Intel’s Job Cuts May Signal a Tough Winter for the Tech Industry

Oct 13, 2022

With the macro outlook gloomier than ever, Intel may become the latest technology company to announce job reductions. This may signal a bitter winter for the industry. On the macro scale, however, there are good reasons to be a little more optimistic.

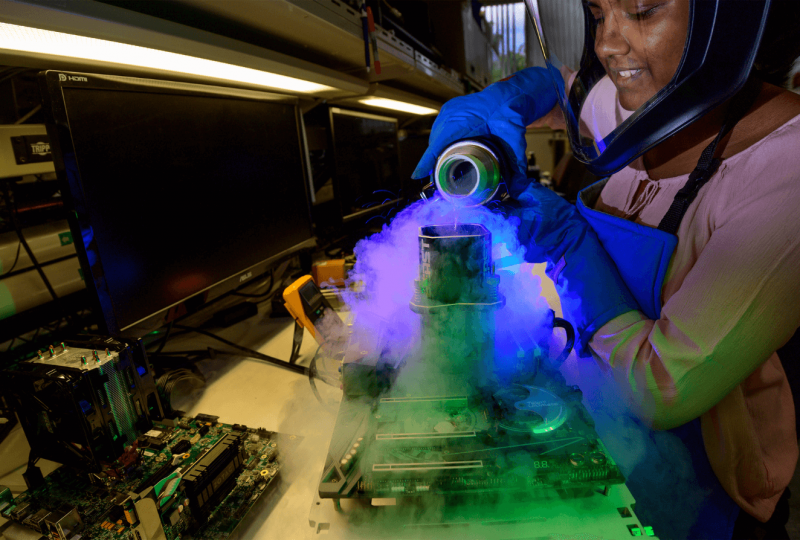

According to Bloomberg, which cited unnamed sources familiar with the matter, Intel is expected to announce the layoffs of thousands of employees somewhere around its quarterly earnings report on October 27 as the company seeks to cut costs amid weak demand for personal computers.

The stock of the microprocessor company, whose chips are widely found in PCs from HP Inc. to Dell Technologies, was up 1.2% in premarket trading on Wednesday. In contrast, the S&P futures index rose 0.8%, while the Nasdaq futures index, which is heavily weighted to tech stocks, rose nearly 1%.

Intel would be the latest of many technology companies to announce layoffs or freezes on hiring this year. Many companies, including Microsoft, Snap, Netflix, Shopify, and others, have already announced such reductions to their staff.

It has been a tough year for tech stocks, with Intel shares dropping 53% so far in 2022 and the Nasdaq falling by 34%, both of which are deep in bear market territory.

A rising interest rate environment has investors fleeing the market, with central banks like the Federal Reserve tightening financial conditions aggressively to deal with the highest inflation since the 1980s. The higher interest rate dampens the demand for risky bets and lowers the value of high-growth technology stocks — as well as increasing the chances of a recession.

Intel's potential job cuts are particularly concerning in light of their reported cause: stagnant PC demand. It is ironic that this slowdown comes just as the tech sector is headed into the holiday season. Holiday seasons usually tend to boost consumer electronics demand, resulting in Wall Street expecting higher tech profits.

As inflation, higher borrowing costs, and recession worries increase, consumers are hesitant to make purchases like PCs and electronics. If this trend persists through the end of 2022, tech stocks that are most affected by retail trends are not going to have a jolly Christmas.

Nevertheless, if layoffs really do occur at Intel, it can also be seen on a more macro level in a positive light that should encourage some optimism in the tech investment community.

Fed officials have been closely watching the labor market as a key indicator of the strength of the U.S. economy as interest rates rise. Inflation is a major concern for central bank officials, but they hope for a "soft landing" — with inflation cooling without causing the American economy to suffer.

With recent indications of a strong labor market, the Fed has more room to raise rates, putting downward pressure on technology stocks.

Having Intel layoffs would indicate that hawkish monetary policy is indeed affecting the real economy and weakening labor markets.

There is little likelihood that job cuts at tech firms will lead to the much-anticipated "Fed pivot" — when the central bank finally begins to slow down — but it is still likely to play an important role in this.