Crypto Trading For Beginners

Mar 31, 2023

Since Bitcoin's debut in early 2009, the popularity of cryptocurrencies has skyrocketed significantly. Although Cryptocurrencies' primary goal was to serve as a fast and decentralized payment alternative, they soon gained recognition as an option to generate a passive income.

The main characteristic of cryptocurrency is its volatility, and while this can bring risks, it is also a critical factor that helps many traders make profits. Several micro and macro factors and influencers have significantly pushed the prices of cryptocurrencies over the years, making it a lucrative option for earning quick profits.

This article will give you an overview of cryptocurrency trading and walk you through every essential to start your trading journey.

Key Takeaways

Cryptocurrencies were first created as a decentralized alternative payment system but are now viewed as a potentially lucrative investment asset.

Cryptocurrency trading and investing are distinct in that trading involves making profits from short-term fluctuations using various strategies, whereas investing is a long-term profit from holding.

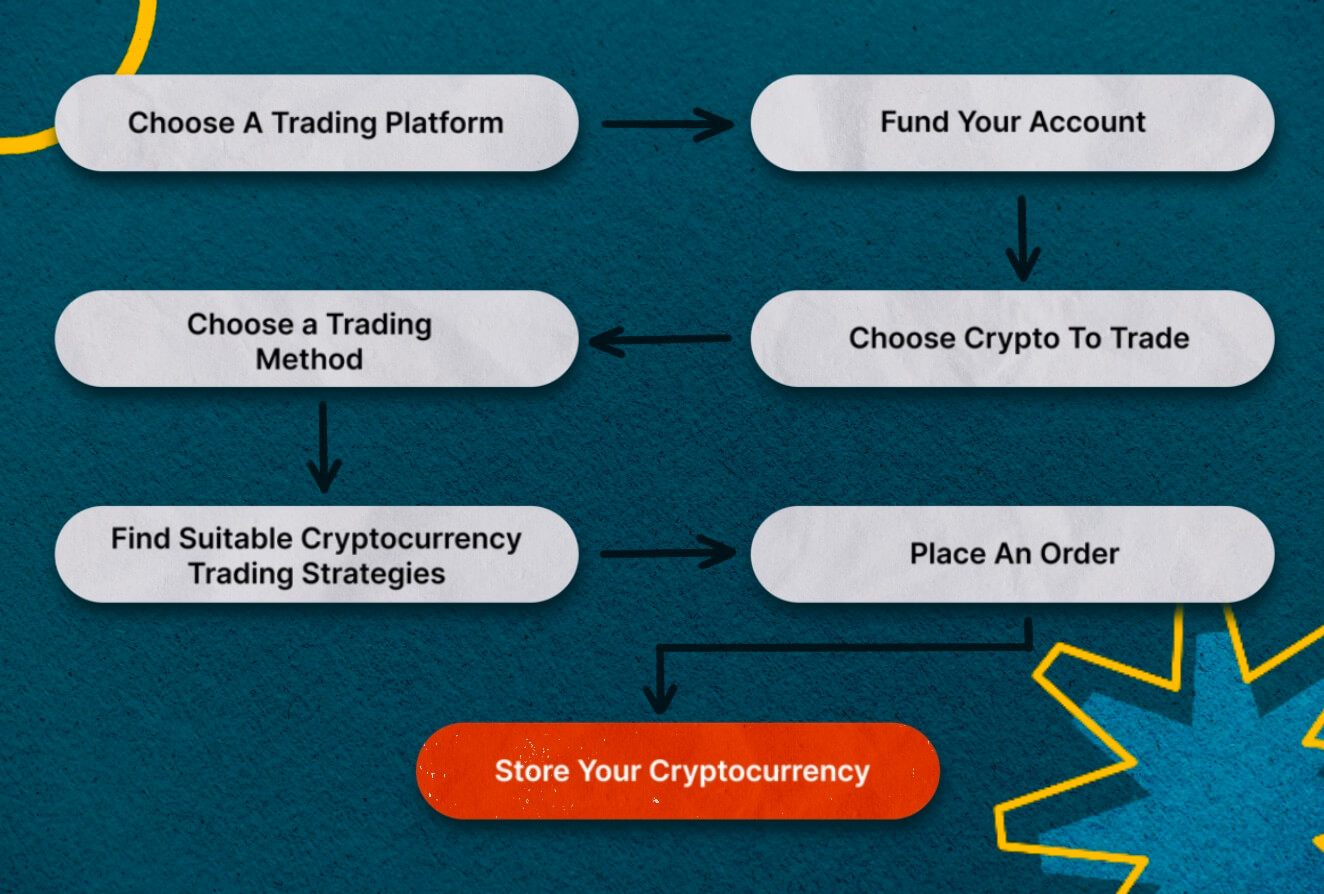

Cryptocurrency trading involves several steps: choosing an exchange or brokerage, funding the account, choosing a crypto asset to trade, and making an order following your trading strategy.

