Technical triggers like moving averages or RSI are valuable to short-term traders, but Dogecoin’s ability to rocket is dramatically contingent upon whether the community can get Dogecoin to new peaks relative to other meme coins and, indeed, newer meme coins.

Payments and Transaction Volume

The network is further assisted by its functionality as a payment currency due to its simplicity. Low fees and fast confirmations help with tipping, microtransactions, and remittances.

Phases with high transaction volume are familiar with spikes of speculative demand when users are experimenting with paying with DOGE or shuffling it from one exchange to another.

On a small scale, this payment side provides legitimacy and supports Doge’s price during those phases when it is falling.

Speculation, Liquidity, and Market Cycles

Speculative demand dominates much of Dogecoin demand. As there are waves of bullish market sentiment toward the crypto space, DOGE is often a beneficiary of said liquidity flowing into Bitcoin and Ethereum.

As liquidity flows out to other meme coins, Dogecoin looks to see fresh inflows once more, but newer meme coins sometimes steal short-term attention.

On bear trends, however, demand evanesces quickly and Doge’s price reverses abruptly. Volatility is risk and attraction to some buyers: Dogecoin can see giant stock advisor returns over short periods, but with corresponding dramatic setbacks to come.

Exchanges, Derivatives, and Reflexivity

Because Dogecoin is listed on virtually all large exchanges with deep derivative and spot market liquidity, it is very accessible. Perpetual futures and options add another layer of reflexivity, due to leverage, which can catalyze crushes or rallies.

Speculative traders weighing Doge’s price typically combine technical analysis with funding data and open interest to determine whether leverage can cause subsequent motion.

These speculative layers are why sudden spikes in price can appear unsubstantiated and make Dogecoin’s market cap shoot to and sometimes past the tens of billions virtually overnight.

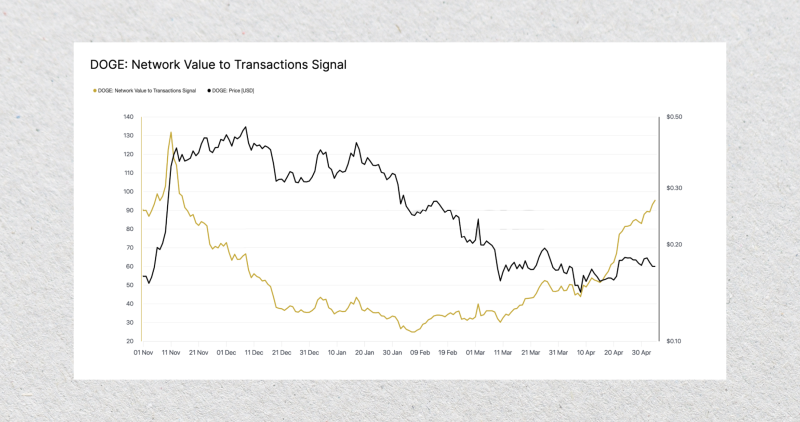

Recent Price Analysis (Last 3–6 Months)

In the last six months, Doge’s price has displayed resilience but remains tied to external catalysts. Compared with other meme coins, it still leads in liquidity and recognition, but newer meme coins occasionally steal attention and capital.

Unlike an equity strategy guided by a stock advisor service promising steady stock advisor returns and market-crushing outperformance compared to benchmarks, Dogecoin remains a speculative asset whose rallies can produce monster returns for many investors, but also sharp retracements in bear markets.

