GameStop Reports a Surprise Loss. ‘We Have Learned From the Mistakes of the Past Decade.’

Mar 20, 2022

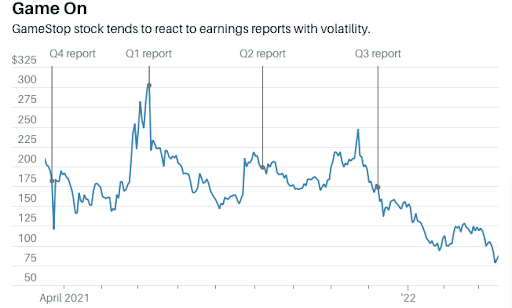

GameStop posted a surprising loss for its fiscal fourth quarter on Thursday. Shares fell in late trade, despite the fact that net sales exceeded estimates.

According to FactSet, GameStop (GME) posted an adjusted net loss of $141 million, or $1.86 per share, compared to the Wall Street consensus forecast of 85 cents per share. Net sales of $2.25 billion exceeded forecasted levels of $2.16 billion.

After-hours trading saw shares fall 9.6 percent. The stock is down nearly 56% year over year as investors look for indications of a larger turnaround for the video game retailer .

The firm stated in a recent Securities and Exchange Commission filing that it is committed to developing GameStop into a "customer-obsessed technology company that delights gamers."

"GameStop is committed to fully leveraging our unique position and brand in the gaming industry," the business stated. "Our strategic strategy is designed to improve our core business while also pursuing strategic initiatives that will position GameStop for the future by extending our addressable market and product offerings to fuel development in the gaming and entertainment sectors."

ADDITIONAL INFORMATION ABOUT EARNINGS

The annual report detailed objectives such as enhancing e-commerce activities, as well as the company's app and website. GameStop has invested in growing its fulfilment and customer service operations, as well as extending its product offerings to include a broader range of computer and consumer electronics goods.

GameStop also shared an update on their foray into the non-fungible token arena on Thursday. It now intends to launch its NFT marketplace by the end of fiscal 2022's second quarter.

Year to far, shares are down around 41% as the meme trade unwinds amid broader market turmoil and increasing interest rates.

The business hosted a brief conference call with analysts to announce earnings but did not accept questions, which was consistent with the previous four quarters. Additionally, the corporation has declined to offer financial guidance throughout that time period.

Chairman Ryan Cohen stated in a recent letter to Bed Bath & Beyond's (BBBY) board of directors that he preferred a management style focused on execution over pleasing Wall Street and television celebrities.

Cohen was appointed to the company's board of directors as an activist investor in January 2021, assisting in the stock's parabolic rise that annihilated hedge funds betting against it. Cohen took over as chairman in June. The business has hired professionals with e-commerce experience, most notably Matt Furlong, a former Amazon employee has been named to the CEO role.

"We've learnt from our past failures, when GameStop failed to adapt to the future of gaming," Furlong said on Thursday's earnings call. "It's critical to emphasize that GameStop had become such a cyclical business and was so cash-strapped that we had to rebuild it from the ground up. Additionally, we've had to alter our approach to income potential by embracing, rather than avoiding, the new frontiers of gaming."

Analysts such as Wedbush's Michael Pachter have stated that the corporation has not articulated a strategy for significantly improving its fortunes. Regarding the findings, Pachter previously told Barron's that he expected the company's CEO would read prepared statements and avoid taking questions.

"There is no direction, no substantial disclosure about the approach," he continued. "They'll frequently use the terms 'blockchain' and 'NFT,' with a few metaverse' allusions tossed in."

Not just Pachter casts doubt on the firm's approach. Reggie Fils-Aime, former GameStop director, told Bloomberg's Emily Chang that he was turned down when he wanted to share his experience as a former Nintendo of America president with Cohen and his allies at the South by Southwest festival in Austin, Texas.

"There has been no coherent plan," Fils-Aime stated. "You may visit the GameStop website and look for strategies. There is no discernible plan. 'Well, we don't want to articulate our plan because we don't want anyone to steal it,' leadership responds."

The phrase earned a round of laughter from the SXSW crowd.

"From a business standpoint, I believe that you must communicate your plan to all of your important constituents," he explained. "You must interact with your company associates; vendors; workers; and shareholders. And each of the three public boards on which I serve communicates its plan."

A spokesperson from GameStop did not respond to a request for comment on Fils-remarks. Aime's

Because GameStop shares are notoriously volatile following quarterly reports, the early after-hours move may reverse in Friday trade. As Cohen stated in his June shareholder presentation, investors should brace themselves.