How Many Trading Days in a Year Are There?

Oct 23, 2024

In today’s fast-paced trading environment, market participants work with hundreds of different indicators and metrics that help shape a sound trading strategy and ensure proper asset allocation in their portfolios.

At the same time, there is only a specific window of time during which trading on financial markets is possible, excluding holidays, weekends, and other exceptional circumstances. So, how many trading days are there in a year when traders and investors can apply their skills and earn profits?

This article will help you understand a trading day, how many trading days in a year are there, and what factors influence their quantity. You will also learn about several methods that help calculate the number of trading days in a year.

Key Takeaways

- The range of trading days yearly depends on the stock exchange, weekends, and statutory holidays.

- U.S. markets have around 252 trading days, while exchanges like the Tokyo Stock Exchange have approximately 244-245 due to extended holiday closures.

- Most global exchanges are closed on weekends, and public holidays such as Lunar New Year, Christmas, and Independence Day can further reduce the number of trading days.

What Defines a Trading Day?

A trading day is when equity exchanges are open, allowing market participants to trade securities such as equities, bonds, and other exchange-traded products. On a trading day, the exchange facilitates the buying and selling these financial assets during specific hours. Trading days vary by country and exchange but typically follow a structured schedule based on the local time zone.

In addition to regular trading hours, many stock exchanges carry out more extensive trading periods, including pre-market and after-hours trading. These sessions allow market participants to trade outside the standard trading hours, often enabling institutional investors to react to news or events before or after the normal trading day.

However, these extended hours often experience lower trading volumes, leading to higher volatility and wider bid-ask spreads, making them riskier for retail investors.

Trading days are also influenced by national holidays and regional customs, which result in stock exchanges closing on certain days of the year. For example, exchanges like the NYSE and NASDAQ are closed in the United States on major holidays such as Thanksgiving, Christmas, and Independence Day.

The Shanghai Stock Exchange in China closes for non-working government holidays like the Lunar New Year. These closures vary from country to country, so global traders must be aware of different market calendars to ensure they can plan their trading activities accordingly.

It’s also important to note that certain trading days may operate under shortened hours, known as half-days, typically preceding or following a major holiday. On half-days, trading volumes tend to be lower as many institutional investors and traders take time off.

As a result, market activity can be less predictable, and liquidity may be reduced. For example, the U.S. markets often have shortened trading hours on the day after Thanksgiving and on Christmas Eve, which can affect trading strategies.

Fast Fact

The 80/20 rule of trading, also known as the Pareto Principle, states that approximately 80% of trading profits come from just 20% of the trades.

How Many Trading Days in a Year Are There?

The number of trading days in a year refers to the total number of days when stock exchanges are open for trading activities. This figure varies across countries and exchanges based on factors such as weekends, public holidays, half-days, and occasional closures for special events or emergencies.

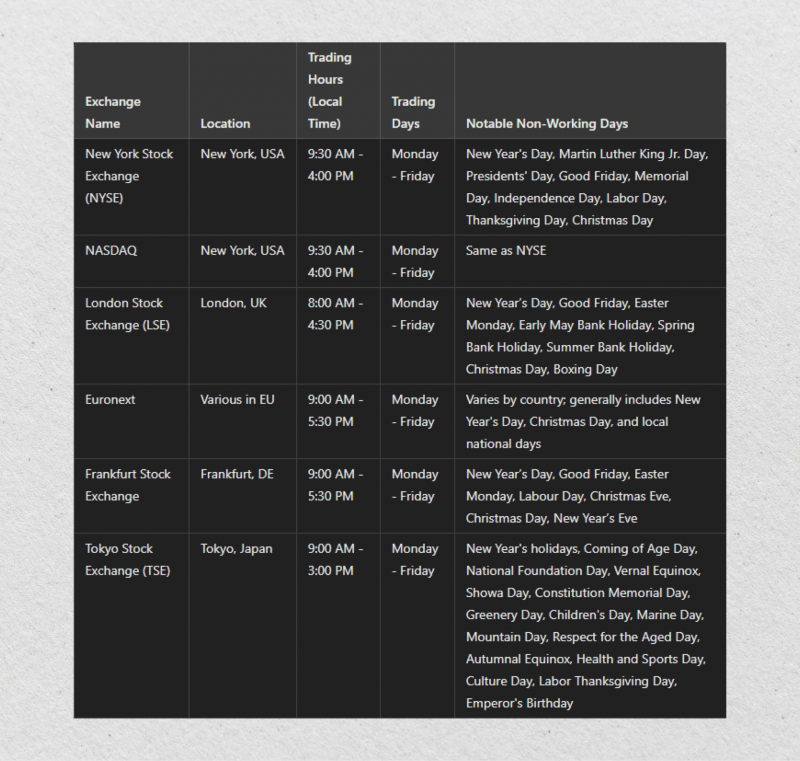

Below is a detailed breakdown of trading days for various major global stock exchanges:

U.S. Stock Markets (NYSE & NASDAQ)

In the United States, both the New York Stock Exchange (NYSE) and NASDAQ typically operate for 252 trading days in a standard year. However, this number can vary slightly based on the occurrence of weekends and official holidays throughout the year.

