B2CONNECT Liquidity Hub: Rebranding, New Features, and Better Connectivity

Nov 05, 2024

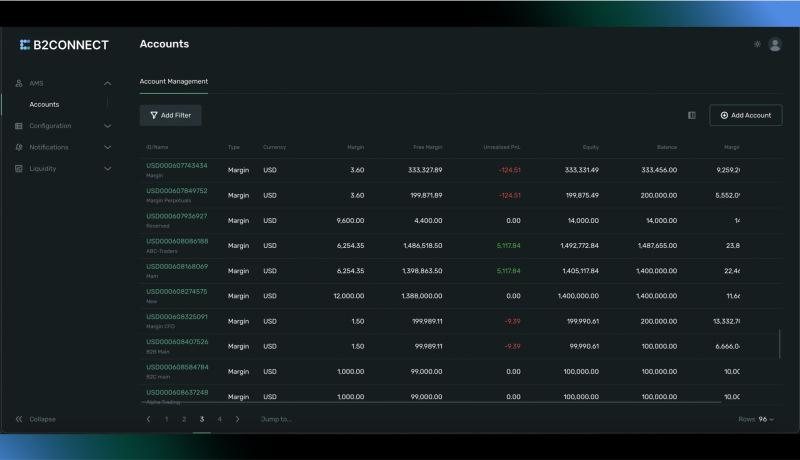

B2BROKER is pleased to announce a significant rebranding and technology upgrade for its premier crypto liquidity hub, formerly known as MarksMan LDE. Now called B2CONNECT, the platform provides crypto brokers and exchanges with seamless access to both spot and futures liquidity for digital assets, offering options for top-of-book and full market depth pricing alongside advanced price construction and risk hedging tools.

In addition to the rebranding, B2CONNECT introduces several key updates, including integration with the B2TRADER Spot Broker, the new Binance Futures WebSocket API, and a fully integrated adapter for Crypto.com.

These enhancements elevate B2CONNECT’s capabilities, positioning it as a powerful gateway to first-class digital asset liquidity pools.

The Rebrand Story: From MarksMan to B2CONNECT

B2BROKER has rebranded its liquidity hub as B2CONNECT to emphasize its primary value – connectivity. This new identity underscores the platform’s commitment to forging robust and efficient links between liquidity providers and trading venues.

As part of this rebrand, B2CONNECT will continue advancing as a leading liquidity infrastructure provider, offering on-demand access to deep liquidity, bespoke integration options, and cutting-edge trading technology.

“We’re genuinely thrilled to bring this significant update to our clients. This release is an important step in B2CONNECT’s development into a standalone product that delivers leading connectivity solutions to Forex and crypto brokerages and exchanges. It also strengthens its role as a major liquidity infrastructure next to our Prime of Prime multi-asset liquidity offering.”

Ivan Navodniy, Chief Product Officer at B2BROKER

Enhanced Connectivity with the B2TRADER Brokerage Platform

One of the standout enhancements for B2CONNECT is the integration of the B2TRADER Spot Broker among its supported trading platforms. This addition introduces an array of innovative features designed to streamline order execution and enhance the user experience. Key among these is a custom FIX API endpoint, which enables efficient access to market data and contract specifications.

Together with a customized order execution flow, these endpoints create a seamless link between B2CONNECT and B2TRADER, ensuring smooth, cohesive interaction between the two systems.

