5 Best Crypto CFD Liquidity Providers 2023

June 30, 2023

In the complex game of trading, one thing’s for sure – liquidity providers are the unsung heroes behind any successful brokerage. No matter what you’re trading – Forex, CFDs, Futures, or even Commodities – having a rock-solid and reliable source of liquidity is a must-have.

When the market is brimming with liquidity, everybody wins, from brokers to traders. High liquidity means better prices for everyone. This happens because the sheer number and size of the buyers and sellers help to create a fair price for the trading product, making everyone happy.

Lately, crypto CFDs have become the top choice in the trading world. As a result, brokers are doing their best to offer this exciting service to their clients. But they first need to find the proper crypto CFD liquidity provider to do that.

This article examines the five top dogs in the crypto CFD liquidity provider scene.

Key Takeaways

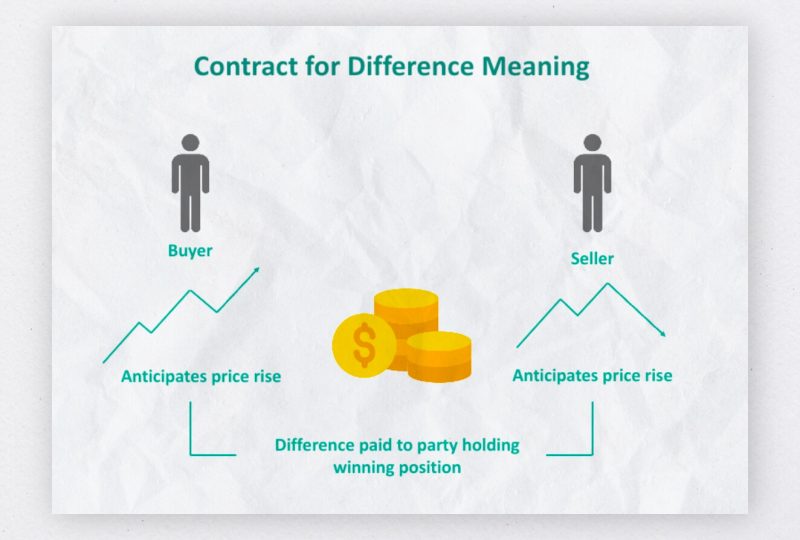

- Crypto CFDs, or Contracts for Difference, allow traders to speculate on the price of cryptocurrencies without actually owning the underlying assets.

- In crypto CFD trading, traders open contracts with a broker, profiting or losing from the difference in price between the opening and closing of the contract.

- Liquidity in crypto CFD trading is essential for smooth transactions, lower spreads, price stability, and potentially higher profitability for traders.

- Offering Crypto CFDs gives brokers a competitive edge, providing traders with a popular, flexible, and potentially lower-risk trading option.

- The top 5 liquidity providers in the crypto CFD market, known for their high-quality service, are B2Broker, GBE Prime, Leverate, Brokeree, and X Open Hub.

What Are Crypto CFDs?

CFDs are a type of financial derivative that have exploded in popularity among traders of digital assets. A Crypto CFD is a contract for the difference between the price of a cryptocurrency at the time of the contract’s execution and the price of that cryptocurrency at a future date.

The main attraction of Crypto CFDs is the possibility of making large returns from even modest market shifts. An investor can participate in crypto price movements without actually holding any cryptocurrency. As a result, an investor can go long (buy) or short (sell) to profit from a change in the cryptocurrency’s price.

Why Is Crypto CFD Trading So Popular?

The increasing popularity of Crypto CFD trading is not a chance occurrence but a calculated choice made by many traders and brokers worldwide. It presents a load of benefits that traditional cryptocurrency trading often cannot.

Firstly, profit, regardless of market direction, is a significant advantage for traders. For instance, if a trader believes Bitcoin’s price will drop, they can short a Bitcoin CFD and potentially profit from the price decrease, a feature absent in traditional crypto trades. This strategic flexibility to profit from rising and falling markets contributes significantly to Crypto CFD trading’s popularity.

