Hong Kong Retail Banks Are Having Their Worst Time In A Decade As Low-Interest Rates Crimp Profits

Jan 26, 2022

Hong Kong's retail banks are experiencing their worst year in a decade, as low-interest rates combined with the ongoing Covid-19 outbreak have slashed profit margins for the third straight year.

According to figures issued by the Hong Kong Monetary Authority (HKMA), the average pre-tax profit of 30 licensed retail banks plummeted 18.6 percent in 2021, while bad or doubtful loans - referred to in Hong Kong as classified loans - were at 0.81 percent at the end of September.

The industry's plight forces the HKMA and the city's banks to choose between extending the interest holiday for the 3,500 enterprises who rely on it for survival and ceasing support to shore up banks' balance sheets. The plan, which has been extended three times since its launch in April 2020, is set to expire this April.

"The HKMA and banks are still discussing with the business sector on the plan," deputy chief executive Arthur Yuen Kwok-hang of the monetary authority said at a news briefing. "Even if we decide to discontinue the plan, funding will not be withdrawn abruptly. Rather, it will be phased out gradually to allow businesses adequate time to prepare."

The economic picture for Hong Kong seems bleak, as a so-called fifth wave of coronavirus epidemic has stifled demand, with the International Monetary Fund declaring last week that the city's "balance of risks is biased to the downside."

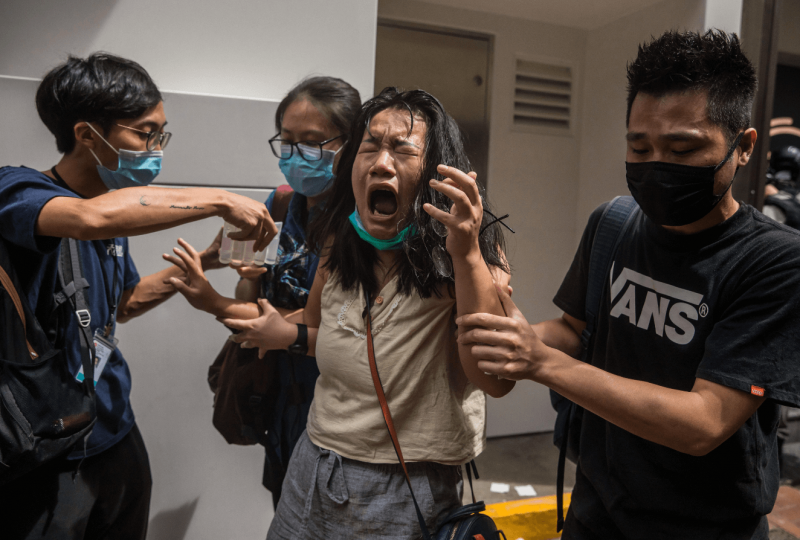

While retail banks' average profitability has decreased in comparison to the 29.4 percent fall in 2020, it is still worse than the 0.6 percent decline in 2019, when Hong Kong was rocked by months of public protests.

The extent of classified loans deteriorated to 0.9 percent in 2020, from 0.57 percent in 2019. Full-year data for 2021 is unavailable.

The HKMA stated that local lenders had "very little exposure" to China's indebted developers, such as the China Evergrande Group.

The current epidemic puts an additional strain on banks' operational costs and raises the probability of classified loans increased in the first quarter, Yuen added.

Tourism has been largely destroyed, with inbound visitor visits falling 98% to 81,950 in the first 11 months of the previous year, down from 3.56 million in the same time in 2020.

Genting Hong Kong declared bankruptcy and hired liquidators last week, citing a US$2.78 billion debt prompted by the failure of two German shipyards, becoming the city's largest business victim of the coronavirus outbreak.

To be sure, Hong Kong's classified loan portfolio remains among the lowest in the world, and the city's banks are adequately capitalized to weather the downturn, Yuen said. In September, the capital adequacy ratio remained stable at 20.4 percent, while total deposits in the banking system climbed by 4.6 percent, and total loans increased by 3.8 percent.

Hong Kong's banks are struggling due to low-interest rates, which have decimated their profit margins, Yuen explained. Retail banks' net interest margins decreased to 0.98 percent in 2021, down from 1.18 percent in 2020, according to HKMA statistics.

"With the United States prepared to raise interest rates this year, Hong Kong's banks' interest revenue is projected to grow in the future year," Yuen added.

While many banks have struggled to attract outside expertise because of Hong Kong's strict Covid-19 quarantine requirements, Yuen said that the city must also develop its own potential.

"Because the skill deficit in green finance and fintech is a worldwide issue, we must develop our own expertise," he explained.