Top 5 Liquidity Bridge Providers in DeFi

Mar 27, 2025

As blockchain technology keeps growing, liquidity bridge operators have come up with a solution to help different blockchain networks work better together. Now, traders and investors aren’t stuck with just one system. They can move their assets across various blockchains, which opens up more opportunities for trading and maintaining a steady flow of assets.

In this article, we will analyze the leading liquidity bridge providers, their differentiating qualities, and their roles in shaping the future of DeFi.

Key Takeaways:

- Liquidity bridges are essential for cross-chain trading, enabling seamless transfers between Ethereum, Solana, and Binance Smart Chain networks.

- Security improvements, such as AI-powered risk management and decentralized validation, make bridges safer and more reliable.

- The future of DeFi depends on low-cost, AI-optimized, and regulation-friendly liquidity bridges to support institutional and retail adoption.

What is a Liquidity Bridge?

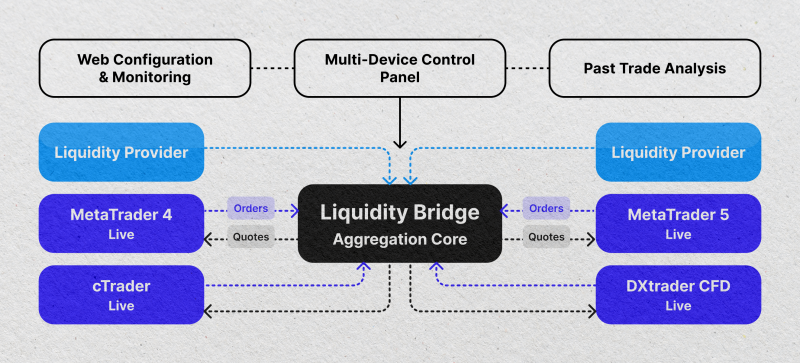

A crypto liquidity bridge is a crucial mechanism in blockchain and DeFi that fosters the straightforward transfer of holdings onto independent blockchains or financial systems without relying on centralized intermediaries.

These bridges enhance trading efficiency by allowing users to access liquidity pools throughout diverse networks, reducing market fragmentation and improving capital mobility.

The process of liquidity bridging typically involves locking assets on one blockchain, such as Ethereum, while an equivalent amount of tokens is minted on another blockchain, like Binance Smart Chain (BSC).

These newly minted tokens can be used for trading, yield farming, or other financial activities within the new ecosystem. When a trader decides to revert the transfer, the minted tokens on the destination blockchain are burned, and the original assets on the source blockchain are unlocked.

By facilitating interoperability and boosting liquidity across various blockchain ecosystems, this mechanism enables traders to move assets effectively and benefit from a variety of trading instances across networks.

By bridging liquidity, traders benefit from lower transaction costs, reduced slippage, and access to a wider range of financial products without being restricted to a single blockchain.

Fast Fact:

Wormhole Bridge once suffered a $320 million hack but has since implemented stronger security measures, becoming one of the most widely used cross-chain bridges in 2025.

Top 5 Liquidity Bridge Providers in DeFi

As of today, liquidity bridges have become essential components in the DeFi ecosystem, enabling seamless asset flows across diverse blockchain networks. These bridges facilitate interoperability, allowing users to move tokens between chains efficiently and securely.

Here are the top five liquidity aggregation system providers leading the industry:

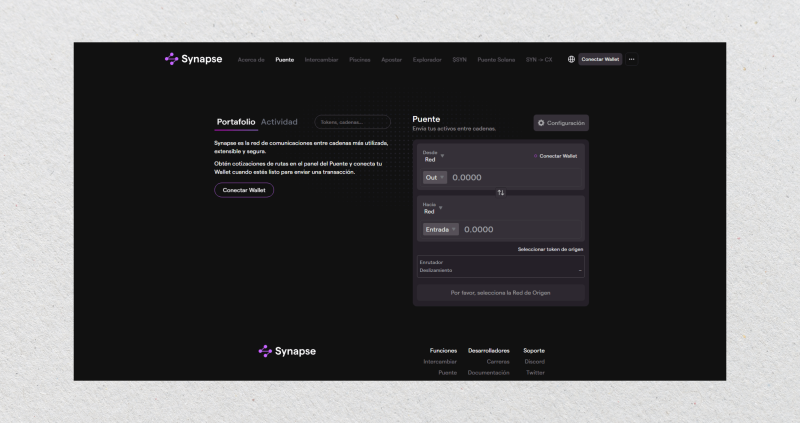

Synapse Protocol

Synapse Protocol stands out for its robust cross-chain capabilities, supporting over 20 blockchain networks, including Ethereum, Binance Smart Chain, and Polygon. It offers a highly efficient and secure way to transfer assets while maintaining interoperability across multiple ecosystems. Its low transaction fees make it a cost-effective choice for traders.

