Investing In Private Equity: What Should You Know?

May 31, 2023

From the seminal stages of the industrial revolution to the vibrant pulse of today’s financial markets, investors have consistently leveraged private equity as a prime tool for fostering business growth and value creation.

The roots of private equity stretch back as far as 1901 when the legendary financier J.P. Morgan (individual and not the institution) bought Carnegie Steel Co. from Andrew Carnegie and Henry Phipps, laying the groundwork for an industry that would dramatically evolve over the next century. Phipps ingeniously used his proceeds to establish what could be seen as one of the first private equity funds, the Bessemer Trust.

Fast forward to the present day, and private equity has become a glitzy, high-stakes game usually played by the financial elite. This is not just an arena for the big fish, though. Sure, it demands considerable capital and a deep understanding of complex financial dynamics. But with the proper knowledge, careful planning, and a sprinkle of savvy, even the smaller investors can potentially navigate the waters of private equity and come out ahead.

So, come along and learn more about the industry that’s changed the face of strategic investment – private equity.

Key Takeaways

- Private equity is putting money into privately owned businesses in exchange for equity stakes, with the expectation of high returns.

- When compared to public markets, private equity investments can provide higher returns because private enterprises can be better positioned and managed to create value.

- The four main types of private equity investments are venture capital, growth equity, buyouts, and mezzanine finance.

What Is Private Equity?

Private equity, often abbreviated as PE, involves owning a part of a company that isn’t publicly traded. It’s a way of investing money, usually gathered from wealthy individuals or firms who buy shares in private companies or take over public companies to make them private and remove them from stock exchanges.

The private equity industry comprises big-time investors like pension funds and major PE firms supported by certified investors. Direct investment is the name of the game in private equity, often done to have a say in or control a company’s operations. This requires a lot of money upfront, so it’s usually the big-money players in the game.

The minimum investment amount can change based on the PE firm or the specific fund. Some need at least $250,000 to get in the door, while others might ask for millions more. This is why PE is often seen as a high-end, expensive market, though less costly options are available.

The idea behind all of this is to profit from the investment. PE firm partners raise and manage funds to earn positive returns for their private equity investors, usually over four to seven years.

Private Equity VS. Public Equity

The debate over the merits of private equity versus public equity is ongoing, with both having distinct strengths. To better comprehend these, let’s compare the two.

In its most elemental form, equity refers to ownership of a company’s value. When this equity is in a company whose shares are traded on a public stock market, we refer to it as public equity.

On the other hand, private equity signifies ownership in a company that isn’t open to public trading.

Public equity is generally grouped into the triad of primary asset classes alongside bonds and cash. In contrast, private equity is categorized as an “alternative” asset class, sharing this designation with a broad spectrum of assets such as private debt, real estate, infrastructure, and natural resources.

While this difference may seem basic, it underscores several attributes typically unique to private equity, beginning with the fund structure.

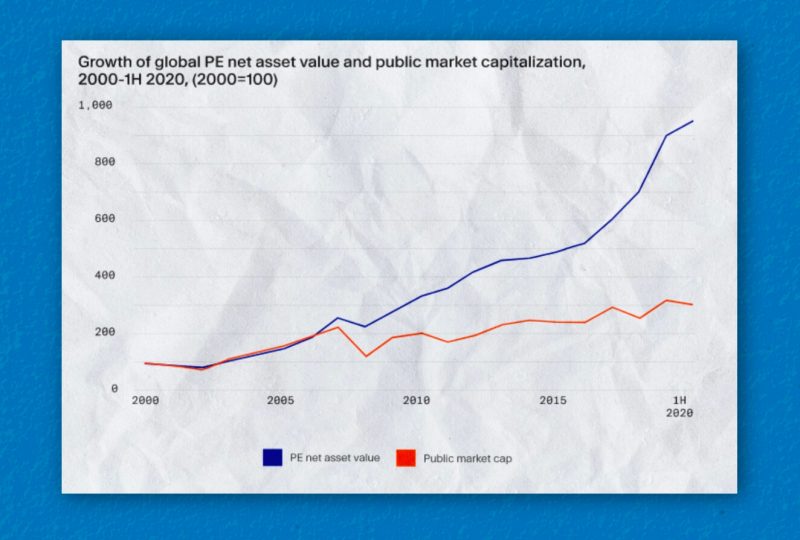

Recent reports from JP Morgan suggest that private equity continues to outperform public equity. Despite a tumultuous 2022 marked by volatility and inflation, 2023 remains an attractive year for entering the market, reaffirming the potential advantages of private equity.

