Coinbase S&P 500 Inclusion – How Will it Affect Bitcoin Price

May 14, 2025

The DeFi space is getting bigger due to institutional adoption and mass approval from traditional investors, and the Coinbase S&P 500 update is a massive milestone!

The popular financial index, S&P 500, is set to welcome the first crypto business into its financial market’s standard. Following the recent surge in cryptocurrencies and investors’ inflow, Coinbase is becoming part of the S&P index starting next week.

How did the company achieve this listing? What does this signify for the overall market? Let’s learn more about the Coinbase S&P 500 listing and the impact on the overall market.

Coinbase to Join S&P 500

On Monday, May 12th, S&P 500 announced that Coinbase will join its listing of the world’s leading financial market index. The crypto exchange will replace Discover Financial Services, which is being acquired by Capital One.

The change is set to take effect before the markets open on May 19th and is expected to spur significant institutional interest and increased inflow, potentially causing the stock price to soar dramatically.

The Coinbase S&P 500 inclusion follows a significant rally in Coinbase shares and comes after the company reported a profitable first quarter on the back of renewed interest in cryptocurrencies.

Benchmark Inclusion Criteria

According to the S&P Dow Jones Indices, Coinbase met all eligibility requirements, and the update reflects changes in market capitalization and sector potential.

The S&P 500 listing eligibility requires companies to be US-based, publicly listed, have a market capitalization of at least $20.5 billion, and post positive earnings in the most recent quarter and over the prior year.

In this regard, the crypto exchange reported overachieving Q1 2025 earnings with a net income of $1.2 billion and a growing valuation of over $50 billion, which helped the company secure its position on the index.

The S&P Dow Jones Indices committee also approved the company’s liquidity figures and sector classification, which made Coinbase a strong candidate.

Impact on Coinbase Stock Price

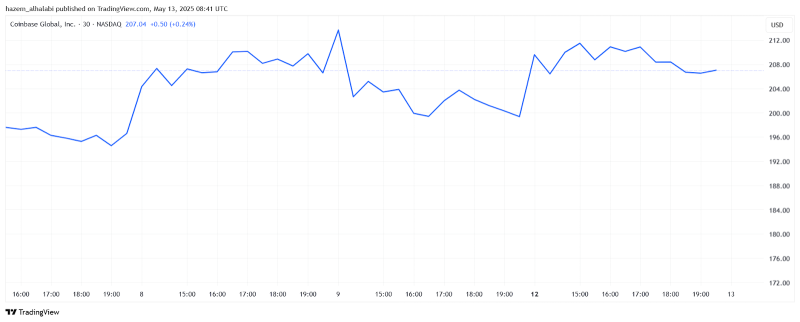

The announcement immediately impacted the company’s stock price, which was already on a positive run. On May 12th, the shares were traded at $209 at the session’s opening hours, marking a 5% increase from the previous day’s closing price of $199.

The upward trend continued throughout the same day, peaking at $213 at midday, recording a 7% increase in a few hours and a 25% growth in less than one month.

Nevertheless, the addition is expected to trigger large-scale buying from index funds and ETFs that involve the S&P 500, which can further boost demand for the stock.

Impact on Crypto Prices

The inclusion news had an impact on the overall crypto market, especially BTC and ETH, which have already been experiencing a bullish movement.

Bitcoin continued its upward trajectory above the $100,000 mark, peaking at $104,600 a few hours after the Coinbase update. Ethereum, on the other hand, soared by $77 during intraday trading on May 12th.

Analysts believe this will reflect a growing mainstream acceptance of crypto infrastructure within traditional finance, which could positively affect sentiment. While some worry about a bubble that can inflate prices uncontrollably, attracting high-profile firms and entities can back up this surge with real assets.

Final Thoughts

The Coinbase S&P 500 listing is a historical milestone for the cryptocurrency space, bridging the divide between traditional finance and virtual assets.

Although the short-term impacts of cryptocurrency are minimal, the addition could open the door to more mainstream adoption and institutional investment, driving the company’s stocks and crypto rates even higher.

Disclaimer: This article is for informational purposes only. It is not financial advice and should not be relied upon for investment decisions. Always do your research and consult a financial advisor before investing.