Security is a major focus for Synapse, with regular audits and a decentralized validator network ensuring that asset transfers remain safe from exploits. Its user-friendly interface simplifies the bridging process, allowing seamless transfers with minimal effort.

Stargate Finance

Built on the LayerZero protocol, Stargate Finance revolutionizes liquidity bridging by offering unified liquidity pools and native asset transfers. Stargate ensures direct token transfers across multiple chains while guaranteeing transaction finality, unlike many bridges requiring wrapped assets.

Its interconnected liquidity pools enhance capital efficiency, reduce slippage, and enable more predictable pricing. Advanced features like slippage control and gas token optimization improve the user experience. The platform’s focus on seamless execution and transparent fees has made it a preferred choice for cross-chain traders.

Portal (Wormhole)

Portal, powered by the Wormhole protocol, is one of the most widely adopted cross-chain bridges, supporting Ethereum, Solana, Binance Smart Chain, and several other networks. Its ability to facilitate fungible token and NFT transfers gives it an edge over competitors.

Despite experiencing security incidents in the past, Wormhole has significantly enhanced its security measures, implementing stricter protocols and additional safeguards to protect user assets. It provides a straightforward and efficient interface that caters to new and experienced users, making asset transfers smooth and reliable.

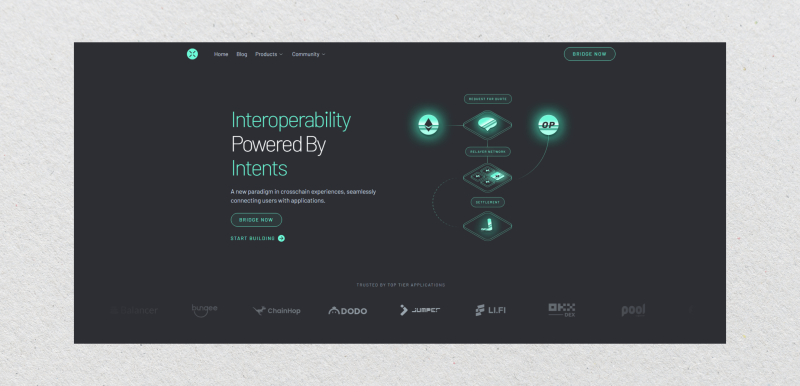

Across Protocol

Across Protocol introduces an intent-based bridging mechanism, allowing users to specify desired transaction outcomes. This approach simplifies the cross-chain transfer process while maintaining high security and cost-efficiency.

The Protocol utilizes a competitive relayer system, where multiple relayers bid to fulfill user intents. This ensures that transfers happen at the best possible speed and cost while maintaining network security.

The settlement layer verifies intent fulfillment, providing additional protection against malicious activities. Across Protocol’s streamlined and intuitive interface makes it an attractive choice for cross-chain traders looking for speed and reliability.

Rhino.fi

Rhino.fi is a self-custodial, multi-chain DeFi aggregator that leverages StarkEx technology for scalability. Utilizing zk-proofs efficiently batches transactions off-chain, reducing fees and ensuring faster transaction finality while maintaining Ethereum-grade security.

Supporting over 23 blockchains, including Ethereum, Solana, and Arbitrum, Rhino.fi enables gas-free cross-chain transfers, allowing users to trade assets without holding native gas tokens. Its frictionless experience across Layer 2s, Ethereum, and non-EVM chains makes it a top choice for traders seeking smooth and cost-effective bridging.

The Future of Liquidity Bridges in the Trading Industry

As blockchain technology and DeFi evolve, liquidity bridges are becoming essential to the trading industry. These bridges facilitate cross-chain transactions, increase capital efficiency, and improve interoperability between diverse blockchain ecosystems.

Looking ahead, liquidity bridges will undergo significant improvements in security, speed, cost-effectiveness, and automation, leading to a more seamless and efficient trading environment.

The Growing Demand for Cross-Chain Interoperability

The shift toward a multi-chain financial ecosystem makes liquidity bridges an essential tool for traders. Users can transfer funds directly instead of relying on centralized exchanges (CEXs) to move assets between blockchains, reducing fees and counterparty risks.

Future developments will focus on standardized cross-chain protocols, multi-chain wallets with built-in bridging functionalities, and FX liquidity aggregation systems that ensure seamless market connectivity.

These innovations will create a more efficient and interconnected financial system where asset transfers across blockchains happen without friction.

Better Security and Decentralization

Security remains one of the biggest challenges for liquidity bridges, as past exploits have led to significant losses. Bridges will implement decentralized validation mechanisms, relying on multiple nodes rather than single custodians.

