Stagflation 2.0? Why Experts Are Sounding the Alarm on the US Economy

Feb 25, 2025

Concerns about stagflation in the US have resurfaced recently, fueled by persistent inflation and shifting economic policies. While some experts believe the US will avoid a full-blown stagflationary period, others warn that warning signs are accumulating.

What Is Stagflation?

Stagflation is an economic condition marked by slow growth, high inflation, and rising unemployment. Unlike typical inflationary periods, during which economic activity remains strong, stagflation creates a paradox: prices keep rising while the economy stagnates.

The last major stagflation crisis in the US occurred in the 1970s, driven by oil price shocks and monetary expansion.

Inflationary Pressures and Economic Uncertainty

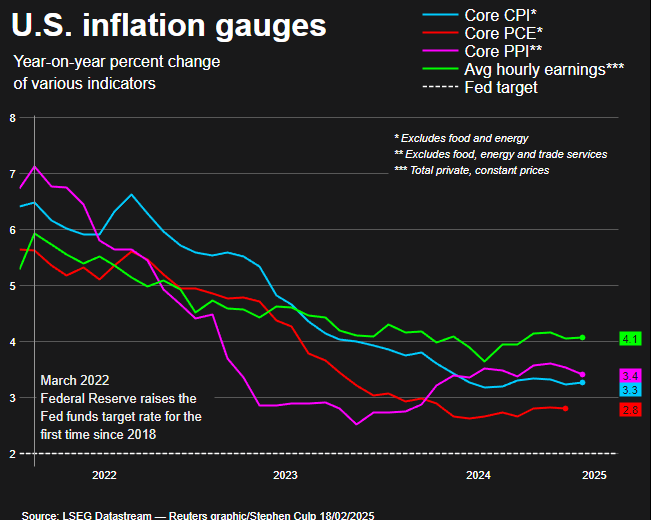

US inflation remains a key driver of stagflation fears. The Consumer Price Index (CPI) rose by 0.5% in January 2025, pushing the annual inflation rate to 3%. Increasing costs of essential goods, such as food and energy, continue to burden consumers. For example, egg prices surged by 15.2% in January due to a bird flu outbreak, further highlighting supply-side disruptions.

Despite efforts to control inflation, the Federal Reserve has signaled caution in adjusting interest rates. After multiple rate cuts in 2024, the Fed has halted further reductions, citing concerns over inflationary persistence. This creates a dilemma—tightening monetary policy could slow the US economy further, while easing it may worsen inflation.

The Role of Trump’s Trade Policies

Trade policies under Donald Trump’s administration have added another layer of complexity. The introduction of new tariffs—10% on Chinese imports, 25% on autos, semiconductors, and pharmaceuticals—has increased production costs. American companies, reliant on global supply chains, are facing higher import expenses, which ultimately trickle down to consumers.

While the administration argues that tariffs will boost domestic industries in the long run, their immediate impact appears inflationary. Increased raw materials and goods costs put pressure on businesses, potentially reducing hiring, lowering investments, and slowing economic expansion.

Labor Market and Stagflation Risks

The US labor market remains another focal point in the stagflation debate. While employment rates have remained relatively stable, proposed immigration policies could disrupt key industries. The potential deportation of undocumented workers threatens sectors like agriculture, construction, and healthcare, leading to labor shortages and increased wages.

Higher labor costs and inflationary pressures create a challenging environment for businesses. Mark Zandi, Moody’s chief economist, warns that these policies could act as “negative supply shocks,” similar to the factors that fueled stagflation in the 1970s.

Investor Sentiment and Market Reactions

Investor sentiment reflects growing uncertainty. A Bank of America’s latest global fund manager survey found that expectations for stagflation are at a seven-month high. At the same time, some investors remain bullish, believing that economic resilience and corporate adaptability will prevent a worst-case scenario.

Gold prices have surged to record highs, indicating that investors are seeking safe-haven assets. Historically, gold performs well during stagflationary periods, as it holds value when both inflation and economic stagnation hit.

Meanwhile, bond markets are showing mixed signals. Some traders are shifting toward long-term Treasury securities as a hedge against potential economic downturns.

Conclusion

While the US is not officially in a stagflationary crisis, warning signs are becoming harder to ignore. Persistent inflation, restrictive trade policies, and labor market shifts create conditions that could tip the balance.

The Federal Reserve’s approach in the coming months will be crucial in determining whether inflation remains controlled or spirals into a full-scale stagflation scenario.

For now, the debate continues. Some analysts argue that the economy will remain resilient, while others see a growing risk of prolonged economic stagnation. As policymakers weigh their next moves, businesses and consumers brace for potential turbulence ahead.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.