B2BROKER Releases B2TRADER 2.3 & 2.4 with oneZero Integration and Advanced Order Controls

Apr 29, 2025

B2BROKER, a liquidity and technology provider for the financial trading industry, has introduced significant updates to its flagship multi-asset trading platform, B2TRADER.

With a focus on delivering enhanced functionality for brokers, exchanges, and institutional traders, the latest versions—2.3 and 2.4—bring improved connectivity, refined interface elements, and upgraded trading controls.

B2TRADER continues to serve a wide range of markets, including spot, crypto, and CFDs, offering users flexibility and precise control in their trading operations.

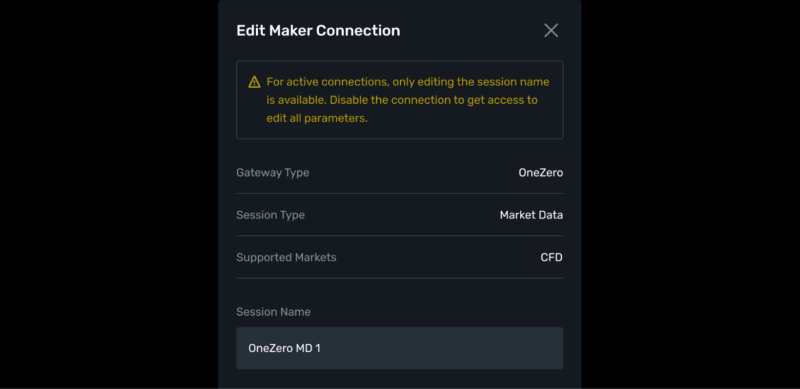

Expanded Liquidity Access Through oneZero Integration

Among the most notable upgrades is B2TRADER’s complete integration with oneZero, a prominent liquidity and distribution platform. This development enables B2TRADER to support both quote streaming and order routing through the oneZero network.

The added flexibility allows brokers to access broader liquidity pools and adjust execution routes dynamically. With this, the platform aims to improve trade execution quality and extend market coverage, while maintaining compatibility with B2TRADER’s multi-connect capabilities.

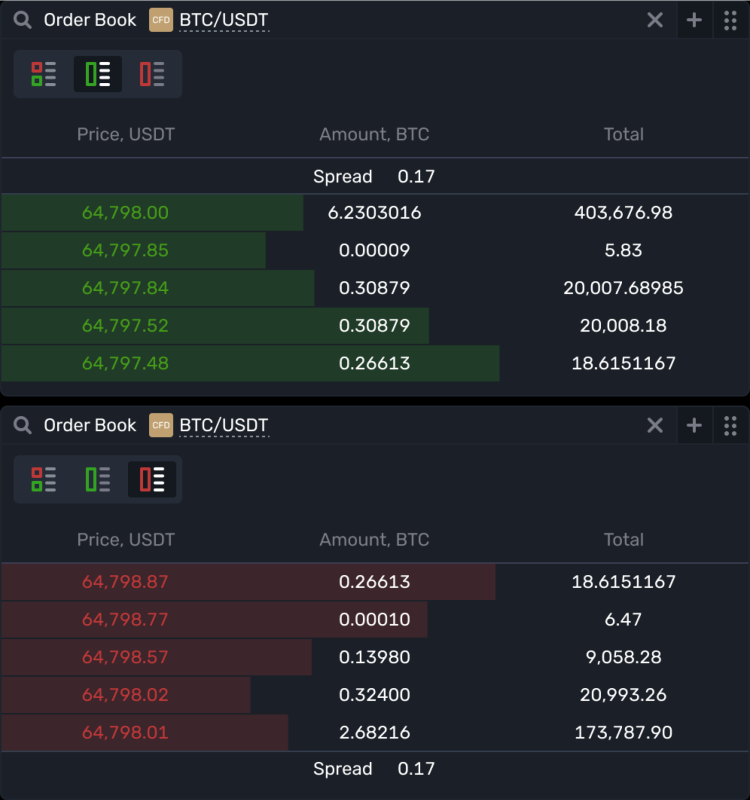

Focused Order Book Views

A new filter function has been added to the order book widget, allowing users to isolate buy orders (Bids) or sell orders (Asks). This feature offers a cleaner, more focused view of market activity, which is especially beneficial for traders analysing order depth and volume, such as scalpers or those employing high-frequency strategies.

Custom Tab Reordering for Improved Workspace

The trading terminal now features enhanced customisation through drag-and-drop tab reordering. Users can rearrange tabs within widgets in a single window, helping them create a layout tailored to their individual preferences and trading approach. This update supports a more efficient and intuitive workspace setup.

Visual Position Markers on Trading Charts

B2TRADER now visually displays open trading positions directly on charts. Traders can quickly view position size, unrealized profit or loss, and any assigned Take Profit or Stop Loss levels. Each position is also colour-coded to indicate whether it is long or short, offering greater clarity for real-time decision-making and position tracking.

Backend Addition: Market Order Price Requests

In the backend, a useful enhancement for brokers has been introduced—B2TRADER now calculates the “Requested Price” for market orders. This capability helps brokers determine income generated through Tier Markups facilitated by the B2CONNECT hub, supporting more precise financial tracking.

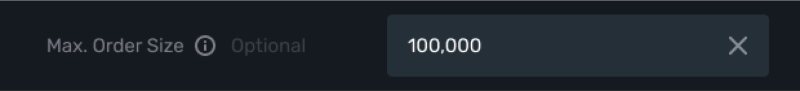

Risk Control via Max Order Size Setting in SPOT Markets

Platform administrators gain a new risk management tool with the ability to set maximum order volume limits for SPOT market trades. This function allows tighter control over order sizes, reducing the risk posed by unusually large transactions and supporting stable market performance.

Commitment to Consistent Improvement

With these updates, B2BROKER reinforces its mission to offer robust and user-centric trading tools. Versions 2.3 and 2.4 of B2TRADER deliver more seamless liquidity access, greater interface flexibility, and new features for risk and trade management—continuing the platform’s evolution in response to the needs of modern traders.