Zero-knowledge proofs (ZKPs) and multi-signature authentication will strengthen asset protection, while AI-powered risk management systems will monitor real-time transactions to detect suspicious activity.

These advancements will make liquidity bridges safer, encouraging wider adoption among institutional and retail traders.

Reduction in Transaction Costs and Latency

One major barrier to mainstream adoption is the high gas fees and slow operation speeds associated with Layer-1 networks. Future liquidity bridges will integrate with Layer-2 solutions like Arbitrum, Optimism, and zkSync, significantly reducing transaction costs.

Sidechains and rollups will also enhance efficiency by bundling multiple transactions before finalizing them on the main chain. Additionally, cross-chain atomic swaps enable instant asset exchanges without intermediary steps. AI-Powered Liquidity Management

Artificial intelligence will play a crucial role in optimizing liquidity bridge operations. AI-driven systems will predict market demand and rebalance liquidity pools, ensuring optimal efficiency.

They will also monitor price discrepancies across chains to reduce arbitrage inefficiencies and dynamically adjust transaction fees based on network congestion. As a result, traders will benefit from smarter liquidity routing, ensuring they receive the best rates with minimal slippage.

Finally, AI-powered bridges will enhance automated trading bots, enabling precise and efficient execution of cross-chain strategies.

Institutional Adoption and Regulatory Conduct

While liquidity bridges are popular in DeFi, institutional investors have hesitated due to regulatory concerns and security risks. The next generation of bridges will incorporate KYC and AML compliance frameworks, allowing institutions to transfer assets across ledger systems while adhering to legal requirements.

Regulatory-approved cross-chain protocols will also emerge, providing safer and more transparent asset transfers. Institutional-grade custodial services will further bridge the gap between traditional finance (TradFi) and DeFi, unlocking new opportunities for large-scale investments in blockchain-based trading.

Growth of Cross-Chain Yield Farming and Staking

As liquidity bridges become more advanced, traders will explore new cross-chain DeFi opportunities, including yield farming, staking, and multi-chain lending.

Users can move assets across distributed ledger systems to access the highest-yielding liquidity pools, maximizing their returns without being restricted to a single ecosystem. Cross-chain staking will also become more common, allowing users to stake assets on one blockchain while receiving rewards on another.

This will increase liquidity and participation in decentralized financial markets, making DeFi more profitable and accessible.

The Evolution of Cross-Chain DAOs and Governance

Decentralized autonomous organizations (DAOs) will play a larger role in governing liquidity bridges, ensuring they remain transparent and community-driven.

Future bridges will be governed by decentralized decision-making systems, where token holders vote on protocol upgrades, transaction fees, and security measures. Interoperable governance tokens will allow users to participate in multiple blockchain ecosystems, enhancing cross-chain collaboration and governance.

This decentralized model will eliminate single points of failure and reduce centralization risks, making liquidity bridges more resilient and community-driven.

More Involvement of Liquidity Bridges in Web3 and the Metaverse

Beyond financial trading, liquidity bridges will be crucial in Web3 applications and the metaverse, allowing assets to move seamlessly between blockchain-based virtual economies, gaming platforms, and NFT marketplaces.

Future developments will introduce cross-chain NFT trading, enabling users to buy and sell digital assets across different networks. Liquidity bridges will also be integrated into Web3 payment gateways, facilitating instant asset transfers in metaverse environments.

As blockchain technology expands, liquidity bridges connect digital economies, enhancing accessibility and financial fluidity in decentralized applications.

Bottom Line

Liquidity bridges are no longer just an option; they are a necessity for traders navigating the multi-chain future of blockchain. With growing security advancements, AI-powered automation, and institutional adoption, cross-chain trading will become faster, cheaper, and more secure.

Whether you’re a retail trader or an institutional investor, understanding the best liquidity bridge providers’ working principles and choosing the best option will help you stay ahead in the rapidly changing DeFi field.

FAQs:

What is a liquidity bridge?

A liquidity bridge enables seamless capital transfers between blockchains, improving trading reliability and market accessibility.

Why are liquidity bridges important in trading?

They eliminate reliance on centralized exchanges, reduce fees, and allow traders to access liquidity thanks to diverse networks.

Which are the top liquidity bridge providers today?

Leading providers include Synapse Protocol, Stargate Finance, Portal (Wormhole), Across Protocol, and Rhino.fi.

Are liquidity bridges safe?

Modern bridges enhance security by using multi-signature authentication, zero-knowledge proofs, and decentralized validation.

How do liquidity bridges impact institutional trading?

Institutions benefit from KYC-compliant bridges, regulated custodial services, and seamless cross-chain capital transfers.