9 Best Alternatives of MetaTrader 4/5 White Label Solution

Jun 11, 2024

For the FX trading industry, MT4 and MT5 have been the go-to platforms for brokerages for years, offering tools and features to satisfy the demands of both novices and professionals. However, recent policy changes and stricter requirements from the platform provider MetaQuotes have caused many to look for other white label platforms.

This article discusses top alternatives to MT4/5 white label solutions, offering insights into their features and benefits.

Key Takeaways

- Third-party trading systems are attractive solutions for new and mid-sized brokers.

- White label solutions offer pre-integrated trading tools and features, reducing technical and financial barriers to entry.

- MetaQuotes has tightened criteria for white label brokers and limited access to MT4/MT5 white label solutions.

Best Alternatives to MT4 and MT5 White Label

The market for white label solutions is constantly evolving and expanding, with new players entering the scene every year.

cTrader

cTrader has established itself as one of the most advanced platforms around, offering a wide range of tools and features tailored specifically for ECN accounts. Its lightning-fast order execution and ability to handle large volumes of market quotations make it a top choice for both novice and professional traders.

The platform strongly focuses on automation and provides users with the option to trade manually or use trading bots and personalized indicators. Its diverse ecosystem also allows users to exchange these tools easily.

cTrader is available on desktop, including Mac devices, mobile, and web-based platforms, ensuring accessibility for traders on the go. The system supports several types of API connections, and its white label version is used by many popular Forex services and brokers, making it a reliable choice for those looking to offer the best trading experience to their clients.

Key Features:

- Powerful Charting: cTrader offers sophisticated charting tools, multiple timeframes, and a range of technical indicators.

- Automated Trading: With cAlgo, traders can seamlessly develop and deploy algorithmic trading strategies.

- Transparency and Fairness: cTrader is known for its transparent pricing model and no-dealing-desk execution.

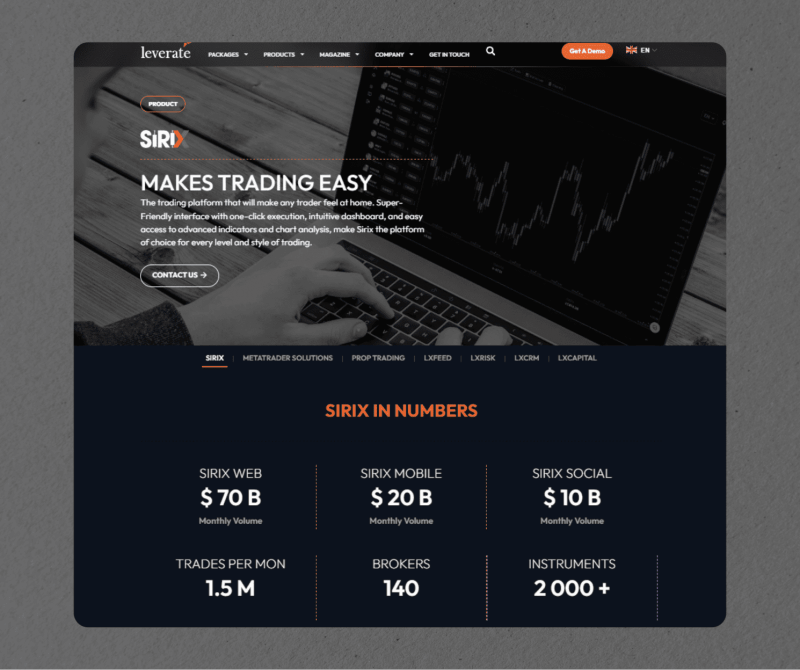

SIRIX

SIRIX is a versatile white label platform offered by Leverate, a leading technology and services provider in the industry. The platform features an intuitive interface, one-click execution, and high-end analytics and indicators. It is available on web, desktop, and iOS/Android.

