Bitwise 10 Crypto Index Fund Application Ready – Will The SEC Approve it?

Nov 28, 2024

It is fair to say that the crypto industry is buzzing with the potential restructuring of the SEC, hoping for a more crypto-friendly approach by the next chairman.

Bitwise has been among the first asset management firms to add crypto ETFs to its trading platform, allowing traditional investors to indulge in the crypto market through a centralized institution. This adoption gave traders confidence in digital assets and saw a massive inflow into Bitcoin and Ethereum ETFs.

Investors are now waiting for the approval of the Bitwise 10 crypto index fund application to increase exposure to more virtual coins amidst the current market frenzy. Will Bitwise’s application go through?

New Bitwise Crypto Index Fund Filing

On 27 November, Bitwise applied to the US Securities and Exchange Commission to list a new crypto-based exchange-traded fund. The new index ETF will comprise the top 10 cryptocurrencies with different weights allocated for each asset.

This records the second filing attempt for the Bitwise crypto index fund after trying the first launch in 2017, which was not approved due to regulatory concerns and financial challenges.

The new Bitwise 10 crypto index fund will include Bitcoin, Ethereum, Bitcoin Cash, Cardano, Solana, Ripple, Chainlink, Polkadot, Avalanche, and Uniswap.

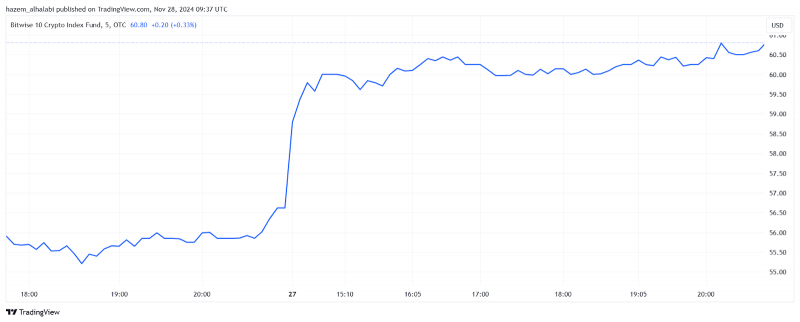

Bitwise shares saw a massive increase following this news. After as low as $30 for the majority of the year, BITW stock jumped to $60, recording a 66% surge compared to the last month and a 9% growth in one day.

What is a Crypto Index Fund ETF?

A crypto index fund ETF is a financial instrument that combines and tracks the market performance of multiple assets without actually holding the underlying securities.

The Bitwise crypto ETF tracks the price action of the associated currencies, giving investors higher exposure to high-risk assets without holding and storing virtual coins.

Bitwise 10 Crypto Index Fund: Governance and Allocations

Bitcoin will have the largest percentage of Bitwise ETF due to its advanced ecosystem and widespread adoption, while other assets will have different weights as follows:

- Bitcoin: 75.14%

- Ethereum: 16.42%

- Solana: 4.3%

- Ripple: 1.56%

- Cardano: 0.66%

- Avalanche: 0.55%

- Chainlink: 0.39%

- Bitcoin Cash: 0.38%

- Uniswap: 0.31%

- Polkadot: 0.30%

The firm named its crypto component partner Coinbase Custody, while the Bank of New York Mellon will serve as the custodian of cash holdings, transfer agent, and administrator.

Conclusion

The new Bitwise 10 crypto index fund application comes in light of Gary Gensler’s awaited exit. The asset management firm is most likely taking advantage of the SEC’s struggle with new appointments under Trump’s administration.

While Bitwise waits for its XRP spot ETF application, passing the new index proposal can place the firm as the top choice for investors looking to gain exposure to the crypto market through regulated institutions.