B2BROKER Releases B2TRADER 2.5 — Boosting Perpetual Futures and Revamping UI/UX

June 18, 2025

B2BROKER, the leading liquidity and technology provider in the financial services industry, has updated its trading platform, B2TRADER, to version 2.5.

This release aligns with the fast-paced market changes and dynamic user preferences, highlighting the emerging trends in Forex, CFD, and crypto trading.

The company invested over $12 million in developing B2TRADER to create the ultimate infrastructure for growth in today’s markets. It brings all financial instruments, asset classes, and trading capabilities in a single platform, putting advanced tools and features at the user’s fingertips and attracting a broad range of trading professionals and market experts.

The thriving trading landscape is at its peak, with approximately 15 million active FX traders, 50 million crypto traders, and over 560 million digital asset holders worldwide.

This growth presents various opportunities for FX brokers adopting crypto assets, as well as crypto exchanges venturing into the Forex/CFD space. Therefore, market participants require cutting-edge solutions that respond to their increasing needs, which is what B2BROKER aims to do.

The B2TRADER 2.5 boosts the platform’s capabilities with perpetual futures and expanded CFD trading capabilities. Let’s dive deeper into this new update and see what it provides.

Fully Supported Perpetual Futures

One key feature of the new B2TRADER 2.5 update is the integration of Perpetual Futures as a whole new asset class. This introduction enables brokers to provide a comprehensive derivatives service, catering to the rising demand for these advanced instruments in the digital asset space.

Perpetual futures have been remarkably growing in the crypto market, with trading volumes overtaking those of the spot market. In 2024, activity on top exchanges exceeded $58 trillion, nearly doubling the amount from the previous year, indicating a growing market interest.

Here are a few advantages that perpetual futures provide:

- High Liquidity: Provide access to deep, active markets characterized by a growing and sustainable interest.

- More Instruments: A growing range of instruments and assets for investors to explore and trade.

- Easy Access: Flexible speculation opportunities without having to physically own the underlying asset.

- Efficient Hedging: Efficient risk management strategies by offsetting volatile market orders in other markets (Spot and CFDs).

- New Opportunities: Unlocking a new range of strategies, such as capitalizing on periodic funding rate payments.

Unlike spot markets, perpetual futures support margin trading through leveraged positions. Moreover, they provide better transparency than contracts-for-differences (CFDs) and over-the-counter (OTC) markets.

This broad range of instruments and asset classes offers multiple strategic trading and risk management capabilities. For example, traders can combine multiple orders to hedge against risky positions, which gives brokers a boost to their trading volume and earnings.

Brokers can utilize this addition to attract experienced traders and capitalize on a growing crypto market share, building a comprehensive, exchange-grade investing environment for all users.

Improved FIX Routing via One Connector

The new update also focused on improving the trade execution mechanism by allowing brokers to route client orders to a liquidity provider through a single market connection.

Thereby simplifying the workflow by utilizing custom FIX tags to identify and process orders, thereby improving overall performance.

This addition replaces a complex, manual workflow with a fully automated one that ensures execution via precise FIX settings, significantly reducing the administrative workload for the broker.

Brokers can achieve better liquidity management flexibility by selecting a suitable execution model, whether a segregated or single-connection method, which offers more control over brokerage operations.

Boosted Prime Brokerage CFDs

Another key update in the B2TRADER 2.5 is the platform’s capability to act as a Prime Brokerage solution for all available asset classes, including Spot, CFD, and Perpetual Future markets.

This was achieved by the new markup functionality and advanced execution logic, including dedicated FIX tags and Netting PAS. These tools will enable brokers to control the whole trade lifecycle using internal systems, pretty much like a liquidity hub.

Brokers can now enjoy better management over revenue streams, handling and applying custom markups to optimize profitability and align their offerings with their business objectives.