Over 140 brokers already trust the software, and it has a monthly trading volume of $70 billion on its web platform and $20 billion on mobile. With access to over 2,000 trading instruments, SIRIX offers a wide range of trading opportunities that are suitable for traders at all levels and styles.

Among the platform’s top features is SIRIX Social, a seamless copy trading tool that allows traders to replicate the strategies of successful traders on the platform. More recently, Sirix has also added cryptocurrency CFDs to its offering, catering to the growing demand for digital assets in the market.

Key Features:

- Mobile Trading: Sirix is available on both web and mobile devices for a trading experience on the go.

- Social Trading Integration: Enables traders to follow and copy the trades of successful peers, enhancing engagement and learning opportunities.

- Clear Interface for Managers: The platform offers a sleek dashboard for brokers and admins.

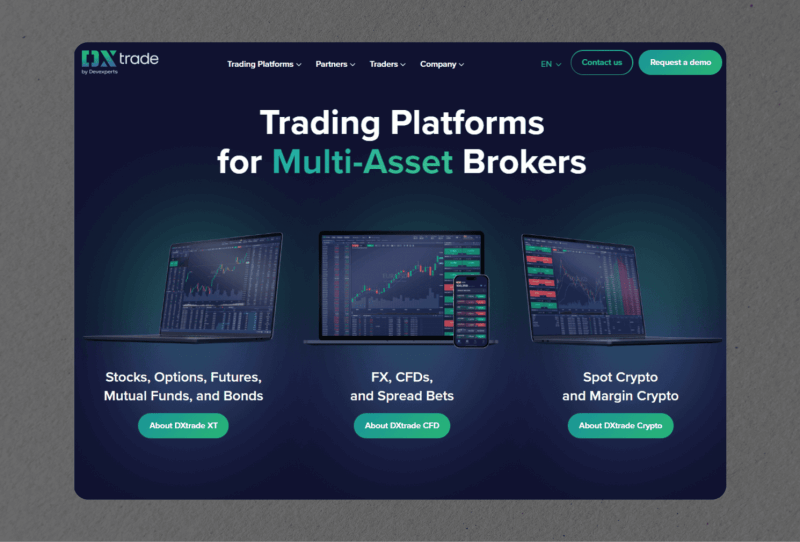

DXtrade CFD

DXtrade is a state-of-the-art white label platform designed to meet the demands of modern traders. Devexperts, a company behind DXtrade, has been in the industry since 2002 and is known for developing cutting-edge and innovative trading technology and platforms. Currently, the provider offers three versions of the DXtrade, each catering to different asset classes.

DXtrade CFD is specifically designed for OTC markets like FX and crypto CFDs. The highly customizable platform allows brokers to add their own branding elements and tailor the interface to meet their clients’ needs. It also offers advanced risk management tools, automated trading functionality, and an array of order types.

DXtrade CFD’s sleek and modern design sets it apart, making trading easy and enjoyable for users. Additionally, the platform integrates seamlessly with various liquidity providers, offering brokers a cost-effective and efficient solution for their trading needs. DXtrade can be a reliable alternative to the MetaTrader 5 white label solution.

Key Features:

- Mobile Apps: DXtrade offers branded iOS and Android mobile apps for traders to use from anywhere.

- Flexible Customisation: Brokers can customize everything from the layout to trading conditions and risk management tools.

- Free Integration: The platform provides free integration with a liquidity provider of broker’s choice.

XOH Trader

XOH Trader is a popular choice for brokers looking for a powerful and customizable white label solution. The platform offers extensive charting tools, including templates, overlay charts, and personalized chart views. Additionally, traders can detach and float charts to suit their preferences.

Furthermore, XOH Trader excels in providing end-users with real-time market news, insights, and trend analysis. The provider provides a calendar of essential financial events, keeping traders informed about market movements. The platform also has a live market sentiment indicator showing the ratio of long versus short positions.

X Open Hub‘s white label solution is highly customisable, allowing brokers to tweak their branding elements like logos, colours, default settings, and more. It also integrates with client education materials, webinars, and news to enhance the trading experience for users.