How Private Equity Works And Creates Value

Before we delve into the various types of investments and strategies in the private equity world, it’s critical to understand how private equity functions and how it generates value. After all, what’s the point if it doesn’t yield a worthy return?

In private equity, the workings are somewhat similar to mutual or hedge funds. Essentially, a private equity fund is a collective investment model where private equity managers consolidate money from various investors into a single fund, which is then used to make investments.

The real profit kicks in when the acquired company is sold again, and these profits can be substantial.

When a private equity firm takes over a company, it usually arrives with a deliberate plan to amplify the value of the investment. This plan might encompass aggressive cost reduction or a significant restructuring – actions that the existing management might have hesitated to implement. With a limited timeframe to enhance the value before selling their stake, private equity owners often have a strong incentive to initiate transformative changes.

Furthermore, the private equity fund managers could possess specialized knowledge lacking in the company’s previous management.

This expertise could assist the company in formulating an e-commerce strategy, integrating cutting-edge technology, or penetrating new markets. The private equity firm often introduces its own management team to drive these initiatives, or it might retain the previous managers to execute a mutually agreed-upon strategy.

One key benefit of PE ownership is the freedom to implement operational and financial changes without the constant pressure of meeting analysts’ expectations or satisfying public shareholders every quarter. This flexibility can allow the management to adopt a more long-term perspective unless this approach clashes with the new owners’ objective of achieving the maximum possible return on investment.

Perks of Investing In Private Equity

Market insulation: One major appeal of private equity is that its valuations are not typically swayed by broader market volatility. This characteristic sets private equity apart from publicly traded companies bound by stringent accounting practices imposed by the Securities and Exchange Commission.

Potential for higher returns: Private equity investments may come with a higher risk but have historically been associated with robust returns. This trend underscores why the private market continually outperforms the public one.

Strategic influence: PE often grants substantial influence or control over a company’s operations and strategic direction, enabling investors to enact transformative changes that could enhance value.

Access to diverse sectors: Investing in PE can open doors to industries or sectors that may be underrepresented or absent in public markets.

Long-term stability: The inherently illiquid nature of private equity investments can benefit investors with a longer-term view. It can help maintain portfolio stability over time as the assets are not subject to daily market price fluctuations.

How To Invest In Private Equity

There are several routes for those interested in joining the private equity landscape. A direct approach involves partnering with a private equity firm. Each firm has unique investment thresholds, expertise areas, fundraising schedules, and exit strategies. Therefore, comprehensive research is vital to find a firm that aligns with your investment goals.

Alternatively, investors can gain exposure to private equity via Exchange-Traded Funds (ETFs). Private equity ETFs offer a way to invest in publicly listed private equity companies, which can be an attractive option for those who do not meet the accreditation or high minimums required by traditional private equity funds. With ETFs, investors can participate in the success of these firms without a substantial initial investment.

Top Private Equity Investment Strategies

When it comes to private equity investments, several key strategies must be considered: venture capital, growth equity, buyouts, and mezzanine financing.

These strategies, each catering to different stages in a company’s lifecycle and requiring unique skills for successful execution, don’t compete against one another. Rather, they coexist to provide potential investors with a full spectrum of opportunities.

Let’s dive into each one, examining their distinct features and providing illustrative examples.

- Venture Capital

Venture Capital (VC) is an investment strategy where financiers inject seed funding into early-stage startups in exchange for equity. Typically, venture capitalists don’t demand a majority share, making it an attractive prospect for founders seeking investment without relinquishing control.

Investing in startups is inherently risky, given that many are yet to prove their profitability. However, successful investments in startups that become industry giants can yield enormous returns.

A classic example is Google. In 1999, Sequoia Capital and Kleiner Perkins Caufield & Byers each invested $12.5 million in Google. When Google went public in 2004, the investments of these firms were worth approximately $4.3 billion each, demonstrating the potential profitability of venture capital.

- Growth Equity

Growth equity is another PE strategy involving capital investments in mature, yet still expanding, companies. This strategy comes into play when a company is established and requires additional funding for further growth. Growth equity investors usually acquire a minority stake and have the advantage of assessing the company’s financial track record before investing.

