Fed Chairman Powell Signals a Slowdown in Rate Hikes, Sending Stocks Soaring

Dec 02, 2022

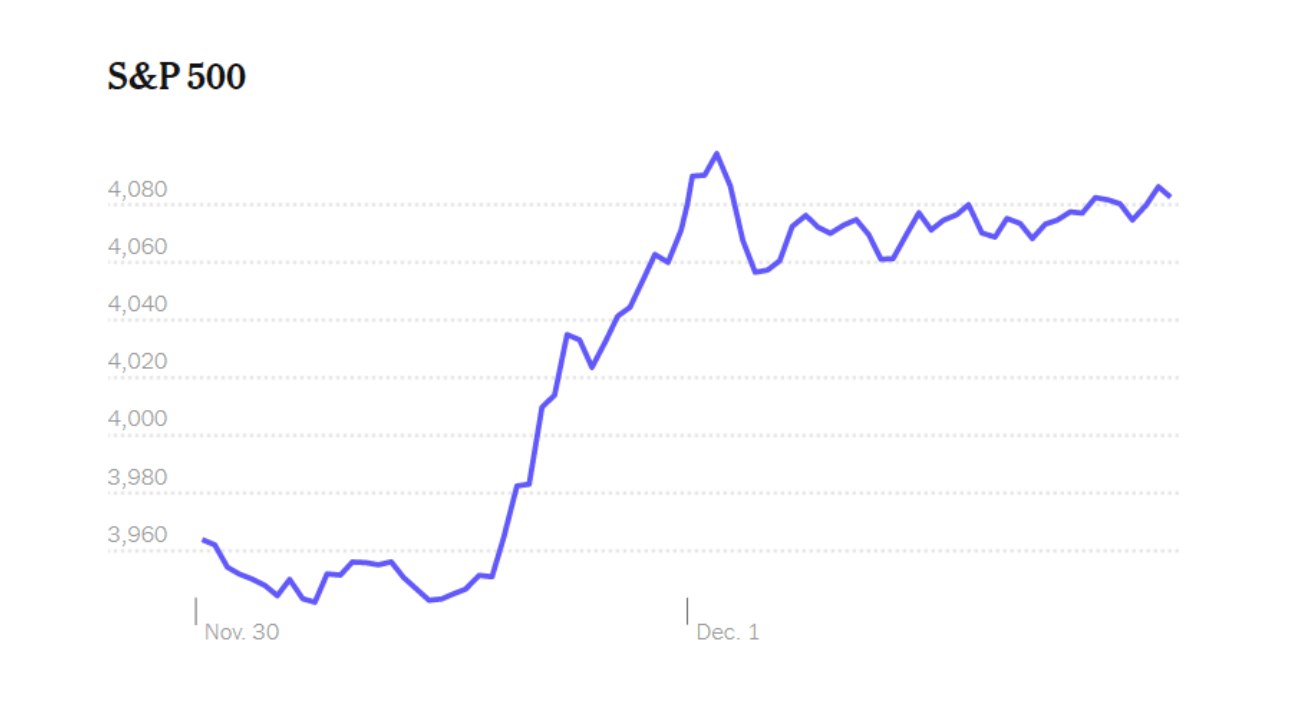

Afternoon trading on Wednesday saw stocks rise as investors assessed comments from Jerome Powell, the chairman of the Federal Reserve, which seemed to confirm the market's expectation for a gradual slowdown in interest rate increases.

"The time for moderating the pace of rate increases may come as soon as the December meeting," the Fed chair stated.

The S&P 500 index gained nearly 3%, recovering from a small decline just before Powell's remarks. It was the best day for the index in over two weeks. The Nasdaq index, an index especially impacted by interest rate rises, increased by 4.4%.

"The headline is that they are going to slow down the pace of rate hikes," Carson Group's director Sonu Varghese explained. "Powell, I think, all but gave this away."

Following the Fed's last policy meeting in early November, the market has been watching for any signals that the central bank might be easing up on inflation-fighting measures. Even though interest rates are expected to rise, investors are betting on the Federal Reserve to hike rates by 0.5 at their December 14 meeting, which is slightly slower than the three-quarter-point hikes seen in the previous four meetings.

The increase in interest rates negatively affects the economy’s growth, which adversely affects household spending and business profit margins. A slowdown in rate hikes would be welcomed by investors, which explains why the S&P 500 climbed more than 5% in November. The index is still down around 14.4% since January.

During his speech, Powell cited rapid wage growth and said that rates would most likely have to be raised more than expected in September to stabilize inflation.

"Despite some promising developments, we have a long way to go in restoring price stability," Powell stressed.

Additionally, investors await the latest jobs report, which will provide insights into whether labor markets are cooling, thereby easing price pressure. According to Bloomberg, analysts expect that 200,000 new job positions will be added in November, a slight decline in hiring but still a decent number.

According to job openings data released on Wednesday, employment growth remained strong, though some signs of moderating were evident. Despite an overall reduction in new job creation in October, there were a relatively small number of layoffs compared to previous months.

Changing outlooks for rising interest rates have also affected government bond yields, which dropped sharply last month. Ten-year yields have fallen to 3.6% from above 4.2% a few weeks ago.

Additionally, the possibility of lower interest rate hikes has negatively impacted the US dollar, falling over 4% in November compared with other global currencies, which is the largest drop in over a decade. This reflects how the Fed's aggressive rate-raising actions have made the dollar stronger. The dollar remains over 10% higher against major currencies in contrast to the start of the year, although it dropped further on Wednesday.

In Europe, the Stoxx 600 index rose 0.6% when inflation figures for the EU showed lower levels compared with forecasts. This fueled speculation that the European Central Bank might taper off rate increases during the next meeting on December 15.

In Asia, the Hang Seng Index in Hong Kong jumped over 2%, and the Nikkei 225 in Japan declined modestly.

The price of oil has risen for the third straight day, climbing 3% up to $81 pb for West Texas Intermediate crude, the benchmark for US oil prices.