Key U.S. Market Holidays:

— New Year’s Day (January 1)

— Martin Luther King Jr. Day (3rd Monday in January)

— Presidents’ Day (3rd Monday in February)

— Good Friday (Friday before Easter Sunday)

— Memorial Day (Last Monday in May)

— Independence Day (July 4)

— Labor Day (1st Monday in September)

— Thanksgiving Day (4th Thursday in November)

— Christmas Day (December 25)

On half-days, such as Christmas Eve and the day after Thanksgiving, trading may occur for reduced hours, typically closing at 1:00 PM ET. However, these days are still counted as trading days.

For example, in a non-leap year, there are 252 trading days. However, the exact number may decrease slightly if holidays like Independence Day or Christmas fall on a weekend and are observed on a weekday, effectively reducing the total sum of trading days.

London Stock Exchange (LSE)

The London Stock Exchange (LSE) typically operates annually for approximately 253 trading days. Like many other stock exchanges, this is because the LSE is closed on weekends (Saturday and Sunday) and observes various public holidays, particularly those specific to the United Kingdom.

Essential UK Market Holidays include New Year’s Day (January 1), Good Friday (the Friday before Easter), Easter Monday (the Monday after Easter), Early May Bank Holiday (the first Monday in May), Christmas Day (December 25), and Boxing Day (December 26). In addition, there are other holidays, such as Spring Bank Holiday and Summer Bank Holiday, which further reduce the total length of trading days each year.

It’s important to note that the total count of trading days per year may vary slightly based on the holiday calendar and the arrangement of weekends. However, as a general example, there are typically 253 trading days yearly.

Tokyo Stock Exchange (TSE)

The Tokyo Stock Exchange (TSE) in Japan typically operates for approximately 244 to 245 trading days each year. This trading schedule accounts for the closure of the market on weekends and during various national holidays.

Some of the notable Japanese market holidays include the New Year’s Holiday, which spans from January 1 to 3; Coming of Age Day celebrated on the second Monday in January; National Foundation Day on February 11; and the Golden Week period, which occurs from late April to early May and includes Constitution Memorial Day, Greenery Day, and Children’s Day.

Additionally, the Emperor’s Birthday on February 23 is also observed as a holiday. The most extended market closures in Japan are during Golden Week and the New Year holiday, leading to a reduction in the number of available trading days.

In an example year, the Tokyo Stock Exchange typically operates for 244 to 245 trading days, depending on the specific holiday structure.

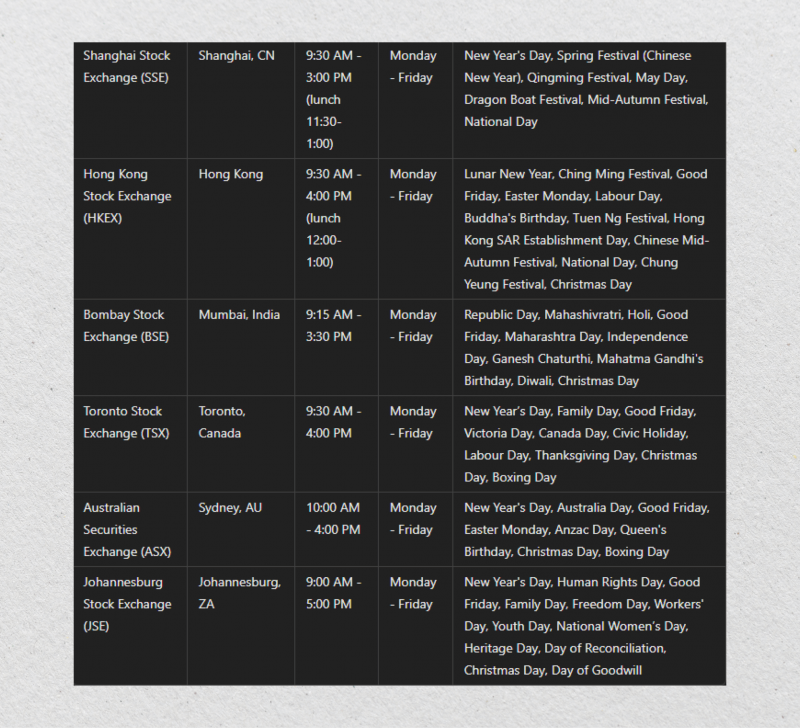

Hong Kong Stock Exchange (HKEX)

The Hong Kong Stock Exchange (HKEX) typically operates for 249 to 252 trading days per year. This is due to the observance of local and global holidays, including those associated with Chinese traditions like Lunar New Year and Western holidays like Christmas.