Key Features:

- Professional Charting Tools: XOH Trader offers powerful charting capabilities that are not available in most white-label solutions.

- Market Analysis and Insights: Users are provided with up-to-the-minute market updates and financial information to assist in decision-making.

- Great Customizability: The platform allows for extensive branding and integration of educational materials.

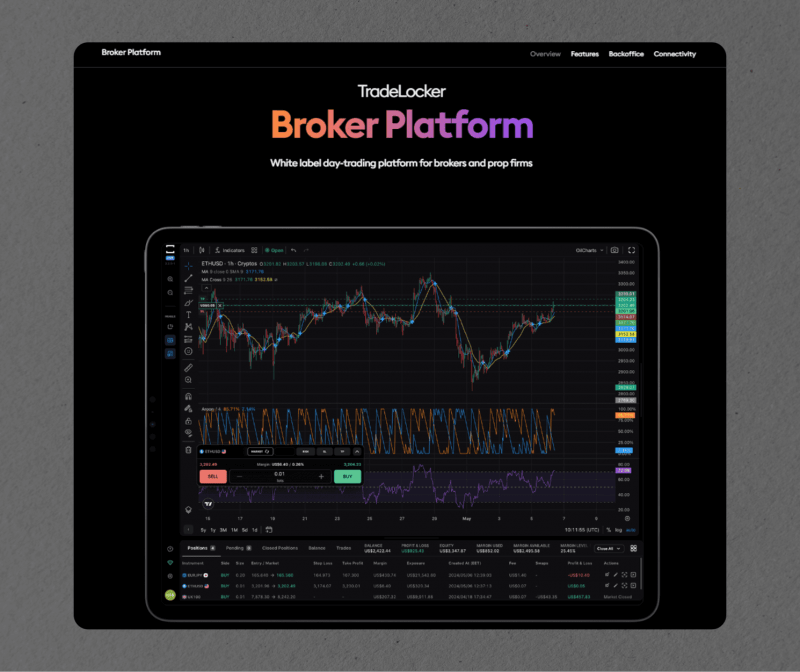

TradeLocker

TradeLocker provides an all-in-one brokerage solution with a user-friendly UI and advanced features. Aside from its traditional offerings, such as analytical tools, charts, and fast execution, TradeLocker incorporates TradingView – a leading analytics platform.

Moreover, TradeLocker offers a variety of trading products and API integrations, making it a well-rounded solution for brokerages with different demands. Its micro-lot trading option is especially beneficial for newcomers with limited funds, allowing them to test their strategies without risking significant amounts of capital.

Key Features:

- Enhanced Charting: TradingView gives users access to a powerful analytics engine for in-depth market analysis.

- Seamless Integration: TradeLocker can easily integrate with existing setups, providing a cost-effective solution for brokerage and prop firms. Its API integration also allows for efficient and automated trading.

- Wide Range of Instruments: TradeLocker supports equities, derivatives, currency, crypto and debt instruments, making it a versatile platform for traders across various markets.

Match-Trader

Match-Trader is a comprehensive white label platform that offers all the essential features and tools for profitable trading. It has a user-friendly design and sophisticated charting capabilities, including in-depth technical analysis functionality. The platform is also built using web technology, making it lightweight and easily accessible from any device with an internet connection.

With Match-Trader, traders can access timely market information and analytical instruments. The platform offers a list of significant market events that could impact trading instruments and real-time market data. Additionally, the platform has a built-in payment gateway for quick and seamless account funding, with complete automation on the broker’s end.

Match-Trader’s WL solution is delivered with a customizable branded app, allowing brokers to create a strong brand and stand out in the market. It also integrates seamlessly with client offices and CRM systems, providing single sign-on for traders and simplifying management for brokers.

Key Features:

- White Label Capabilities: Match-Trader offers extensive branding options.

- Adaptable Interface: The platform is designed to work with various devices and screen resolutions.