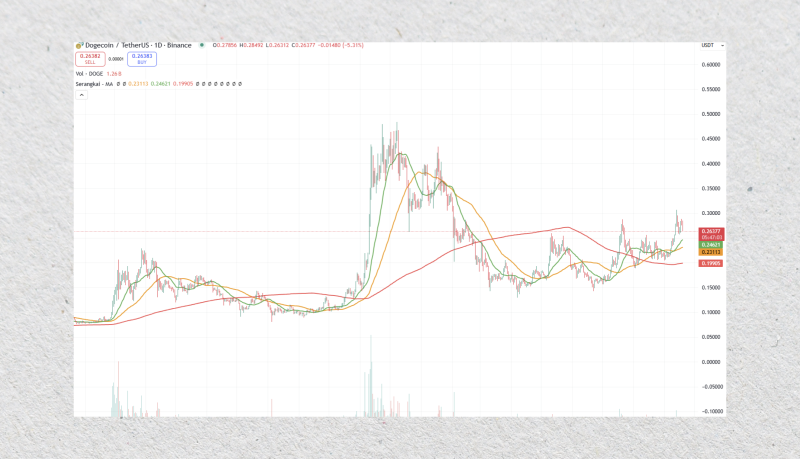

Trend and Moving Averages

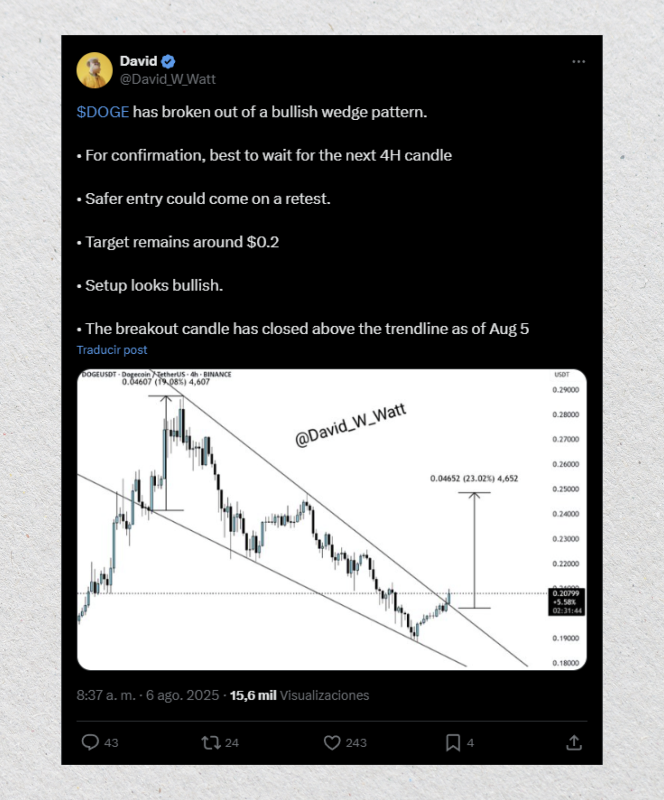

The Dogecoin price has shown areas of strength in recent months and has formed a series of higher lows, reflecting that buyers are consistently regaining dominance.

Those who are tracking 50 and 200-day moving averages have seen those two lines converge towards a bullish cross, a technical pattern willingly conceived as a medium-term confirmation of trend. While Dogecoin has temporarily fallen below its 200-day moving average, the rebound speed has left sentiment intact.

For those who are wondering if Dogecoin reached $1 at some point, these trend signs reflect some optimism, but must be considered in the broader context of market cap studies and liquidity.

Momentum and Technical Indicators

These kinds of indicators, like RSI and MACD, show back-and-forth strength and weakness. Daily chart RSI divergences have preceded short-term peaks, and MACD crossings have formed entries correlating well with recent gains.

Realized volatility has squeezed at some windows, a concept suggesting a breakout is possible. However, history has proven that Doge’s price is prone to react more aggressively than ordinary technical studies suggest, at least when comparing to other meme coins and newer meme coins with the ability to gain buzz out of nowhere.

Structure and Market Levels

Significant support has formed near closely watched psychological levels, and areas of resistance have formed near previous swing peaks. Volume profile charts indicate that liquidity is concentrated at these points, making them areas that traders need to monitor.

Breakouts through resistance can cause abrupt rallies whenever sentiment is gaining crypto-wide, and invalidations below support bases would spoil any plans for a bullish tilt.

Many commentators note that Doge’s price has a way of staging reverse rallies, regardless of fundamentals, when those are neutral, and backing its hold among other meme coins as being extremely narrative-driven.