Several factors cause the fluctuation in the crypto market. These factors include supply and demand, market capitalization, press coverage, ease of integration process, major project updates, and more.

What Is Cryptocurrency?

Simply put, cryptocurrency is a digital currency that can be transferred between users without needing a third party, such as a bank, to verify the transfers. Everyone from any location can use this decentralized payment system to send and receive funds.

Notably, payments made with cryptocurrencies are not actual coins or bills that can be carried around or traded; instead, they are simply entries in a digital ledger that records individual purchases or sales details. When you send or receive cryptocurrency, your transaction details are publicly available in a distributed ledger.

The name "crypto" comes from the fact that cryptocurrency transactions are verified through encryption. This indicates that advanced coding is required for storing and transmitting cryptocurrency data between wallets and public ledgers. Encryption's primary function is to ensure the safety of its users.

Basics Of Trading Cryptocurrency

Cryptocurrency trading entails buying and selling digital assets on exchanges to make a profit. In the same way that traditional currencies have a Forex market, cryptocurrencies have their very own digital currency exchange market on which users can trade crypto coins.

Cryptocurrency trading is a round-the-clock market, unlike the stock market, which closes at the end of each trading day.

Since there are two opposing sides to every crypto transaction, someone is bound to benefit more than the other. Therefore, trading is, by definition, a zero-sum game in which both sides leave with some sort of net gain or loss.

When it comes to an asset's market value, it is established when trade between a buyer and seller is completed (via an exchange) at an agreed-upon price. Typically, purchasers will place bids at a lower price than sellers. This forms the front and back of an order book.

Cryptocurrency prices tend to rise when demand exceeds supply, as seen when buy orders exceed sell orders. Contrarily, when there are more sellers than buyers, the price drops. The purchase and sale processes are typically denoted by two distinct shades of color in trading interfaces. This is to provide a quick snapshot of the market's current condition for the trader.

Crypto Trading VS Crypto Investing

Before we dive deep, let's agree on one thing: trading and investing in cryptocurrencies are two distinct activities, each with unique risks and potential rewards.

Profitability in the financial markets is a goal shared by both cryptocurrency traders and investors. But how they intend to accomplish this goal is very different.

Most investors are looking for returns over several years, if not decades. Their strategy is usually simply holding, and due to the extended periods, investors are looking for higher rates of return on their investments.

On the other hand, traders aim to profit from market fluctuations. They trade more frequently, often entering several trades at once, and may be satisfied with lower returns on each trade.

Cryptocurrency Trading Steps For Beginners

Getting started in cryptocurrency trading is technically simple. Still, it requires a thorough analysis of existing exchanges, brokerages, and market trends. Here are seven major steps every beginner trader needs to acknowledge when starting the trading journey.

1. Choose A Trading Platform

Choosing a suitable platform is the initial step. You can use a regular broker or a cryptocurrency exchange to buy and sell crypto assets.

Traditional brokerages let you buy and sell cryptocurrencies and other financial assets like stocks, bonds, and ETFs.These platforms typically have cheaper trading fees but fewer cryptocurrency options.

Speaking of cryptocurrency exchanges, they offer a broader option to choose crypto assets. Various crypto exchanges have different features, such as wallet storage methods, interest-bearing account options, and more. The transaction fees the exchanges charge are usually calculated based on the value of the traded assets.

When comparing various platforms, consider the cryptocurrencies they support, the fees they charge, their security features, storage, and withdrawal options.

Here is a quick video guide to understanding the difference between exchanges and brokerages to make the right decision.

2. Fund Your Account

After settling on a trading platform, now it's time to fund your trading account. Although it varies by platform, most crypto exchanges let customers buy cryptocurrency with fiat (i.e., government-issued) currencies like the US dollar, British pound, or Euro using their debit or credit cards.

Some services also accept wire transfers and ACH transactions. The deposit and withdrawal methods available and the associated times vary by service. For the same reason, different deposit methods have different processing times.

3. Choose Crypto To Trade

Bitcoin and Ethereum attract the vast majority of cryptocurrency investors' capital. On the other hand, Altcoins have a lot of untapped potential and can yield substantial profits.

In cryptocurrency trading, portfolio diversification is essential. The market can be volatile, so putting all your eggs in one basket is risky. While well-established projects such as Ethereum, Bitcoin, Ripple, etc., gain more investor confidence, new altcoins with high growth potential can also become valuable gems. Additionally, new assets are frequently the focus of speculation and short-lived hype; if you get in early and know when to get out, you might strike it rich.

4. Choose A Trading Method

The next thing to do is settle on a method for trading. There are three primary approaches to trading cryptocurrencies for short time frames.