Secondly, leverage in Crypto CFD trading plays a vital role. Consider a scenario where a trader has $1000, and the leverage is 10:1. The trader can then take a position worth $10,000, amplifying potential profits. However, while leverage might be a tool to bolster profits, it is a double-edged sword. If the market trends unfavorably, the losses incurred are equally magnified.

Crypto CFD trading also addresses certain practical limitations of traditional cryptocurrency trading. Instead of grappling with the intricacies of setting up a digital wallet or dealing with potentially unreliable crypto exchanges, traders can utilize their existing trading accounts, regulated and secure, to trade Crypto CFDs.

Further, Crypto CFDs widen the spectrum of tradeable crypto assets. In conventional crypto trading, lesser-known or less liquid cryptos might be difficult to acquire, but with CFDs, these become readily accessible. A trader interested in an emerging crypto, like Polkadot or Chainlink, can trade CFDs without holding the actual cryptocurrencies.

For brokerages, Crypto CFDs are not just another asset class. They bridge a rapidly expanding market with a burgeoning client base. Offering Crypto CFDs could be an enticing lure for a prospective client who’s eager to tap into the crypto market but hesitant about the complexities of direct crypto ownership.

Additionally, the volatility of cryptos can lead to heightened trading volumes, a desirable scenario for brokerages. With each trade, brokerages earn via commissions and spreads. More trades equate to higher earnings, making the volatile crypto market an attractive proposition for these firms.

Crypto CFD trading’s rising popularity stems from the versatility, practicality, and potential profitability it offers traders and the customer acquisition and revenue enhancement opportunities it provides for brokerages.

Steps for Setting up a Crypto CFD Brokerage

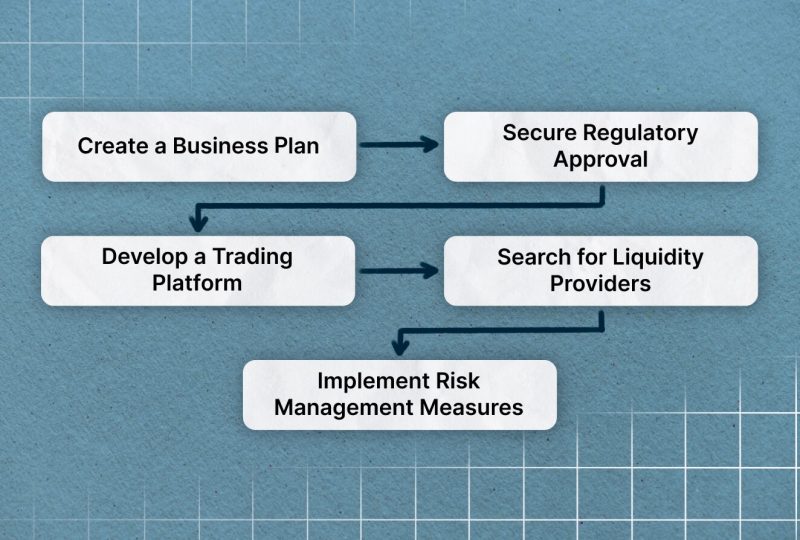

The rising popularity and demand for cryptocurrencies makes it a good time to launch a crypto CFD brokerage. However, it’s a complex procedure that needs thorough planning and execution.

Create a Business Plan

A Crypto CFD brokerage should start with a robust business plan like any business. This plan should outline your target market, unique selling proposition, marketing strategy, and financial projections. In cryptocurrency trading, being clear about your vision and strategy is critical.

Secure Regulatory Approval

Depending on the jurisdiction in which you intend to conduct business, cryptocurrency and CFD trading will be subject to varying regulations. Obtaining the appropriate authorizations and meeting the requisite legal standards are fundamental.

