Maximizing Returns: How Traders Use High Leverage in Forex Markets

Sep 12, 2025

High leverage is both the sizzle and the sting of modern currency trading. Handle it with skill, and you can turn a modest account into something that looks almost heroic. Misjudge it, and the market can clean out your equity before you have time to click “close.” In this guide, we’ll look at why leverage exists, how seasoned traders exploit it, and just as crucial, the guardrails that keep a turbo-charged strategy from flying off the track.

Understanding High Leverage in Forex

Leverage is often marketed as the unique selling point of retail FX. While a stockbroker may let you borrow 2:1 or 4:1, high-leverage Forex brokers still offer 1:100, 1:200, or, outside the stricter European jurisdictions, 1:500 and beyond. That multiple tells you how many dollars you can control for every dollar actually in your account.

The Mechanics Behind the Multiplier

Let’s keep the math simple. If you open a standard 100,000-unit EUR/USD position with 1:100 leverage, you need just 1,000 of margin. The remaining $99,000 is fronted by your broker, secured by the funds in your account. A one-pip move roughly 0.0001 in EUR/USD equates to 10. That means a ten-pip swing generates $100 on your $1,000 of margin, or 10% return. The same price change without leverage would barely tick the needle. Leverage, then, is nothing more than buying power on steroids.

Why Leverage Is Easier in Currencies than in Stocks

FX trades in pairs, which generally move far less in percentage terms than single equities. A “large” intraday move in EUR/USD might be 1%, whereas an individual stock can gap 5% or 10% on an earnings release. Smaller swings mean brokers are comfortable letting you borrow more. High liquidity also helps: the average daily volume in the forex market eclipses every other asset class, giving providers confidence they can offset client exposure quickly.

Why Traders Chase High Leverage

Many new traders equate bigger leverage with flashing zeros on their P&L, but pros view it as a tactical tool rather than an adrenaline rush.

Amplifying Small, Predictable Moves

Major currency pairs often trade in tight ranges around scheduled events: central-bank minutes, employment data, CPI prints. These events can trigger 20-pip bursts that fade within hours. With 1:100 leverage, capturing half of that move on a one-lot position can return 1%-2% on margin in the morning. Without leverage, the same trade is hardly worth the spread and the caffeine.

Capital Efficiency Matters

Fund managers, including macro hedge funds, sometimes use forex futures purely to hedge currency exposure on overseas holdings. But when they spot a directional opportunity, leverage means they don’t have to tie up capital that could be working elsewhere. A portfolio that’s long U.S. Treasuries and short Japanese yen can run both legs simultaneously, each using minimal margin.

Psychological Edge

Ironically, high leverage can impose discipline at least for traders who respect it. When a 25-pip adverse move risks a margin call, entries become surgical and exits decisive. Seasoned scalpers argue that low leverage breeds laziness because losses feel small.

The Knife Edge: Managing Risk with High Leverage

High leverage will magnify every trading sin. The same 10-pip loss that costs 0.1% at 1:10 leverage can vaporize 5% at 1:500. Risk management, then, is not a footnote; it’s the headline.

Position-Sizing Rules that Survive Real Markets

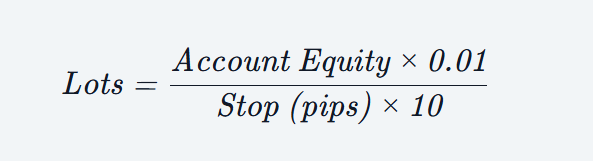

Many professionals cap any single‐trade risk at 1% of account equity. With 1:100 leverage, that often translates to allocating no more than one micro-lot per $1,000 balance if the stop-loss is ten pips away. The formula is simple:

Where “10” is the pip value per standard lot. Notice how leverage never appears in the equation; it’s your stop size that determines exposure. The multiplier only decides how much margin the broker requires.

Adaptive Stop-Loss Techniques

Static ten-pip stops don’t work in every session. A better approach is to place stops behind structure: prior highs or lows, VWAP bands, or ATR-based buffers. Adaptive stops let traders maintain tight risk control without suffocating trades. The tougher part is resisting the temptation to widen stops just because more leverage is available.

Broker Choice and Regulatory Caps

Various jurisdictions have various ceilings. ESMA in Europe limits retail FX leverage to 1:30, while ASIC in Australia allows 1:500 for “wholesale” clients. Evaluate a broker not just on maximum leverage but also on how they handle negative-balance protection, margin call level, and execution speed. A five-millisecond delay can turn a controlled 20-pip loss into 25 pips when you’re geared 100:1.

Case Study: 1:500. Where It Works, Where It Fails

Picture two traders, Alex and Brianna, each with $5,000. Both believe USD/JPY will bounce from 144.00 to 144.25 on a Bank of Japan press release.

- The leverage Alex uses is 1:30, where he is purchasing a mini-lot (10,000 units).

- Brianna trades at 1:500 and purchases five standard lots (500,000 units).

The move occurs. Profit check:

- Alex pockets roughly 25 (0.5).

- Brianna gains $1,250, a cool 25% return.

So far, leverage looks like a no-brainer. But let’s flip the scenario: price spikes down to 143.75 before reversing. Alex’s stop at 143.90 is triggered for a 10 loss. Brianna’s stop at the same level incurs 500, a 10% hit. Had volatility widened the spread by two extra pips, Brianna could have been closed out entirely.

The takeaway? High leverage shines in tightly defined, high-conviction setups with disciplined stops. It fails spectacularly when traders treat a 100:1 account like a 1:1 account and let losers run.

Mid-Trade Adjustments That Separate Pros from Gamblers

During live positions, three levers give traders flexibility without abandoning risk protocol:

- Scaling Out. Taking partial profits at predefined targets reduces exposure and cushions the psychology of letting the remainder ride.

- Trailing Stops. Automated or manual, a trailing stop locks gains while keeping you in trending moves.

- Hedging. In rare cases, opening a temporary counter-position can freeze net P&L during major news releases rather than closing and re-entering at worse prices.

None of these techniques excuses poor entry timing. They simply acknowledge that once you’re riding a leveraged position, static rules may leave too much on the table or too much at risk.

Checklist Before You Pull the Trigger

Below is a quick pre-trade routine many high-leverage specialists swear by. Work through it systematically:

- Corroborate macro context (central-bank story, data agenda).

- Identify confluent technical level (support/resistance, Fibonacci, order-block).

- Determine the definition of stop-loss in pips as applied to the market structure, rather than account size.

- Divide the position to risk between 1%-2% of equity.

- Check the margin requirement twice, with free margin exceeding 300% after entry.

- Installed warnings of future high volatility events in the trade horizon.

- Pre-determine the way and point of scaling out or adding size.

Follow the list often enough, and it becomes muscle memory. Skip it once and you’ll remember why it exists.

Conclusion: Leverage as an Edge, Not a Crutch

The high leverage is neither bad nor good; it is just strong. Consider it electricity: you may light up a whole trading life, or you may shock yourself to death. Master traders consider leverage as a controlled drug, used in small doses and under careful control to multiply already good odds. They honor stop-loss discipline, they adjust to volatility, and they never mix available leverage with the necessary leverage.

If you’re an aspiring trader, the goal isn’t to max out the broker’s multiplier; it’s to decide when, why, and by how much the multiplier serves your strategy. Stick to calculated risk, keep meticulous records, and let the compounding work. With that approach, leverage becomes what it was meant to be: a tool for maximizing returns, not extinguishing them.