Key Hong Kong Market Holidays include:

— Lunar New Year (usually a 3-day closure in January or February)

— Good Friday (the Friday before Easter)

— Christmas Day (December 25)

— National Day (October 1)

— Mid-Autumn Festival (date varies based on the lunar calendar)

Both local Chinese and international holidays result in fewer trading days than Western exchanges but more than mainland Chinese markets. The exact number of trading days, whether 249, 250, 251, or 252, depends on how public holidays fall in a given year.

Factors Influencing the Number of Trading Days

Within the trading practice, the number of trading days per year is determined by several factors, each of which has both direct and indirect influence and varies greatly depending on the region where the exchange markets are located.

Weekends

Stock exchanges worldwide typically close on weekends, which accounts for a significant reduction in the number of trading days each year. Most global stock exchanges follow the Saturday-Sunday weekend structure, but this can vary depending on the region.

Markets in the U.S., Europe, and many Asian countries are closed on Saturdays and Sundays. This automatically reduces around 104 to 105 days from the trading calendar annually.

Some regions, especially in the Middle East, have different weekend structures. For example, the Saudi Stock Exchange (Tadawul) and Kuwait Stock Exchange observe a Friday-Saturday weekend. This difference in weekend structure impacts the number of trading days and must be accounted for by international investors. In these cases, the markets may open when Western markets are closed, and vice versa.

Public and National Holidays

Stock exchanges close for key national holidays, which can vary in length and frequency. For instance, U.S. markets are closed for Thanksgiving, Christmas, and Independence Day, reducing the total number of trading days. European markets observe holidays like Boxing Day and Easter Monday, while Chinese markets close for major holidays like Lunar New Year and National Day.

Cultural and Religious Holidays

Countries with diverse cultural and religious traditions often observe several holidays. For example, the Hong Kong Stock Exchange (HKEX) is closed for both Chinese cultural holidays like Lunar New Year and Western holidays like Good Friday. Similarly, the Tokyo Stock Exchange (TSE) is closed for multiple holidays during Golden Week (late April to early May), reducing the total trading days for that period.

Leap Years

A leap year adds an extra day to the calendar, making February 29th a trading day, provided it doesn’t fall on a weekend or holiday. This results in a slight increase in the number of trading days for leap years, with one additional trading day for markets that normally trade on February 29. This can increase the trading day count for that year by 1.

Exchange-Specific Policies

Stock exchanges may close unexpectedly due to unforeseen circumstances such as natural disasters, political unrest, or technical issues. For example, during Hurricane Sandy in 2012, the NYSE closed for two days.

In 2020, some global exchanges shut down temporarily or operated with reduced hours due to the COVID-19 pandemic. Emergency closures are rare but can reduce the number of trading days.

Some exchanges operate on half-days around holidays. For instance, the NYSE closes early on days like Christmas Eve and the day after Thanksgiving. These shortened sessions are considered trading days but often see lower trading volumes and less market activity. Other markets, such as the London Stock Exchange, may also have early closures on Christmas Eve and New Year’s Eve, leading to limited trading.

Market-Specific Variations

Different regions have varying numbers of trading days due to differences in national holidays, cultural observances, and market customs. For instance:

Shanghai Stock Exchange (SSE): The Chinese market typically has around 245 trading days annually due to extended closures during Lunar New Year and National Day.

Tokyo Stock Exchange (TSE): Japan observes numerous public holidays, including the multi-day Golden Week in the spring, resulting in approximately 244-245 trading days annually.

U.S. Markets (NYSE & NASDAQ): These exchanges usually have around 252 trading days annually, with shorter holiday breaks compared to Asian markets.

In addition to national holidays, stock exchanges may close or operate differently during significant national events, such as national elections (in countries where election day is a public holiday), state funerals, and major sports events like the Olympics or World Cup, which may impact trading volumes and hours.

Weekend Shifts

When public holidays coincide with weekends, various exchanges may have different approaches. For example:

U.S. markets

If a Christmas or Independence Day holiday falls on a weekend, the markets usually close on the following Monday (if the holiday is on a Saturday) or the preceding Friday (if it’s on a Sunday). This practice is in place to ensure that the number of trading days is not reduced.

European markets

Many European exchanges adopt a similar policy, observing a public holiday on the nearest weekday if it falls on a weekend.

China

In China, if a public holiday falls on a weekend, markets remain closed without compensating for the lost day on a weekday, potentially reducing the number of trading days.

