Cash Account vs Margin Account in 2024: What’s the Difference?

Dec 26, 2023

When it comes to investing in the financial market, one of the first choices you need to make at your preferred brokerage is whether to open a cash account or a margin account. Each type of account has its own unique features and benefits, used for different trading styles and market situations.

In this guide, we will walk you through the key differences of cash a account vs margin account, helping you determine which option may be best for your needs.

Key Takeaways:

- Margin accounts allow investors to potentially increase their buying power and engage in short selling.

- Increased risks come with margin trading, including the possibility of receiving a margin call and high-interest rates on borrowed funds.

- Cash accounts have limited risk exposure but also limit an investor’s potential returns.

- The choice between cash and margin accounts should depend on individual circumstances, investment goals, and risk tolerance.

What is a Cash Account?

A cash account is the most basic type of brokerage account that is available at any brokerage firm out there. With a cash account, you can only invest the funds that you have deposited on your balance.

For example, if you have deposited $1,000 into your cash account, you can buy up to 20 shares of an ABC stock worth $50 – you can’t invest more than $1,000 in total. If you want to buy more securities, you’ll need to deposit additional funds into your account or sell some of your existing investments.

One of the key advantages of a cash account is that your potential losses are always limited to the amount you invest. If you invest $1,000 in a stock and it goes down in value, the most money you can lose is $1,000. This makes cash brokerage accounts a suitable choice for beginners who are just starting out in the markets and want to limit their risk exposure.

Advantages of a Cash Account

- Limited Risk: With a cash account, your potential losses are capped at the amount you invest. This can provide peace of mind for new investors who are cautious about taking on too much risk.

- Simplicity: Cash accounts are straightforward and easy to understand. You can only invest the cash you have, eliminating the complexity of borrowing money or dealing with interest rates.

- Beginner-Friendly: Cash accounts are ideal for novice investors who are still learning the ropes of the stock or any other market. They offer a simple and low-risk way to get started in investing.

Disadvantages of a Cash Account

- Limited Buying Power: The main disadvantage of a cash brokerage account is that you can only invest the money that you have in your account. This means that your buying power is limited to your cash balance, which may restrict your investment opportunities.

- Inability to Short Sell: Cash accounts do not allow short selling, a trading strategy where you profit from a decline in a stock’s price. If you’re interested in short selling, you’ll need to open a margin account.

What is a Margin Account?

A margin account, on the other hand, is a more advanced type of brokerage account that allows you to borrow money from your broker to invest in financial instruments.

With a margin account, besides deposited cash, you can use resources that the brokerage firm lends you based on your account balance and other factors.

The primary advantage of a margin account is that it provides you with additional buying power. This means that you can potentially invest more money than you have, allowing you to take advantage of investment opportunities that may not be available with a cash account. For example, if you have $1,000 in your margin account, you may be able to borrow an additional $1,000, giving you a total buying power of $2,000.

While margin trading may sound like a lucrative opportunity to get big profits fast, it should be noted that margin amplifies losses as well as gains. For example, if you buy $20,000 worth of stock with a margin and it decreases by 10%, not only will you lose $2,000 of your initial investment, but you will also owe an additional $1,000 to your broker for the borrowed funds.

Specifics of Trading with Margin

When it comes to margin accounts, brokers follow certain regulatory requirements. These regulations are set by government entities such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA):

Firstly, in order to even open a margin account, an investor must meet the minimum margin requirement. This typically includes depositing a minimum of $2,000 in cash or 100% of the purchase price for stocks that will be bought on margin. Keep in mind, however, that some brokerages may have even higher requirements.

Once an investor has met the minimum margin requirement, they can then utilise the initial margin to increase their purchasing power. Initial margin allows an investor to borrow up to 50% of the cost of the securities they intend to buy. This essentially doubles their buying power and can lead to greater potential returns.

Investors should also be aware of the minimum maintenance margin. This is the minimum balance that must be maintained in a margin account after you purchase securities on margin. The SEC requires this balance to be at least 25% of the assets in the margin account. If this balance falls below the threshold, a margin call may be issued.

What Is a Margin Call?

It refers to an alert that an investor may receive from their brokerage when the value of their investments has fallen below a certain threshold deemed acceptable by the brokerage for the margin loan. This means that the assets you purchased with borrowed money are no longer sufficient collateral for the loan.

If the value of your investments decreases, the brokerage may issue a margin call in order to recoup their loaned money and avoid losses. This is because they are obligated by law to maintain certain levels of collateral for margin loans. If you fail to meet these requirements, the brokerage has the right to sell your securities without your consent.

Understanding Interest Rates of Margin Accounts

Margin interest rates refer to the annual percentage rate that an investor owes on a margin loan or margin account. These rates can vary depending on your brokerage, but they are often considered to be higher than other types of loans.

Fast Fact

Financial planners have noted that margin rates tend to be 3-4% higher than home equity lines or other forms of debt.

While margin interest rates may not seem like a major factor for those who only use margin for short-term trades, they can quickly add up for those who rely on margin heavily. Each month, the interest costs associated with margin can eat into an investor’s returns, potentially impacting your overall profits.

Different brokerage houses can have different margin rates. There are some margin rates as low as 6.83% (IBKR Pro), while others can be 13.50% (TD Ameritrade). Thus, if you want to have more preferable conditions for margin trading, some brokerages can be a better choice for you.