Develop a Trading Platform

Any brokerage that hopes to succeed must provide its clients with a trading platform that is accessible, dependable, and safe. Despite the widespread availability of pre-built solutions, some brokerages still opt to build their own systems. Efficient trading, user security, and a frictionless interface are musts for every platform selection.

Search for Liquidity Providers

Locating trustworthy liquidity providers is a critical first step in launching a Crypto CFD brokerage. The capacity to execute trades quickly and at competitive pricing depends on the brokerage’s liquidity. Even during times of severe market volatility, the liquidity provider should offer a wide variety of crypto assets and guarantee fast, easy transactions.

Implement Risk Management Measures

Setting up effective risk management procedures is also essential. This involves taking steps to control credit, market, and operational hazards. A thorough risk management approach includes regular audits, strong cybersecurity, and clear trading instructions.

The Importance of Liquidity and Its Providers for Crypto CFD Trading

The idea of liquidity is fundamental to the financial trading industry as a whole, and Crypto CFD trading is no exception. Liquidity is the ability to buy and sell an item quickly and easily without significantly impacting its price and facilitating the swift and error-free execution of trades with little to no price slippage. It is crucial since it influences the usefulness and attractiveness of a trading platform.

High liquidity in Crypto CFD trading has several benefits. It guarantees quick transactions, an important quality given the volatility of cryptocurrency values. Due to high liquidity, traders may take advantage of opportunities as they emerge by making transactions quickly.

Tighter spreads, or the gap between the buy and sell prices of a contract, are another common consequence of a liquid market. Low spreads are preferable since they allow traders to keep their costs down and, in theory, enhance their profits. Tight spreads can have a big effect on a trader’s profit in volatile markets where price movements can occur quickly and dramatically.

All these are made possible by liquidity providers, who also play a crucial role in keeping market prices stable. By keeping the same number of buy and sell orders flowing in, they keep the market stable, which leads to more secure and predictable trading conditions.

How To Choose The Right Crypto CFD Liquidity Provider

The choice of the right Crypto CFD liquidity provider plays a pivotal role in the success of a brokerage. This decision requires careful consideration of several crucial aspects, each of which carries implications for the brokerage’s operational efficiency, client satisfaction, and overall profitability.

Range of Instruments

Making sure the liquidity provider supports a wide variety of coins and tokens is crucial. This variety allows the brokerage to serve a wide range of customers with different trading preferences. Also, see if the service you’re considering gives FIX protocol access and historical data, as well as the option to convert your preferred cryptocurrencies into fiat money and vice versa.

Market Depth

This refers to the number of buy and sell orders at each price point for a particular cryptocurrency. A provider with substantial market depth will likely be more stable and can better accommodate large orders without significantly affecting the price.

Execution Speed

In a market known for its volatility, speed is of the essence. The right liquidity provider should be able to execute trades swiftly with minimum slippage and requotes, especially during significant news events that can trigger rapid price movements.

Competitive Pricing

The liquidity provider’s pricing structure is a crucial consideration. Competitive spreads, low commissions, and low swaps are desirable. However, these must not compromise service quality or execution efficiency. Balance is key – finding a cost-effective pricing provider without sacrificing performance.

Reliability of Price Feeds

The provider’s data feeds should be stable and reliable and offer real-time price data from all relevant exchanges and the Forex market. Timely and accurate price data are crucial for effective trading. Any delays can result in price gaps, adversely affecting trade execution and profitability.

Technological Capabilities

A top-tier liquidity provider should be able to offer advanced technological solutions, including a FIX protocol connection and other APIs. Compatibility with popular trading platforms like MT4 is essential, ensuring seamless integration and operational efficiency.

Reputation and Regulation

Don’t overlook the provider’s market reputation and regulatory status. A well-regarded provider with robust regulatory oversight is more likely to offer reliable, high-quality service. Check online reviews, seek recommendations, and verify their regulatory compliance. This, coupled with the SEC’s recent aggressive regulatory moves around the cryptocurrency business, could create uncertainty about USDT.