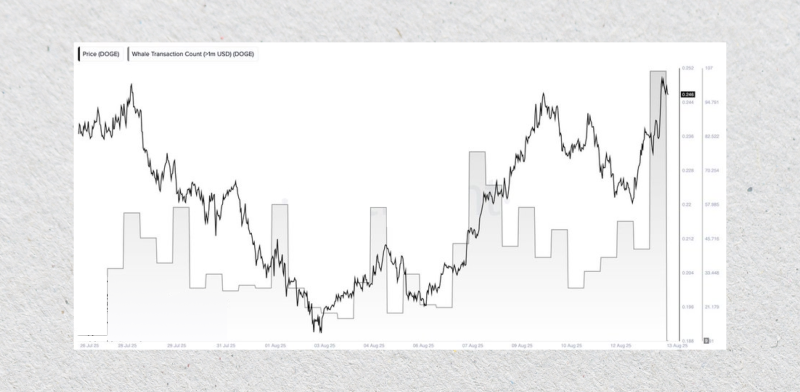

Flows and Whale Activity

On-chain metrics indicate that mutual change flows are neutral. Net outflows at specific intervals are a sign of accumulation, while sudden inflows tend to come before local peaks.

Whale action is once again a two-sided coin: certain large bags control an outsized supply, and their movements can swing Doge’s price by double what is expected.

Derivative funding rates and open interest have at times spiked, highlighting volatility. For traders wondering whether Dogecoin will touch new peaks, these flow metrics are worth double those of ordinary chart formations.

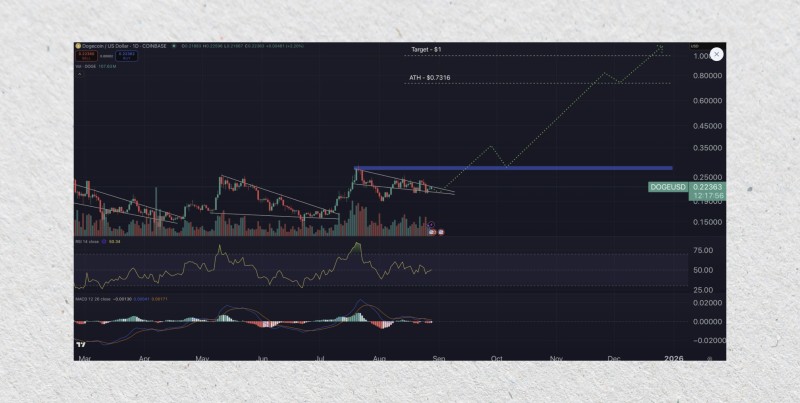

The $1 Scenario Math

The most popular query regarding Dogecoin is whether it is ever likely to see Dogecoin’s price touch and maintain the figure of $1. To figure that out, we will have to study figures intensely, forecast supply for the future, and compare it to both the broader crypto marketplace and other meme-based coins vying to join its fans.

Today’s Snapshot

With the current circulating supply of some 145 billion DOGE, a $1 valuation would create a market cap of approximately $145 billion. To scale, this would position Dogecoin larger than several mature financial institutions and solidly amongst the global leading crypto holdings.

Even compared to other meme coins, this scale is unrivaled. Shiba Inu and Pepe, with all their parabolic price runs, trade with substantially smaller market caps. This illustrates structurally why it is challenging to maintain Dogecoin’s price at $1.

Forward Supply Projection

As Dogecoin injects a fixed 5 billion coins per year, the supply always grows. In 5 years, the circulating supply will total near 170 billion DOGE, so for Doge’s price to hit $1 by then, the necessary market cap will swell to $170 billion. Continuing this further, over the next 10–15 years, the threshold only grows bigger.

This inflationary supply paradigm is one reason why traders like to rotate out of veteran meme coins during speculative periods—lower supply bases can grab eyeballs and shine with faster possible upside. Nevertheless, Dogecoin’s mature brand name continues to make it the yardstick by which meme coins are measured.

Comparables and Scale

For reference, Ethereum’s market capitalization is often in the ballpark of $250–$400 billion during bull runs. To get to $1 for Dogecoin, its price would need to go to ranges commonly only observed by core infrastructure protocols and not lightweight payment protocols.

Amongst other meme coins, none has yet approached this threshold, and it lends credence to the belief that if any meme coin is to achieve it, it would be Dogecoin.