Adjustments for Global Markets

International investors need to keep track of the different holiday calendars across markets. For example, while U.S. markets may be closed for Labour Day, European and Asian exchanges remain open, affecting global liquidity and trading volume. Conversely, closures for the Lunar New Year in China might not impact U.S. or European markets, but they can reduce global trading activity due to fewer participants.

Market-Specific Regulations

Regulatory Changes: Changes in a country’s regulations may extend or reduce trading hours or even add new trading days. For instance, some countries have proposed extending trading hours to increase market liquidity. If such changes are implemented, it could result in longer trading sessions without necessarily adding more trading days.

Weekend trading

While most exchanges do not operate on weekends, there have been discussions in some countries about implementing weekend trading. If this were to happen, the number of available trading days could increase, impacting how investors strategize and execute trades.

Technology & Digital Exchanges

As digital trading platforms evolve, there is potential for continuous 24/7 trading. Cryptocurrency exchanges and foreign exchange (Forex) markets already operate around the clock. If traditional stock markets were to adopt similar models, the concept of a fixed number of trading days could change dramatically.

How to Track Trading Days?

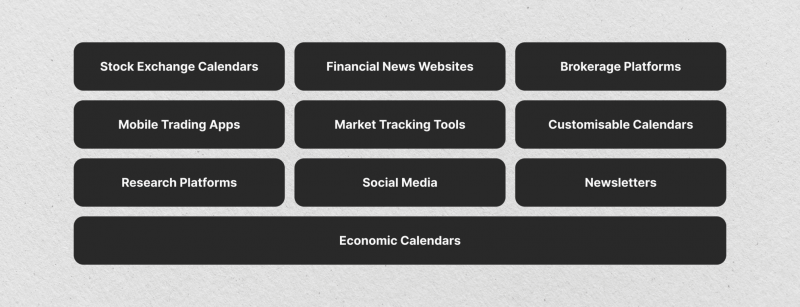

Tracking trading days is of the utmost importance for planning and staying updated on market closures. Here’s how to efficiently track them:

Stock Exchange Calendars

Make sure to check out the official trading calendars on stock exchange websites such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), and Shanghai Stock Exchange (SSE) for detailed information about market hours, public holidays, and half-days.

Financial News Websites

You can find trading schedules, holiday closures, and live alerts on Bloomberg, Reuters, and MarketWatch platforms. To stay updated on market hours, search for “market hours” or set up notifications to receive timely information.

Brokerage Platforms

Interactive Brokers and TD Ameritrade offer integrated calendars with alerts for stock market closures and holidays. This feature helps investors stay informed about trading schedule changes and plan their investment activities accordingly.

Mobile Trading Apps

Investment platforms such as Robinhood, Fidelity, and Webull provide market calendars and send push notifications to alert users about early market closures and holidays.

Market Tracking Tools

Apps like Robinhood, Fidelity, and Webull provide market calendars to inform users about important dates such as early closures and holidays. Additionally, these apps send push notifications to alert users about any changes or events that may impact the market.

Customizable Calendars

You can import trading schedules into Google Calendar or Outlook to receive personalized alerts about holidays and closures, helping you stay informed about any potential impact on your trading activities.

Research Platforms

Sophisticated platforms such as Bloomberg Terminal or FactSet can consolidate international trading schedules and deliver up-to-the-minute information in real time.

Social Media

For the latest information on market closures and schedule changes, follow the official stock exchange accounts on Twitter or LinkedIn. They provide real-time updates to keep you informed.

Newsletters

Make sure to sign up for stock exchange newsletters to receive timely updates about any changes in trading hours and unexpected closures. Stay informed about any developments that could impact your trading activities.

Economic Calendars

Keep an eye on major economic news and trends that could have implications for the equity markets by utilizing resources such as Investing.com and Forexfactory.com. These platforms provide economic calendars and valuable insights into important global economic indicators and announcements that may influence trading activities.

Conclusion

The total quantity of trading days in a year is influenced by a variety of factors, including weekends, public holidays, exchange-specific policies, and regional variations. These factors contribute to differences in trading day counts between global exchanges, with most falling within a range of 240 to 253 days per year.

Understanding these factors is crucial for traders and investors who operate in multiple markets, as market closures, holiday shifts, and half-days can impact trading volumes, liquidity, and profit opportunities. Keeping track of these differences ensures better planning and execution of trades across different markets.

FAQ

What do trading days stand for?

Trading days are when exchanges are active for trading securities such as equities, bonds, and other financial products. They exclude vacation days and non-working public holidays.

How many trading days in a year are in the U.S.?

On average, U.S. stock markets (NYSE and NASDAQ) have 252 trading days in a typical year. This number can vary slightly depending on how weekends and holidays fall.

Do leap years affect the number of trading days?

Leap years add an extra day to the calendar, which may result in one additional trading day, provided that February 29 does not fall on a weekend or holiday.