Five Top-Notch Crypto CFDs Liquidity Providers

Liquidity is the lifeblood of any financial business, and choosing the right liquidity provider can make a significant difference in Crypto CFD trading. Here are the top five providers that have carved a niche for themselves in this field.

1. B2Broker

Established in 2017, B2Broker quickly ascended the ranks, initially providing CFDs for 30 crypto trading pairs. Presently, their liquidity pool encompasses 134 pairs, offering access to the most sought-after digital assets. Notably, they offer a BTC spread from just $0.1, with order execution times starting at 12 milliseconds.

Margin requirements are generally at 20% for most pairs, allowing traders to leverage up to 1:5. B2Broker continually expands its liquidity offerings and currently grants access to 400 instruments.

2. Leverate

Leverate, with 12 years of experience in the financial markets, offers attractive solutions for a wide range of market players. LXCapital, one of their key services, connects your order book to a deep liquidity pool featuring more than 15 crypto trading pairs.

Leverate ensures high-speed order execution, low spreads, and zero gaps. They distribute liquidity through MetaTrader 4 and their proprietary platform, Sirix.

3. GBE Prime

GBE Prime has created a robust liquidity pool involving premier FX institutions globally. Brokers can choose their optimal connection location with trading servers in London, New York, and Tokyo. They offer liquidity for over ten trading pairs, including BTC, ETH, XRP, and LTC. Competitive advantages include tight spreads and low commissions. Beyond Crypto CFDs, they provide liquidity for assets totaling around 250 products.

4. X Open Hub

X Open Hub links brokerage businesses to over 3000 instruments by connecting them to extensive institutional liquidity pools. For CFD contracts on cryptocurrencies, their pool includes pairs with seven digital assets, including BTC, ETH, LTC, XRP, DASH, EOS, and XLM. They boast industry-leading execution speeds, and their pricing structures suit STP and ECN brokerage firms.

5. Brokeree

Brokeree builds a liquidity bridge for brokerages, facilitating Crypto CFD trading. They collaborate with leading liquidity aggregators to tap into the deepest liquidity pools. Brokers can access high liquidity for over 50 trading pairs, enjoying minimal execution time and low spreads. Brokeree distributes liquidity via MetaTrader 4 and MetaTrader 5 platforms.

Final Takeaway

When launching a brokerage, your primary aim should be to provide your clients with the utmost flexibility, an extensive selection of asset classes, and the best possible trading conditions. It’s no surprise that CFDs have emerged as one of the top choices for traders, owing mainly to their relatively low risk. However, none of this would be feasible without the unseen orchestrators of the market – the liquidity providers.

Hence, for any financial institution operating in the crypto or forex landscape, identifying the right liquidity provider is not just a goal – it’s a necessity. It’s the crucial first step to set the stage for a successful, profitable trading operation. So, conduct extensive research, scrutinize your options, and choose a liquidity provider that best aligns with your business model and clients’ needs.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

Is Binance a liquidity provider?

Yes, Binance acts as a liquidity provider in the crypto market. It offers a substantial volume of crypto assets for trading, contributing to market liquidity.

How do liquidity providers make money?

Liquidity providers typically earn money from the bid-ask spread – the difference between the buying price and the selling price of an asset. They may also receive fees or commissions from each transaction using their liquidity.

How do I choose a liquidity provider?

When choosing a liquidity provider, consider factors such as the range of assets they cover, their pricing and fee structure, the speed and reliability of their execution, the stability and volume of their liquidity, and their technological capabilities, such as API connections or compatibility with various trading platforms.

Is high liquidity good in crypto?

Yes, high liquidity is generally beneficial in crypto trading. It allows traders to buy and sell assets more easily without causing significant price changes. It also typically results in tighter spreads, potentially reducing trading costs and increasing profitability.