- No Restrictions on Instruments: Brokers can access a variety of trading instruments and set up markups and more.

Quadcode

Quadcode Trading is a white label solution designed “by traders, for traders”. It was developed by a team of designers and engineers with years of trading experience who worked to create the ideal product for brokerage businesses. This platform offers comprehensive features and a diverse range of multi-asset liquidity.

The WL solution offers a high level of customization, allowing brokers to set up their trading instruments, assets, menu options, and more. The company also delivers everything from a branded app to KYC compliance modules, streamlining the process of creating and managing a successful brokerage platform.

Key Features:

- Customization Options: Quadcode Trading offers extensive customization options for brokerage platforms.

- Regulatory Compliance: Quadcode Trading helps mitigate the challenge of ensuring regulatory compliance with its included KYC module.

- Connected Modules: The platform seamlessly integrates with client offices and CRM systems, simplifying management for brokers.

WOW Trader

With over 11 years of research and development behind it, TradeSmarter’s WOW Trader offers a uniquely designed white label platform that addresses the issue of different technologies, functionalities, and appearances across different platforms. It offers an all-in-one solution for FX and CFD margin trading, while its sister platform, WOW Invest, caters to non-margin real accounts and prop trading for stocks, ETFs, and features.

In terms of features, WOW Trader provides a simple yet advanced interface that caters to both beginners and advanced traders. This includes take-profit and stop-loss sliders, pending orders, and tiered leverage options. The software also offers customizable themes to create a unique look and feel for the brand. Additionally, a variety of risk settings are available to tailor the platform according to business needs, including account-based risk and tiered risk.

WOW Trader also offers integrations with over 300 payment gateways, making it easier for brokers to facilitate client account funding. TradeSmarter’s WL solution boasts 180+ liquidity integrations for a wide range of CFD asset classes, giving traders access to the most popular markets.

Key Features:

- Comprehensive Risk Management: Brokers can set risk limits and restrictions based on their specific business needs.

- Diverse Market Access: With over 180 liquidity integrations, brokers can offer their clients access to more than 1000 assets.

- Social Features and Visualisation: WOW Trader offers tournament and challenge capabilities, along with a Leaderboard and Social feature, allowing traders to see others’ performance easily.

Web Trader

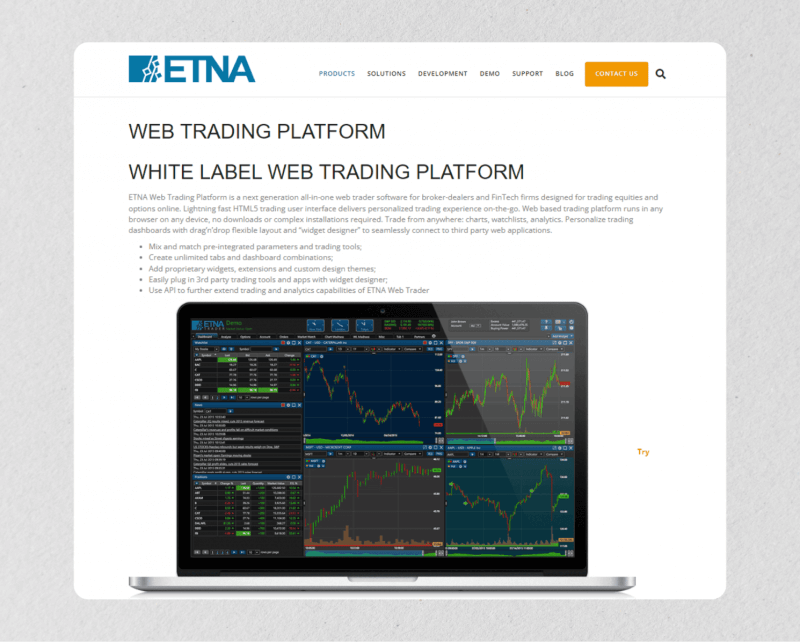

ETNA’s Web Trader is a powerful white label software designed for broker-dealers and FinTech firms. It offers an all-in-one solution for trading different instruments online, with lightning-fast HTML5 technology delivering personalised trading experiences on-the-go.

