B2TRADER Releases V2.6: Automated Perpetual Futures, Upgraded Dealing Desk and More

July 24, 2025

A few months after the recent updates to its native trading platform, B2BROKER announced B2TRADER 2.6 — the latest release of its multi-market, multi-asset trading platform, which powers brokers, exchanges, and other financial firms seeking to expand in the brokerage world.

This update focused on providing more control tools for brokers and traders alike, expanding the Dealing Desk, and adding custom Trader Reports. Also, Automated Perpetual Futures have been added, adding more efficiency in trading these highly demanded financial instruments.

Let’s explore the new updates and what B2TRADER 2.6 has in store.

Upgraded Dealing Desk: Full Brokerage Control

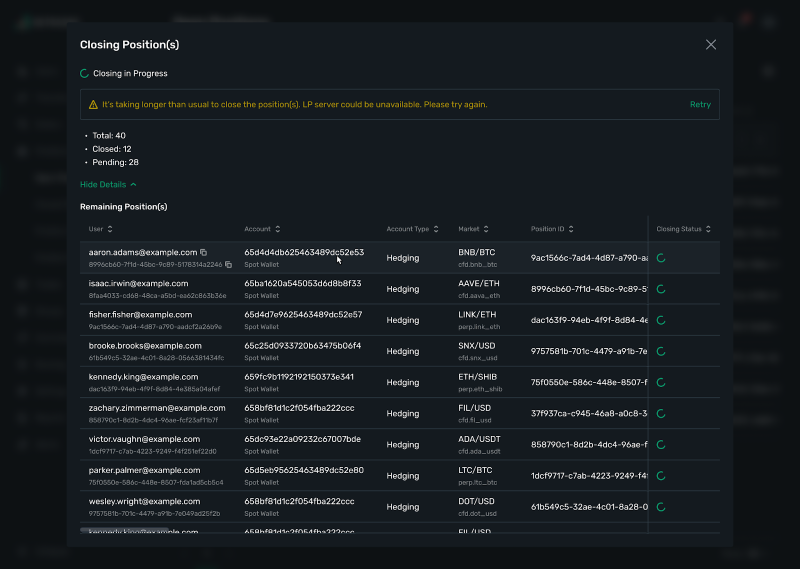

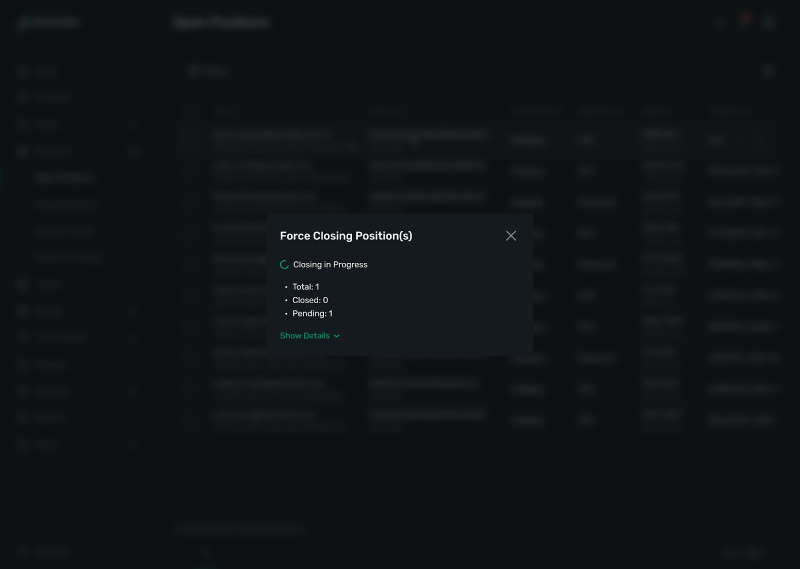

The new B2TRADER 2.6 supports brokers with risk management by introducing a fully controlled Dealing Desk. This gives admins advanced control over trading activities, enabling them to manage open and pending orders right from the backend.

This includes fully or partially closing positions, cancelling pending orders, and adjusting the Take Profit or Stop Loss limits more easily.

Moreover, brokers can use the “Force Close” function to liquidate any position at the last available price instantly, even when trading sessions are closed or the market is disabled.

This tool is crucial to managing risky accounts and handling terminated user positions.

