B2Broker Raises the Leverage for Major FX Pairs to 1:200

Apr 18, 2024

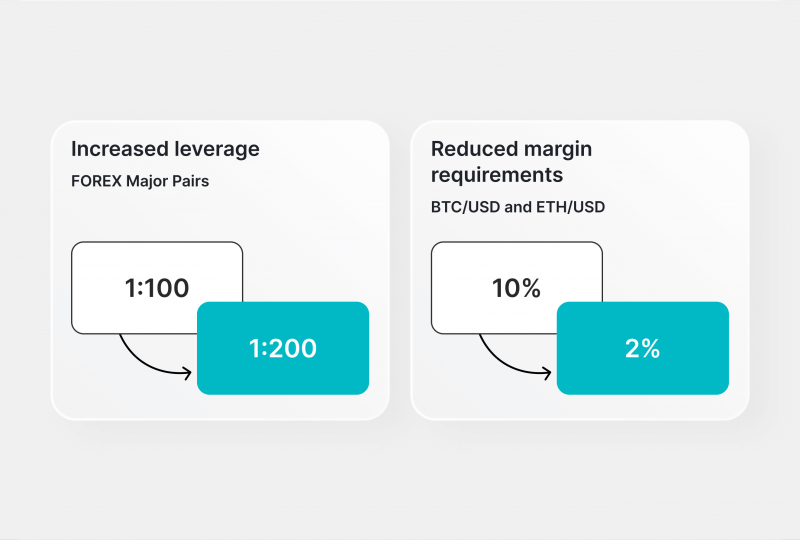

B2Broker, a leading Prime of Prime liquidity provider dedicated to excellence in meeting clients’ requests, announced raising the leverage to 1:200 for major FX pairs, thereby reducing the margin requirements from 1% to 0.5%.

Additionally, in response to the clients’ demands for higher leverage in the cryptocurrency market, the company has increased the leverage up to 1:50 for BTC/USD and ETH/USD. Thus, margin requirements are reduced from 10% to 2%, which can significantly enhance B2Broker clients’ market position.

Exploring B2Broker Liquidity Solutions

B2Broker has been in the industry for over a decade already. The company offers 1500+ instruments across eight asset classes, such as FOREX, Crypto CFD, Spot Indices, Precious Metals, Single Stocks, ETFs, Commodities and NDFs CFD.

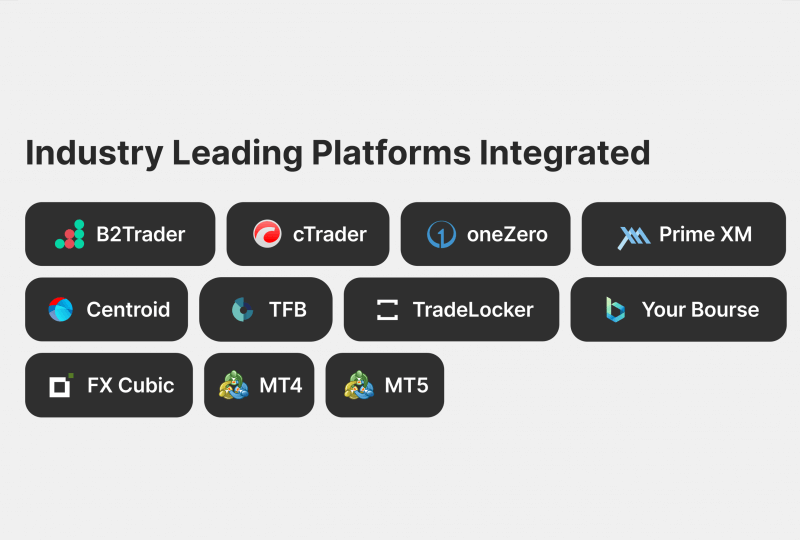

It ensures access to deep liquidity pools from Tier-1 providers, facilitating tight spreads and ultra-fast execution. Advanced technology platforms and FIX API integrations like B2Trader, cTrader, oneZero, Prime XM, Centroid, TFB, TradeLocker, Your Bourse, FX Cubic, and MT4/MT5 allow for seamless connectivity across multiple trading systems.

B2Broker’s infrastructure supports aggregation and distribution of liquidity across multiple channels, improving trade execution and risk management.

B2Broker’s liquidity solutions stand out due to their robust system, numerous connectivity options, and ability to tailor liquidity setups to fit each client’s needs.

Being an industry leader, the company has introduced multiple innovative solutions. One of them was last year’s introduction of NDFs as a new asset class in the form of CFDs, with the advantage of next-day settlements. B2Broker pioneered spot and perpetual futures CFDs, offering competitive margin conditions and crypto CFDs based on spot and perpetual futures LPs.

Over 250 institutional clients and 30 professional funds have strengthened the company’s balance sheet, enabling it to fulfil client demands and increase leverage. This increased leverage on highly demanded trading pairs in key markets like FX and Crypto allows brokers to provide traders with greater capital management flexibility, broadening their client appeal to a larger user base.

John Murillo, Chief Dealing Officer of B2Broker Group of Companies, remarked:

“This strategic update not only enhances our clients’ competitive edge but also augments their capacity to cater to the evolving demands of their clientele, attract new business, and elevate their service standards by leveraging our liquidity solutions.

Thanks to our robust balance sheet and extensive client base, coupled with our impressive trading volumes, we stand at the forefront of the market. Our innovative mindset has been evident throughout our journey. We were the first to introduce crypto CFDs based on spot and, later, on perpetual futures. In addition to FOREX, today, we proudly offer over 150 crypto CFD pairs, a testament to our commitment to innovation and meeting the diverse needs of our clients.”

Final Remarks

B2Broker, a leading FinTech leader, has significantly impacted the industry over the past decade. Their comprehensive ecosystem offers solutions for various business models, and their commitment to innovation ensures clients stay competitive.

The recent update has boosted the company’s financial services, providing better deals for large clients such as professional traders, hedge funds, and other financial companies.

Contact the B2Broker representatives for tailored solutions that drive success!

Email: [email protected]

Phone: +44 208 068 8636

Website: b2broker.com