However, traders should never forget hype-based run-ups to newer meme coins are capable of outperforming DOGE percentage-wise for a specified time period, while Dogecoin is still significantly ahead by a large margin in liquidity.

Liquidity and Market Depth

It is possible to reach $1 on an intraday wick, especially if derivatives markets overshoot the move. However, to keep Doge’s price at $1 would require colossal buy-side depth and liquidity on exchanges.

Thin order books can potentially amplify Doge’s price action at mania high points, but continued consolidation staying above $1 would require constant demand to keep pace with Ethereum and close in line with Bitcoin. This is a much steeper barrier to other meme coins.

Short-Term Wicks vs. Sustained

There is a massive distinction between Doge’s price temporarily reaching $1 and successfully closing several daily or weekly candles above it. Traders need to keep in mind that derivatives leverage can create fleeting extremes only to see those quickly deflate and leave retail buyers vulnerable.

This has already occurred with some newer meme coins, whereby rallies diminished after only a few days. Due to its already established presence, Dogecoin has greater staying power, yet the same risk persists.

Scenarios and Probabilistic Outlook

To see if Doge’s price will maintain at higher levels in later years, it is useful to sketch out three possible scenarios: bullish, base, and bearish. Each describes how macro circumstances, liquidity, and competition from other meme coins are likely to develop.

Bull Case: Road to $1

Even in the best-case scenario, with a combination of macroeconomic tailwinds, a new meme supercycle, and large payments adoption momentum, Dogecoin can hit levels close to $1.

For it to do so, global liquidity has to improve, risk assets have to rebound, and retail demand for meme coins has to return with full vigor. Adoption by merchants of DOGE as a payment method has to go mainstream and augment payment volume while solidifying Dogecoin’s position as the first among other meme coins.

If there is alignment like this, it is possible that Doge’s price can briefly touch, and/or consolidate near $1, but sustaining it would require a market cap akin to those of large infrastructure chains.

Base Case: Range-Bound with Episodic Spikes

The more probable case is a price range-bound market for Doge, producing sporadic rallies during speculative manias but ultimately printing lower highs than the 2021 all-time high.

On this base case, Dogecoin stays ahead of other meme coins by virtue of its liquidity and recognition, but is never quite capable of differentiating itself beyond speculation.

New meme coins will sporadically come into favor and temporarily outpace DOGE, siphoning capital from it only to wither away. Without new sources of structural demand, it is unlikely Dogecoin will hit $1 in this case, but volatility-driven rallies can yet cause huge short-term gains in price.

Bear Case: Dilution and Meme Fatigue

The bear case envisions a persistent liquidity shortage scenario, tighter monetary policy, and dwindling interest in meme coins. Here, Doge’s price consistently trails Bitcoin and Ethereum and is diluted by 5B DOGE’s once-a-year issuance.

As retail interest permanently shifts to newer meme coins or other speculative vehicles, Dogecoin risks losing cultural dominance. Slowly through time, and with ongoing boosts to supply and diminishing demand to compensate, DOGE can grind lower and lower until the idea that Dogecoin can reach $1 is literally off the table.

Conclusion

Dogecoin has proven it’s far more than a fleeting internet joke. Its cultural power, loyal community, and presence on nearly every exchange give it staying power that most other meme coins can’t match.

Still, Doge’s price depends heavily on liquidity cycles, speculation, and sentiment rather than fundamentals. Reaching $1 is mathematically possible, but sustaining it requires conditions usually reserved for the largest crypto assets by market cap.

For now, Dogecoin remains the unpredictable heart of the meme coin world—capable of sudden surges and dramatic reversals, but always at the center of the conversation.

FAQ

Will Dogecoin reach $1?

It is possible, but sustaining $1 would require a massive market cap and extraordinary demand.

How much is 1 Dogecoin worth today?

The value changes daily—always check the latest DOGE to USD price.

Is Dogecoin inflationary?

Yes. Around 5 billion new DOGE are issued each year, lowering the percentage inflation rate over time.

How does Dogecoin compare to other meme coins?

It leads in liquidity and recognition, though newer meme coins can sometimes grab short-term attention.