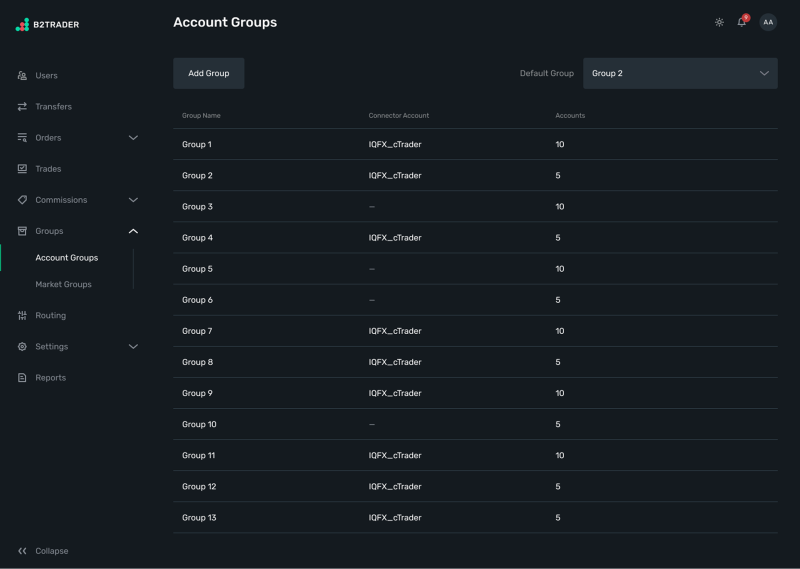

Redesigned User Interface

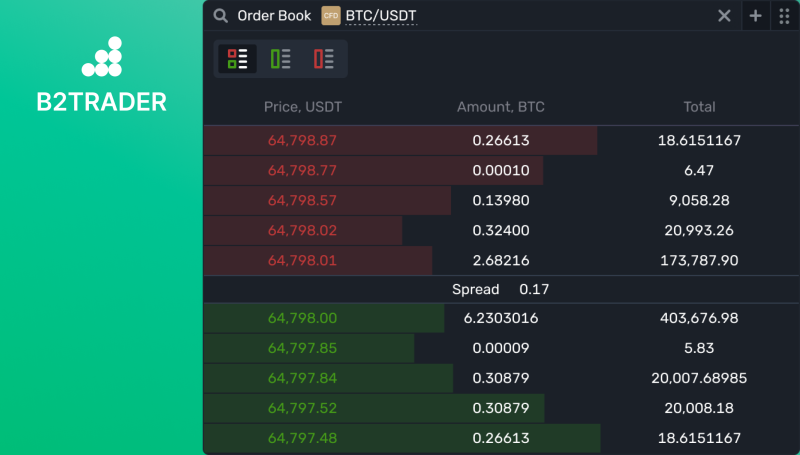

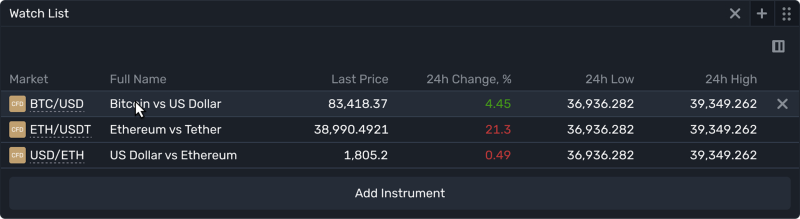

As part of the update, B2TRADER has undergone a major UI overhaul that focused on simplicity and efficiency. The new design displays more critical data and reduces waste, providing faster and better analysis.

The dashboard now offers a more compact design, featuring an “S-Size” table layout on many widgets, which reduces padding, provides slimmer rows, and ensures perfectly aligned numerical data.

These changes reflect B2BROKER’s commitment to ensuring modern design solutions that resonate with client preferences by focusing on improving the user experience and ease of use.

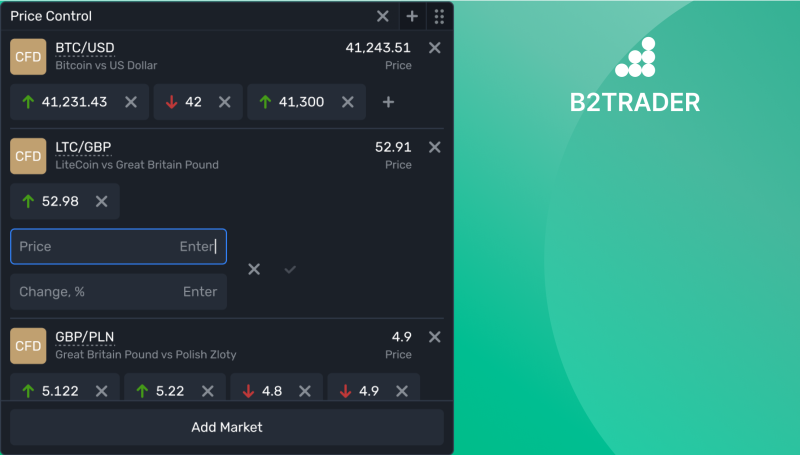

More Personalized and Price Alerts

The update also introduces a fresh-looking Price Control Widget with better price alert management. Traders can adjust notifications and track market movements more quickly, efficiently, and with greater flexibility.

With a single click, users can modify price alerts by editing the current values, supporting faster monitoring and analysis. When a new market is added to the widget, the input fields will automatically open for editing.

Concluding Thoughts

The new B2TRADER 2.5 release offers a strategic move towards user convenience and empowerment, as B2BROKER strives to offer a similar experience to brokerages of all sizes.

The focus on flexibility and efficiency makes the B2TRADER trading platform suitable for different business models, whether for launching a new business or expanding an existing platform.

It offers traditional brokerage firms a smooth transition into crypto assets and contemporary trading instruments, while offering crypto-focused, modern brokerages an entry to Spot and Perpetual Futures.