Comprehensive Liquidity Adapter for Crypto.com Now Available on B2CONNECT

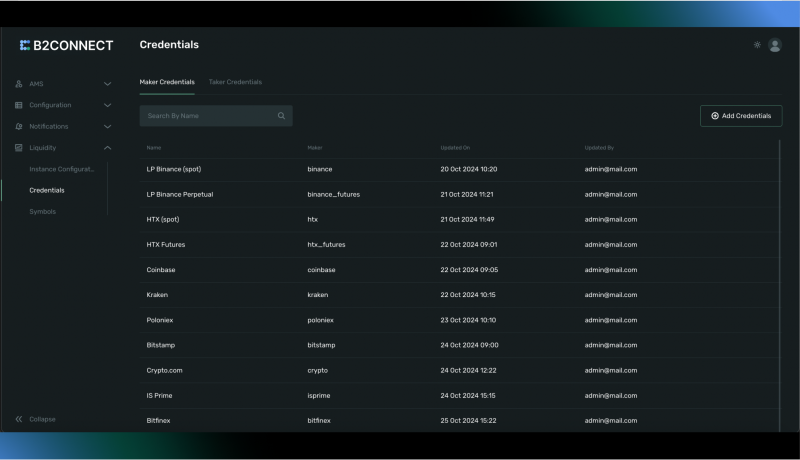

The Crypto.com liquidity acquisition adapter is now fully accessible to all B2CONNECT Liquidity Hub clients through the FIX API. Crypto.com, a prominent cryptocurrency exchange, has become a favored choice for B2B clients looking for direct market access.

With this new integration, B2CONNECT clients can enhance their offerings with expanded trading pairs, boosting their capacity to diversify and manage risks, including counterparty and regulatory concerns. The adapter provides access to comprehensive price feeds (Level 2 quotes) and supports seamless order placement, execution, and confirmation.

These processes operate concurrently, maximizing throughput while minimizing latency for a highly efficient trading experience.

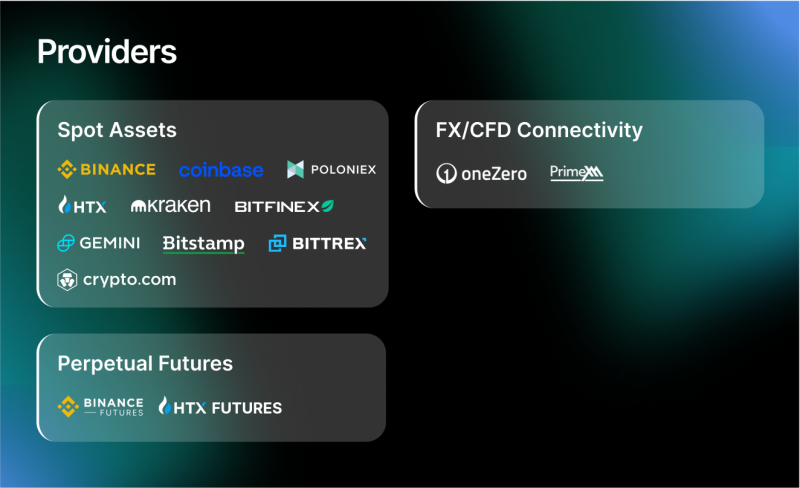

In addition to the newly integrated Crypto.com adapter, B2CONNECT offers a seamless, structured flow from top centralized crypto exchanges like Binance, Coinbase, Kraken, HTX, Gemini, Bitstamp, BITFINEX, BITTREX, and Poloniex. This extensive connectivity ensures clients have consistent and reliable access to a wide range of liquidity sources.

High-Speed Perpetual Futures with Binance WebSocket API on B2CONNECT

A standout enhancement in this update is the integration of Binance Futures’ new WebSocket API into the B2CONNECT Liquidity Hub. Launched by Binance earlier this year, this high-speed API represents a substantial advancement in order execution for perpetual futures. The WebSocket-based API supports full-duplex, bidirectional communication, significantly improving trading efficiency.

With this new integration, B2CONNECT has achieved a fourfold improvement in average round-trip time for trades, delivering faster order execution and providing end users with smoother, more responsive trading experiences.

Future Growth with B2CONNECT: Expanding Connectivity and Setting New Standards

Looking ahead with B2CONNECT, the vision remains focused on expanding connectivity services and establishing new benchmarks within the industry. Currently, B2CONNECT aggregates spot and futures liquidity from leading crypto exchanges, including Binance, Binance Futures, Coinbase, Kraken, Gemini, Bitstamp, HTX, HTX Futures, and more, with plans to further broaden its network.

With the addition of new platforms such as B2TRADER and Crypto.com, alongside innovative technologies like Binance Futures’ WebSocket API, B2CONNECT is poised to create seamless connections with key market participants, enhancing access and efficiency for all clients.Discover more about the latest B2CONNECT updates here!