Web Trader stands out with its flexibility and customisation options, allowing brokers to mix and match pre-integrated parameters and trading tools. The platform also features a drag-and-drop layout and a “widget designer” for creating personalized dashboard combinations.

Brokers can connect seamlessly with third-party web applications and use the API to extend analytical capabilities further. They can also add proprietary widgets, extensions, and custom design themes to create a unique environment for end-users.

ETNA provides a full suite of white label services along with the platform, including hosting, maintenance, and support. The suite includes a client portal, back-office module, and mobile trading app. Additionally, brokers can access ETNA’s API for seamless integration with execution venues and market data providers of their choice, making it a robust alternative to the MT4 white label solution.

Key Features:

- Customizable Trading Dashboards: Brokers can create unlimited tabs and dashboard combinations for a personalized experience.

- Sophisticated API Capabilities: Brokers can use the API to extend trading and analytics capabilities.

- News and Content Integration: Brokers can plug in news sources and web content via API or RSS/XML feeds.

What Is a White Label Trading Platform?

A white label platform is a turnkey trading solution provided by third-party vendors, allowing brokers to offer trading services under their own brand without the need to develop their own platform from scratch.

These platforms come pre-integrated with trading functionality, risk management components, and administrative controls, enabling brokers to launch their services in a span of just several days or weeks. White label solutions are particularly attractive for new and mid-sized brokers, as they reduce the technical and financial barriers to entry.

Forex WL Providers

As a broker, choosing the right WL provider can make all the difference in providing your clients with a secure and efficient trading experience. With numerous options available in the market, it can be overwhelming to determine which provider is best suited for your brokerage.

To assist you in making an informed choice, we have compiled a list of the top WL providers in the forex industry. All of these providers offer comprehensive brokerage services packages, including customized trading platforms, advanced risk management tools, liquidity solutions, compliance support, and more.

Are MetaTrader WL Solutions Accessible?

MetaQuotes, MT4 white label provider, has significantly tightened its requirements for white label brokers. The updated guidelines emphasise strict compliance with regulatory standards, focusing on the legal incorporation of brokerages, verification of directors and shareholders, proof of physical addresses, and corporate account verification.

The company has taken decisive action against unregulated brokers, revoking licenses and cutting off access to its platforms. Notable examples include the termination of True Forex Funds’ WL license in February 2024. Similar actions have been taken against other offshore brokers.

Currently, many white label technology providers halted MT5 and MT4 whitelabel offerings.

Final Thoughts

While MetaTrader 4/5 remain powerful options for millions of traders, the new reality compels brokers to explore alternative white label solutions. Multi-platform offerings can also be advantageous for companies, allowing them to appeal to a broader market and provide a more comprehensive service for their clients.

As always, due diligence is essential when selecting a white label trading platform. Evaluate each option’s features, compliance capabilities, and overall fit with your business model to ensure that you choose the option that positions your brokerage for success.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

How do you assess a trading platform?

There are several factors to consider when assessing a platform. One of the first things to look for is its reliability, which can be determined by reading reviews and user feedback. Furthermore, evaluating the platform’s security measures and data protection policies is important. Consider the system’s functions and tools, such as real-time market data and order options. Also, consider the fees associated and ensure they align with your budget.

Why use third-party trading technology?

Using third-party trading software can save your company time and resources as it eliminates the need to develop your own software from scratch. Additionally, thousands of traders have tried and tested these platforms, making them more reliable than self-developed solutions.

How much does a white label forex broker cost?

The cost of a white label forex broker can vary depending on the technical specifications required for your specific business needs. On average, you can expect to pay around $25,000 to $50,000 for a white label solution. However, this cost may differ based on the level of customization and features you require.