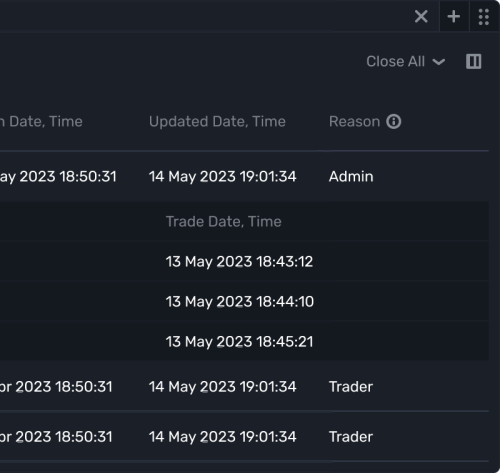

To add more transparency to this sensitive process, all actions are timestamped, recording if the activity was triggered by a team member, the trader, or a system event. This simplifies trail-auditing for compliance and support inquiries.

This feature is a fundamental Dealing Desk upgrade that improves how brokers manage activities on their platforms securely and at scale.

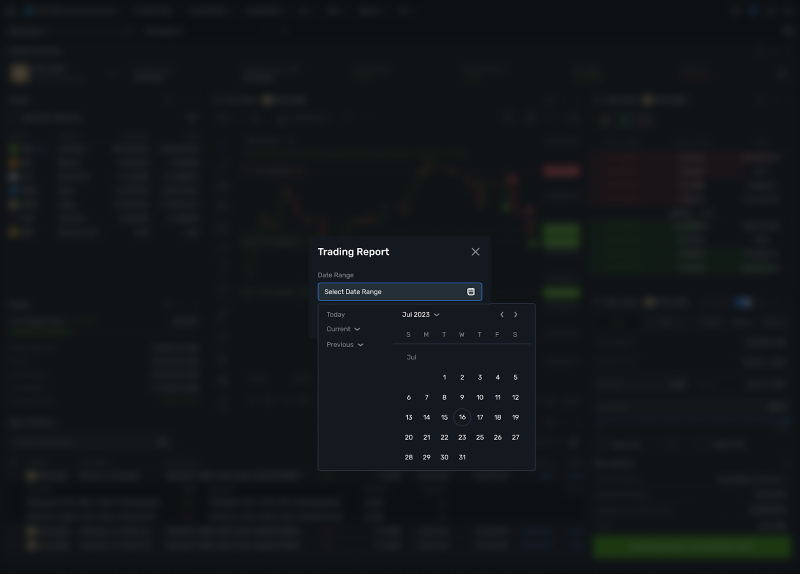

On-Demand Trader Reports: Better Transparency & Trust

The new release also introduced on-demand Trader Reports, which provide end-users with a transparent record of their trading activities and transactions directly from the terminal.

This comprehensive report includes closed positions, processed orders, executed trades, conducted transfers, and complete account statements with profit & loss summary and commissions.

Clients can access this feature from the Settings menu, where they can select a date range of up to 92 days and download the data as a CSV file.

This functionality can enhance client satisfaction and reduce the team’s workload by reducing the manual handling of such queries through the support team, ultimately fostering long-term customer relationships.

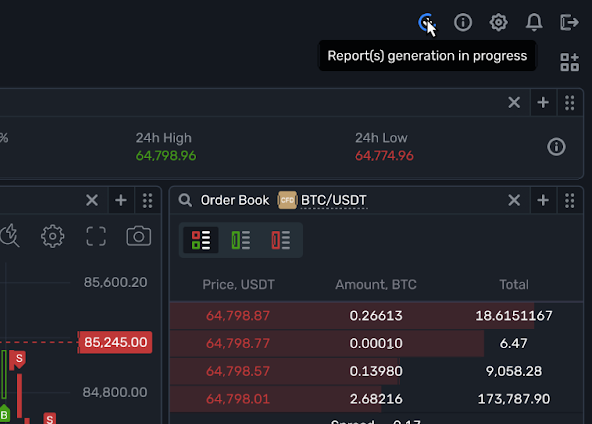

Automated Perpetual Futures: Efficient Rate Listing and Update

Another key introduction in the B2TRADER V2.6 release is automated Perpetual Futures management, which allows admins to create and update quotes directly from the B2CONNECT hub for increased efficiency.

Opposite to the usual practice of manually configuring each perpetual contract, B2TRADER now eliminates this workflow completely. The new approach automatically syncs and populates market listings, ensuring that offerings are always up-to-date without requiring any administrative intervention.

This will save time and enable businesses to be more agile and efficient. Brokers can now launch new, in-demand perpetual futures contracts whenever they become available, offering an essential time-to-market advantage.

The system will automatically synchronize any update to market settings from the liquidity provider. For example, changes in lot sizes or other parameters will instantly apply, guaranteeing platform compliance and improving the trader’s experience.

Check Full Release Notes on B2BROKER

Final Takeaways

B2TRADER V2.6 expands on the recently added perpetual futures and gives users (brokers and traders) more control over their activities and operations.

This makes multi-market brokerage more accessible to all businesses, from small startups to established financial firms looking to expand into new markets.

Contact the B2TRADER team to learn how to launch your multi-asset brokerage