Grayscale XRP ETF is Under Review – Will The SEC Approve it This Time?

Feb 21, 2025

The crypto future seems so bright under the new US administration, with signs of lenient regulations and pro-blockchain policies. Asset management firms began submitting crypto-based ETF applications, taking advantage of this resilient stance and the potential of some altcoins.

Ripple is the latest speculated cryptocurrency to be adopted as an exchange-traded fund at traditional financial institutions. The SEC started reviewing Grayscale XRP ETF filing, setting 18 October as a deadline for giving its final verdict.

With high hopes of a positive answer, the Ripple coin price chart started an upward movement. Will an approval come sooner?

What is Grayscale XRP ETF?

Grayscale Investments, a US-based digital currency asset management firm, filed a proposal to the Securities and Exchange Commission to list XRP-based ETFs on its trading desk on 30 January 20205.

The company currently offers multiple digital asset ETFs, notably the Grayscale Bitcoin Trust ETF (GBTC) and the Grayscale Ethereum Trust ETF (ETHE).

The application is designed to offer institutional and retail investors exposure to Ripple coin without directly holding the asset, establishing a major step in integrating altcoins into traditional financial markets.

The Review Process

The SEC has commenced reviewing the filing, starting with a 21-day public comment window, where experts, investors, and other stakeholders provide feedback, raise concerns, or support the proposal.

Then, the agency has 240 days to give the final verdict. In this case, the SEC determined 18 October as the deadline. The process includes reviewing compliance frameworks, security guidelines, the XRP ETF price mechanism, and investor protection.

Despite the ongoing issues between the regulator and Ripple, there is rising optimism surrounding the XRP ETF approval potential. The pro-crypto stance of the new administration and the XRP spot ETF adoption in Brazil, can influence the commission’s decision.

SEC vs Ripple

One concern about the filing is the ongoing lawsuit between the US regulator and XRP’s developers. In 2020, the SEC sued Ripple Labs for accumulating money from unregistered securities.

The dispute surrounds the treatment of XRP as registered security. However, a 2023 court ruling fined the issuers $125 million, determining that sales to retail investors did not violate the law, but institutional sales did.

XRP Price Performance

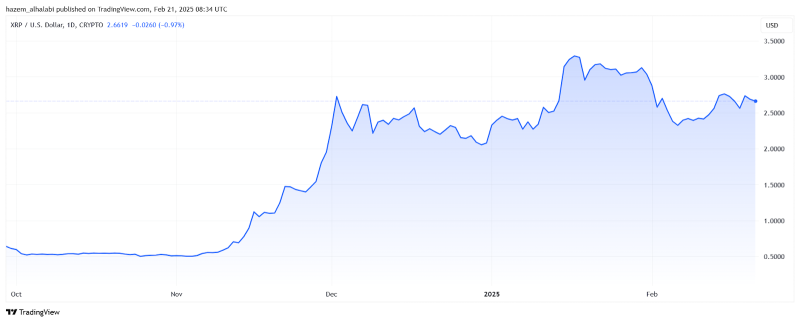

Ripple started its bullish movement in Q4 of 2024, revisiting the $1 mark in November 2024 after three years and reaching the $2 threshold for the second time since 2017. Much of this activity was attributed to speculations around the XRP ETF news and the overall crypto bullish movement.

XRP closed the year 2024 at a high mark of $2.09. In 2025, it surged significantly by 50% in two weeks, registering a new all-time high of $3.29 on 18 January.

Despite a slight correction in February, the price never dropped below $2.3, setting the stage for an optimistic approach this year. Today, the coin is traded at $2.66, marking a 3.5% increase over last week.

Conclusion

The SEC started reviewing the Grayscale XRP ETF application, setting 18 October as the deadline for announcing its decision.

Despite an ongoing lawsuit between the financial regulator and Ripple Labs, the hopes are high for a positive answer, especially after the new pro-crypto stance of the US president and new financial regulators.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.