Silver Lake’s investment in Alibaba was one of the most significant growth equity investments in recent history. Between 2011 and 2012, Silver Lake invested $500 million in Alibaba. When Alibaba went public in 2014, Silver Lake’s stake was worth over $5.1 billion, providing a return of more than 10x the initial investment.

- Buyouts

Private equity buyouts represent a strategy further down the company lifecycle, often involving mature, typically public companies being taken private. The new owners may be a private equity firm or the company’s existing management team. A buyout results in the previous investors exiting and the new owner(s) holding a controlling share.

Buyouts are typically of two types: management buyouts, where the existing management team assumes control, and leveraged buyouts, funded with borrowed money.

- Mezzanine Financing

Lastly, there’s mezzanine financing, a blend of debt and equity financing. The lender has the right to convert the debt to an equity interest in case of a default, typically after other senior lenders and venture capital firms are paid.

This kind of financing carries a risk level between senior debt and equity. It often involves equity instruments, known as warrants, which increase the subordinated debt’s value and allow for more flexibility in dealing with bondholders.

Cheaper Private Equity Investment Options

While often regarded as a luxurious asset class, some options are also available for average private equity investors. These options provide opportunities for individuals who don’t meet the high-net-worth or accredited investor requirements. Let’s explore some of these alternatives in order of sophistication and the means required:

1. Angel Investing

Angel investing involves seasoned entrepreneurs or affluent professionals investing in startups and young businesses in exchange for partial ownership. This form of investment provides crucial seed money to firms that may be too early or small for venture capitalists. Angel investors typically invest an average of around $75,000.

2. Equity Crowdfunding

Equity crowdfunding is a model where a company or private business raises funds through an online platform from multiple individuals. Unlike regular rewards-based crowdfunding, equity crowdfunding grants investors part ownership in the business.

The minimum contribution requirements for these platforms can range from as low as $2,000 to as high as $100,000, depending on the investor’s income. It’s worth noting that equity crowdfunding platforms are subject to regulation by the Securities and Exchange Commission (SEC).

3. Fund of Funds

A fund of funds is a pooled investment fund that invests in other funds, particularly high-end mutual and hedge funds. These funds are priced similarly to mutual funds and typically have minimum investment thresholds of around $1,000. They expose private equity investors to a diversified investment portfolio of private equity investments through a single investment vehicle.

4. Private Equity ETFs

Exchange-traded funds have become increasingly popular, and private equity is no exception. Private equity ETFs primarily invest in private companies and are offered by investment companies that sponsor ETFs. With these publicly traded funds, investors can purchase any shares they desire, providing a more accessible entry point to private equity.

5. Real Estate

Real estate is also considered an affordable private equity investment vehicle. This asset class involves a group of investors pooling their resources to invest in properties. While the capital required for these investments is generally lower than other private equity options, the returns are also typically lower.

Risks of Investing In PE

Investing in private equity entails risks and drawbacks that investors must consider carefully. One of the critical concerns is the illiquidity associated with private equity investments. Unlike more common fund types such as mutual funds, private equity funds often require long-term commitments, sometimes lasting up to 10 years.

Limited partners in these funds must be prepared to hold their investments for an extended period. The nature of private equity funds involves capital calls, where the firm requests investment amounts from its investors to deploy over a specific period.

Additionally, once the firm has invested in target companies, it may take considerable time to improve or stimulate growth before selling them. As a result, private equity investments are highly illiquid compared to investments like stocks that can be readily converted into cash.

Another challenge associated with PE is the lack of transparency, regulation, and data. Unlike mutual funds, private equity funds are not registered with the Securities and Exchange Commission, which means private equity firms are not obligated to disclose information publicly.

Moreover, privately held companies, often the targets of private-equity acquisitions, are not subject to public scrutiny. It falls upon the private equity firm to evaluate target companies and assess their financial health and the accuracy of their balance sheets.

Consequently, the risk levels within the private equity universe can vary significantly. Mature companies in buyouts may provide comprehensive information on earnings and operations over the years, while early-stage startups may have limited data available.

This inherent lack of transparency and variability in risk levels make investments in unproven startups through venture capital inherently riskier compared to investing in growth-stage companies with established revenue and market share.

Summary

The private equity industry has grown to manage trillions of assets, making it a viable alternative investment class for wealthy people and organizations. By learning what PE is and how it works, you may start making investments in a market that is slowly but surely opening up to the average investor.

Beyond the obvious financial benefits, PE is also important because it acts as a catalyst for the growth and dissemination of new ideas and technologies throughout the world.