Directly Trade Cryptocurrencies Against One Another

You directly trade cryptocurrencies against each other when you buy at low and sell at its high. The most common strategy is to invest in a specific asset before some major events occur, and once the hype ceases, convert these holdings into stablecoins. For instance, during the latest Ethereum Merge update, many market observers purchased ETH at its lowest, pushed the price a little, and sold after the Merge. However, note that this strategy requires accurate market timing and extensive preparation, as any late decision can miss your chance.

Trade Cryptocurrency Derivative Instruments

Crypto derivatives can be traded without actually owning any cryptocurrency. Instead, you could "bet" on the price changes. Many kinds of derivatives exist, such as futures, options, perpetual swaps, etc.

Trade Cryptocurrency CFDs

Contracts for difference, also known as CFDs, are a specialized form of derivative that lets investors speculate on how the price of an underlying asset will move. CFDs allow traders to use leverage and speculate on price movements without owning the underlying asset, just like other derivatives do.

However, unlike other derivatives, CFDs are not purchased or sold on an open market. Instead, you buy from/sell to the broker you are working with.

5. Find Suitable Cryptocurrency Trading Strategies

When trading crypto, a trading strategy is a huge help to reduce your exposure to financial risk. A crypto trading strategy helps you avoid impulsive decisions that cost you a lot of hard-earned money. Day trading, HODL, scalping, swing trading, etc., are some of the most common cryptocurrency trading strategies.

6. Place An Order

You can place an order from the web or mobile platform your exchange/brokerage supports. Select "buy," choose a suitable order type, enter the desired amount, and confirm the order. For "sell" orders, the procedure is identical.

7. Store Your Cryptocurrency

When you buy cryptocurrency, you need a secure place to keep it until you're ready to spend it. Cryptocurrencies are usually kept in a cryptocurrency wallet, either on physical devices or online software. Some exchanges/brokers let you keep your funds in a digital wallet, and you can access it right from the platform. However, note that not all the platforms offer wallet services.

Although many digital wallets exist, they are generally split into two categories: hot and cold wallets.

Hot wallets are cryptocurrency storage facilities that keep your private keys in a cloud-based service.

Meanwhile, cold wallets, AKA hardware wallets, keep your private keys in an offline electronic device and are often considered a safer option as they are less vulnerable to hacks.

Cold wallets typically impose fees, while hot wallets do not.

What Moves The Cryptocurrency Market?

The price of cryptocurrencies fluctuates based on supply and demand. However, because of their decentralized character, crypto-assets do not depend on the same monetary and political fluctuations as traditional currencies. A lot of mystery still surrounds cryptocurrencies, but the following can have a major impact on their values:

Supply: the total number of coins in circulation and the rate at which new coins are created, destroyed, and lost.

Market capitalization: calculating the total value of all coins in circulation and how users expect this value to change.

Media hype: how cryptocurrency is portrayed in the press and the attention it receives.

Seamless integration: the ease with which a cryptocurrency can be integrated into existing infrastructure, such as e-commerce payment systems.

Major development updates: things like regulatory updates, technical developments, forks, etc.

Whales: Large investors (or "whales") disproportionately impact market prices. Some whales act as "market makers," who set the bidding and asking prices on both sides of an asset's market to increase its liquidity and make a profit.

How To Read The Crypto Market Trends

When saying "reading the market," we refer to the ongoing process of observing the market and identifying patterns you can later use to act upon. Understanding the basic market trends is essential since it defines the success of any trade. There are two main market trends - a bullish and a bearish one.

When prices appear to be moving upward, we face a bullish market. The spikes in price are called "pumps" because of how the market reacts to sudden influxes of buyers.

Meanwhile, when prices appear to go down over a prolonged period, it indicates the start of the bearish market. The widespread selling pressure causes significant price fluctuations, often called "dumps."

Consolidation is another type of market state that occurs when prices move sideways or within a narrow range. When an asset cools off after a sharp upward or downward trend, it enters a consolidation phase. Consolidation can also occur before the trend reverses or demand drops.

FAQs

Is cryptocurrency trading good for beginners?

Anyone with a basic understanding of market trends, technical analysis skills, and an active trading strategy can start trading cryptocurrency. However, the crypto market is volatile and risky, and even an experienced trader cannot guarantee 100% profits.

Is cryptocurrency trading profitable?

The high volatility and the rapid price pumps make cryptocurrency highly lucrative but also risky.

How much crypto should I buy as a beginner?

This purely depends on the crypto exchange or broker you are working with. For instance, most exchanges require $100 as a minimum deposit, while some accept as low as $5.

Can I buy and sell crypto on the same day?

The cryptocurrency market never officially closes. Therefore, investors can buy and sell whenever they like, regardless of the time of year.

Is it too late to get into crypto?

It is never too late to invest in crypto as the industry grows and new opportunities appear daily.

Final Takeaway

The popularity of cryptocurrency trading has grown significantly over the last few years as people on a global scale realized they could generate passive income from these assets. However, as the opportunities grow, so do the associated risks. Therefore, research well, find a suitable broker/exchange, address the market risk, and do not let your emotions direct your trading decisions.