Brokerages with the best margin rates:

Advantages of a Margin Account

- Increased Buying Power: Margin accounts give you access to additional funds, allowing you to potentially invest more money than you have in your account.

- Ability to Short Sell: Unlike cash accounts, margin accounts allow you to engage in short selling. This means that you can profit from a decline in a stock’s price, providing you with more flexibility in your trading strategies.

- Flexibility in Cash Flow: Margin accounts can be useful for short-term cash flow needs. If you need instant access to cash, your brokerage can provide you with a margin loan, which you can repay at a later date.

Disadvantages of a Margin Account

- Increased Risk: While margin accounts offer increased buying power, they also come with higher risks. If your investments decline in value, you may lose not only your own money but also the borrowed funds, potentially amplifying your losses.

- Margin Interest Rates: When you borrow money from your broker in a margin account, you are charged interest on the loan. Margin interest rates can be high, and failing to repay the loan in a timely manner can result in significant interest charges.

- Margin Calls: One of the biggest risks of margin trading is the possibility of receiving a margin call. A margin call occurs when the value of your account falls below the minimum requirement set by the brokerage. In this case, you may be required to deposit additional funds or sell securities to meet the margin requirements.

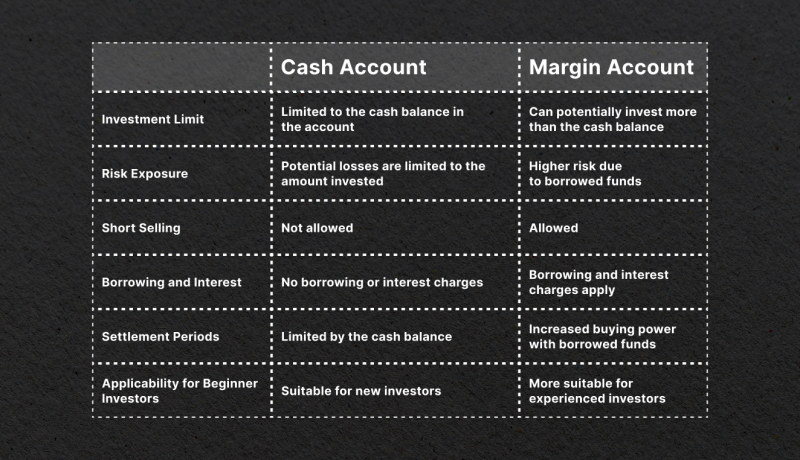

Key Differences between Cash Accounts and Margin Accounts

To summarise, here are the key differences of a margin account vs cash account and margin account :

Choosing the Right Account for You

Deciding whether to open a cash account or a margin account depends on your individual circumstances, investment goals, and risk tolerance. Here are some factors to consider when making your decision:

- Trading Style: If you’re an active day trader, a cash account may be more suitable as it allows you to avoid the restrictions of the Pattern Day Trading (PDT) rule. On the other hand, if you’re interested in short selling or engaging in more complex trading strategies, a margin account is necessary.

- Risk Appetite: Cash accounts offer limited risk exposure, making them a safer option for conservative investors. If you’re comfortable with taking on more risk and have a higher risk tolerance, a margin account may provide you with more flexibility and potential returns.

- Investment Strategies: Consider the investment strategies you plan to pursue. If you’re primarily interested in long-term investing or swing trading, a cash account may be sufficient. However, if you want to explore options, futures, or crypto short selling, a margin account is essential.

- Financial Resources: Assess your financial resources and determine how much capital you can comfortably invest. Remember that margin accounts require an initial deposit and may involve interest charges, so make sure you have the financial means to support margin trading.

- Knowledge and Experience: Margin accounts come with additional complexities and risks. If you’re a beginner investor, it’s generally recommended to start with a cash account to build your knowledge and experience before venturing into margin trading.

Closing Thoughts

In conclusion, the choice between a cash account and a margin account depends on your goals, appetite for risk, and trading style. Cash accounts offer simplicity and limited risk and are suitable for new investors. On the other hand, margin accounts provide increased buying power, the ability to engage in short selling, and more flexibility for experienced traders.

Remember, financial investments carry inherent risks. Conduct thorough research, seek professional advice, and stay updated with market trends to make well-informed investment decisions.

FAQs

What is PDT?

A pattern day trader, or PDT, is a term used to describe traders or investors who actively engage in buying and selling financial securities within a short period of time, typically within the same day, using a margin account.

To be classified as a PDT, one must execute four or more day trades in a span of five business days, with these day trades making up more than 6% of the total trade activity in the margin account. Brokers may flag an account as PDT if these requirements are met, which can result in certain restrictions on further trading.

Who can open a margin account?

To open a margin account, you must meet certain requirements set by your broker. Typically, these requirements include being at least 18 years old and having a minimum deposit of at least $2,000 in cash or twice that in fully paid eligible securities.

Can I open a margin and cash account at the same brokerage house?

Yes, you can open both a margin and cash account at the same brokerage house. Many brokers offer the option to have multiple types of accounts under one login. This allows you to manage your investments in different ways depending on your trading strategy.

What if you ignore a margin call?

Ignoring a margin call can have serious consequences for your trading account. If you fail to meet a margin call, the broker has the right to close positions in your account without considering profit or loss. This is known as forced liquidation, and it can result in significant losses, which may also be subject to taxes.